Alabama Federal Trade Commission Affidavit regarding Identity Theft

Description

How to fill out Federal Trade Commission Affidavit Regarding Identity Theft?

If you wish to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's user-friendly and convenient search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the Alabama Federal Trade Commission Affidavit concerning Identity Theft in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Alabama Federal Trade Commission Affidavit regarding Identity Theft.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The Department of Justice prosecutes cases of identity theft and fraud under a variety of federal statutes.

The FTC enforces federal consumer protection laws that prevent fraud, deception and unfair business practices. The Commission also enforces federal antitrust laws that prohibit anticompetitive mergers and other business practices that could lead to higher prices, fewer choices, or less innovation.

FTC Commissioners aren't calling you ? really Scammers have been calling, pretending to be people from the FTC. While the names they use might be real, they're actually scammers ? some of them hoping to trick you into thinking they're an FTC Commissioner. But they're not.

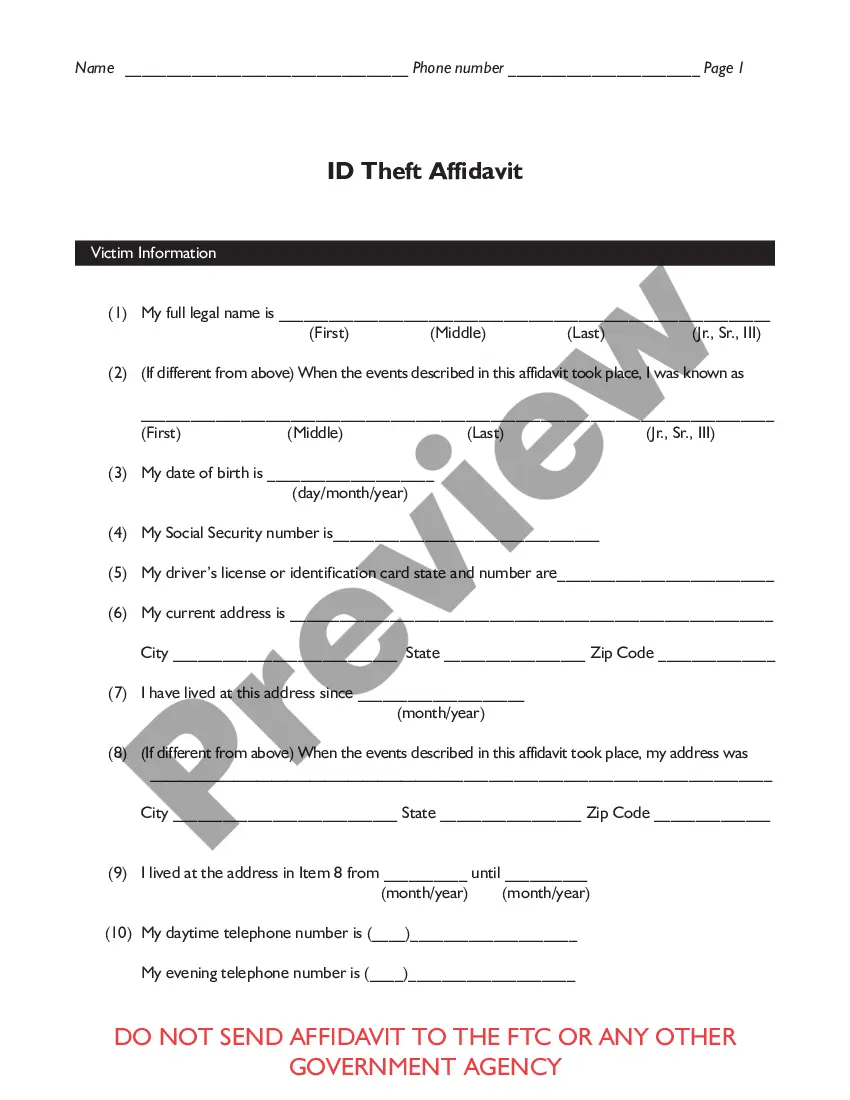

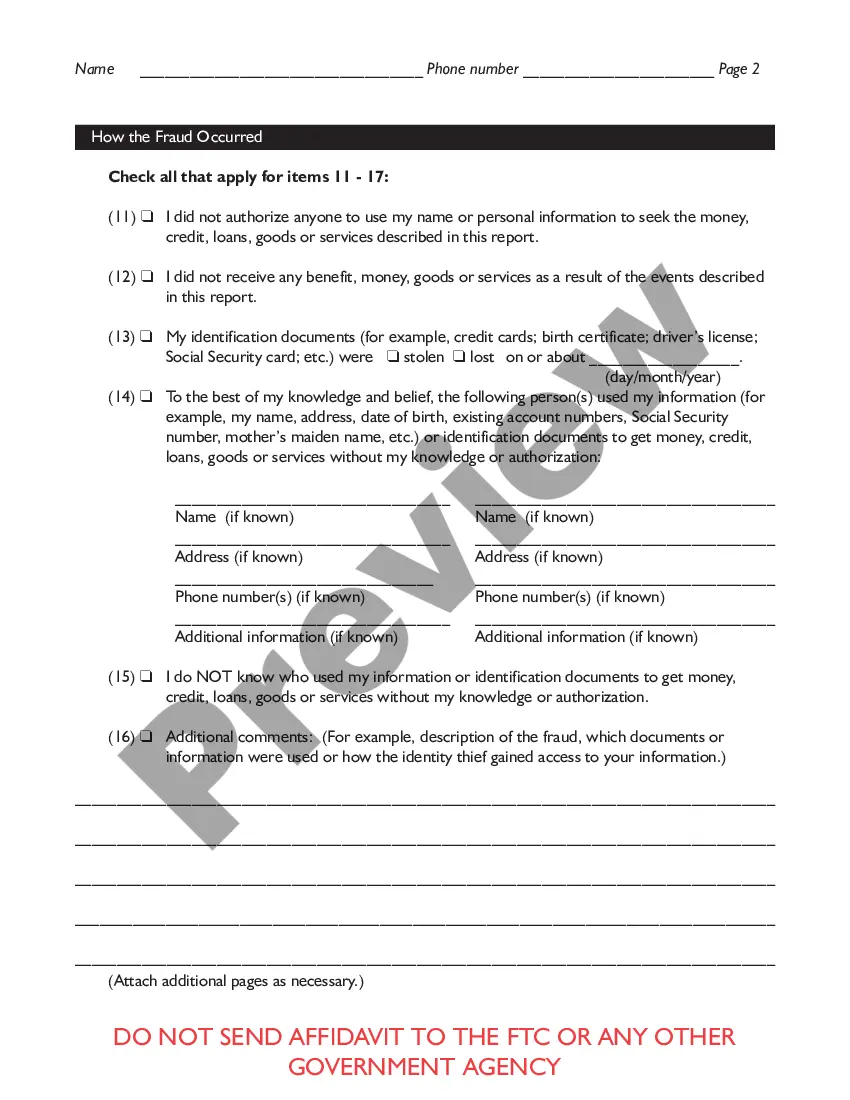

