Title: Alabama Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death Keywords: Alabama, letter, creditor, collection agencies, credit issuer, utility company, death notification, deceased individual Introduction: When a loved one passes away, it is essential to inform relevant parties about the individual's demise, including creditors, collection agencies, credit issuers, and utility companies. In the state of Alabama, specific letters and notifications should be sent to these entities to ensure a proper legal transition and minimize any future complications. This article provides a detailed description of the Alabama Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of Death, highlighting its importance and potential types of letters depending on the situation. I. Purpose and Importance of the Letter: The Alabama Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of Death serves as an official communication to inform relevant parties about the passing of an individual. This letter plays a pivotal role in updating account statuses, closing accounts, transferring responsibilities, and preventing any unauthorized activities associated with the deceased individual. By promptly notifying creditors, collection agencies, credit issuers, and utility companies, you ensure that their records are updated accordingly and avoid potential issues in the future. II. Types of Alabama Letters to Notify: 1. Alabama Letter to Creditor: This letter is specifically drafted to inform creditors about the death of an individual who owed them money. It provides details such as the deceased's name, account number, date of death, and any relevant supporting documents, such as a death certificate. 2. Alabama Letter to Collection Agencies: If the deceased individual had outstanding debts with collection agencies, this type of letter is required. It notifies the agency about the death, including the necessary details, and requests appropriate actions, such as closing the account or transferring the responsibility to an executor or heir. 3. Alabama Letter to Credit Issuer: When the deceased had active credit accounts, such as credit cards, loans, or lines of credit, this letter should be sent to the respective credit issuer. It informs them about the death, so that appropriate measures can be taken, such as suspension of the account and ensuring no further charges are made. 4. Alabama Letter to Utility Company: This type of letter is necessary to notify utility companies, such as electricity providers, water companies, or internet providers, about the death. It includes the deceased's name, account number, date of death, and instructions regarding discontinuation of services or changing the account holder's name. III. Necessary Information to Include: Regardless of the type of letter, it is crucial to provide accurate and detailed information when notifying relevant entities of a death. Make sure to include the following essential details: — Deceased individual's full name and any relevant identifiers (e.g., account numbers) — Datdeathat— - Supporting documents, such as a death certificate or any legal documentation — Contact information of the person responsible for the deceased individual's accounts (Executor, Administrator, or Next of Kin) — Clear instructions on account closure, transferring responsibilities, or any required actions — Request for a written confirmation acknowledging the receipt of the letter and the actions taken. Conclusion: Writing a letter to creditors, collection agencies, credit issuers, and utility companies in Alabama are a crucial step in the post-death legal process. By providing accurate information and documenting all necessary exchanges, you ensure that the deceased individual's financial matters are appropriately handled. Remember to tailor the letter based on the specific entity, ensuring compliance with Alabama laws and regulations.

