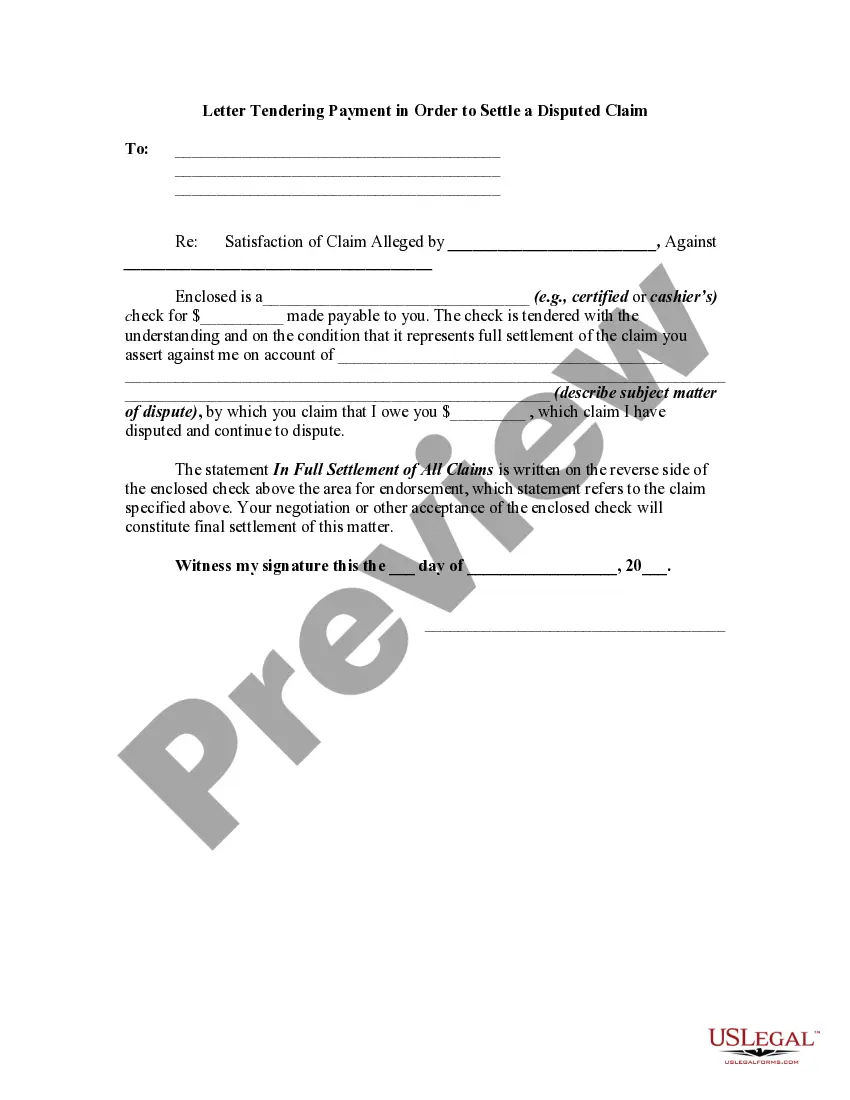

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

Alabama Settlement Offer Letter from a Business Regarding a Disputed Account

Description

How to fill out Settlement Offer Letter From A Business Regarding A Disputed Account?

You might spend hours online searching for the legal document format that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

It is easy to download or print the Alabama Settlement Offer Letter from a Business Regarding a Disputed Account from our service.

In order to find another version of the form, use the Search box to locate the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Alabama Settlement Offer Letter from a Business Regarding a Disputed Account.

- Every legal document you purchase is yours indefinitely.

- To obtain another copy of the acquired form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the region/city you choose.

- Check the form description to confirm you have selected the appropriate document.

Form popularity

FAQ

In Alabama, most debts become uncollectible after a statute of limitations period of six years. Once this period has passed, the creditor can no longer sue you to collect the debt. If you are disputing a debt, receiving an Alabama Settlement Offer Letter from a Business Regarding a Disputed Account can be crucial in resolving the issue before it becomes uncollectible.

In Alabama, a credit card company generally has six years to file a lawsuit for unpaid debts. This time frame starts from the date of the last payment or the date you defaulted on the account. Receiving an Alabama Settlement Offer Letter from a Business Regarding a Disputed Account can serve as an important reminder that you should address outstanding debts before time runs out.

To negotiate a debt collection settlement letter, begin by reviewing the collection details and validating the debt. In your communication, express your willingness to settle while also stating your financial constraints. Using an Alabama Settlement Offer Letter from a Business Regarding a Disputed Account may strengthen your position, as it may provide a framework for discussing a reduced settlement amount.

Typically, debt collectors can wait a few months to a few years before deciding to sue. However, the exact timeline often depends on the company's policies and the nature of the debt. If you receive an Alabama Settlement Offer Letter from a Business Regarding a Disputed Account, it’s essential to take it seriously, as it may indicate that legal action could be on the horizon.

The percentage you offer to settle a debt usually ranges from 30% to 70% of the total amount owed. Factors such as your financial situation and the creditor's willingness to compromise influence this percentage. When drafting your Alabama Settlement Offer Letter from a Business Regarding a Disputed Account, ensure your offer is fair and justifiable based on your circumstances.

In Alabama, creditors typically have six years to sue you for a debt. This time frame can vary depending on the type of debt, so it’s always best to consult legal advice or check the specifics. Understanding these time limits can help you determine the urgency of responding to an Alabama Settlement Offer Letter from a Business Regarding a Disputed Account.

Writing a settlement offer letter involves a few key components. Begin with a formal greeting, state your intent to settle the dispute, and mention the amount you wish to settle for. Use the format of an Alabama Settlement Offer Letter from a Business Regarding a Disputed Account, ensuring clarity and professionalism while including specific details about your reasons for the offer.

To make an offer to settle a debt, review your financial situation and decide on a realistic amount you can afford. Write a clear and concise letter, titled Alabama Settlement Offer Letter from a Business Regarding a Disputed Account, detailing your offer, your understanding of the debt, and any relevant circumstances. It’s essential to remain respectful and professional throughout the process.

In a debt settlement letter, be clear and concise about your offer. Include your reasons for the settlement and any supporting documentation that strengthens your case. For instance, referencing the Alabama Settlement Offer Letter from a Business Regarding a Disputed Account can lend credibility to your request, showing the other party that you are aware of your rights and the norms within this context.

When negotiating a debt settlement, start by clearly stating your intent. Explain your financial situation honestly and express your willingness to settle the debt in a way that feels fair. Use the Alabama Settlement Offer Letter from a Business Regarding a Disputed Account as a reference to justify your proposal, and be open to discussing alternatives that may work for both parties.