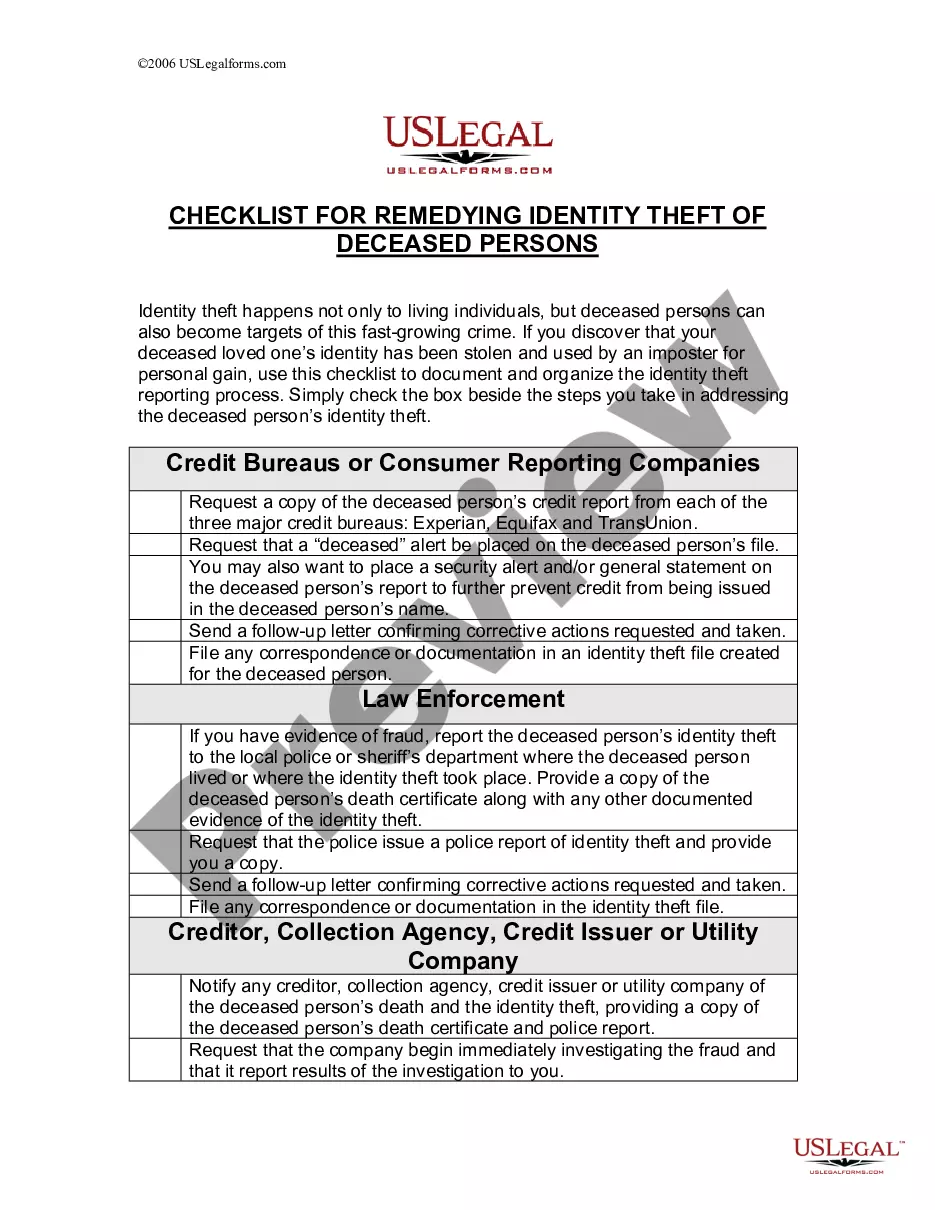

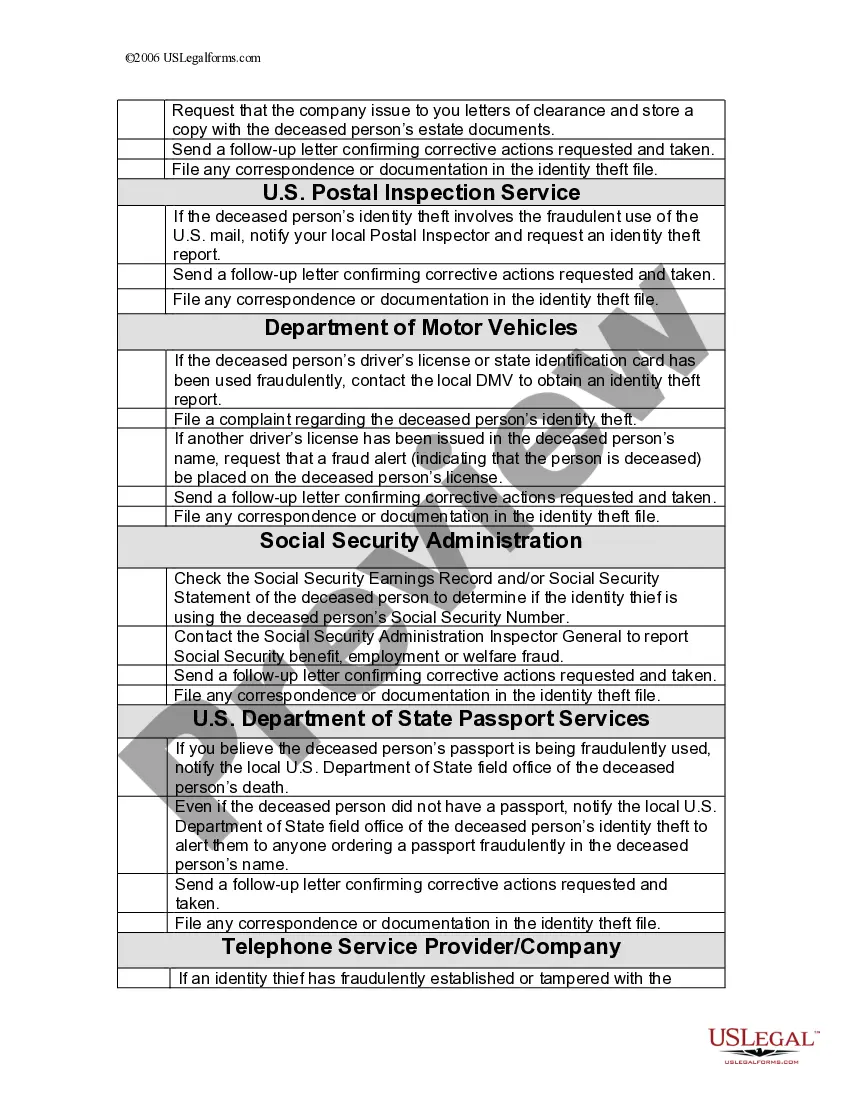

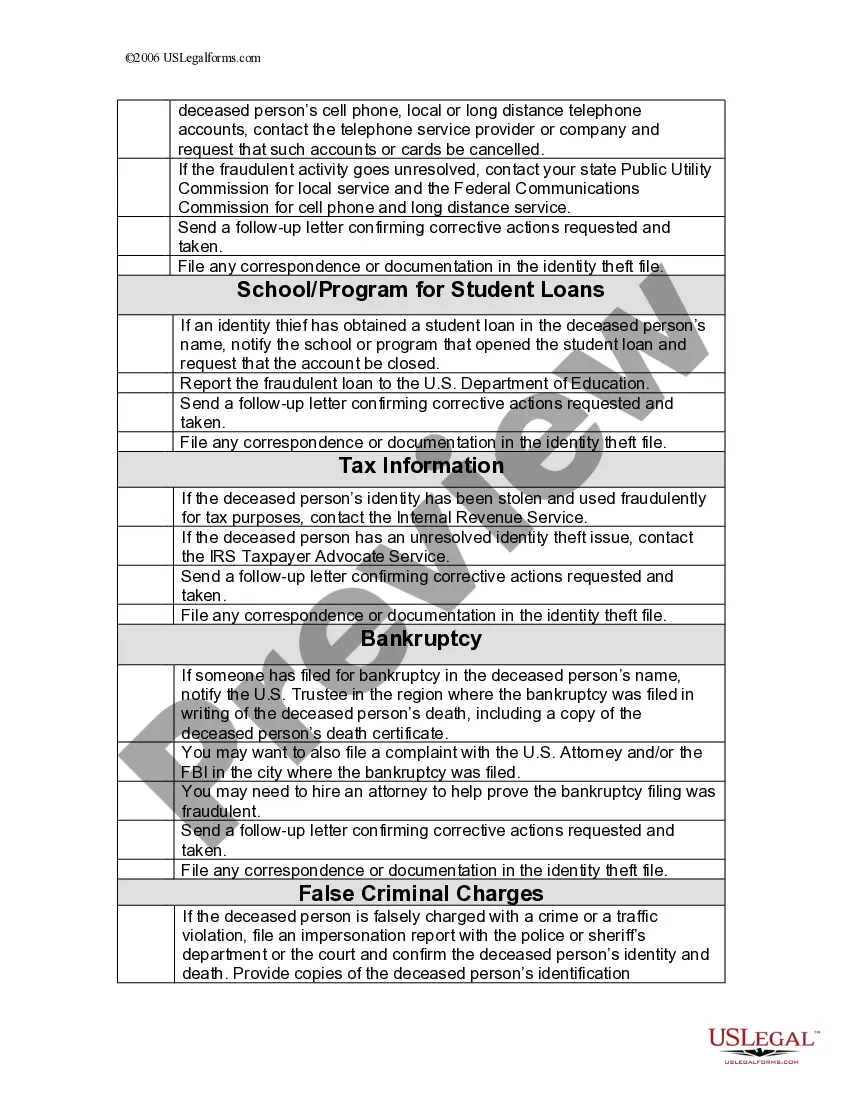

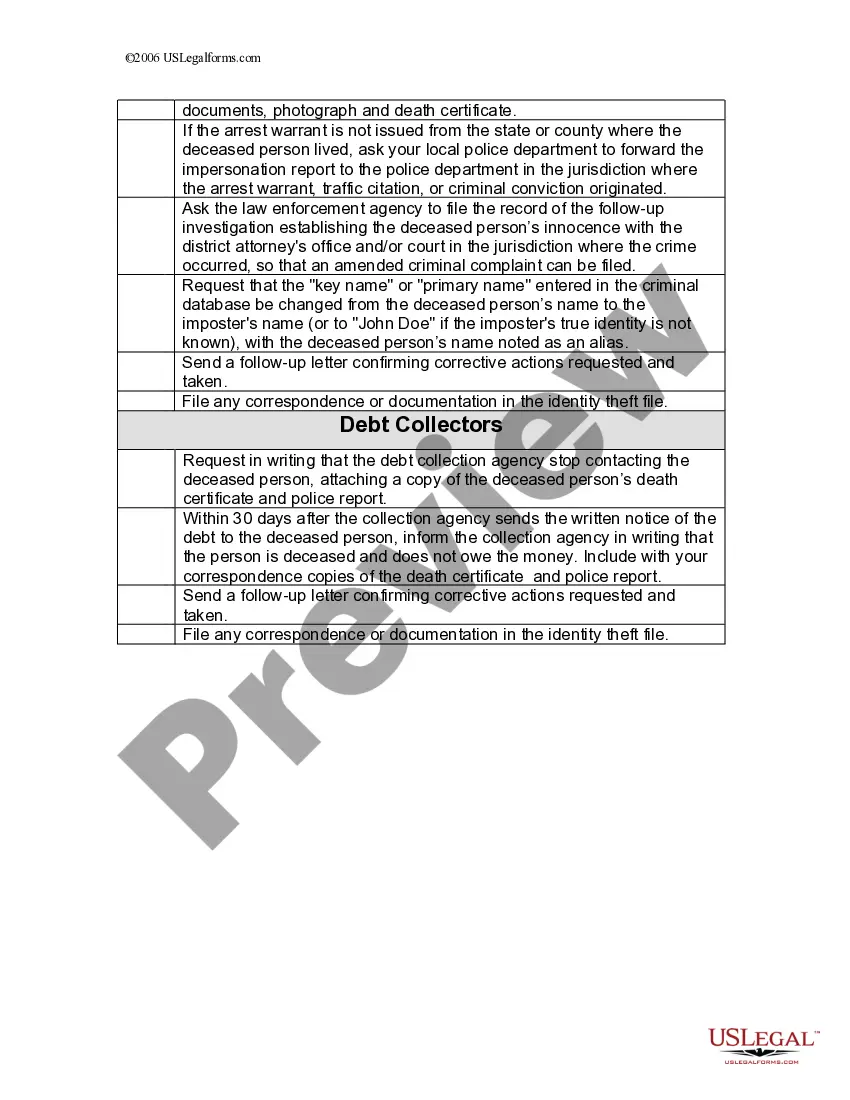

The Alabama Checklist for Remedying Identity Theft of Deceased Persons is a set of guidelines and procedures designed to assist individuals in preventing and resolving cases of identity theft involving deceased individuals. This checklist is created and maintained by the Alabama Attorney General's Office and provides a step-by-step process to help affected individuals safeguard their loved ones' identities and financial information. Keywords: Alabama, checklist, remedying, identity theft, deceased persons, prevention, resolution, guidelines, procedures, individuals, attorney general's office, step-by-step, safeguard, loved ones, identities, financial information. The Alabama Checklist for Remedying Identity Theft of Deceased Persons consists of various steps and actions that should be taken to ensure the deceased person's identity is protected. Although there may not be different types of checklists, the procedures outlined in the checklist can be tailored based on individual circumstances. Here is an overview of the possible steps covered in the Alabama Checklist for Remedying Identity Theft of Deceased Persons: 1. Gather necessary documents: The checklist advises individuals to gather essential documents such as the deceased person's death certificate, Social Security number, driver's license, and insurance policies. These documents are vital in confirming the identity of the deceased person and establishing proof of their passing. 