A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Alabama Conditional Guaranty of Payment of Obligation

Description

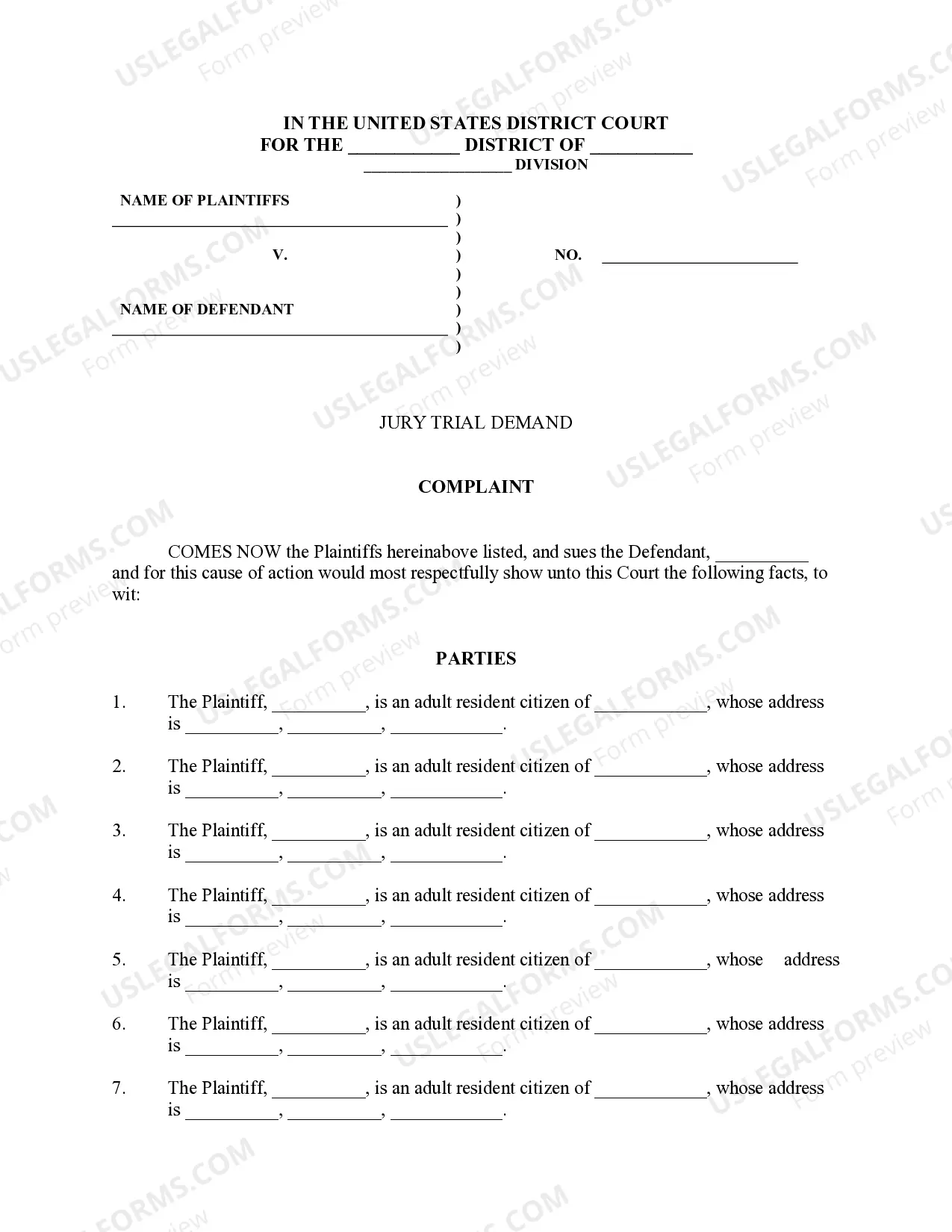

How to fill out Conditional Guaranty Of Payment Of Obligation?

Have you found yourself in the circumstance where you need documents for either business or personal purposes almost daily.

There are numerous legal document templates accessible online, but obtaining reliable versions isn’t straightforward.

US Legal Forms provides thousands of form templates, such as the Alabama Conditional Guaranty of Payment of Obligation, designed to comply with state and federal requirements.

Once you identify the correct form, simply click Purchase now.

Select the pricing plan you prefer, input the required information to set up your account, and finalize the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the Alabama Conditional Guaranty of Payment of Obligation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it’s for the correct city/region.

