Alabama Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) is a legal document filed by a person or a business entity in Alabama when a check they received from a drawer is not honored due to insufficient funds in the account. This check bouncing can result in financial losses for the recipient, who then may choose to file a complaint to seek legal recourse. In Alabama, there are different types of complaints that can be filed against the drawer of a bad check: 1. Civil Complaint: This is the most common type of complaint filed by individuals or businesses, seeking a legal remedy for the damages caused by a bounced check. The complainant must provide evidence of the bad check, including the date, amount, and details of the transaction, along with any additional fees or costs incurred. 2. Criminal Complaint: In certain situations, the complainant may choose to file a criminal complaint against the drawer. This is typically done when the drawer knowingly issued the check without sufficient funds or with the intent to defraud. Prosecution may result in penalties, fines, or even imprisonment for the drawer. 3. Small Claims Complaint: If the amount of the bounced check falls within the small claims limit of Alabama (usually up to $3,000), the complainant may opt to file a small claims complaint. This allows for a simplified legal process, often without the need for an attorney, to resolve the matter. When drafting an Alabama Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check), it is important to include relevant keywords such as: — Alabama Bad Check Law— - Insufficient Funds Check Alabama — Alabama Springs of Action for Bounced Checks — Legal Remedies for Dishonored Checks in Alabama — Civil Complaint for Bad ChecAlabamaam— - Criminal Complaint for Bad Check Alabama — Small Claims Process for Bounced Checks in Alabama — Penalties for Writing Bad Checks in Alabama — Legal representation for Bad Check Complaint Alabama Remember, it is crucial to consult with an attorney or seek legal advice specific to your situation when filing a complaint against a check drawer in Alabama.

