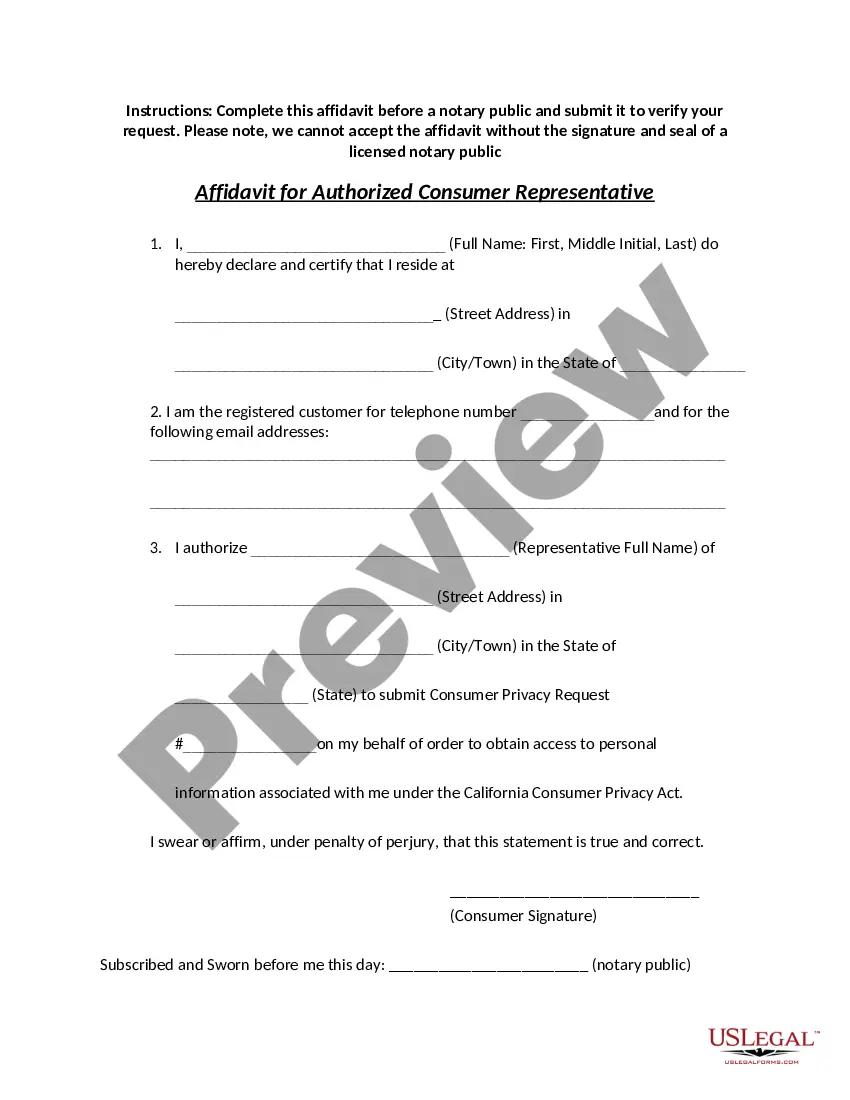

The Fair Credit Reporting Act provides that the consumer, in obtaining disclosure of information in the consumer's file from a consumer reporting agency personally, is permitted to be accompanied by one other person of the consumer's choosing, which person must provide reasonable identification. The act further provides that the consumer reporting agency may require the consumer to furnish a written statement granting permission to the consumer reporting agency to discuss the consumer's file in such person's presence.

