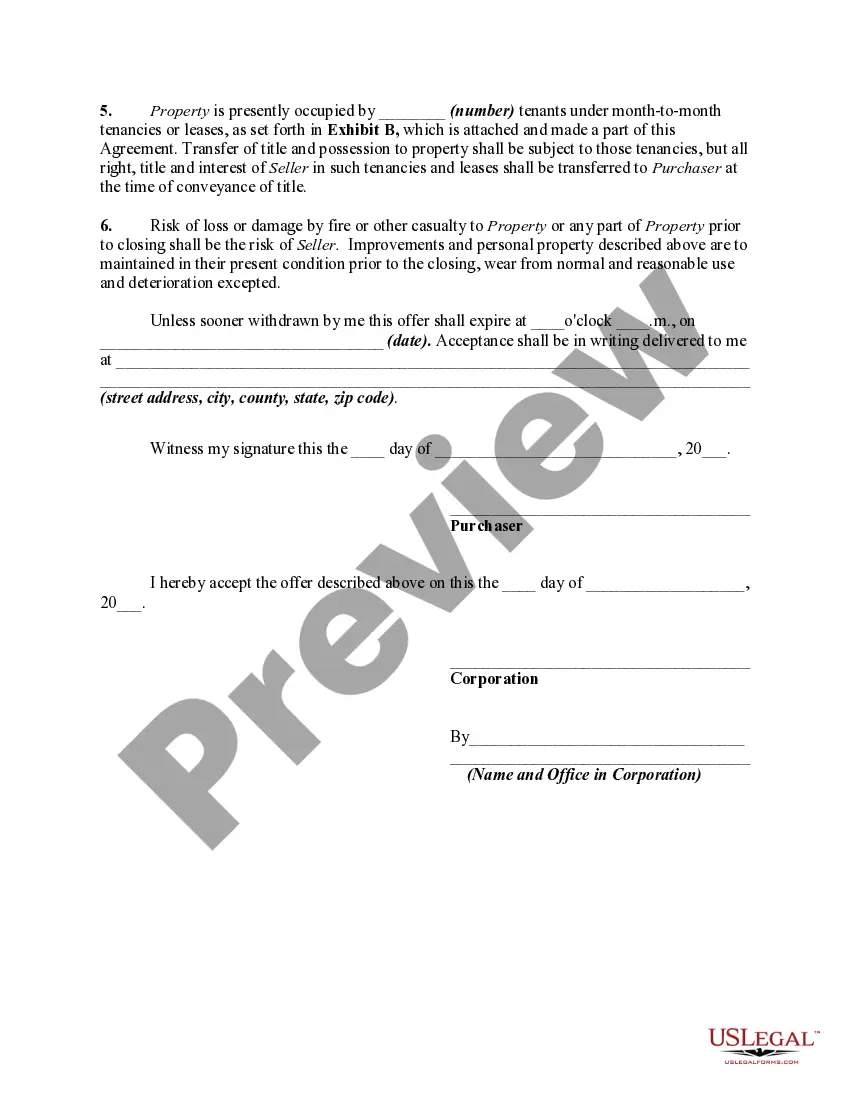

A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Alabama Offer to Purchase Commercial Property: A Comprehensive Guide Introduction: The Alabama Offer to Purchase Commercial Property is a legally binding agreement used in real estate transactions specifically for the purchase of commercial properties located within the state of Alabama. It serves as a significant milestone in the acquisition process, outlining the terms and conditions agreed upon by buyers and sellers. This article aims to provide a detailed description of Alabama Offer to Purchase Commercial Property, covering its key components, variations, and important considerations. 1. Key Components of Alabama Offer to Purchase Commercial Property: The Alabama Offer to Purchase Commercial Property typically comprises the following essential elements: a) Parties Involved: It identifies the parties involved in the transaction, including the buyer, seller, and possibly the real estate agents representing them. b) Purchase Price and Terms: It stipulates the agreed-upon purchase price, including any contingencies related to obtaining financing or conducting inspections. c) Property Description: It provides a detailed description of the commercial property, including its address, legal description, and any specific features that are included in the sale. d) Closing Date and Contingencies: The offer establishes a specific closing date, allowing both parties to plan accordingly. Additionally, it may include contingencies such as property inspections, environmental assessments, or obtaining necessary zoning approvals. e) Earnest Money Deposit: The offer may require the buyer to provide an earnest money deposit as a sign of good faith. This deposit is typically held in escrow until the closing or termination of the agreement. f) Due Diligence Period: The offer may include a due diligence period during which the buyer can conduct thorough investigations to ensure the commercial property meets their needs and expectations. 2. Types of Alabama Offer to Purchase Commercial Property: While the primary structure of the Alabama Offer to Purchase Commercial Property remains consistent, there may be different variations depending on the specific requirements of the parties involved. Some common types include: a) Standard Offer: This is the standard form used for most commercial property transactions in Alabama. It encompasses the essential components mentioned above and provides a framework for negotiations between the buyer and seller. b) Lease with Option to Purchase: In some cases, a buyer may opt for a lease agreement with an option to purchase the commercial property at a later date. The offer would outline the lease terms, purchase price, and any relevant conditions. c) Exchange Offer: In a 1031 exchange or similar scenarios, where a buyer intends to exchange their existing commercial property for the one being purchased, a specialized offer may be used. It incorporates specific language and conditions necessary for the exchange process. 3. Important Considerations: When drafting or reviewing an Alabama Offer to Purchase Commercial Property, it is crucial to consider the following: a) Seek Professional Guidance: Consulting with a real estate attorney or a qualified real estate agent is highly recommended ensuring compliance with Alabama real estate laws and address any specific concerns. b) Negotiation Flexibility: Both buyers and sellers can negotiate the terms and conditions of the offer to account for individual requirements or address any contingencies. c) Thorough Documentation: The offer should be drafted with utmost attention to detail, incorporating all relevant clauses and contingencies to protect the interests of both parties. d) Timely Execution: Once the offer is accepted and signed by both parties, adherence to agreed-upon timelines is crucial to ensure a smooth transaction. Conclusion: The Alabama Offer to Purchase Commercial Property is a vital document in the acquisition process, outlining crucial terms and conditions. Understanding its key components, different types, and important considerations allows buyers and sellers to navigate the commercial real estate market in Alabama more effectively. Seek professional guidance and conduct thorough due diligence to ensure a successful transaction.Title: Alabama Offer to Purchase Commercial Property: A Comprehensive Guide Introduction: The Alabama Offer to Purchase Commercial Property is a legally binding agreement used in real estate transactions specifically for the purchase of commercial properties located within the state of Alabama. It serves as a significant milestone in the acquisition process, outlining the terms and conditions agreed upon by buyers and sellers. This article aims to provide a detailed description of Alabama Offer to Purchase Commercial Property, covering its key components, variations, and important considerations. 