Negotiating Worthless Instrument Alabama Example

Description

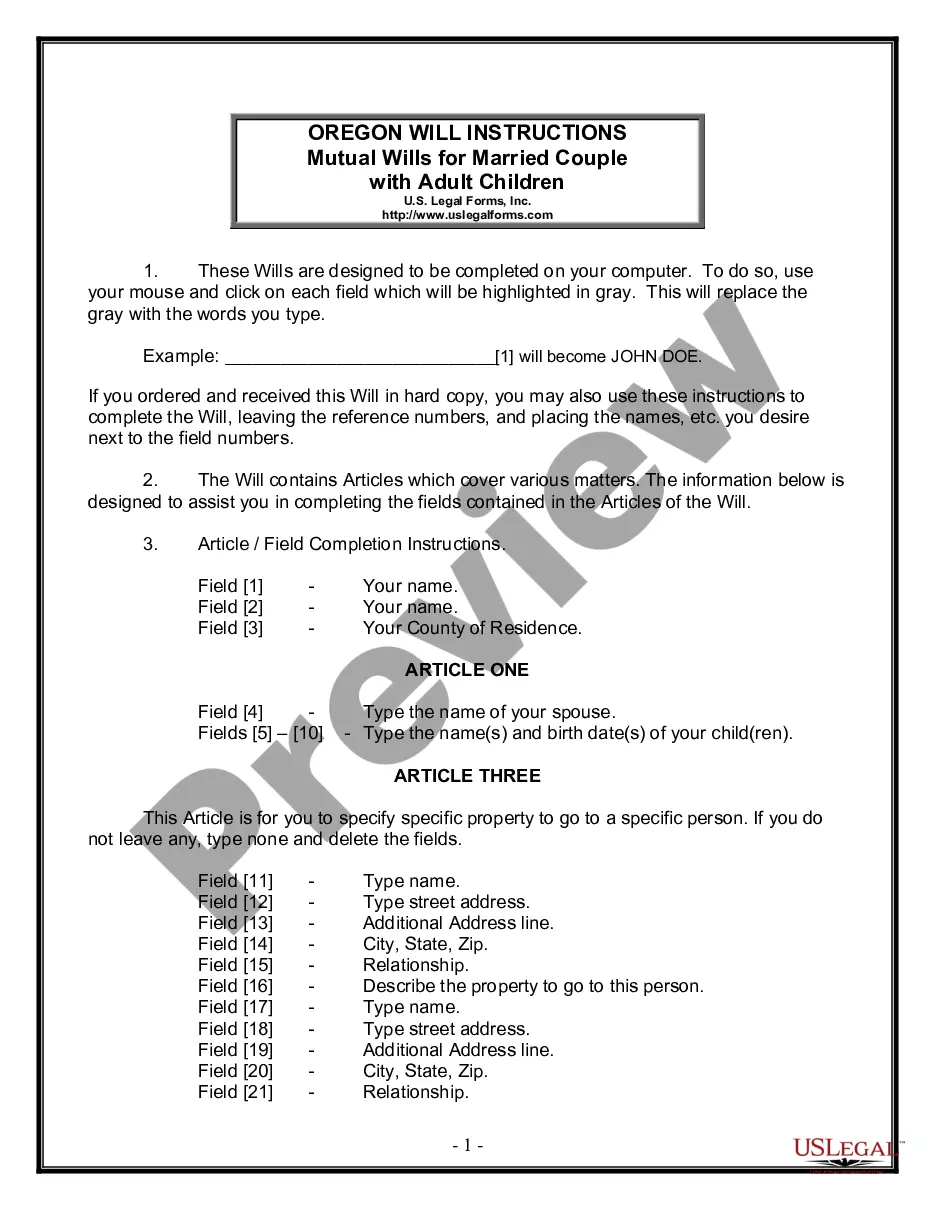

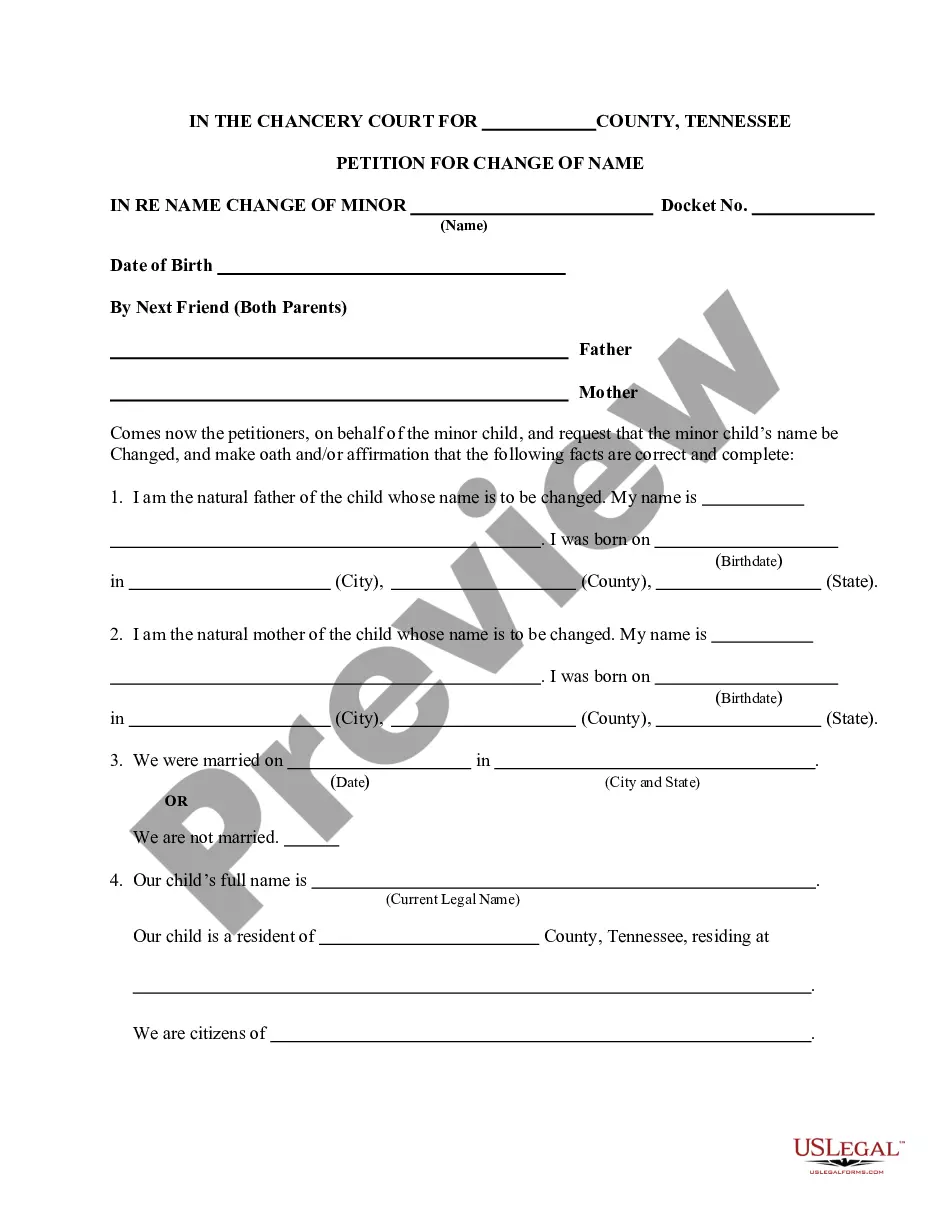

How to fill out Alabama Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

You can invest time on the web trying to find the legal file format which fits the federal and state needs you will need. US Legal Forms provides a huge number of legal types that are evaluated by pros. It is simple to obtain or print out the Alabama Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) from my service.

If you have a US Legal Forms accounts, you may log in and then click the Download switch. Afterward, you may total, edit, print out, or indicator the Alabama Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). Every legal file format you acquire is the one you have permanently. To acquire an additional duplicate for any obtained kind, go to the My Forms tab and then click the related switch.

If you work with the US Legal Forms web site the first time, keep to the straightforward guidelines listed below:

- Very first, ensure that you have selected the best file format for your area/city of your choice. Browse the kind outline to ensure you have picked out the correct kind. If offered, make use of the Preview switch to check through the file format at the same time.

- If you want to locate an additional model in the kind, make use of the Research discipline to obtain the format that fits your needs and needs.

- After you have located the format you would like, click on Purchase now to move forward.

- Select the costs plan you would like, type in your qualifications, and register for an account on US Legal Forms.

- Complete the financial transaction. You should use your Visa or Mastercard or PayPal accounts to cover the legal kind.

- Select the format in the file and obtain it in your gadget.

- Make adjustments in your file if possible. You can total, edit and indicator and print out Alabama Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

Download and print out a huge number of file web templates making use of the US Legal Forms website, which offers the biggest variety of legal types. Use skilled and state-distinct web templates to handle your business or individual requirements.