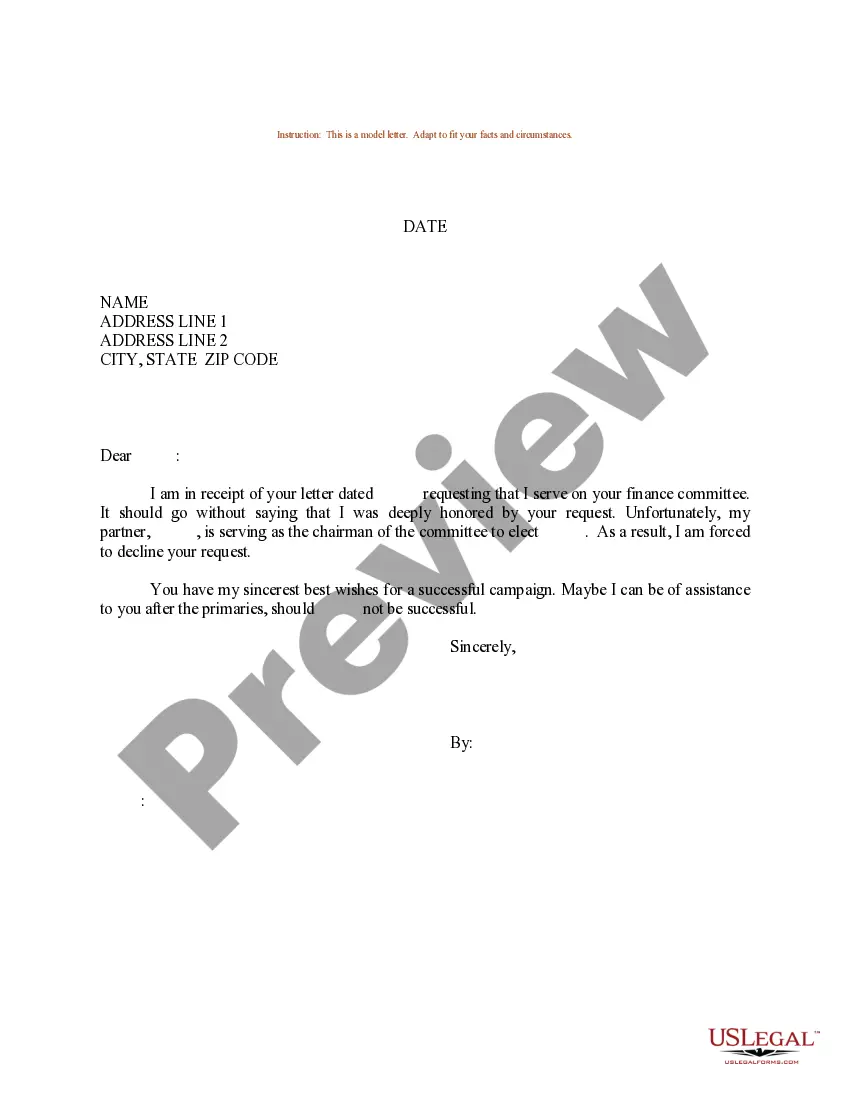

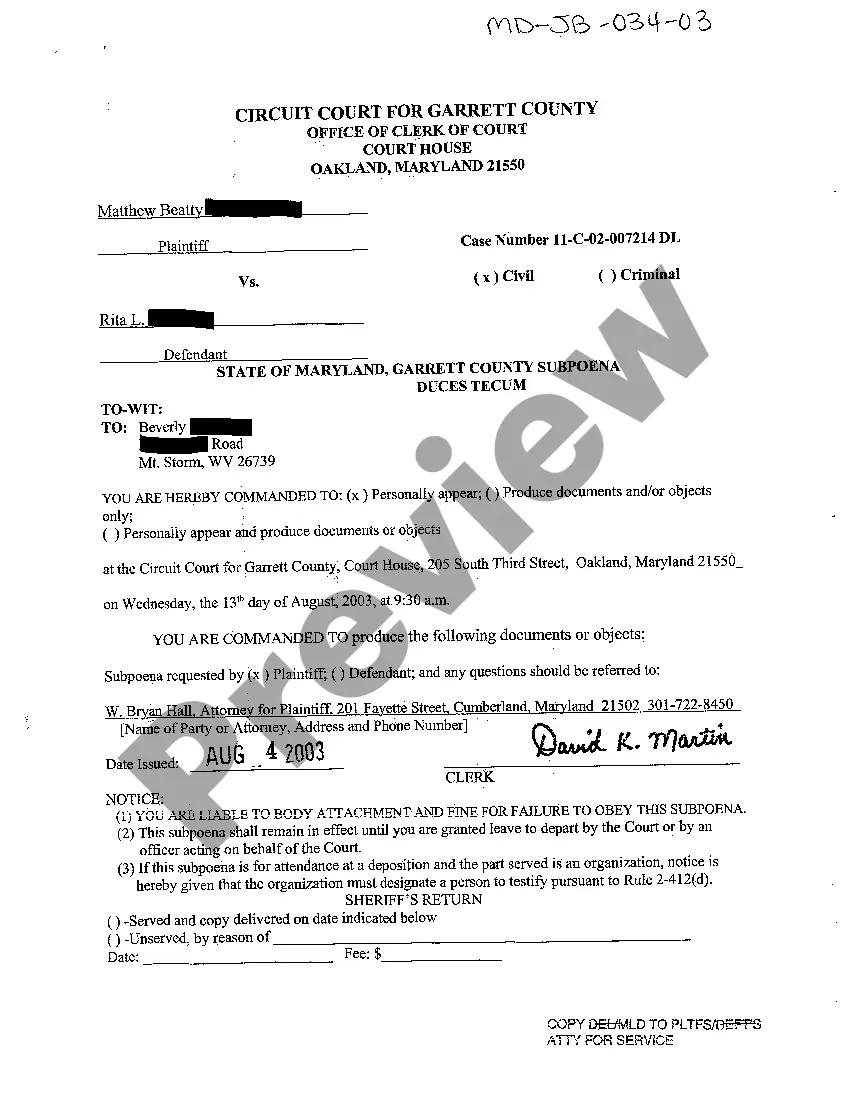

- Utilize the Preview button to review the form.

- Examine the description to confirm you’ve selected the right form.

- If the form is not what you are searching for, use the Lookup area to find the form that fits your requirements.

Form popularity

FAQ

An unconditional guarantee assures that the guarantor will honor the payment regardless of circumstances or claims by others. This type of guarantee provides a safety net for creditors and facilitates smoother transactions. When you seek clarity on an Alabama Conditional Guaranty of Payment of Obligation, knowing how unconditional guarantees function can empower your decision-making in financial matters.

A conditional payment guarantee ties the obligation of the guarantor to the fulfillment of certain terms or conditions specified in the contract. This guarantees payment only if specific criteria are met, protecting both parties involved. If you are exploring the Alabama Conditional Guaranty of Payment of Obligation, this type of guarantee might be beneficial for managing risk in your agreements.

An unconditional and irrevocable guarantee means that the guarantor cannot withdraw their commitment once given. This type of guarantee promises payment without any conditions attached. When you consider the Alabama Conditional Guaranty of Payment of Obligation, it's crucial to distinguish this type of guarantee for unwavering security in financial dealings.

Code 36 12 40 concerns the public's right to access government documents and records in Alabama. Transparency is a key component of this code, promoting accountability in public office. For those navigating the Alabama Conditional Guaranty of Payment of Obligation, understanding your rights can facilitate better dealings.