2. Notify appropriate parties: The checklist recommends informing relevant parties about the death to minimize the risk of identity theft. These parties may include financial institutions, credit reporting agencies, government entities, and the Social Security Administration. 3. Obtain multiple copies of the death certificate: The checklist suggests obtaining multiple certified copies of the death certificate as they may be required when notifying and working with various organizations and agencies. 4. Monitor financial accounts: It is crucial to review the deceased person's financial accounts and credit reports regularly. The checklist advises individuals to look for any unauthorized activities or accounts opened in the name of the deceased person. 5. Contact credit reporting agencies: Individuals are instructed to contact the three major credit reporting agencies (Equifax, Experian, and TransUnion) to request a "deceased alert" or "deceased indicator" on the deceased person's credit file. This helps prevent fraudulent activity related to credit. 6. Contact financial institutions: The checklist suggests contacting all financial institutions where the deceased person held accounts, including banks, credit unions, and investment firms. Informing them about the death protects against potential fraudulent transactions or identity misuse. 7. Cancel and secure documents: The checklist advises canceling credit cards, driver's licenses, and other necessary documents of the deceased person to prevent misuse. It also suggests securely storing all important documents related to the deceased person. 8. Report fraudulent activity: If any signs of identity theft or fraudulent activity are discovered, the checklist recommends reporting it immediately to the appropriate authorities, including local law enforcement agencies and the Federal Trade Commission (FTC). 9. Stay vigilant: It is crucial to remain vigilant and regularly monitor the deceased person's financial accounts and credit reports even after taking preventive measures. Any suspicious activities should be reported promptly. While there may not be categorically different types of Alabama Checklists for Remedying Identity Theft of Deceased Persons, variations or additional steps may exist based on specific situations. It is important for individuals to carefully follow the Alabama Attorney General's Office guidelines and adapt them as needed to effectively combat identity theft involving deceased persons.

Alabama Checklist for Remedying Identity Theft of Deceased Persons

Description

How to fill out Alabama Checklist For Remedying Identity Theft Of Deceased Persons?

US Legal Forms - one of the greatest libraries of legal types in the States - gives a wide array of legal record themes it is possible to down load or produce. Using the internet site, you can get 1000s of types for business and personal uses, sorted by groups, claims, or keywords and phrases.You can get the most recent versions of types much like the Alabama Checklist for Remedying Identity Theft of Deceased Persons within minutes.

If you already have a monthly subscription, log in and down load Alabama Checklist for Remedying Identity Theft of Deceased Persons from the US Legal Forms collection. The Acquire switch can look on each form you see. You gain access to all formerly delivered electronically types within the My Forms tab of your own account.

If you wish to use US Legal Forms the first time, listed here are straightforward guidelines to obtain started out:

- Ensure you have selected the correct form to your town/county. Click the Review switch to analyze the form`s information. See the form explanation to ensure that you have selected the right form.

- In the event the form doesn`t suit your needs, make use of the Research industry on top of the monitor to get the one that does.

- If you are happy with the shape, validate your selection by simply clicking the Purchase now switch. Then, opt for the rates prepare you like and provide your qualifications to sign up to have an account.

- Method the financial transaction. Use your charge card or PayPal account to perform the financial transaction.

- Select the file format and down load the shape in your system.

- Make changes. Complete, change and produce and signal the delivered electronically Alabama Checklist for Remedying Identity Theft of Deceased Persons.

Every single design you put into your money does not have an expiry date and it is yours permanently. So, if you wish to down load or produce one more duplicate, just check out the My Forms segment and then click about the form you want.

Gain access to the Alabama Checklist for Remedying Identity Theft of Deceased Persons with US Legal Forms, one of the most extensive collection of legal record themes. Use 1000s of specialist and status-particular themes that fulfill your organization or personal requirements and needs.