Form popularity

FAQ

Discover how to collect on a bad check below. Call the bank. After you find out that the check bounced, contact the bank. ... Contact the customer. You might be able to resolve the situation easily by contacting the customer. ... Get government help. ... Hire a collection agency. ... Go to court.

The bank will "bounce" the check if you write a bad one because there are insufficient funds in your account to cover it. It will decline to pay the amount. But some individuals write and try to pass checks even though they know there's not enough money in their accounts to cover them.

30-X-7-. 14 - Bad Checks. (1) If a bad check or negotiable instrument is dishonored, the writer of the check or instrument shall be required to tender payment of the full amount of such check or instrument plus a service charge of $30.00 as provided by the Code of Ala.

While your initial response may be anger, there are actionable steps you can take to resolve the situation and get paid. Contact the customer that wrote the NSF check. ... Send a new bill with the bank fee included. ... Send a demand letter. ... Turn it over to a collection agency. ... Initiate legal action.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft fee. If the account stays negative, the bank may charge an extended overdraft fee.

When you write a check and there's not enough funds in your account when it's presented, this is considered non-sufficient funds (NSF). When a check is returned due to NSF, it's returned to the payee that deposited the check, at their bank. This allows them to redeposit the check at a later time, if available.

What should I do if I receive a bad check? Contact the check writer. Look for a phone number and current address listed on the check. ... Try depositing the check again. Ask the check writer if it's safe to redeposit the bounced check. ... Seek legal action.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft fee. If the account stays negative, the bank may charge an extended overdraft fee.