Alabama Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

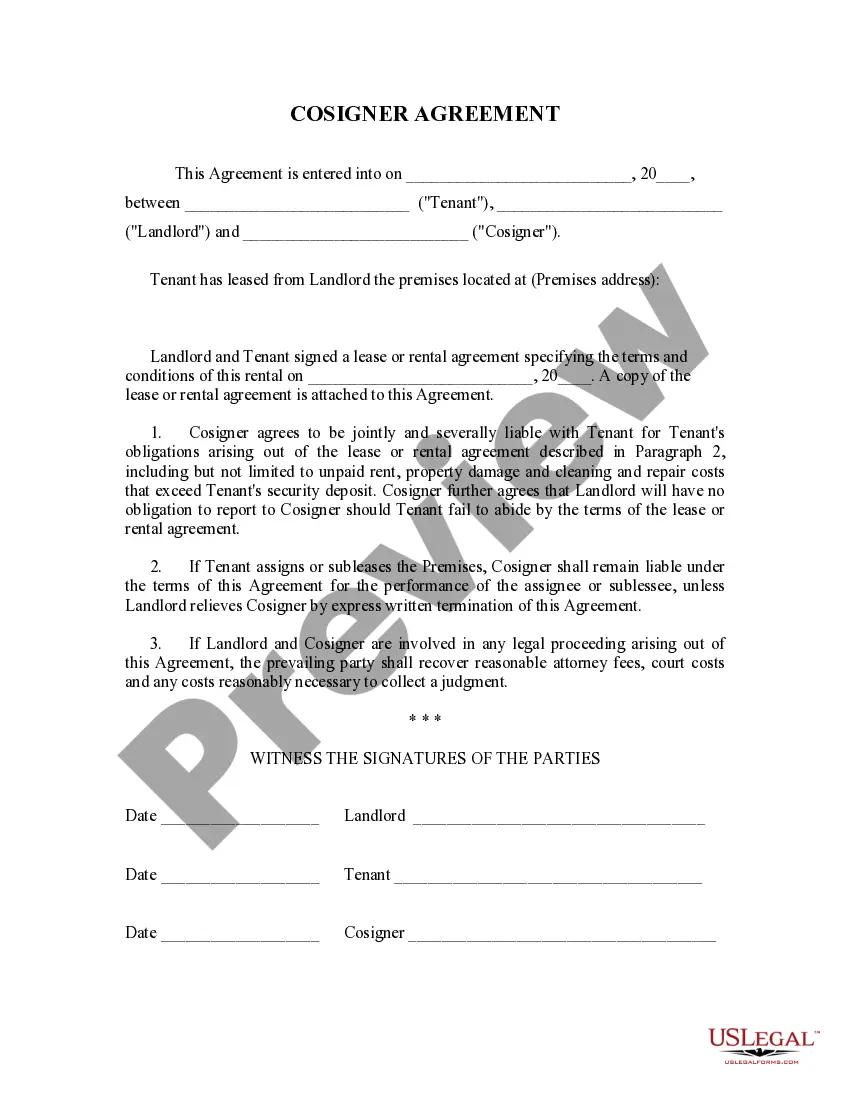

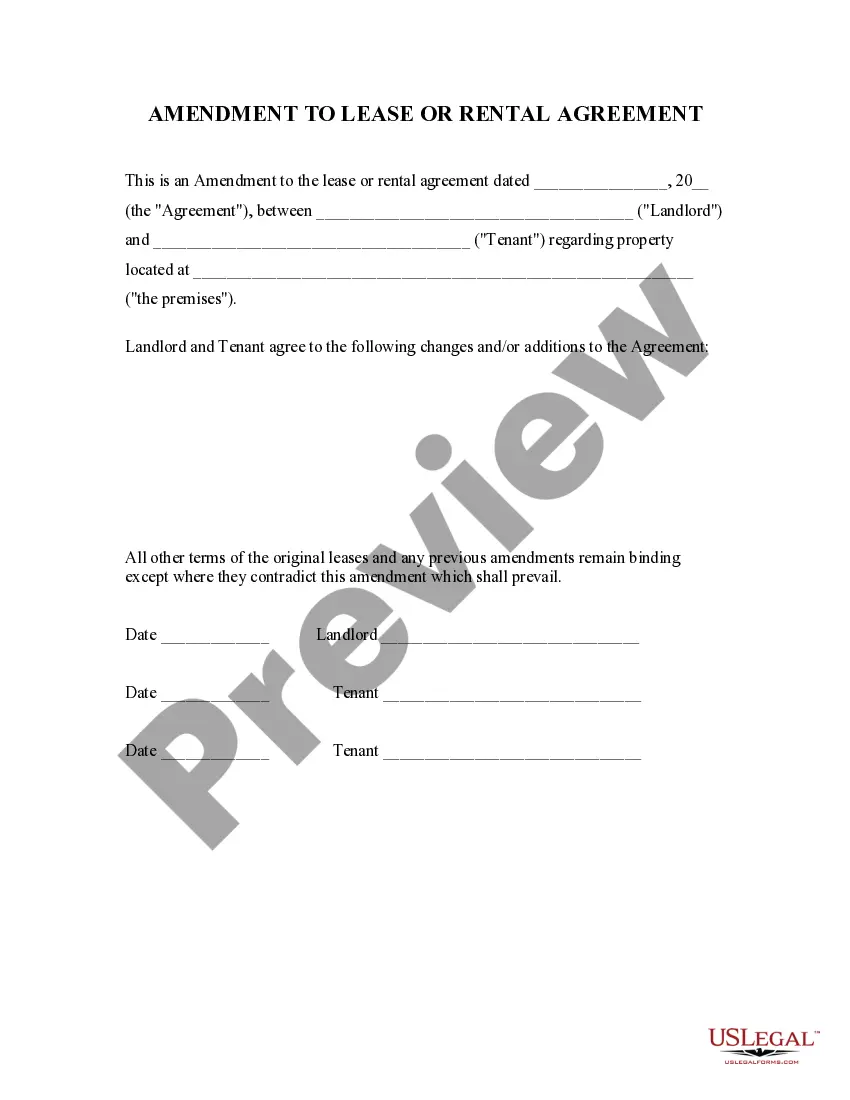

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

US Legal Forms - one of many biggest libraries of lawful kinds in the United States - provides an array of lawful papers templates you are able to down load or print. Utilizing the website, you can find a large number of kinds for business and individual uses, categorized by groups, states, or search phrases.You will discover the most recent types of kinds just like the Alabama Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death in seconds.

If you currently have a monthly subscription, log in and down load Alabama Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death in the US Legal Forms local library. The Down load option can look on each and every type you view. You have access to all earlier delivered electronically kinds within the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, here are basic directions to help you get started:

- Ensure you have chosen the best type for your personal town/area. Click the Review option to examine the form`s content material. See the type explanation to ensure that you have chosen the correct type.

- When the type does not fit your needs, use the Research discipline near the top of the display screen to find the one that does.

- Should you be satisfied with the form, affirm your option by clicking on the Acquire now option. Then, choose the prices prepare you prefer and give your qualifications to register for the bank account.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to accomplish the financial transaction.

- Pick the file format and down load the form on your own product.

- Make adjustments. Load, edit and print and indicator the delivered electronically Alabama Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death.

Every single template you included with your money lacks an expiry particular date which is the one you have for a long time. So, if you wish to down load or print an additional backup, just proceed to the My Forms portion and click on the type you want.

Obtain access to the Alabama Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death with US Legal Forms, by far the most considerable local library of lawful papers templates. Use a large number of professional and state-particular templates that fulfill your organization or individual needs and needs.

Form popularity

FAQ

Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice]. This payment is now [number of days since the due date] past due.

Tell the debt collector that you'll call them back as soon as you verify the information. Review your bills and bank statements to confirm if the debt is yours. This may also help you confirm if the amount you owe is correct. You can ask the collection agency to contact you only in writing.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Using the credit report as your guide, contact all banks and credit card companies at which the deceased had an open account and close those accounts as quickly as possible. You will need to provide a certified copy of the death certificate to close the account.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.