Alabama Option to Purchase Stock - Long Form

Description

How to fill out Option To Purchase Stock - Long Form?

Selecting the appropriate authentic document template can be challenging. Clearly, there are numerous templates available online, but how do you find the correct form you need? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Alabama Option to Purchase Stock - Long Form, that can be utilized for both business and personal purposes. All of the forms are reviewed by experts and satisfy state and federal requirements.

If you are currently registered, Log In to your account and click the Download button to locate the Alabama Option to Purchase Stock - Long Form. Use your account to search through the legal forms you have acquired in the past. Visit the My documents section of your account and download another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Alabama Option to Purchase Stock - Long Form. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize this service to acquire professionally crafted papers that comply with state requirements.

- Firstly, ensure you have chosen the correct form for your city/region.

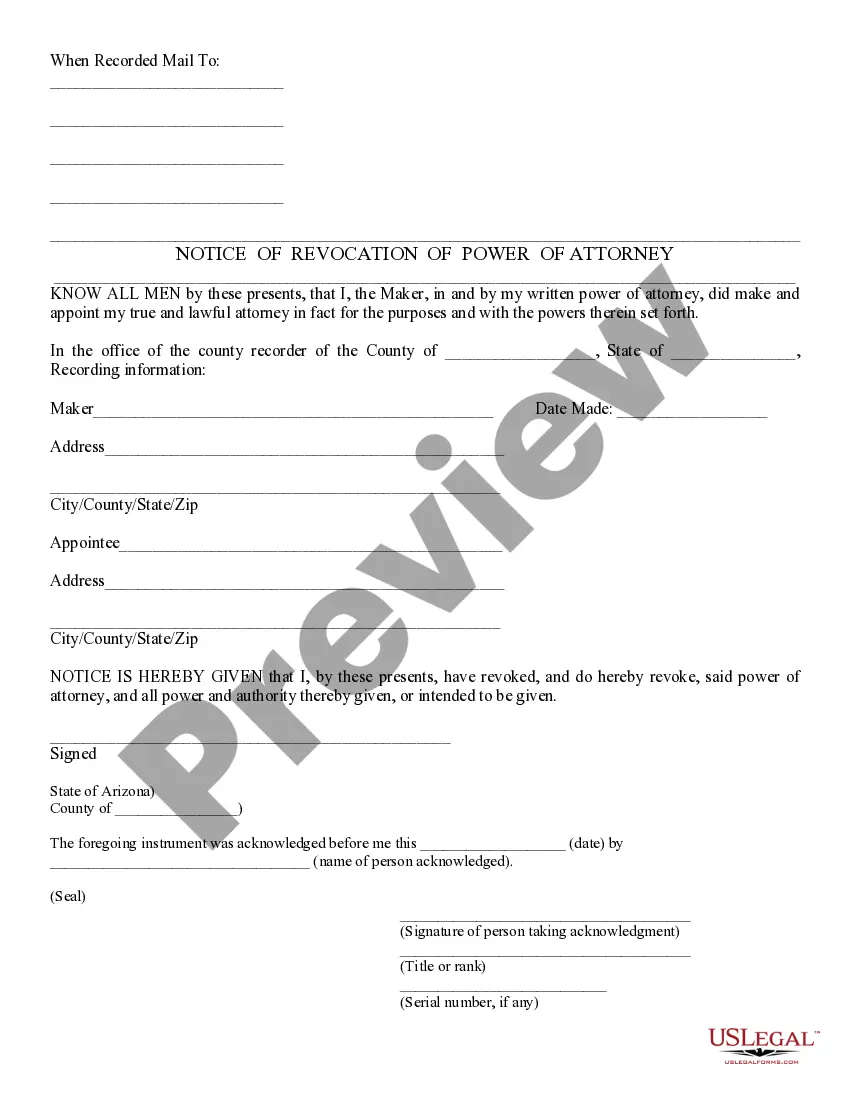

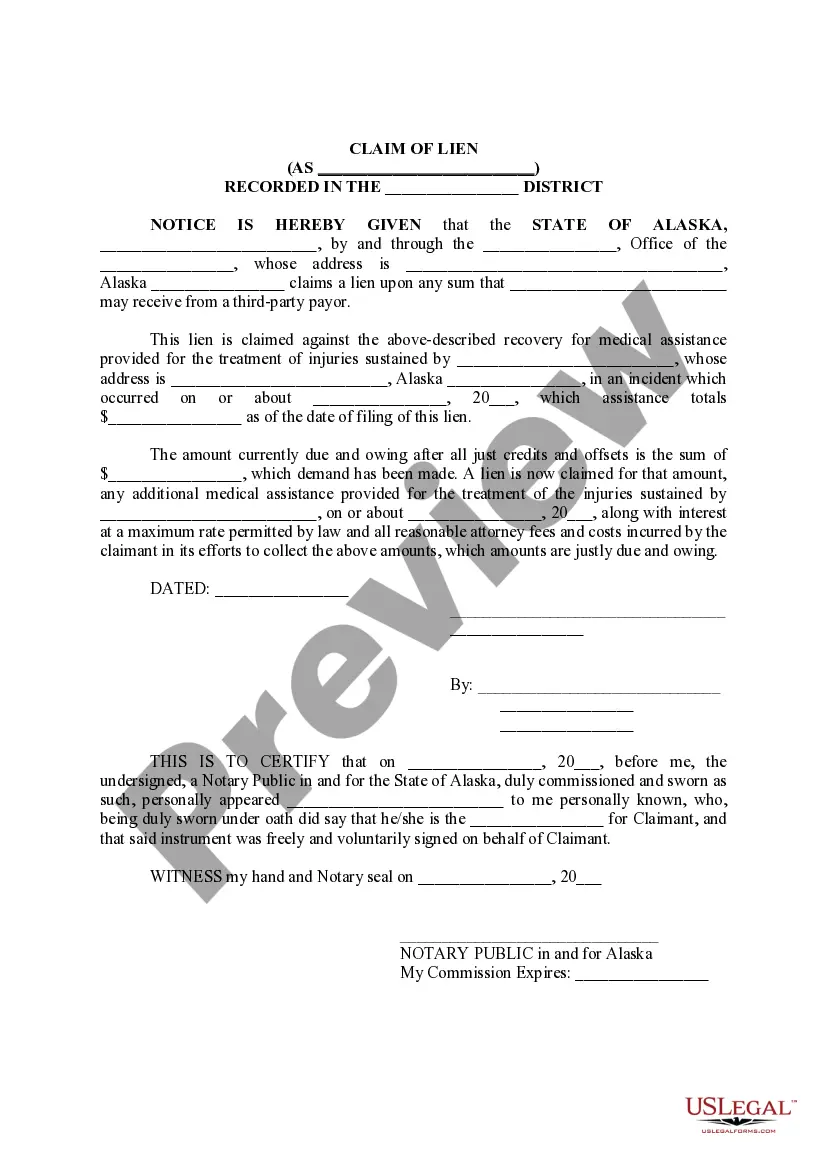

- You can review the form using the Review option and read the form description to ensure it is suitable for your needs.

- If the form does not satisfy your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Buy now option to obtain the document.

- Select the pricing plan you desire and input the necessary information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

In Alabama, employers are required to withhold state income tax from employee wages. The withholding rate can vary based on income level and filing status. It's essential to familiarize yourself with these rules, especially if you are exercising stock options, to ensure that the proper amounts are withheld for Alabama tax purposes.

Both Form 40 and Form 40NR have specific requirements, including income reporting and filing deadlines. You must ensure that all income is reported accurately, including gains from stock options. Understanding these requirements will help you maximize your benefits while minimizing potential tax liabilities related to your Alabama options.