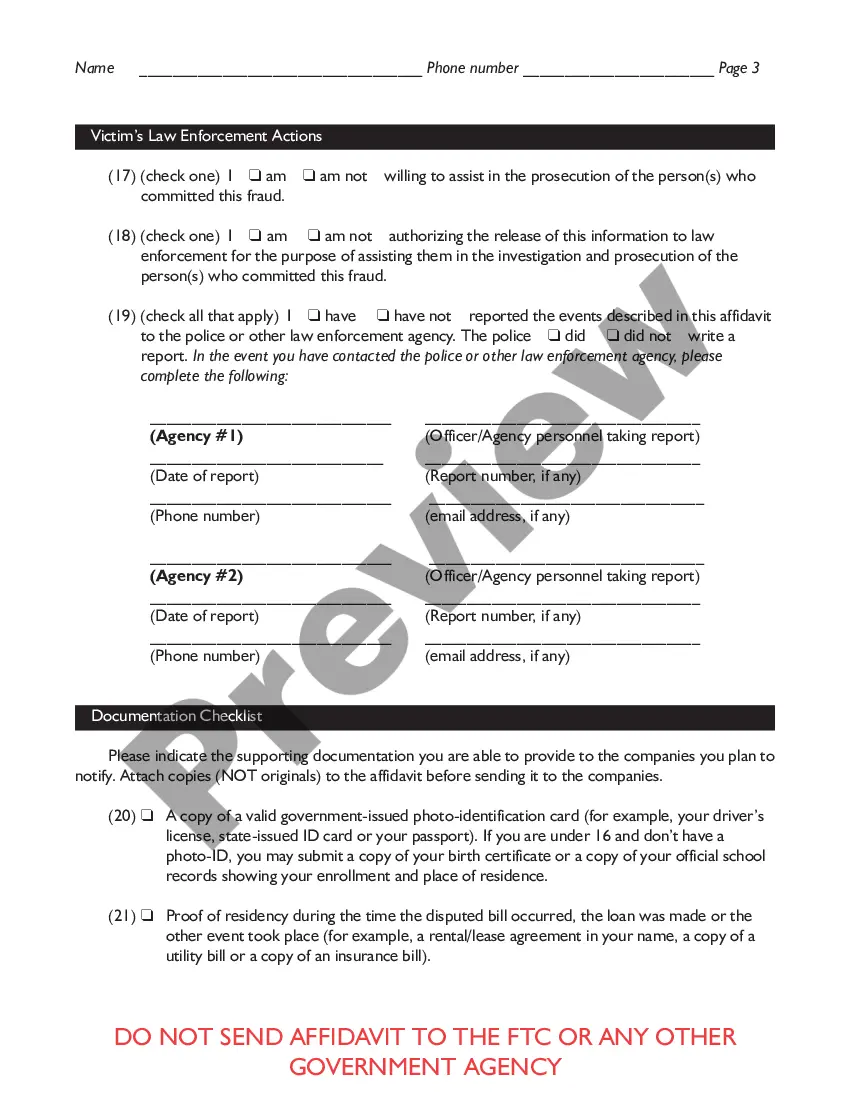

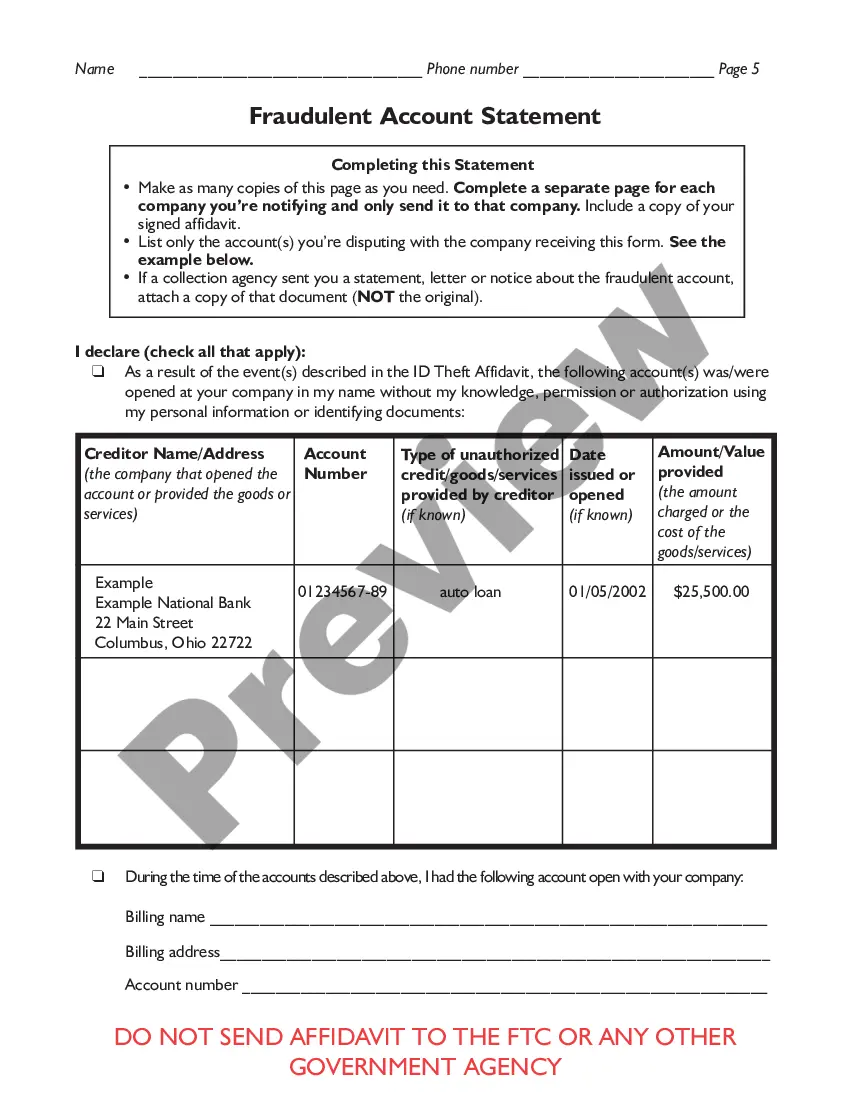

To complete the FTC's Identity Theft Affidavit, you need to provide personal data including your Social Security number, address and contact information. You also will need to provide your driver's license number or information from another government-issued ID.

In 1998, Congress enacted the Identity Theft and Assumption Deterrence Act (?the Identity Theft Act? or ?the Act?),1 directing the Federal Trade Commission to establish the federal government's central repository for identity theft complaints and to provide victim assistance and consumer education.

