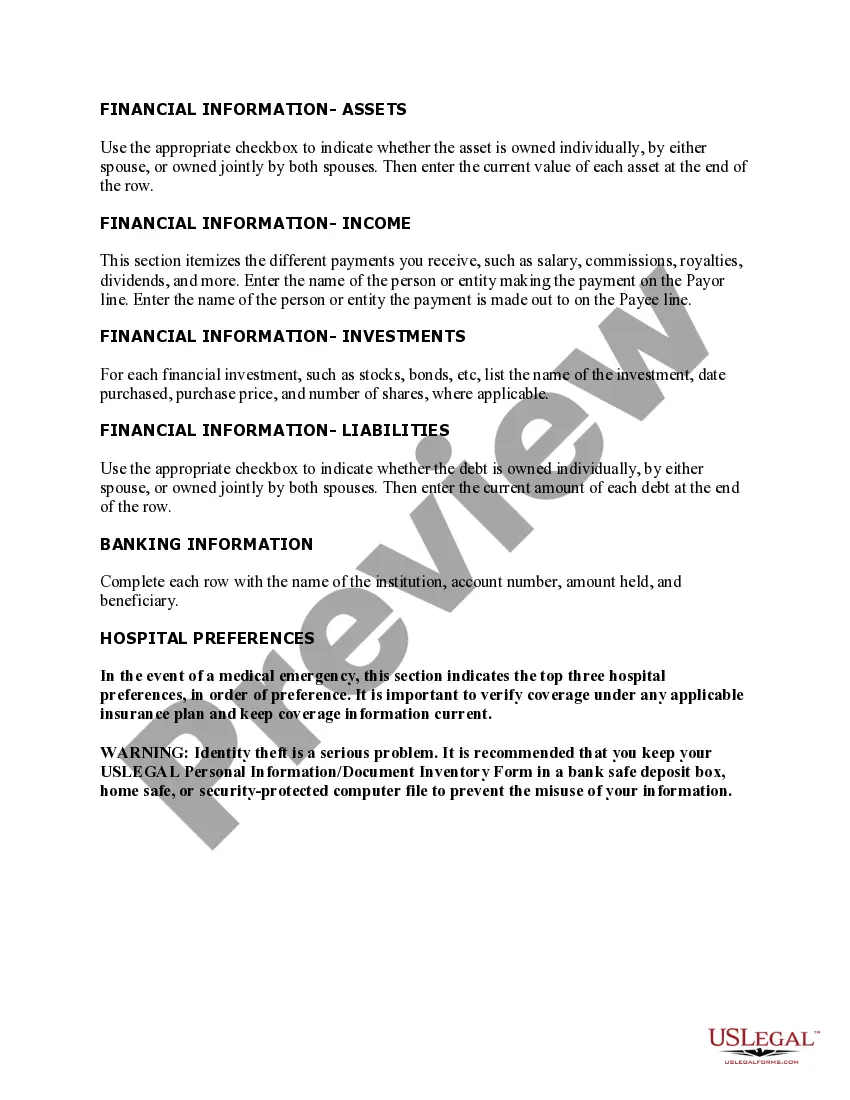

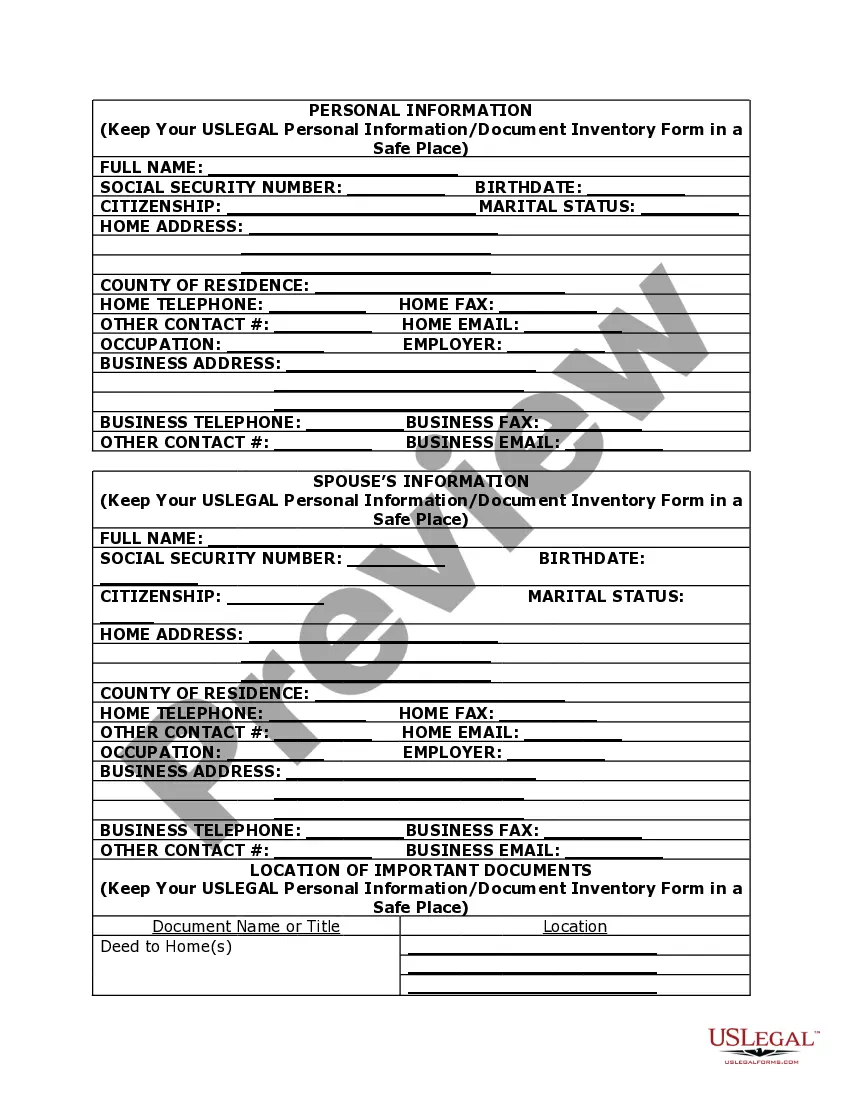

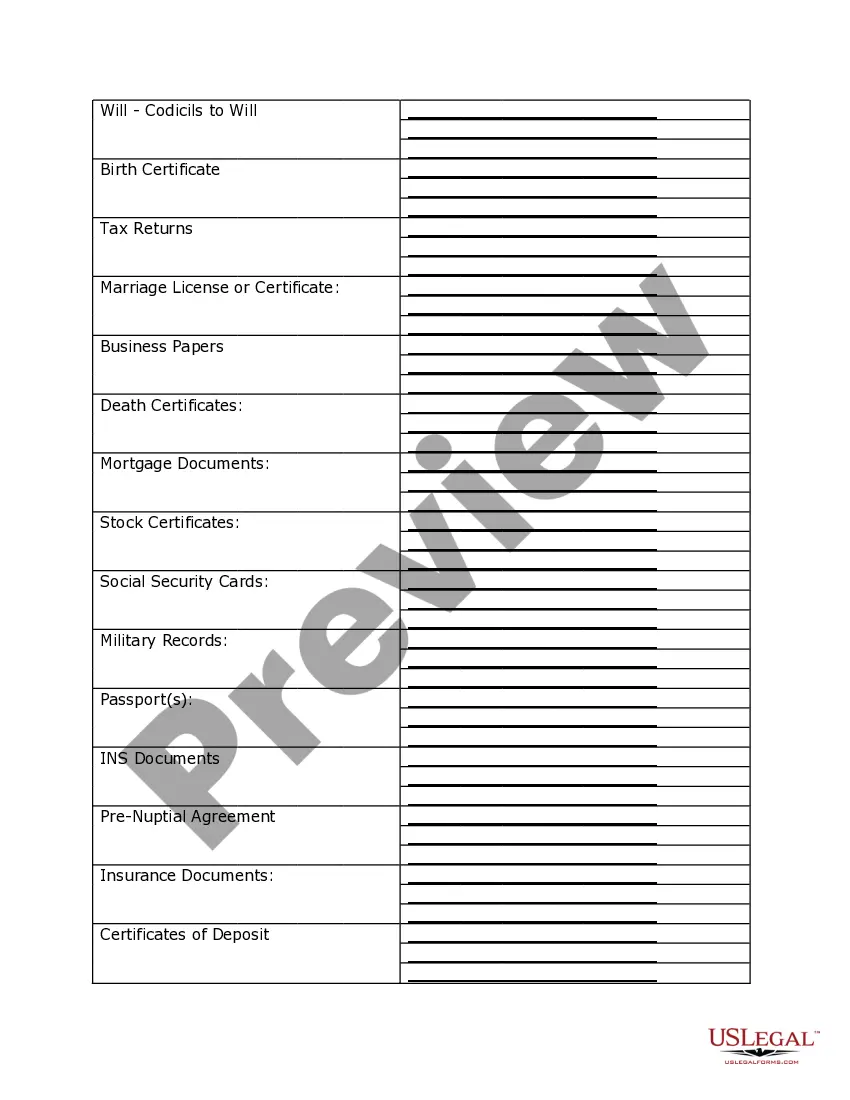

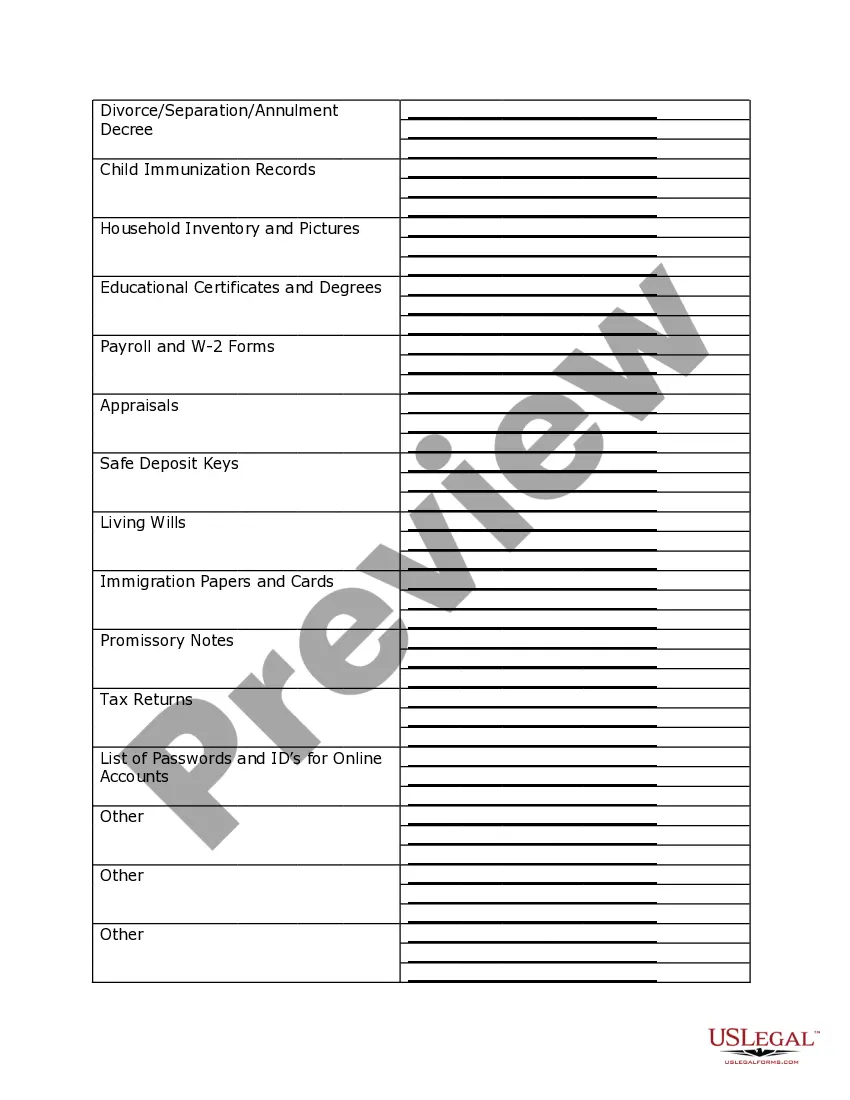

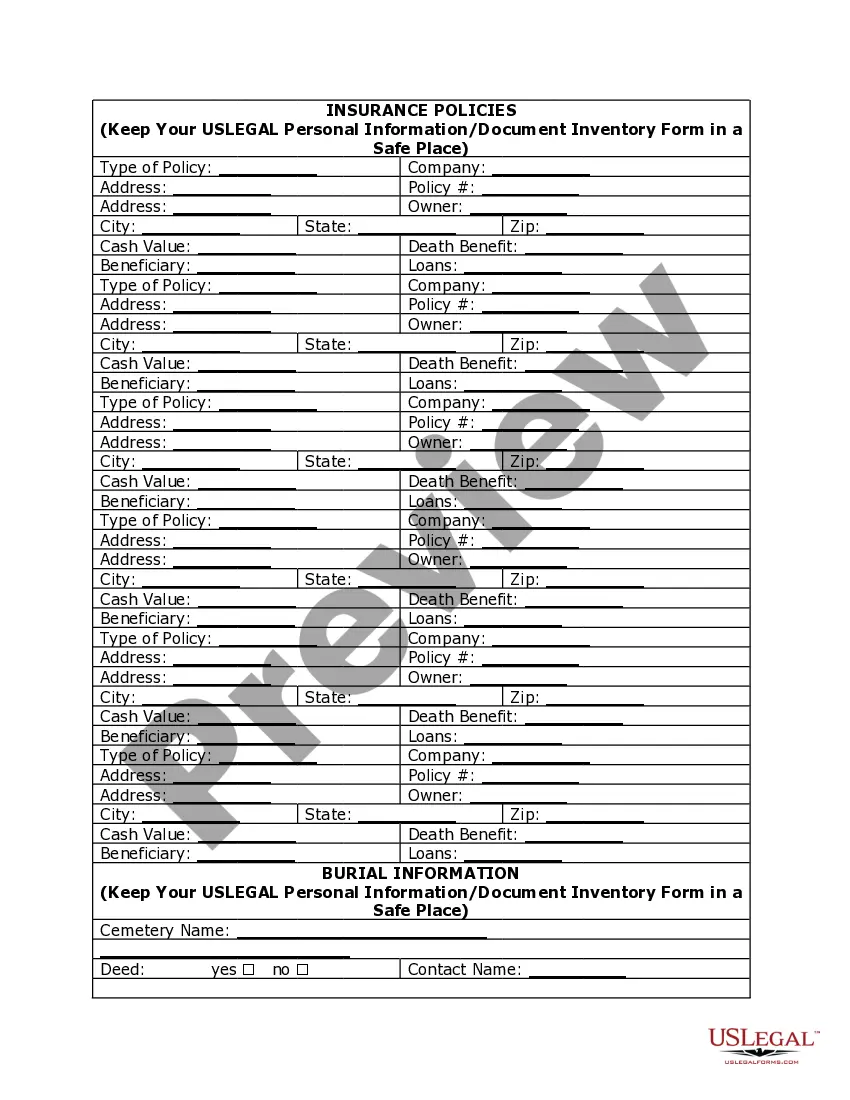

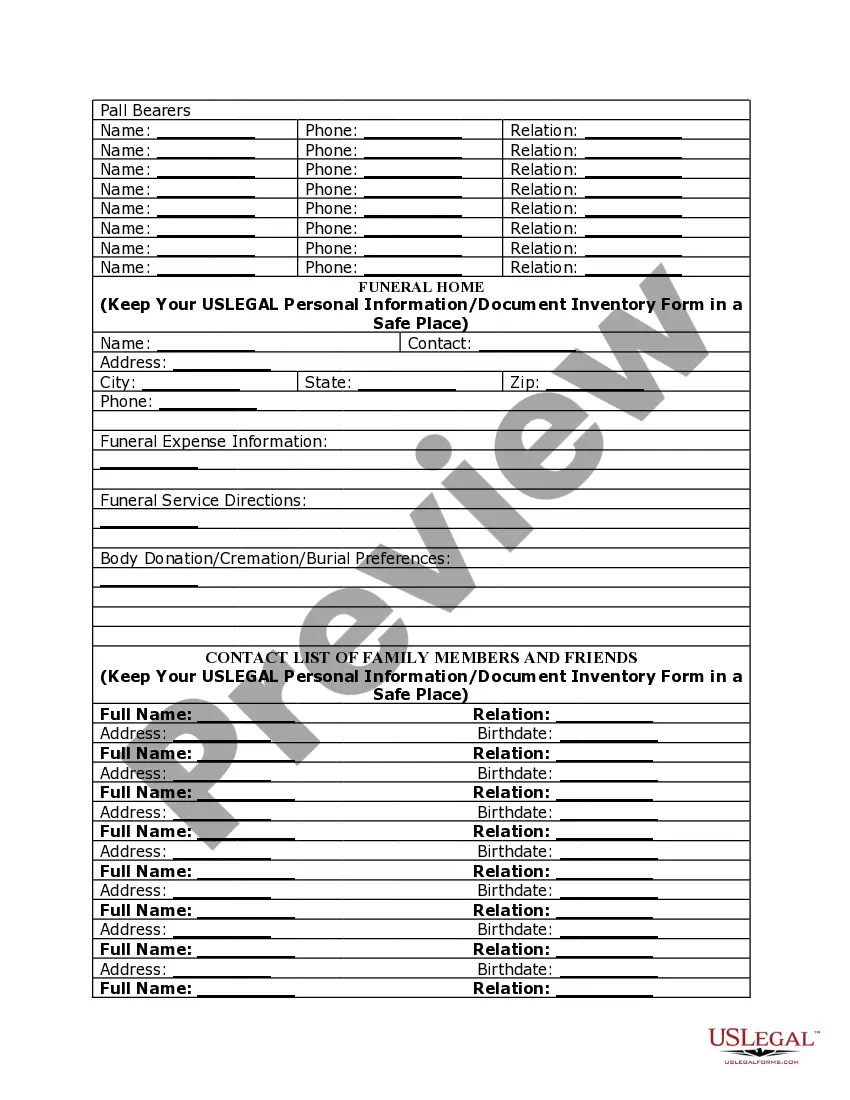

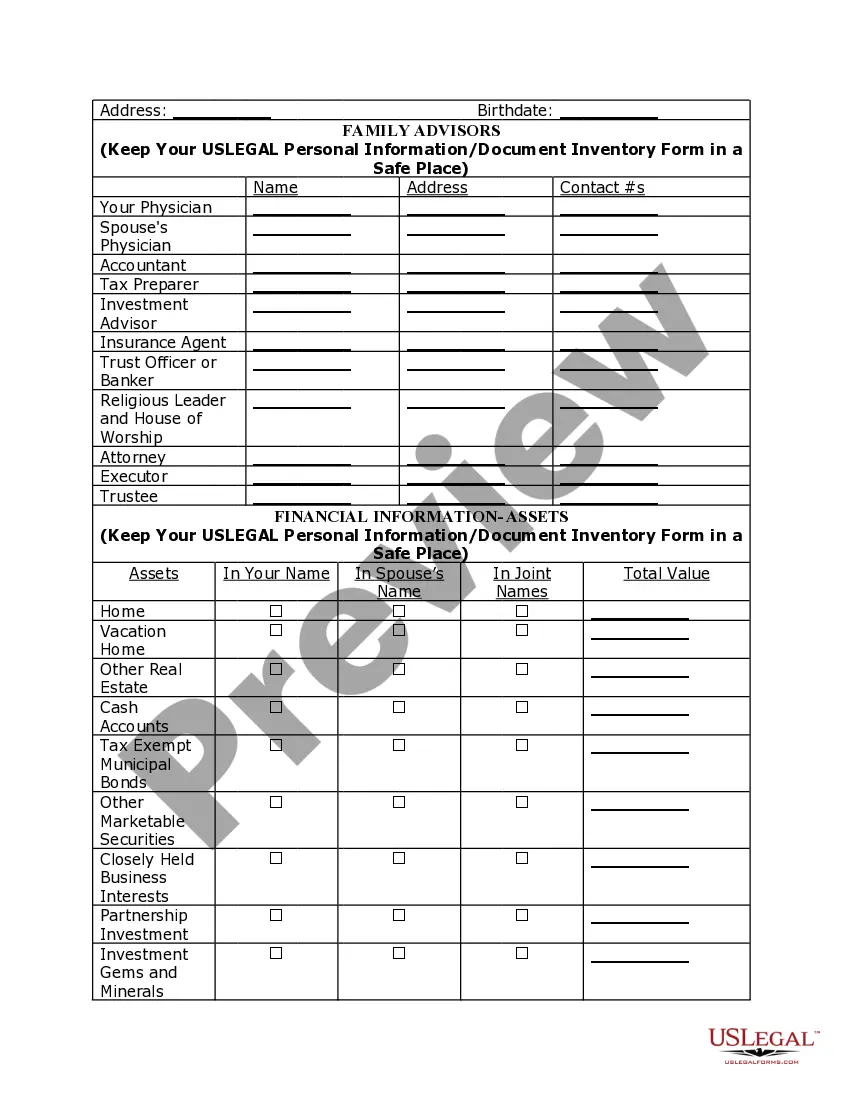

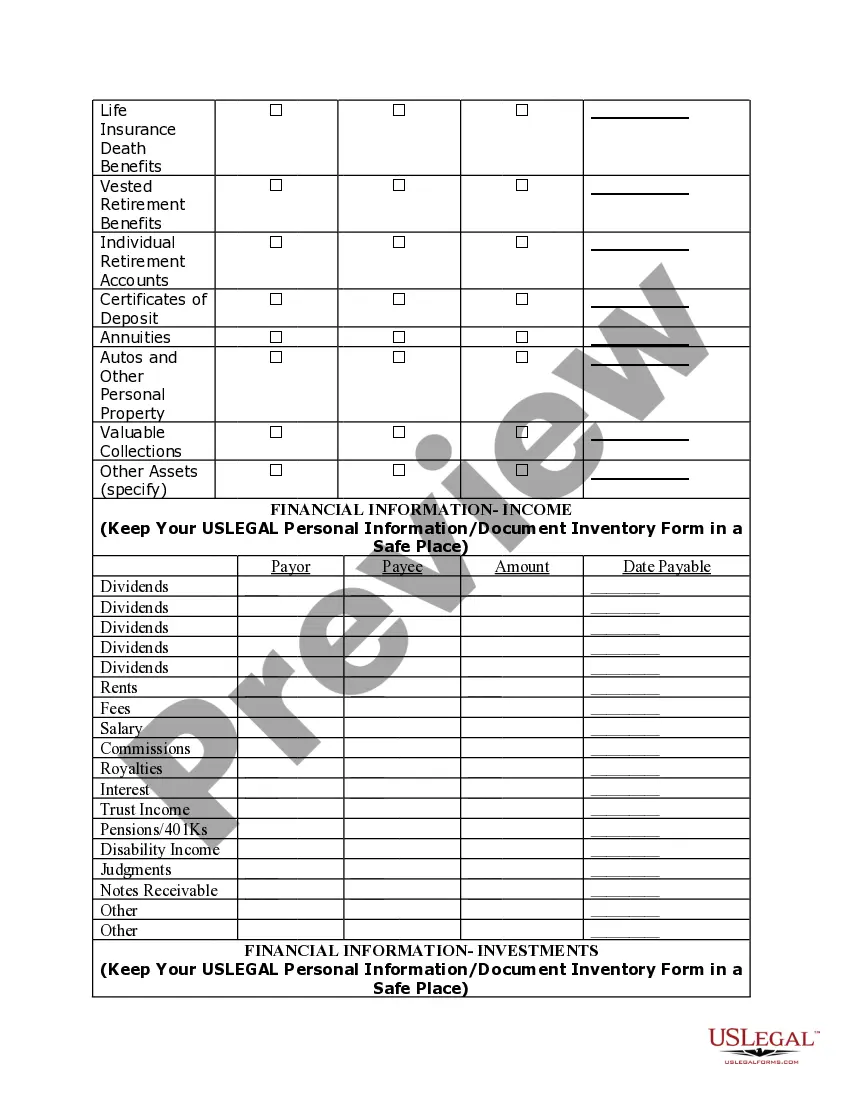

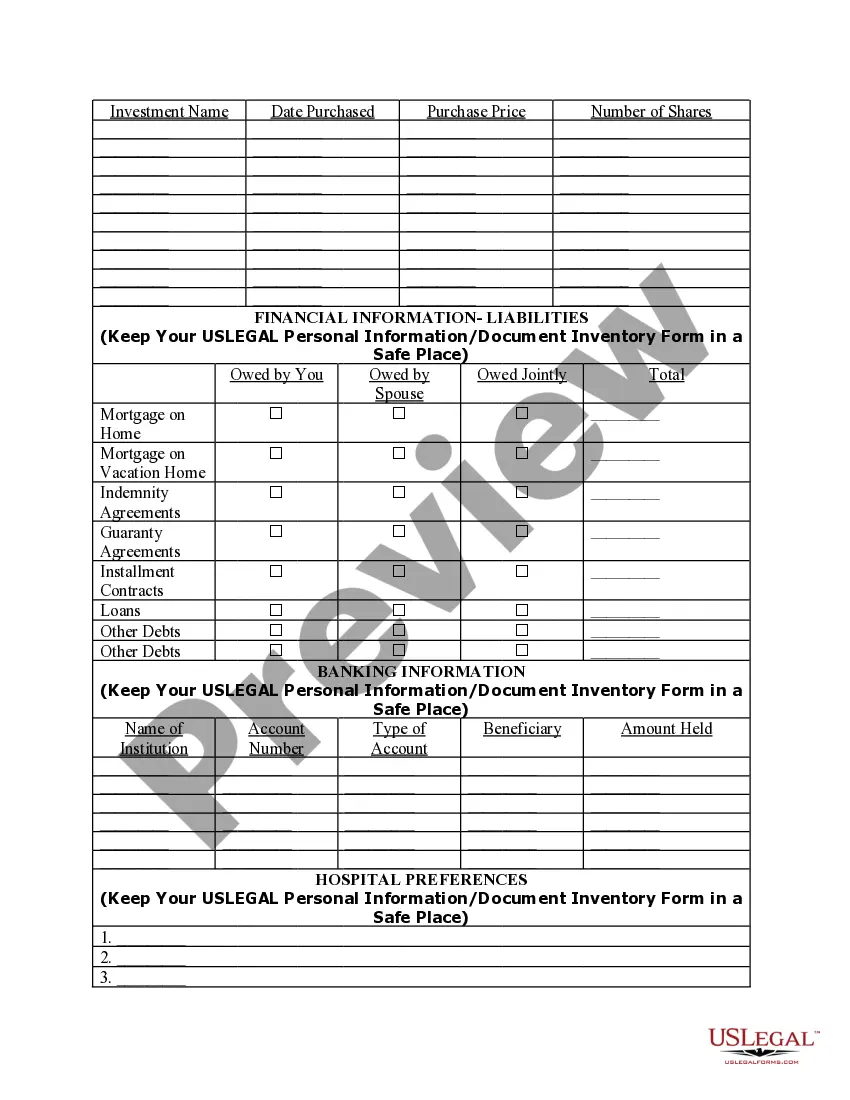

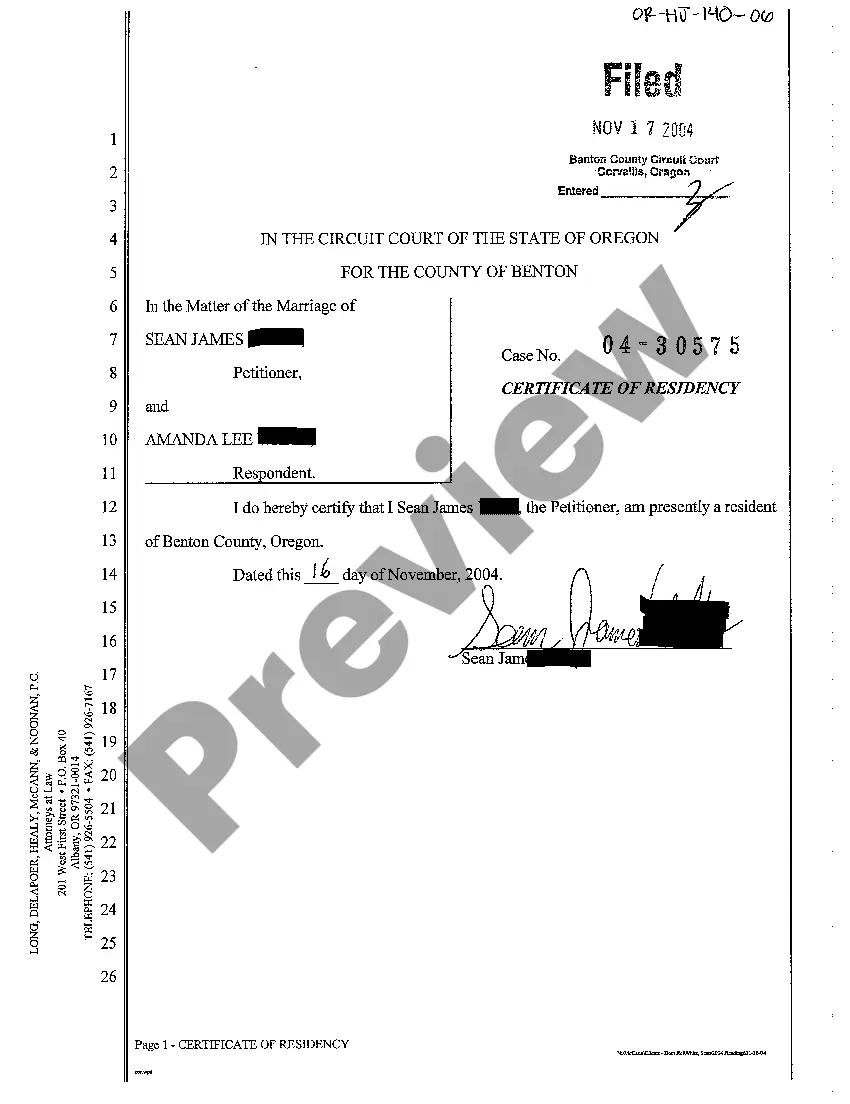

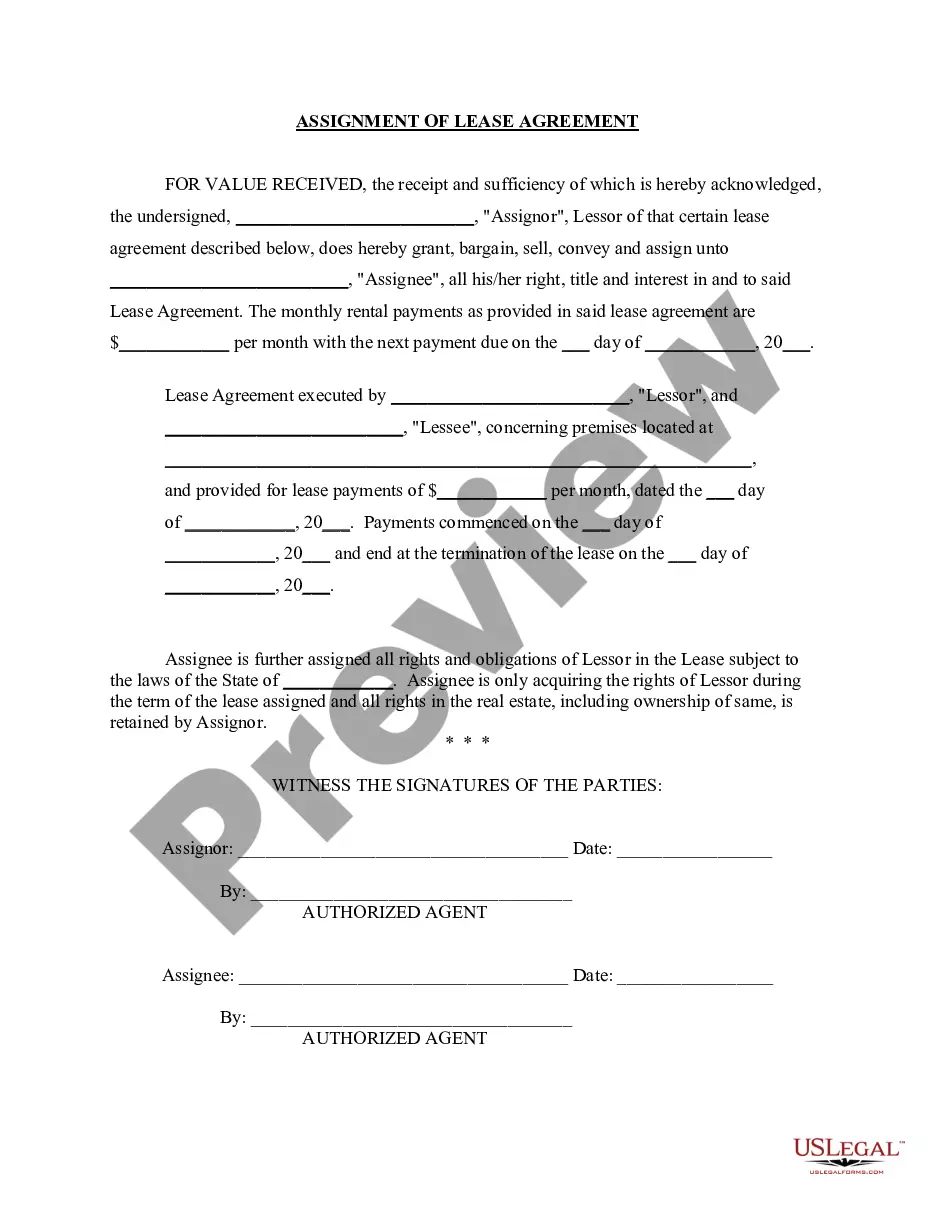

Alabama Personal Planning Information and Document Inventory Worksheets — A Legal Life Document is a comprehensive tool that helps individuals and families organize vital information and important documents related to personal planning and estate administration. These worksheets serve as a