Alabama Promissory Note — Satisfaction and Release refers to a legal document used to acknowledge the full payment and satisfaction of a promissory note in the state of Alabama. This document serves as proof that the debt has been repaid in its entirety and releases the borrower from any further obligations or liabilities related to the promissory note. The Satisfaction and Release document is essential for both parties involved in the transaction as it provides clarity and protection. Keywords: Alabama, Promissory Note, Satisfaction, Release, Legal Document, Full Payment, Obligations, Liabilities, Transaction. Types of Alabama Promissory Note — Satisfaction and Release: 1. General Satisfaction and Release: This type of satisfaction and release document is used to acknowledge the completion of payment and release the borrower from any further liability. It applies to any promissory note in Alabama, regardless of the specific terms or conditions. 2. Partial Satisfaction and Release: In certain cases, a borrower may have made partial payments towards the promissory note. This type of satisfaction and release document recognizes the partial payment and releases the borrower from the respective amount owed. It is crucial to specify the exact amount being satisfied and released in the document. 3. Conditional Satisfaction and Release: Sometimes, the satisfaction of a promissory note may be subject to certain conditions or terms set forth by the lender or involved parties. This type of satisfaction and release document outlines the specific conditions that need to be met for the release to take effect. It ensures that both parties are aware of and agree to the conditions before finalizing the release. 4. Collateral Satisfaction and Release: When a promissory note is secured by collateral, such as real estate or personal property, this type of satisfaction and release document acknowledges the repayment of the debt and releases the collateral from the lien or encumbrance created by the promissory note. It allows the borrower to regain full ownership and control over the collateral. These different types of Alabama Promissory Note — Satisfaction and Release documents provide flexibility in recognizing the completion of payment and releasing the borrower from obligations appropriately. It is crucial to consult with legal professionals to ensure the accurate drafting and execution of these documents according to Alabama laws and regulations.

Alabama Promissory Note - Satisfaction and Release

Description

How to fill out Alabama Promissory Note - Satisfaction And Release?

Are you presently in the situation where you need documents for potential business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Alabama Promissory Note - Satisfaction and Release, designed to meet state and federal requirements.

Once you obtain the correct form, click on Buy now.

Select the payment plan you prefer, fill in the required information to create your account, and complete your order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alabama Promissory Note - Satisfaction and Release template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct locality/county.

