Alabama Shareholders Agreement — Short Form: A Comprehensive Guide Introduction: A shareholders' agreement is a legal document created by the shareholders of a company to define their rights, obligations, and responsibilities towards each other. It ensures a clear and transparent framework for managing and resolving potential conflicts and issues within the company. This article delves into the details of an Alabama Shareholders Agreement — Short Form, outlining its purpose, key components, and benefits. Key Components of an Alabama Shareholders Agreement — Short Form: 1. Ownership Structure: This agreement outlines the specific ownership structure of the company, including the percentage of shares held by each shareholder. It establishes the basis for decision-making authority, profit distribution, and liability allocation. 2. Capital Contributions: The agreement defines the expectations for capital contributions made by each shareholder. It lays out the procedures and timelines for additional capital investments, determining how the funds will be utilized to benefit the company. 3. Decision-Making Process: This component specifies how major business decisions will be made within the company. It outlines whether voting will be based on a simple majority or requires a higher threshold, such as a two-thirds majority. The agreement also identifies key decisions that may require unanimous shareholder approval. 4. Board Structure and Powers: The agreement determines the composition and powers of the board of directors. It specifies how directors are elected or appointed, their roles and responsibilities, and the decision-making authority of the board. 5. Transfer of Shares: The agreement establishes guidelines for the transfer of shares between shareholders. It clarifies the process, including any preemptive rights, tag-along or drag-along provisions, and restrictions on transferring shares outside the existing shareholder group. 6. Dispute Resolution: In case of disputes between shareholders, this section outlines the mechanisms to resolve conflicts, including mediation, arbitration, or litigation. It aims to provide an efficient and cost-effective way to address disagreements while minimizing disruption to the company's operations. Types of Alabama Shareholders Agreement — Short Form: 1. Standard Alabama Shareholders Agreement — Short Form: This agreement covers the essential elements required for small to mid-sized companies. It focuses on key aspects such as ownership structure, capital contributions, decision-making, and share transfer, providing a framework for smooth shareholder cooperation. 2. Alabama Shareholders Agreement — Short Form with Buy-Sell Provisions: This variant includes additional provisions that address potential scenarios like the death, disability, or retirement of a shareholder. It outlines mechanisms for the purchase or sale of shares in these situations to ensure smooth transitions and continuity within the company. 3. Alabama Shareholders Agreement — Short Form with Non-Compete Agreements: This type of agreement includes non-compete clauses to prevent shareholders from engaging in activities that may harm the company's interests. It ensures that shareholders do not compete in the same market or industry while maintaining their involvement in the company. Benefits of an Alabama Shareholders Agreement — Short Form: 1. Protection of Shareholder Interests: The agreement safeguards the rights, obligations, and expectations of each shareholder, preventing disputes and ensuring fairness in decision-making. 2. Clear Governance Structure: It establishes a transparent governance structure, defining the roles and powers of shareholders and directors, which promotes efficient management and accountability. 3. Efficient Conflict Resolution: By outlining dispute resolution mechanisms, the agreement offers a cost-effective method to resolve conflicts, avoiding costly and time-consuming legal battles. 4. Continuity and Succession Planning: With provisions addressing share transfers and unforeseen circumstances, the agreement ensures the smooth continuation of the business and facilitates effective succession planning. Conclusion: An Alabama Shareholders Agreement — Short Form is a vital contractual tool for shareholders to establish a well-defined framework for their company's operations and relationships. By addressing ownership, decision-making, conflict resolution, and share transfers, this agreement provides a clear roadmap to protect shareholders' interests and foster the long-term success of the business.