valuable resource for estate planning attorneys, individuals, and executors to efficiently manage personal and legal affairs. The Alabama Personal Planning Information and Document Inventory Worksheets cover various aspects of personal information and legal documents, including: 1. Personal Information: This section includes detailed information about the individual, such as full name, date of birth, social security number, contact information, and family members' details. It also enables individuals to record important contacts like attorneys, financial advisors, and insurance agents. 2. Estate Planning Documents: Individuals can list and summarize all their estate planning documents, such as wills, trusts, powers of attorney, living wills, and healthcare proxies. This section allows individuals to easily locate and review their estate planning documents. 3. Financial Information: This part focuses on recording financial information, such as bank accounts, investment accounts, retirement accounts, and insurance policies. Individuals can include information about account numbers, institutions, and designated beneficiaries. 4. Real Estate: This section allows individuals to provide details about owned properties, such as the property address, ownership type (sole or joint), mortgage information, and related documents like deeds and titles. 5. Personal Property: Individuals can document details of valuable personal property, including jewelry, artwork, collectibles, and other possessions. This section facilitates proper management and distribution of personal assets during estate settlement. 6. Debts and Liabilities: This part helps individuals record any outstanding debts, loans, or liabilities. It includes details like creditor names, account numbers, outstanding balances, and terms of repayment. 7. Digital Assets: With the increasing importance of digital assets, this section enables individuals to list digital accounts, usernames, passwords, and instructions regarding the management or deletion of digital assets. 8. Final Wishes: Individuals can document their final wishes pertaining to funeral arrangements, burial or cremation preferences, and organ donation choices. This section ensures that loved ones have guidance