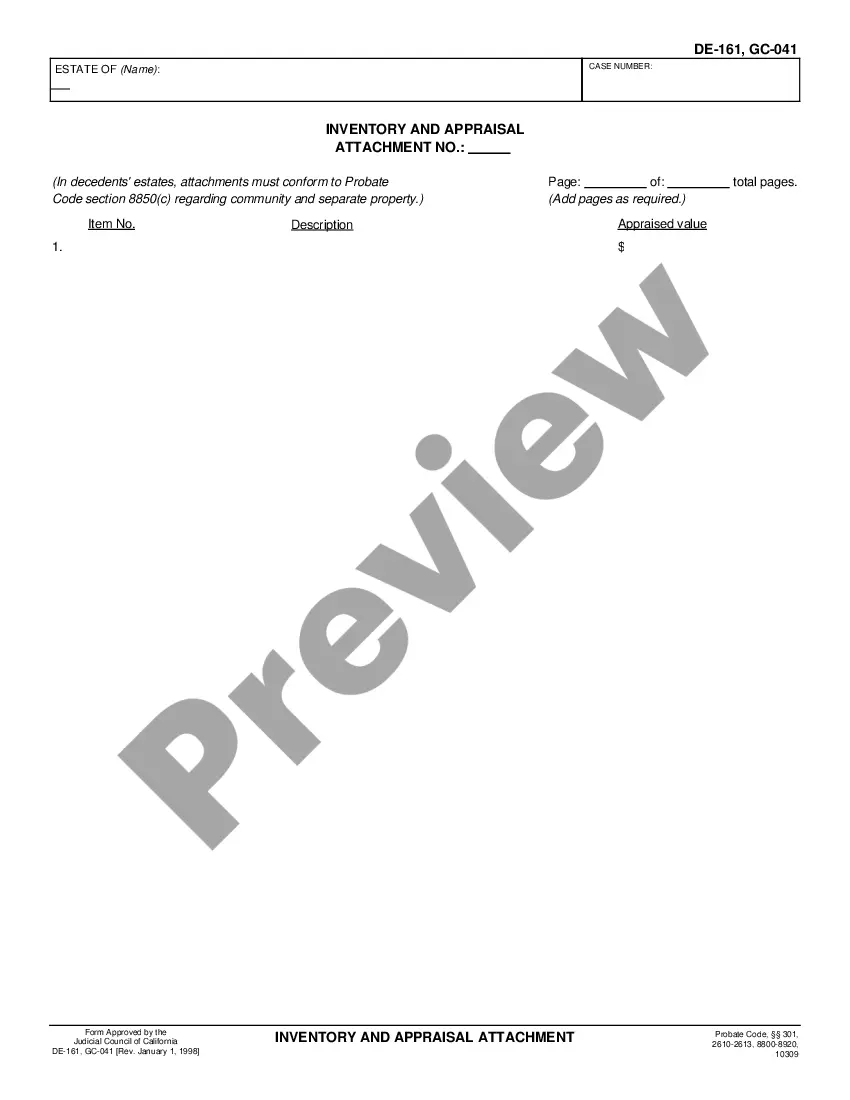

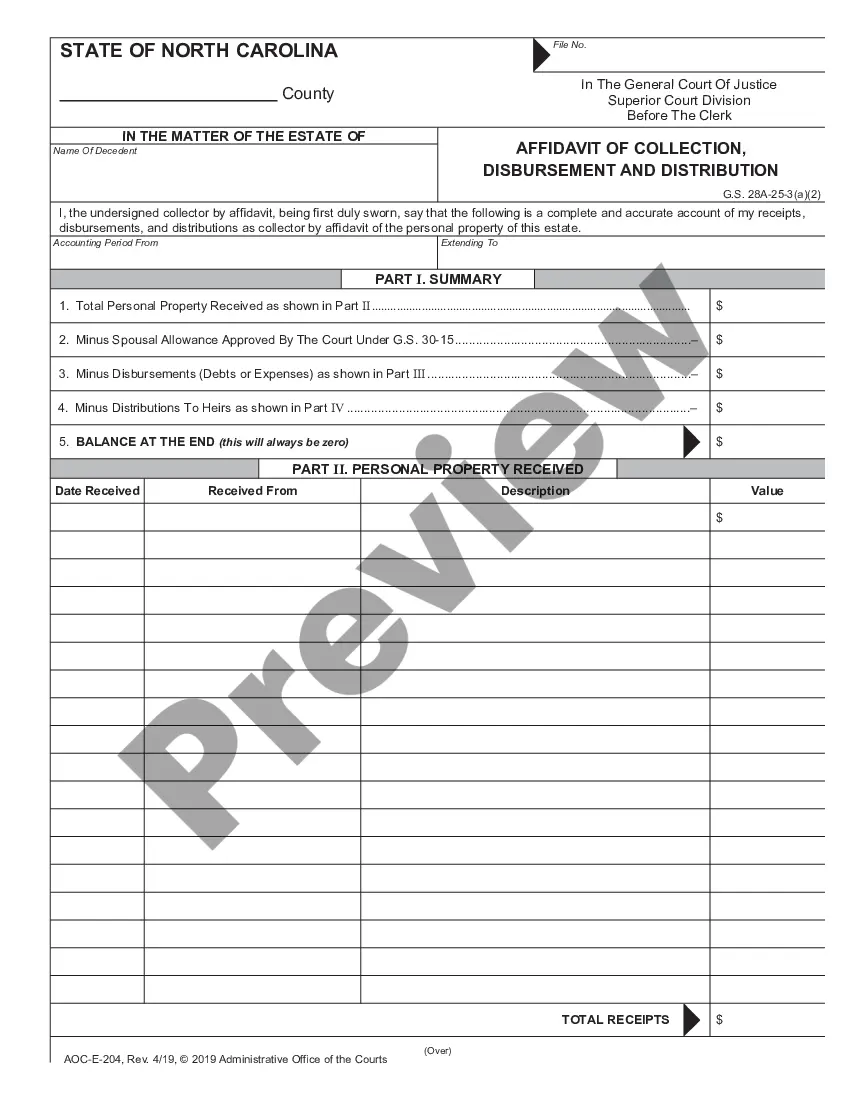

- Utilize the Review button to examine the form.

- Check the summary to ensure that you have selected the correct form.

- If the form is not what you are looking for, use the Search box to find a form that matches your needs.

Form popularity

FAQ

In Alabama, a will does not have to be notarized to be valid; however, notarization can help in proving its authenticity. If you create a self-proving will, notarization becomes a valuable addition. This simplifies the probate process, as the will's validity is established upfront. For comprehensive legal forms and assistance, consider using the US Legal Forms platform.

Filling out an Alabama Promissory Note - Satisfaction and Release requires attention to specific details. Start by entering the names and addresses of the borrower and lender. Include the amount borrowed, the interest rate, and the repayment schedule. Ensure you sign and date the document to validate it legally.

In Alabama, the statute of limitations on a promissory note generally lasts for six years. This permits creditors to collect amounts owed within this time frame. However, after this period, claims may become unenforceable in court. To help you navigate these complex timelines, US Legal Forms offers detailed information and forms to aid in ensuring proper satisfaction and release.

Promissory notes in Alabama may have limitations, including enforceability and time constraints for collection. If a borrower defaults on a note, a lender must act within the prescribed statute of limitations to seek recovery. Moreover, informal agreements may not provide the same clarity and security as a formal promissory note. US Legal Forms helps ensure that your promissory note meets legal standards.

The statute of limitations for written contracts in Alabama is usually six years. This means that if a party does not enforce their rights within this time frame, they may lose the ability to seek collection through court. It is crucial for parties involved in a promissory note to be aware of these limits for satisfaction and release. For precise information, consult resources available on US Legal Forms.