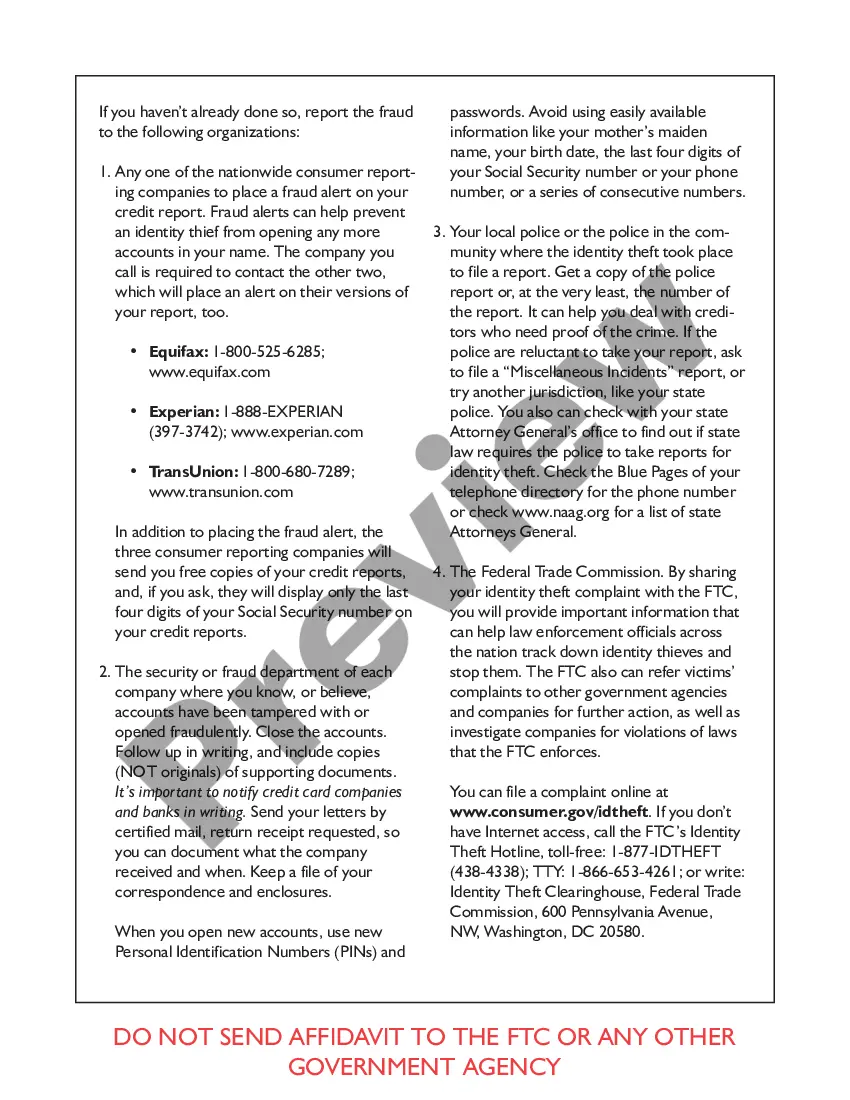

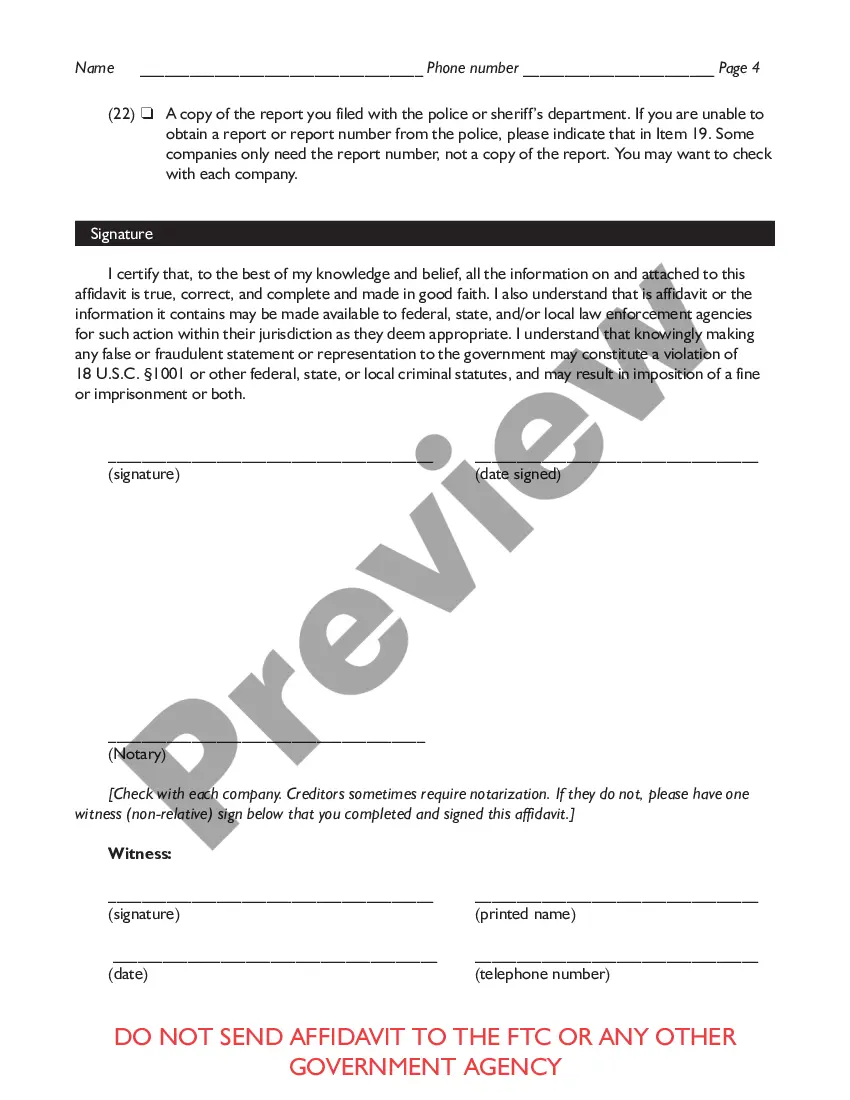

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

How to report identity theft. To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338.

Visit ftc.gov/idtheft to use a secure online version that you can print for your records. Before completing this form: 1. Place a fraud alert on your credit reports, and review the reports for signs of fraud.