Alabama Computer Software Lease with License Agreement

Description

How to fill out Computer Software Lease With License Agreement?

Are you presently in a condition where you need documentation for both business or private purposes nearly every working day.

There are numerous legal document templates available online, but finding reliable versions is not simple.

US Legal Forms offers thousands of form templates, including the Alabama Software Lease with License Agreement, which can be downloaded to comply with federal and state requirements.

Once you locate the appropriate form, click on Download now.

Select the pricing plan you need, fill in the required details to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alabama Software Lease with License Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

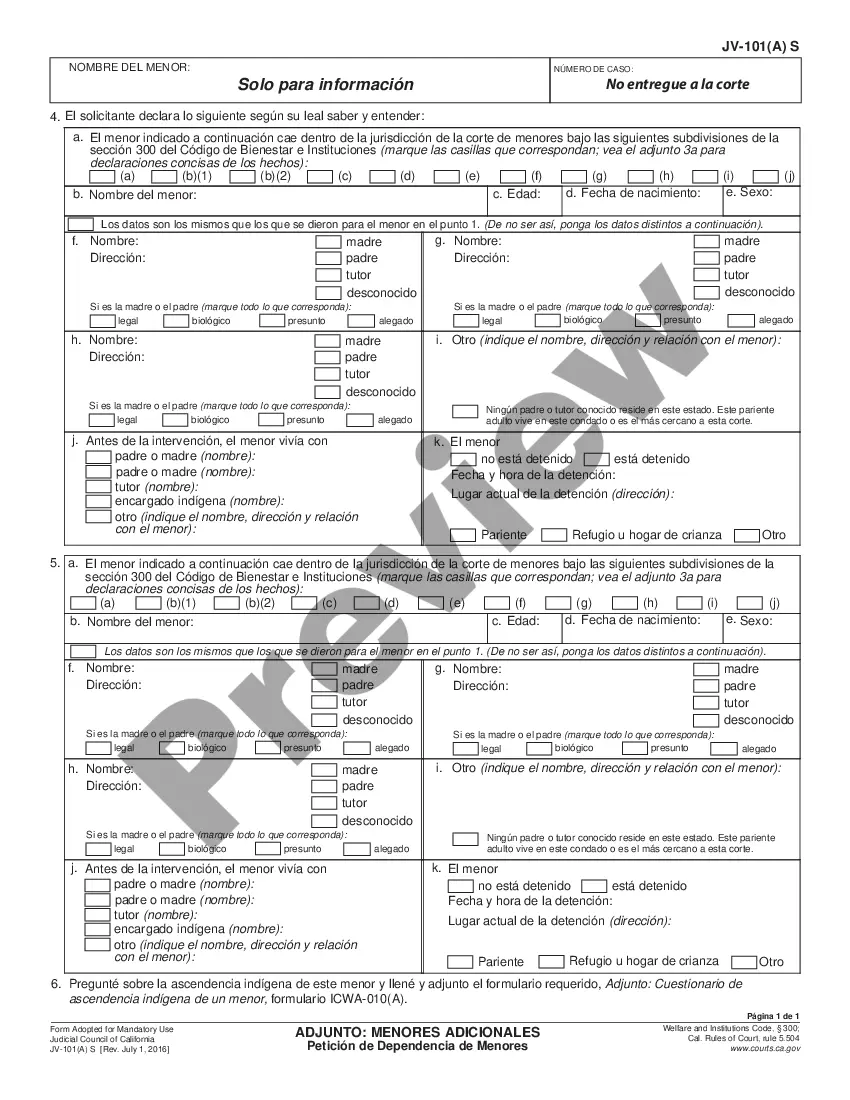

- Use the Preview button to examine the document.

- Review the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that matches your needs and requirements.

Form popularity

FAQ

Section 68 of the Alabama Constitution addresses the prohibition against the legislative action that would lead to the imposition of a retrospective tax, ensuring fairness in the taxation process. This section is significant for businesses engaged in agreements such as the Alabama Computer Software Lease with License Agreement, as it underscores the importance of understanding both current tax responsibilities and the legal framework surrounding tax amendments. Awareness of these provisions can help you avoid legal pitfalls in your transactions.

Title 40 of the Alabama Code deals with taxation, providing detailed statutes on various tax-related matters throughout the state. This title includes essential information on the taxation of both goods and services, impacting agreements like the Alabama Computer Software Lease with License Agreement. If you navigate this title, you'll find critical regulations that affect your tax obligations when leasing software.

In Alabama, several items qualify for sales tax exemption, including specific types of leases and businesses that utilize software for manufacturing or agricultural purposes. Additionally, nonprofits may be exempt from sales taxes under certain conditions. If you engage in an Alabama Computer Software Lease with License Agreement, it’s wise to consult the details of the exemption criteria to determine eligibility and save on potential tax liabilities.

Section 40 23 2 of the Alabama Code outlines the sales tax regulations applicable to tangible personal property and some services, which can impact how software licenses are treated. This section is particularly important for those dealing with the Alabama Computer Software Lease with License Agreement, as it connects the sale of software and related services with their tax liabilities. Understanding these regulations helps individuals and companies navigate their responsibilities more effectively.

The taxability of software as a service (SaaS) in Alabama depends on how the service is provided and its classification under current tax laws. Generally, if the service provides access to software through the cloud without the user obtaining ownership, it may be subject to sales tax. Therefore, when looking at the Alabama Computer Software Lease with License Agreement, it's essential to assess whether the service aligns with taxable services as defined by Alabama law.

Section 40 9 60 of the Code of Alabama 1975 addresses the legal framework for leasing computer software, specifically regarding the tax treatment of these agreements. This section clarifies the implications of the Alabama Computer Software Lease with License Agreement, providing clear guidance on whether software leases are subject to sales tax. Understanding this section is crucial for businesses and individuals engaging in software leasing, ensuring compliance with Alabama tax laws.

Yes, software licenses are generally subject to sales tax in Alabama. The Alabama Computer Software Lease with License Agreement will fall under this category, necessitating tax payments during the licensing process. Businesses must ensure they comply with these regulations to avoid unexpected tax liabilities.

SaaS taxation varies by jurisdiction across the United States. In many states, including Alabama, SaaS can be considered taxable, especially under specific agreements like the Alabama Computer Software Lease with License Agreement. It's advisable to consult a tax professional to understand the tax implications of your specific SaaS offerings.

810 6 5 02 refers to a rule that outlines the taxation guidelines for software and digital products in Alabama. This provision helps clarify sales tax responsibilities when engaging in an Alabama Computer Software Lease with License Agreement. For businesses operating within this framework, understanding these guidelines is essential for compliant transactions.

Yes, software is generally taxable in Alabama, including different forms such as traditional software sales and software-as-a-service. The state imposes tax on the licensing and leasing of software under the Alabama Computer Software Lease with License Agreement. Keep in mind that various exemptions may apply, so reviewing specific transactions with a tax advisor is important.