In Alabama, a debt may become uncollectible after a certain period, which is typically governed by the statute of limitations. Generally, this period is six years for most debts, including promissory notes. It's important to keep accurate records and stay informed about payment statuses. US Legal Forms provides guidance to help you understand your rights and manage debts effectively.

In Alabama, a promissory note remains valid until it is satisfied or released according to its terms. Typically, this means that as long as the borrower continues to make payments, the note is active. However, once the debt is fully repaid, the lender must provide a satisfaction and release document to confirm this. For those navigating this process, US Legal Forms offers helpful resources.

To void a promissory note, both parties must agree to cancel the document, typically when the agreement is no longer valid or has been mistakenly created. This can be done through a mutual cancellation document, which should be signed by both the lender and borrower. Understanding how to properly void a promissory note ensures that there are no misunderstandings or future liabilities. Uslegalforms can provide the necessary templates and legal insights to support this process.

To terminate a promissory note, the borrower must repay the outstanding balance according to the agreed terms. Once the debt is cleared, the lender provides a written acknowledgment of termination, effectively releasing the borrower from their obligations under the note. This process is integral to maintaining clear financial records. Leveraging tools from uslegalforms can provide the necessary documents to facilitate this termination securely.

In Alabama, a promissory note does not necessarily need to be notarized; however, notarization can add an extra layer of validation to the document. A notarized note can help protect both parties by providing verifiable evidence of the agreement. Understanding the notary requirements in Alabama can be crucial for ensuring your promissory note is enforceable. Uslegalforms can offer additional resources on notarization and other legal matters.