Alabama Shareholders Agreement - Short Form

Description

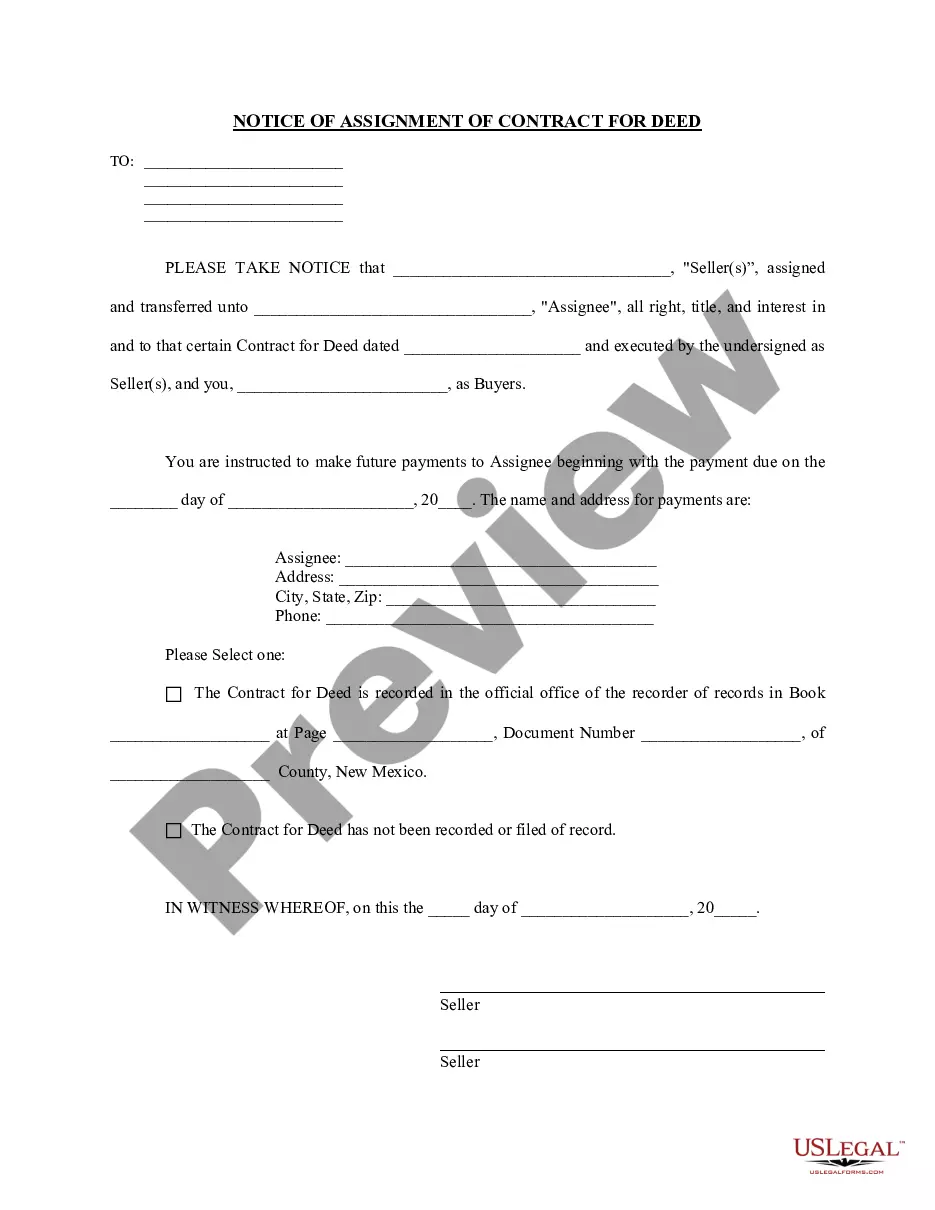

How to fill out Alabama Shareholders Agreement - Short Form?

You might invest time online attempting to discover the approved document template that meets the federal and state criteria you need.

US Legal Forms offers a significant number of legal forms that can be examined by professionals.

You can download or print the Alabama Shareholders Agreement - Short Form from my service.

If applicable, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you may fill out, modify, print, or sign the Alabama Shareholders Agreement - Short Form.

- Every legal document template you acquire is yours indefinitely.

- To retrieve an additional copy of a purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Read the form information to confirm that you have chosen the right kind.

Form popularity

FAQ

Another name for a shareholder is a stockholder. Both terms describe individuals or entities that own shares in a corporation, holding rights to profits and decision-making. Understanding the role of a stockholder is crucial when drafting an Alabama Shareholders Agreement - Short Form. This agreement ensures that the interests of stockholders are well-protected and their rights clearly defined.

Another name for a shareholder agreement is a stockholders agreement. This term often conveys the same legal meaning and serves the same purpose in defining relationships among shareholders. When drafting an Alabama Shareholders Agreement - Short Form, using relevant terminology ensures clarity and effectiveness in conveying essential information. Always prioritize accuracy in legal documents to avoid misinterpretation.

While a co-founder agreement and a shareholder agreement serve similar purposes, they are not the same. A co-founder agreement typically addresses the relationship and responsibilities of co-founders at the outset of a business. In contrast, an Alabama Shareholders Agreement - Short Form focuses on shareholder rights and obligations within a corporation. Understanding these distinctions ensures that you create the most suitable agreement for your situation.

A shareholder agreement is a legal document that outlines the rights and responsibilities of shareholders in a corporation. It establishes rules for ownership, management, and the transfer of shares. An Alabama Shareholders Agreement - Short Form simplifies this process, making it easier for businesses to protect their interests. It also provides clarity and reduces conflicts among shareholders.

Alabama Shareholders Agreement - Short Form typically includes various types such as voting agreements, buy-sell agreements, and management agreements. Each type serves a specific purpose, like defining how votes are cast or outlining procedures for selling shares. Understanding these variations helps you choose the right agreement for your business structure. For tailored solutions, consider using uslegalforms to create an agreement that meets your unique needs.

The common abbreviation for shareholders agreement is 'SHA.' This abbreviation is widely recognized in business discussions. If you are drafting a document like the Alabama Shareholders Agreement - Short Form, you might consider using this abbreviation to save space and improve readability within your agreement.

To make a shareholder agreement, start by gathering important information about your business structure, the roles of each shareholder, and the rules governing your company's operations. Then, draft the document using a template like the Alabama Shareholders Agreement - Short Form, available on uslegalforms, which covers essential terms and conditions. After drafting, review the agreement with all shareholders to ensure everyone is in agreement and finalize it with signatures.

Typically, a shareholders agreement is drawn up by the business owners themselves or with the assistance of a lawyer. If you prefer a more streamlined approach, you can use the Alabama Shareholders Agreement - Short Form from uslegalforms, which provides a user-friendly template that simplifies the process. This way, you can create an effective agreement tailored to your specific needs.

Yes, you can write your own shareholders agreement, but it is important to ensure it meets legal requirements. The Alabama Shareholders Agreement - Short Form can guide you through key components and language, making the task much easier. However, consider consulting with a legal professional to ensure your document is comprehensive and enforceable.

Writing a shareholder agreement involves clearly defining the roles and responsibilities of the shareholders, outlining the decision-making processes, and specifying how disputes will be resolved. To help you with this process, you can utilize the Alabama Shareholders Agreement - Short Form available on uslegalforms. This template provides essential clauses that make the drafting process straightforward and efficient.

Interesting Questions

More info

Click here to register.