Alabama Sale of Business - Noncompetition Agreement - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Noncompetition Agreement - Asset Purchase Transaction?

If you need to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and convenient search feature to locate the documents you require.

Various templates for business and personal applications are organized by categories and suggests, or keywords. Utilize US Legal Forms to acquire the Alabama Sale of Business - Noncompetition Agreement - Asset Purchase Transaction in just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every form you’ve downloaded from your account.

Click on the My documents section and select a form to print or download again. Be proactive and download and print the Alabama Sale of Business - Noncompetition Agreement - Asset Purchase Transaction with US Legal Forms. There are numerous professional and state-specific forms available for your personal or business needs.

- If you are an existing US Legal Forms customer, sign in to your account and then click the Download button to obtain the Alabama Sale of Business - Noncompetition Agreement - Asset Purchase Transaction.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your relevant city/state.

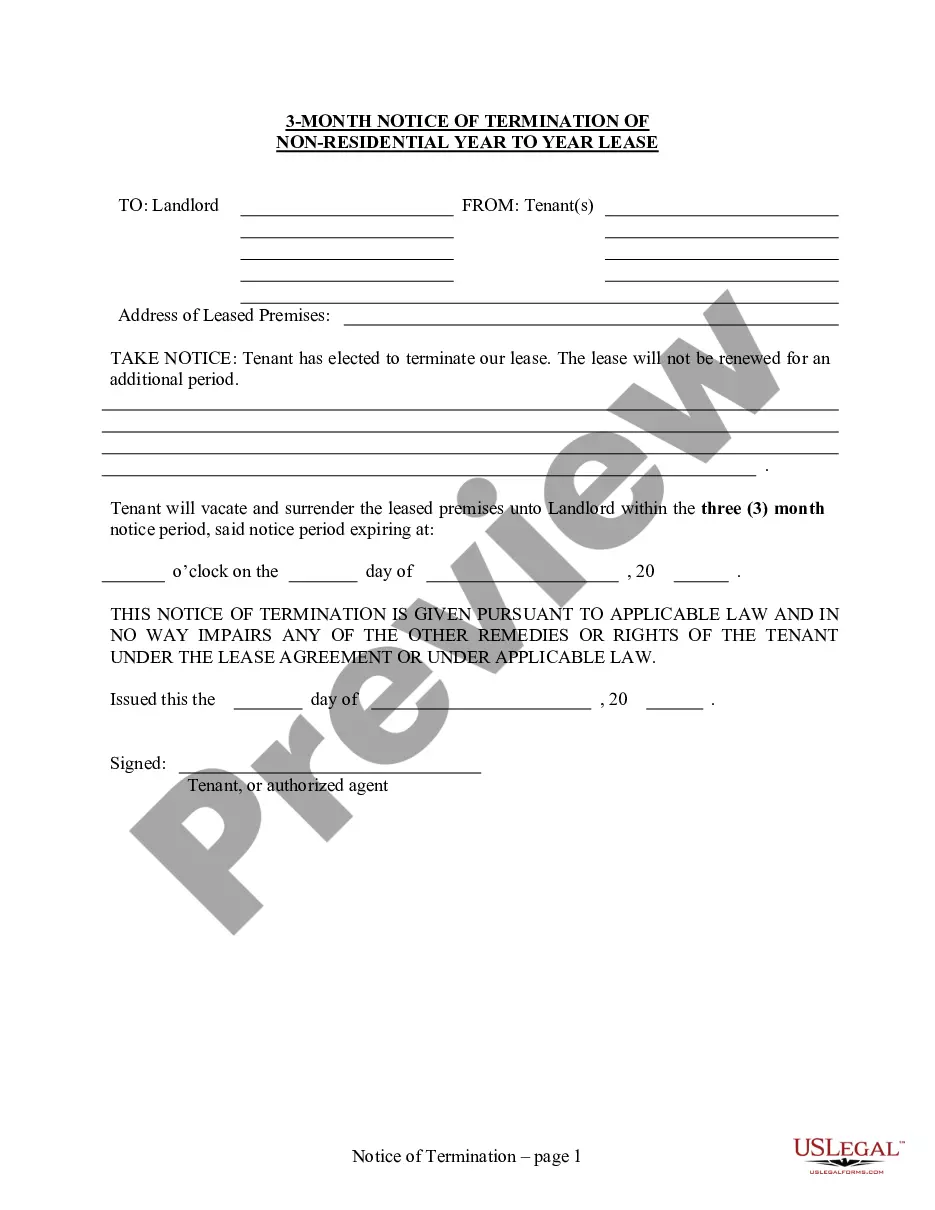

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. After finding the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can pay using your credit card or PayPal account.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Alabama Sale of Business - Noncompetition Agreement - Asset Purchase Transaction.

Form popularity

FAQ

Covenant Not to Compete Must Be Amortized Over 15 years The Tax Court, in a CASE OF FIRST IMPRESSION, has held that a company must amortize over 15 years a covenant not to compete because it was entered into with an indirect acquisition of an interest in a trade or business -- that is, the redemption of the company's

Among other things, non-compete agreements can be considered an acquired intangible asset from the seller and be amortized for cost recovery for federal tax purposes.

Non-competition clause examples include: Example 1: Preventing former employees from using trade secrets. Example 2: Stopping contractors from competing with you. Example 3: Former partners limiting the geographical reach.

A noncompete agreement is an intangible asset because there is value in preventing another party from operating a business within the same industry. While it is difficult to place a specific value on a noncompete agreement, value can be assigned during purchase accounting.

Non-solicitation Agreements are Specifically Regulated. The New Act, however, now seems to require that an employer possess a protectable interest to enforce a non-solicitation agreement and appears to impose other requirements similar to those needed to enforce non-compete agreements.

Tax Treatment of Noncompete Covenants: Owner Where the owner enters into a compensatory noncompete covenant, the consideration received is taxed to the owner at ordinary income rates, whether the transaction is structured as a stock or asset sale.

Noncompete agreements help businesses retain valuable employees, safeguard inside information and prevent unfair competition. But although they're designed to protect companies, they can also put them at great risk if they're not properly structured and maintained.

The non-solicitation agreement is a less restrictive contract and is narrowly aimed at preventing an employee from soliciting his or her former employer's clients. Unlike the non-compete agreement, the employee is allowed to immediately start work in the same industry and in the same geographic area.

How do I get around a non-compete agreement?Prove your employer is in breach of contract.Prove there is no legitimate interest to enforce the non-compete agreement.Prove the agreement is not for a reasonable amount of time.Prove that the confidential information you had access to isn't special.More items...

Non-compete and non-solicitation agreements are clauses that attempt to limit a former employee's ability to work with a competitor and/or solicit former clients for a specific duration of time.