Title: Alabama Agreement to Repay Cash Advance on Credit Card: Understanding the Process, Types, and Benefits Introduction: The Alabama Agreement to Repay Cash Advance on Credit Card is a legally binding document that outlines the terms and conditions for obtaining a cash advance on a credit card in the state of Alabama. It is essential for credit card holders to thoroughly understand this agreement to ensure responsible borrowing and avoid financial pitfalls. This article aims to shed light on the specifics of this agreement, its variations, and the advantages it offers. 1. Understanding Alabama Agreement to Repay Cash Advance on Credit Card: The Alabama Agreement to Repay Cash Advance on Credit Card is a contractual agreement between the credit card issuer and the cardholder. It allows cardholders to access funds from their credit cards, usually in the form of a cash withdrawal from ATMs or cash equivalents, such as purchasing traveler's checks. 2. Terms and Conditions: The agreement outlines the terms and conditions for cash advances, including the interest rates, fees, repayment obligations, and potential penalties. It is crucial to carefully read and comprehend these terms before proceeding with a cash advance, as they differ from regular credit card transactions. 3. Different Types of Alabama Agreement to Repay Cash Advance on Credit Card: a) Standard Cash Advances: This type of cash advance involves withdrawing funds from an ATM using a credit card. Typically, there will be a limit on the maximum amount that can be withdrawn, as well as associated fees and interest rates. It is advisable to check with the credit card issuer regarding any specific terms and conditions for standard cash advances. b) Over-the-Counter Cash Advances: In addition to ATMs, some credit card issuers allow cardholders to obtain cash advances over-the-counter at participating banks or financial institutions. Similar terms and conditions, such as fees and interest rates, may apply. c) Convenience Checks: Credit card companies may provide convenience checks that cardholders can use to obtain cash advances. These checks function similarly to regular checks. However, it is crucial to be aware of the terms, fees, and interest rates associated with using convenience checks. 4. Benefits and Considerations: a) Quick Access to Funds: Alabama Agreement to Repay Cash Advance on Credit Card provides cardholders with immediate access to funds, ensuring convenience during emergencies or when cash is not readily available. b) Flexible Repayment Options: The agreement outlines the repayment terms, allowing cardholders to repay the cash advance over time with minimum monthly payments or in full, depending on their financial situation and preference. c) Boost Credit Score: Timely repayment of cash advances can positively impact a cardholder's credit score. However, missed or late payments can have adverse effects, including increased interest rates and potential damage to credit history. d) Higher Interest Rates and Fees: It's essential to note that cash advances typically have higher interest rates compared to regular credit card transactions. Additionally, cash advances may incur additional fees, such as transaction fees or percentage-based charges. Conclusion: Understanding the Alabama Agreement to Repay Cash Advance on Credit Card is vital for using cash advances responsibly and avoiding financial setbacks. By familiarizing oneself with the agreement's terms and conditions, identifying the different types of cash advances available, and considering the benefits and potential drawbacks, cardholders can make informed decisions regarding their financial needs while utilizing their credit cards effectively. Always consult with the credit card issuer to ensure a comprehensive understanding of the specific terms and conditions associated with obtaining a cash advance in Alabama.