1. Key Components of Alabama Offer to Purchase Commercial Property: The Alabama Offer to Purchase Commercial Property typically comprises the following essential elements: a) Parties Involved: It identifies the parties involved in the transaction, including the buyer, seller, and possibly the real estate agents representing them. b) Purchase Price and Terms: It stipulates the agreed-upon purchase price, including any contingencies related to obtaining financing or conducting inspections. c) Property Description: It provides a detailed description of the commercial property, including its address, legal description, and any specific features that are included in the sale. d) Closing Date and Contingencies: The offer establishes a specific closing date, allowing both parties to plan accordingly. Additionally, it may include contingencies such as property inspections, environmental assessments, or obtaining necessary zoning approvals. e) Earnest Money Deposit: The offer may require the buyer to provide an earnest money deposit as a sign of good faith. This deposit is typically held in escrow until the closing or termination of the agreement. f) Due Diligence Period: The offer may include a due diligence period during which the buyer can conduct thorough investigations to ensure the commercial property meets their needs and expectations. 2. Types of Alabama Offer to Purchase Commercial Property: While the primary structure of the Alabama Offer to Purchase Commercial Property remains consistent, there may be different variations depending on the specific requirements of the parties involved. Some common types include: a) Standard Offer: This is the standard form used for most commercial property transactions in Alabama. It encompasses the essential components mentioned above and provides a framework for negotiations between the buyer and seller. b) Lease with Option to Purchase: In some cases, a buyer may opt for a lease agreement with an option to purchase the commercial property at a later date. The offer would outline the lease terms, purchase price, and any relevant conditions. c) Exchange Offer: In a 1031 exchange or similar scenarios, where a buyer intends to exchange their existing commercial property for the one being purchased, a specialized offer may be used. It incorporates specific language and conditions necessary for the exchange process. 3. Important Considerations: When drafting or reviewing an Alabama Offer to Purchase Commercial Property, it is crucial to consider the following: a) Seek Professional Guidance: Consulting with a real estate attorney or a qualified real estate agent is highly recommended ensuring compliance with Alabama real estate laws and address any specific concerns. b) Negotiation Flexibility: Both buyers and sellers can negotiate the terms and conditions of the offer to account for individual requirements or address any contingencies. c) Thorough Documentation: The offer should be drafted with utmost attention to detail, incorporating all relevant clauses and contingencies to protect the interests of both parties. d) Timely Execution: Once the offer is accepted and signed by both parties, adherence to agreed-upon timelines is crucial to ensure a smooth transaction. Conclusion: The Alabama Offer to Purchase Commercial Property is a vital document in the acquisition process, outlining crucial terms and conditions. Understanding its key components, different types, and important considerations allows buyers and sellers to navigate the commercial real estate market in Alabama more effectively. Seek professional guidance and conduct thorough due diligence to ensure a successful transaction.