Alabama Consent to Discuss Consumer's File in Presence of Third Person

Description

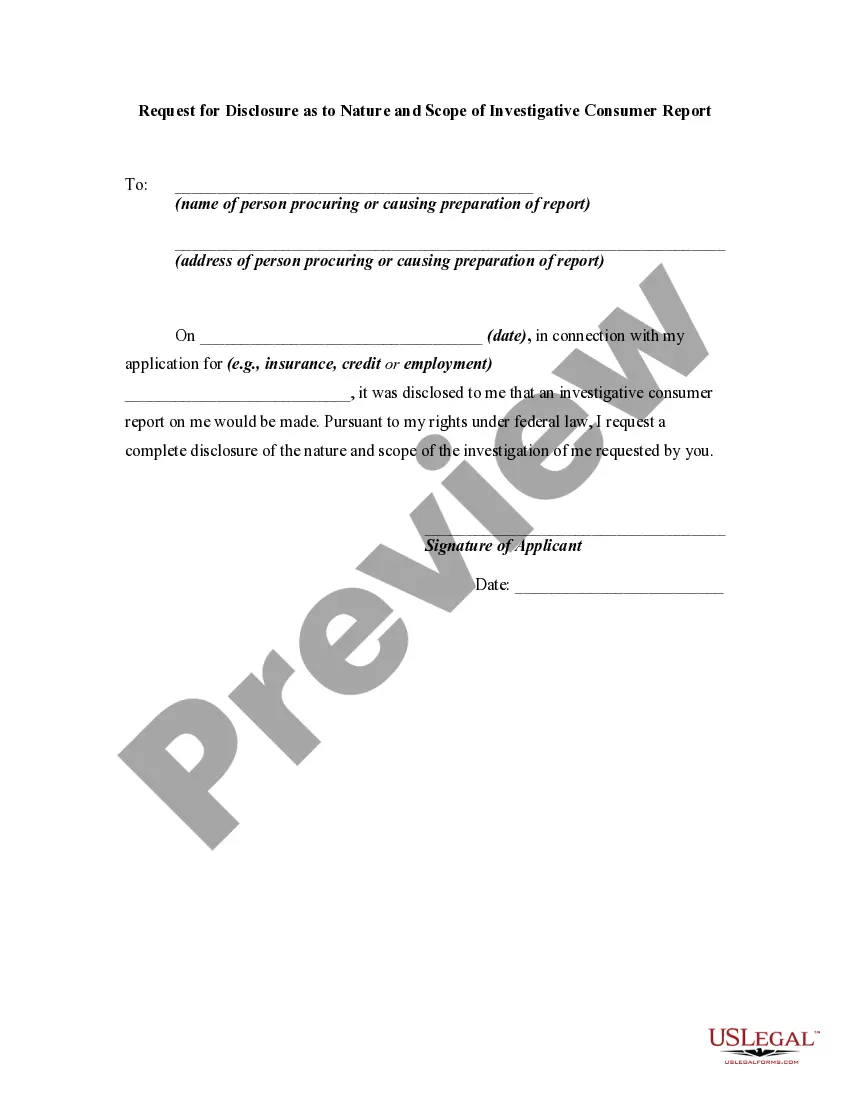

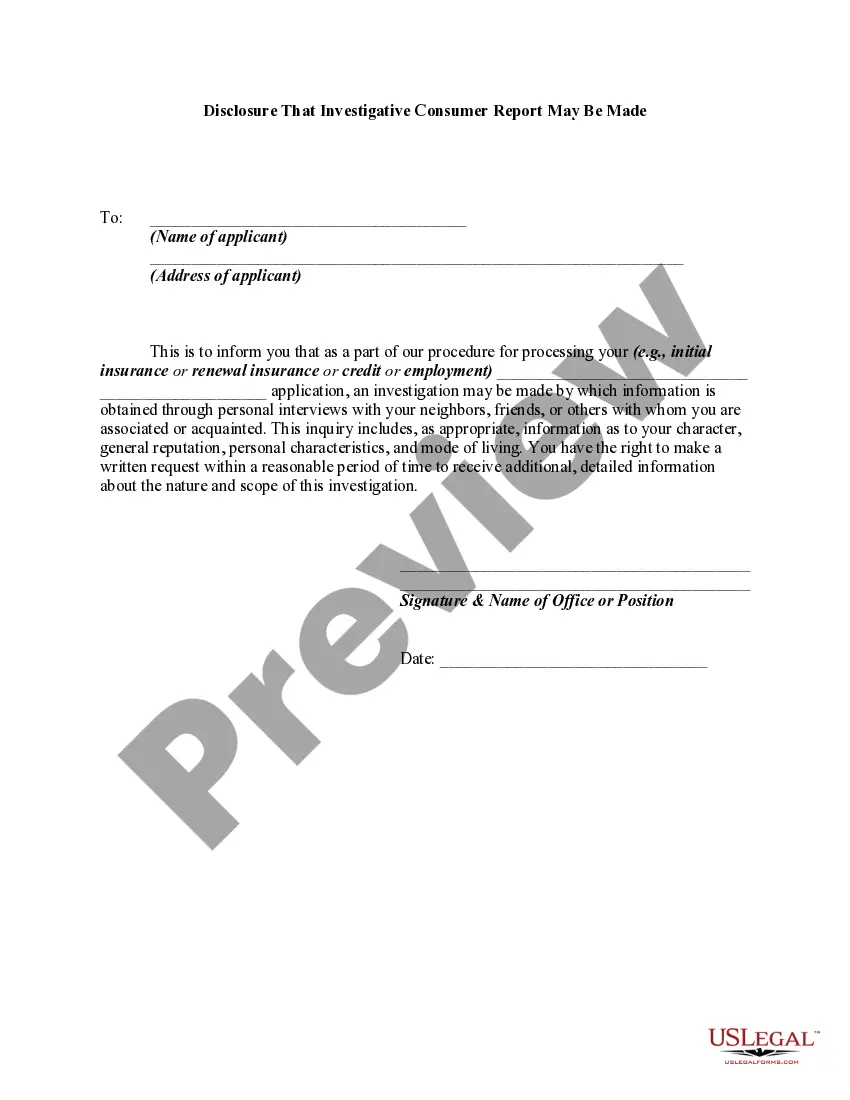

How to fill out Consent To Discuss Consumer's File In Presence Of Third Person?

US Legal Forms - one of the most significant libraries of legitimate kinds in America - gives a wide range of legitimate document layouts you can down load or print out. Using the web site, you will get thousands of kinds for enterprise and person uses, categorized by classes, claims, or search phrases.You will discover the latest types of kinds like the Alabama Consent to Discuss Consumer's File in Presence of Third Person within minutes.

If you already have a membership, log in and down load Alabama Consent to Discuss Consumer's File in Presence of Third Person through the US Legal Forms collection. The Obtain switch will appear on each and every form you see. You have access to all previously saved kinds in the My Forms tab of your respective account.

If you would like use US Legal Forms initially, here are simple instructions to help you get started off:

- Make sure you have chosen the correct form for the metropolis/area. Select the Review switch to examine the form`s content. See the form information to actually have chosen the correct form.

- In case the form doesn`t suit your demands, make use of the Search area at the top of the display to get the one that does.

- If you are content with the form, validate your option by clicking the Get now switch. Then, choose the rates program you like and give your accreditations to sign up for an account.

- Method the purchase. Use your charge card or PayPal account to accomplish the purchase.

- Find the file format and down load the form on your product.

- Make changes. Complete, change and print out and signal the saved Alabama Consent to Discuss Consumer's File in Presence of Third Person.

Each web template you included in your bank account lacks an expiry particular date and is the one you have permanently. So, if you wish to down load or print out an additional copy, just go to the My Forms segment and click on about the form you will need.

Obtain access to the Alabama Consent to Discuss Consumer's File in Presence of Third Person with US Legal Forms, the most extensive collection of legitimate document layouts. Use thousands of professional and state-certain layouts that satisfy your small business or person requirements and demands.

