Alabama Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a diverse selection of legal templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal use, categorized by type, state, or keywords. You can quickly find the latest document templates, such as the Alabama Minimum Checking Account Balance - Corporate Resolutions Form.

If you already have an account, Log In and retrieve the Alabama Minimum Checking Account Balance - Corporate Resolutions Form from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms from the My documents section of your account.

Proceed with the transaction. Utilize your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Edit. Fill out, revise, and print and sign the saved Alabama Minimum Checking Account Balance - Corporate Resolutions Form. Every template added to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you require. Access the Alabama Minimum Checking Account Balance - Corporate Resolutions Form with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and region-specific templates that cater to your business or personal requirements.

- Ensure that you have selected the appropriate form for your location.

- Click the Review button to examine the content of the form.

- Check the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, select your preferred payment plan and provide your information to set up an account.

Form popularity

FAQ

In the context of tax, PPT stands for Property Personal Tax. This tax affects individuals and businesses with property holdings. It’s crucial for maintaining the Alabama Minimum Checking Account Balance - Corporate Resolutions Form, as improper management of these taxes can impact your financial standing. Understanding PPT helps you navigate your financial responsibilities better.

In Alabama, any business entities engaged in trade, commerce, or any professional activity must file the business privilege tax. This includes corporations, limited liability companies, and partnerships. Meeting the requirements for the Alabama Minimum Checking Account Balance - Corporate Resolutions Form may involve filing this tax, so it's essential to understand your obligations and ensure compliance.

A statutory form power of attorney in Alabama is a legally defined document that grants authority to an agent to manage a principal's financial matters. This form simplifies legal procedures and ensures that your financial affairs are managed as you intended, especially regarding your Alabama Minimum Checking Account Balance - Corporate Resolutions Form. Utilizing this form can prevent misunderstandings and provide clarity in financial decisions.

A PPT form, or Property Power of Attorney form, in Alabama allows you to designate someone to manage your property and financial affairs. This form is essential for individuals or businesses wanting to ensure their interests are protected when they cannot act on their own behalf. It's important when establishing an Alabama Minimum Checking Account Balance - Corporate Resolutions Form, as it outlines who can make financial decisions for you.