The Alabama Code addressing giving false information is found in various sections governing fraud and misrepresentation. Violating these codes can lead to stiff penalties and legal repercussions. When dealing with guarantees, including the Alabama Conditional Guaranty of Payment of Obligation, ensuring truthful disclosures is crucial.

Code 40 12 262 relates to the guidelines for property taxes in Alabama, detailing payment responsibilities and exemptions. Navigating this code can be perplexing but is key for property owners. Having a clear understanding of the financial obligations outlined in the Alabama Conditional Guaranty of Payment of Obligation can assist in property dealings.

To collect on a judgment in Alabama, you can use various methods including wage garnishment, property liens, or bank levies. Engaging a legal professional can streamline this process. If the debtor has a conditional guaranty of payment, understanding public requirements will aid in your collection efforts.

Alabama Code 6 10 7 pertains to the waiver of certain rights regarding debtors and creditors. It specifies when a party can relinquish their rights to claim against a guarantor. This is particularly relevant if you are dealing with the Alabama Conditional Guaranty of Payment of Obligation, as it affects your ability to enforce claims.

Alabama Code 39 2 12 outlines requirements for performance bonds and surety agreements in public contracts. This code aims to protect contractors and the public by ensuring that financial obligations are met. When dealing with the Alabama Conditional Guaranty of Payment of Obligation, familiarity with this code enhances your legal position.

The Title 39 bid law in Alabama governs public contracts and procurement processes for state and local governments. It ensures transparency, fairness, and competition among bidders. Understanding this law is essential, especially when considering the implications of the Alabama Conditional Guaranty of Payment of Obligation.