Form popularity

FAQ

There are four distinct types of invasion of privacy cases: (1) wrongful intrusion, physically or otherwise, on the solitude or seclusion of another or his or her private affairs or concerns; (2) publicity which violates the ordinary decencies; (3) putting the person in a false, though not necessarily defamatory, light ...

The disbarred or suspended lawyer, after entry of the disbarment or suspension order, shall not accept any new retainer or engage as a lawyer for another client in any new case or legal matter of any nature.

There are four distinct types of invasion of privacy cases: (1) wrongful intrusion, physically or otherwise, on the solitude or seclusion of another or his or her private affairs or concerns; (2) publicity which violates the ordinary decencies; (3) putting the person in a false, though not necessarily defamatory, light ...

Alabama Code § 13A-11-30 stipulates that at least one person involved in a conversation must consent to its recording. No person may record conversations he or she is not a part of unless given verbal or written consent prior to the recording being made.

Invasion of privacy involves the infringement upon an individual's protected right to privacy through a variety of intrusive or unwanted actions. Such invasions of privacy can range from physical encroachments onto private property to the wrongful disclosure of confidential information or images.

Relates to consumer protection, creates the Alabama Consumer Privacy Act, allows a consumer to request a business to disclose personal information it collects about the consumer and to require a business to make those disclosures under certain conditions, allows a consumer to request deletion of certain personal ...

Those four types are 1) intrusion on a person's seclusion or solitude; 2) public disclosure of embarrassing private facts about a person; 3) publicity that places a person in a false light in the public eye; and 4) appropriation, for the defendant's advantage, of the person's name or likeness.

A public agency shall not do any of the following: Require any person or nonprofit organization to provide the public agency with personal information or otherwise compel the release of personal information. Release, publicize, or otherwise publicly disclose personal information in its possession.