This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Mortgage Securing Guaranty of Performance of Lease

Description

How to fill out Mortgage Securing Guaranty Of Performance Of Lease?

Are you presently in a placement where you need papers for sometimes company or person purposes nearly every working day? There are a variety of legitimate document layouts available on the Internet, but discovering ones you can trust is not simple. US Legal Forms provides thousands of develop layouts, much like the Alabama Mortgage Securing Guaranty of Performance of Lease, that happen to be composed to meet federal and state requirements.

In case you are previously informed about US Legal Forms web site and possess your account, merely log in. After that, it is possible to acquire the Alabama Mortgage Securing Guaranty of Performance of Lease design.

If you do not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you need and make sure it is for your appropriate area/state.

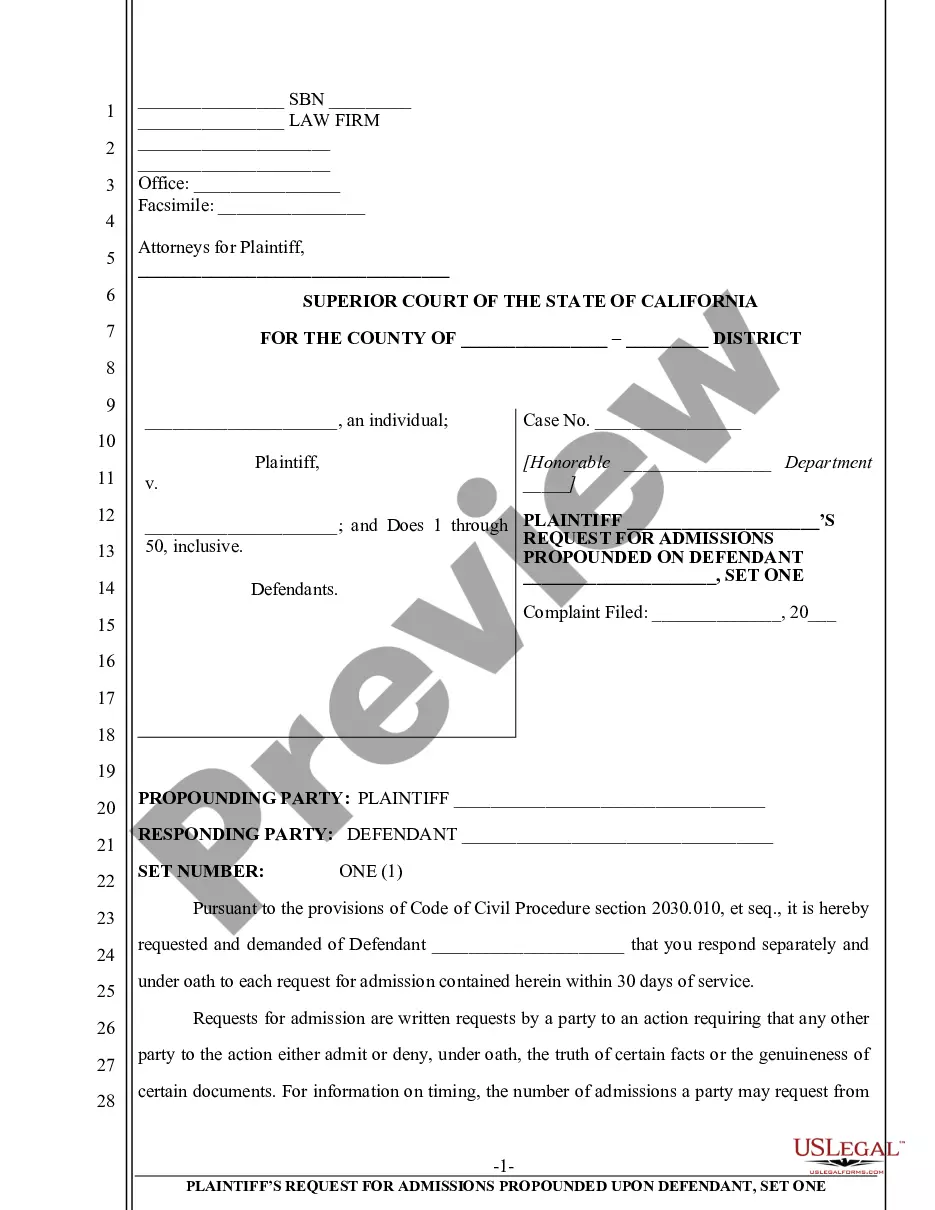

- Make use of the Review option to review the form.

- See the information to actually have chosen the proper develop.

- In case the develop is not what you`re seeking, make use of the Look for industry to find the develop that meets your needs and requirements.

- If you get the appropriate develop, click on Purchase now.

- Choose the costs prepare you want, complete the required information to create your account, and pay money for your order making use of your PayPal or credit card.

- Choose a convenient document formatting and acquire your backup.

Discover each of the document layouts you have bought in the My Forms food selection. You can get a more backup of Alabama Mortgage Securing Guaranty of Performance of Lease any time, if possible. Just select the needed develop to acquire or print out the document design.

Use US Legal Forms, probably the most comprehensive collection of legitimate varieties, to save lots of time and prevent errors. The service provides appropriately created legitimate document layouts that can be used for a variety of purposes. Create your account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

This Guarantee is supplemental to the Mortgage and incorporates the Mortgage Conditions. The Guarantor acknowledges receipt of the mortgage deed, the mortgage conditions, and the offer (as defined in the mortgage conditions) and confirms that he or she has read and understands them.

Article 12 - Adverse Possession. Section 6-5-200 - When Title to Land Conferred or Defeated; When Claim May Be Defended or Prosecuted; Construction of Section.

A guarantor home loan works as a way to get into the market sooner. You may only need a small deposit. In some cases, you may not need a deposit at all. That's because a guarantor ? usually a family member, offers equity in their own home as additional security for your loan.

The Bottom Line A guarantor is an individual that agrees to pay a borrower's debt if the borrower defaults on their obligation. A guarantor is not a primary party to the agreement but is considered to be an additional comfort for a lender.

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit. If the guarantor has pledged collateral to secure the guaranty obligation, foreclosure proceedings against that will often be commenced.

If this happens and additional funds are advanced or re-advanced, the guarantee secures the additional funds up to the fixed amount. When a mortgage secures a guarantee, it secures the guarantor's obligation to repay the funds advanced related to the other party's debt, up to the guarantee amount.

CONSIDERATION The writing should specify some form of "consideration" being given to the guarantor for the guaranty. As noted in the article on Contracts, to be binding either some form of consideration must be paid to a party, or reasonable reliance and detriment must be shown for the relying party.

With a guarantor mortgage, you may be able to get a mortgage even if you have no deposit or a bad credit score. A mortgage guarantor is someone ? usually a parent, a relative or even a close friend ? who will cover your mortgage repayments if you can't pay them for any reason.