Alabama Agreement to Repay Cash Advance on Credit Card

Description

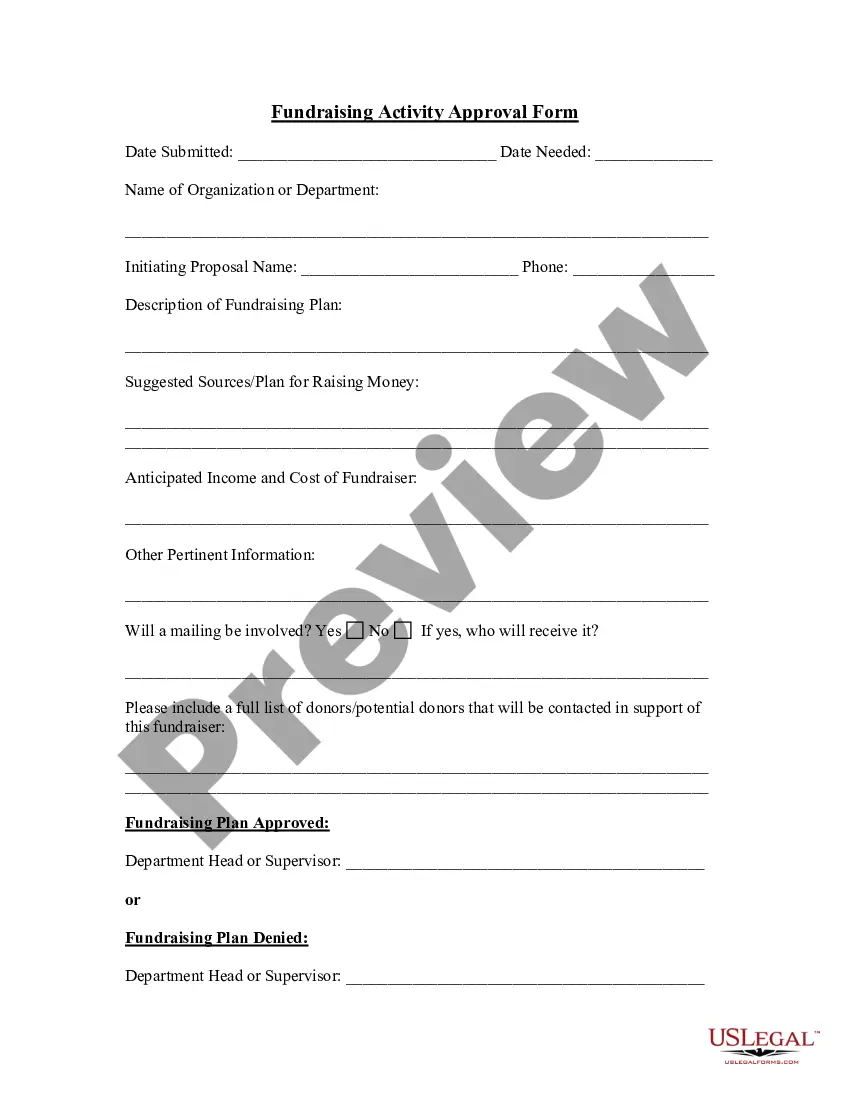

How to fill out Alabama Agreement To Repay Cash Advance On Credit Card?

Are you currently in the situation where you need documents for possibly business or individual uses almost every time? There are plenty of legitimate file web templates available on the net, but discovering versions you can rely isn`t easy. US Legal Forms offers a large number of kind web templates, just like the Alabama Agreement to Repay Cash Advance on Credit Card, which can be written to fulfill state and federal needs.

Should you be currently acquainted with US Legal Forms site and have an account, merely log in. Afterward, you can download the Alabama Agreement to Repay Cash Advance on Credit Card template.

Should you not have an accounts and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you require and ensure it is to the proper metropolis/region.

- Utilize the Preview key to examine the shape.

- Read the explanation to actually have selected the appropriate kind.

- In the event the kind isn`t what you are trying to find, use the Lookup field to find the kind that fits your needs and needs.

- If you find the proper kind, simply click Acquire now.

- Choose the prices program you want, fill in the specified information to make your money, and pay for the transaction using your PayPal or credit card.

- Choose a practical paper formatting and download your backup.

Get all of the file web templates you may have bought in the My Forms menu. You can get a extra backup of Alabama Agreement to Repay Cash Advance on Credit Card any time, if needed. Just click the needed kind to download or print the file template.

Use US Legal Forms, by far the most comprehensive selection of legitimate varieties, to save time and avoid blunders. The services offers expertly manufactured legitimate file web templates that can be used for a selection of uses. Generate an account on US Legal Forms and begin creating your daily life easier.