during emotional and challenging times. Different types of Alabama Personal Planning Information and Document Inventory Worksheets may also include additional sections or fields based on specific requirements or preferences. These worksheets provide a structured format to compile essential information and documents, simplifying the estate planning and administration process while ensuring the smooth transfer and preservation of assets.

Alabama Personal Planning Information and Document Inventory Worksheets - A Legal Life Document

Description

How to fill out Alabama Personal Planning Information And Document Inventory Worksheets - A Legal Life Document?

US Legal Forms - one of the greatest libraries of authorized kinds in the USA - gives an array of authorized record web templates you can acquire or printing. While using website, you can find a large number of kinds for company and specific uses, categorized by classes, states, or keywords and phrases.You can get the newest variations of kinds much like the Alabama Personal Planning Information and Document Inventory Worksheets - A Legal Life Document within minutes.

If you have a membership, log in and acquire Alabama Personal Planning Information and Document Inventory Worksheets - A Legal Life Document through the US Legal Forms catalogue. The Download switch will show up on each and every type you see. You have access to all earlier acquired kinds inside the My Forms tab of your respective profile.

If you would like use US Legal Forms the first time, here are straightforward recommendations to get you started off:

- Be sure to have selected the proper type to your town/region. Click the Review switch to analyze the form`s articles. See the type explanation to ensure that you have chosen the correct type.

- If the type does not satisfy your specifications, utilize the Lookup area at the top of the display to find the one which does.

- In case you are pleased with the form, affirm your choice by visiting the Buy now switch. Then, choose the prices program you like and supply your references to register on an profile.

- Method the deal. Use your charge card or PayPal profile to accomplish the deal.

- Select the format and acquire the form in your device.

- Make changes. Load, change and printing and indicator the acquired Alabama Personal Planning Information and Document Inventory Worksheets - A Legal Life Document.

Every single web template you put into your bank account lacks an expiration time and it is yours forever. So, if you would like acquire or printing an additional duplicate, just check out the My Forms area and click on in the type you need.

Gain access to the Alabama Personal Planning Information and Document Inventory Worksheets - A Legal Life Document with US Legal Forms, by far the most comprehensive catalogue of authorized record web templates. Use a large number of skilled and express-particular web templates that meet your business or specific requirements and specifications.