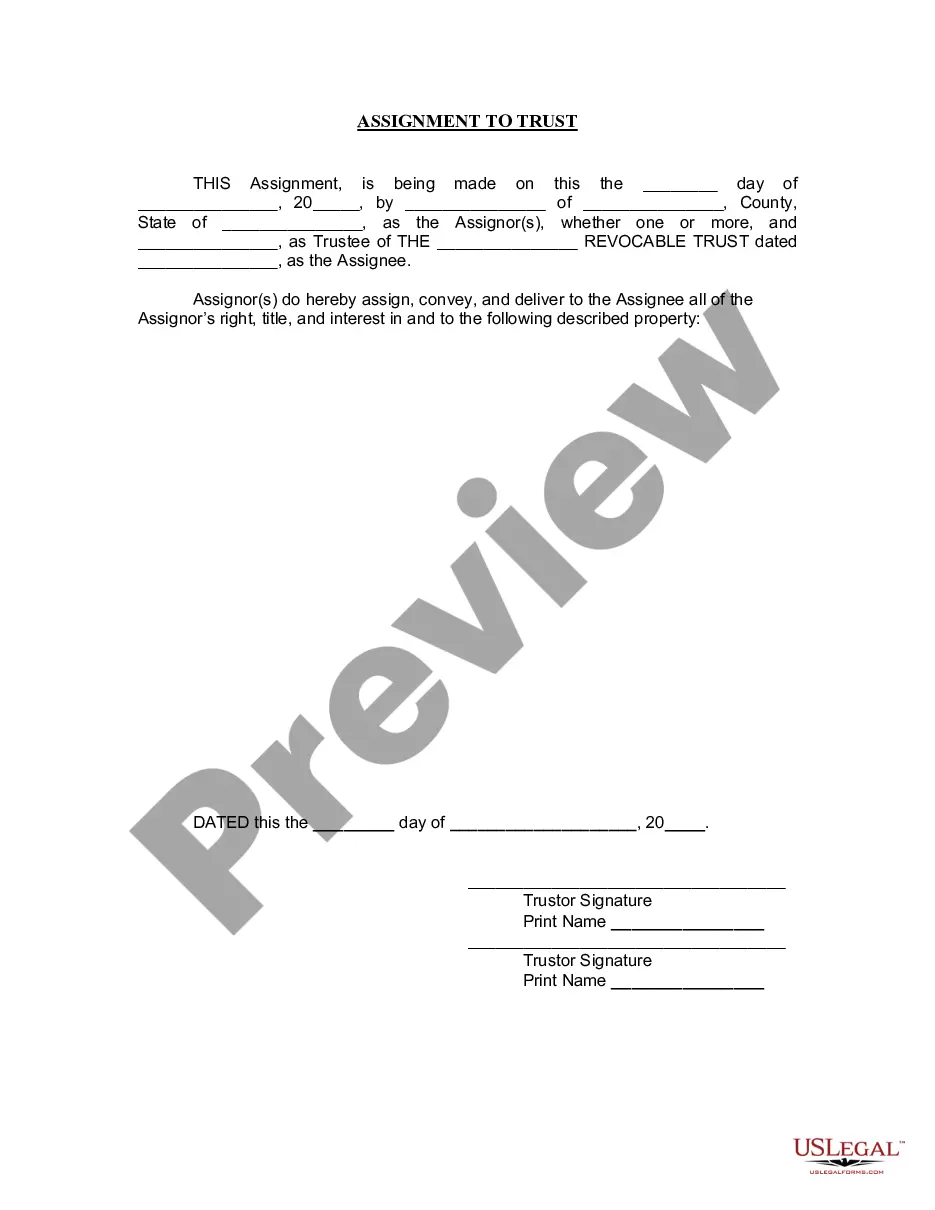

A banking resolution is a legal document that records the decisions made by a corporation regarding banking matters. This document usually defines who has the authority to perform banking transactions on behalf of the company, ensuring clarity and accountability. Understanding the Alabama Minimum Checking Account Balance - Corporate Resolutions Form can help you create an effective banking resolution that safeguards your company's financial interests.

To get a banking resolution, start by determining the actions you want your resolution to include. Then, visit uslegalforms or similar platforms for templates that suit your needs. Make sure your final document is reviewed and signed by the necessary parties to ensure its validity, especially if it relates to the Alabama Minimum Checking Account Balance - Corporate Resolutions Form.

You can obtain a banking resolution from various sources, including legal websites, your bank, or corporate service providers. Many platforms, such as uslegalforms, offer downloadable templates to help create compliant documents tailored to your needs. This can be particularly handy for ensuring that your Alabama Minimum Checking Account Balance - Corporate Resolutions Form meets all the criteria necessary for your banking requirements.

Form CPT in Alabama refers to the Corporate Resolution for Personal Transactions used for banking purposes. This form outlines specific actions that corporate officers can take regarding personal transactions within the corporate bank accounts. If you need guidance or templates, you can find comprehensive options on the Alabama Minimum Checking Account Balance - Corporate Resolutions Form to assist your understanding and completion.

To create your bank account resolution, you first need to draft a document that includes your company's name, the date of the resolution, and the specific actions authorized. It's essential to have this signed by the board members to validate it. Utilizing the Alabama Minimum Checking Account Balance - Corporate Resolutions Form can streamline this process, ensuring all necessary information is included and compliant with state requirements.

A corporate resolution for a bank account is a formal document that outlines specific decisions made by a company's board of directors. This document authorizes certain individuals to act on behalf of the company regarding its bank accounts, including opening or closing accounts and making financial transactions. When dealing with the Alabama Minimum Checking Account Balance - Corporate Resolutions Form, you ensure that your banking activities align with your corporate governance.