Alabama Promissory Note with Installment Payments is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Alabama. This type of promissory note specifically includes provisions for installment payments, which allows the borrower to repay the loan in regular, scheduled payments over an agreed period of time. The Alabama Promissory Note with Installment Payments is a binding contract that clearly defines the rights and obligations of both parties involved in the loan transaction. It specifies the loan amount, the interest rate, the repayment schedule, and other essential terms agreed upon by the lender and borrower. There are different types of Alabama Promissory Note with Installment Payments that vary based on the specific circumstances and needs of the parties involved. Some commonly used types include: 1. Personal Installment Loan Promissory Note: This type of promissory note is used when an individual borrows money for personal use, such as paying medical bills or financing a major purchase. It typically outlines the repayment terms and any collateral or security provided by the borrower. 2. Business Installment Loan Promissory Note: This promissory note is utilized when a business borrows funds for various purposes, such as expanding operations or purchasing equipment. It includes provisions tailored for business loans, such as defining how the loan will be used and specifying any personal guarantees or corporate collateral. 3. Mortgage Installment Promissory Note: This type of promissory note is commonly used in real estate transactions when a borrower obtains a mortgage loan to purchase a property in Alabama. It outlines the terms of the mortgage, including the repayment schedule, interest rate, and the consequences of default. 4. Student Loan Installment Promissory Note: This promissory note is specifically designed for educational loans, where a student borrows money to finance their education. It includes provisions such as grace periods, deferment options, and repayment terms that are unique to student loans. Regardless of the type, Alabama Promissory Note with Installment Payments serves as crucial documentation to protect the lender's interests and ensure that the borrower fulfills their obligation to repay the loan. It is always recommended consulting with a legal professional to ensure compliance with Alabama state laws and to tailor the promissory note to individual circumstances.

Alabama Promissory Note with Installment Payments

Description

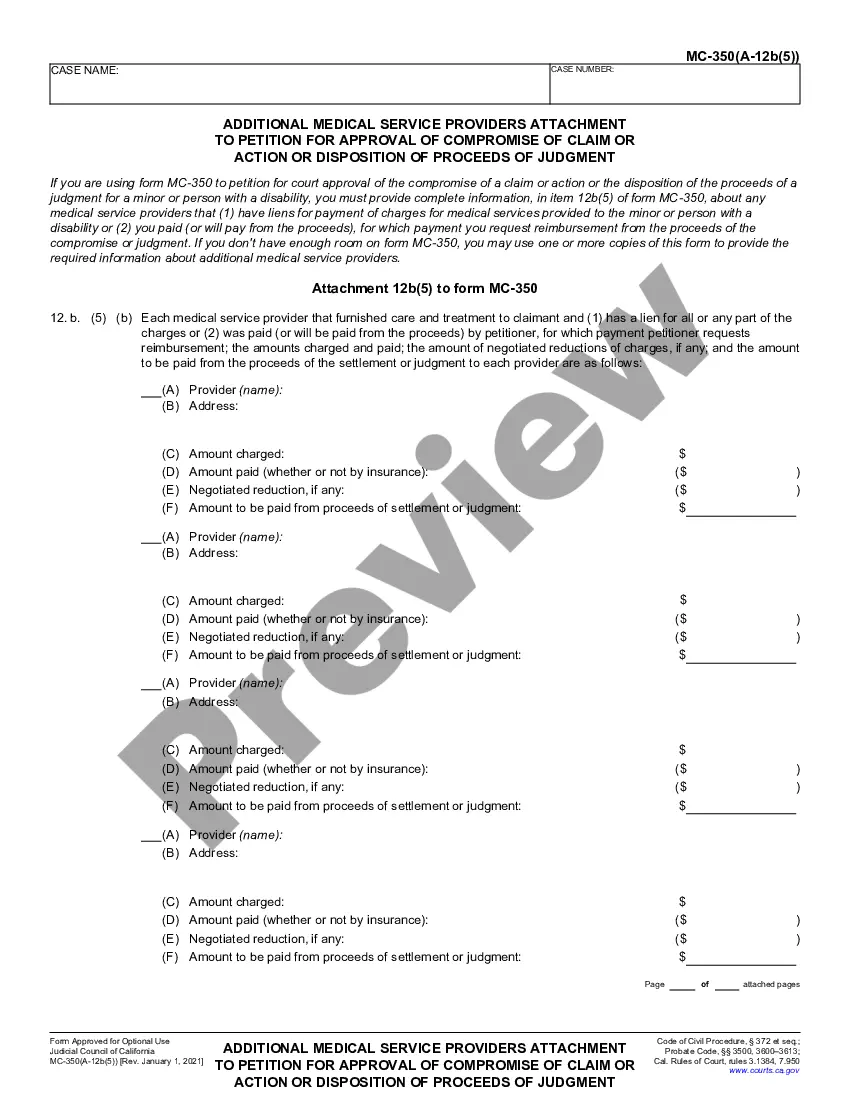

How to fill out Alabama Promissory Note With Installment Payments?

You can allocate time online searching for the approved document format that meets the national and regional requirements you have.

US Legal Forms offers numerous legal templates that can be reviewed by experts.

You have the option to obtain or print the Alabama Promissory Note with Installment Payments from their service.

If available, use the Review button to view the document format simultaneously.

- If you have a US Legal Forms account, you can Log In and hit the Download button.

- Subsequently, you can complete, modify, print, or sign the Alabama Promissory Note with Installment Payments.

- Every legal document format you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents section and click on the relevant button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form description to confirm that you have chosen the right document.

Form popularity

FAQ

While an Alabama Promissory Note with Installment Payments can facilitate borrowing, it also comes with some disadvantages. If the borrower defaults, the lender may encounter challenges in recovering the owed amount. Additionally, some notes may not have sufficient legal protections, which can lead to disputes. By using uslegalforms, you can ensure that your promissory note includes provisions that protect your interests effectively.

The format of an Alabama Promissory Note with Installment Payments typically starts with the title, 'Promissory Note', followed by the date of the agreement. Next, include the lender's and borrower's information, along with the principal amount and terms of repayment. Ending the document, both parties should provide their signatures. This format helps ensure that all necessary details are covered succinctly.

The conditions for a promissory note typically include details such as the amount borrowed, repayment schedule, interest rate, and consequences for default. Additionally, it may require signatures from both the lender and the borrower. By utilizing an Alabama Promissory Note with Installment Payments, you set clear expectations and obligations that protect both parties involved.

In Alabama, a promissory note does not necessarily require notarization to be legally binding. However, having the document notarized can provide an extra layer of security and verification. To ensure your Alabama Promissory Note with Installment Payments is valid and enforceable, consider using our online services for added assurance.

There are several types of promissory notes, including demand notes, installment notes, and secured notes. A demand note requires repayment in full upon request, whereas an installment note specifies ongoing payments, usually with interest. If you need assistance in creating an Alabama Promissory Note with Installment Payments, our platform offers templates that simplify this process.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Federal law prohibits prepayment penalties for many types of home loans, including FHA and USDA loans, as well as student loans. In other cases, the early payoff penalties that lenders can charge are permitted but include both time and financial restrictions under federal law.

Prepayment. Maker may prepay all or any part of the principal balance of this Promissory Note at any time without premium or penalty. Amounts prepaid may not be reborrowed. 5.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

Interesting Questions

More info

Keywords Search.