Form CPT is used in Alabama for the payment of certain corporate taxes. This form helps ensure that corporations comply with state tax laws. If you need to fill out this form or any other related documents, uslegalforms offers helpful tools and templates that can assist you effectively.

To form an Alabama LLC, you must choose a unique name that complies with state regulations, select a registered agent, and file a Certificate of Formation with the Alabama Secretary of State. You will also want to create an operating agreement that outlines the management of your LLC. Using uslegalforms can simplify each step of this process with clear instructions and necessary templates.

In Alabama, a bill of sale does not typically need to be notarized unless the transaction involves a vehicle or other items requiring additional verification. Notarization can add an extra layer of legitimacy to your document, but it is not a strict requirement for most sales. For peace of mind and legal assurance, consider using the resources available at uslegalforms.

Corporations, limited liability entities, and disregarded entities organized outside of Alabama, but qualifying with the Alabama Secretary of State to do business in Alabama, must file an Initial Business Privilege Tax Return and pay the business privilege tax reported on the return within two and one-half months after

File and pay Business Privilege Tax online. There is no cost. Register your BPT account with the letter provided by our office.

With a cashless exercise/same-day sale, the full exercise spread income is reported on Form W-2, and you report it on your tax return as ordinary income. Even though you never owned all the stock after exercise, you also need to report this transaction on Form 8949 and Schedule D.

In general, individual traders and investors who file Form 1040 tax returns are required to provide a detailed list of each and every trade closed in the current tax year.

PAID PREPARER INFORMATION.Anyone who is paid to prepare the Alabama Form 20S for an Alabama S corporation must sign and provide the information re- quired in the Paid Preparer's Use Only section of the Form 20S.