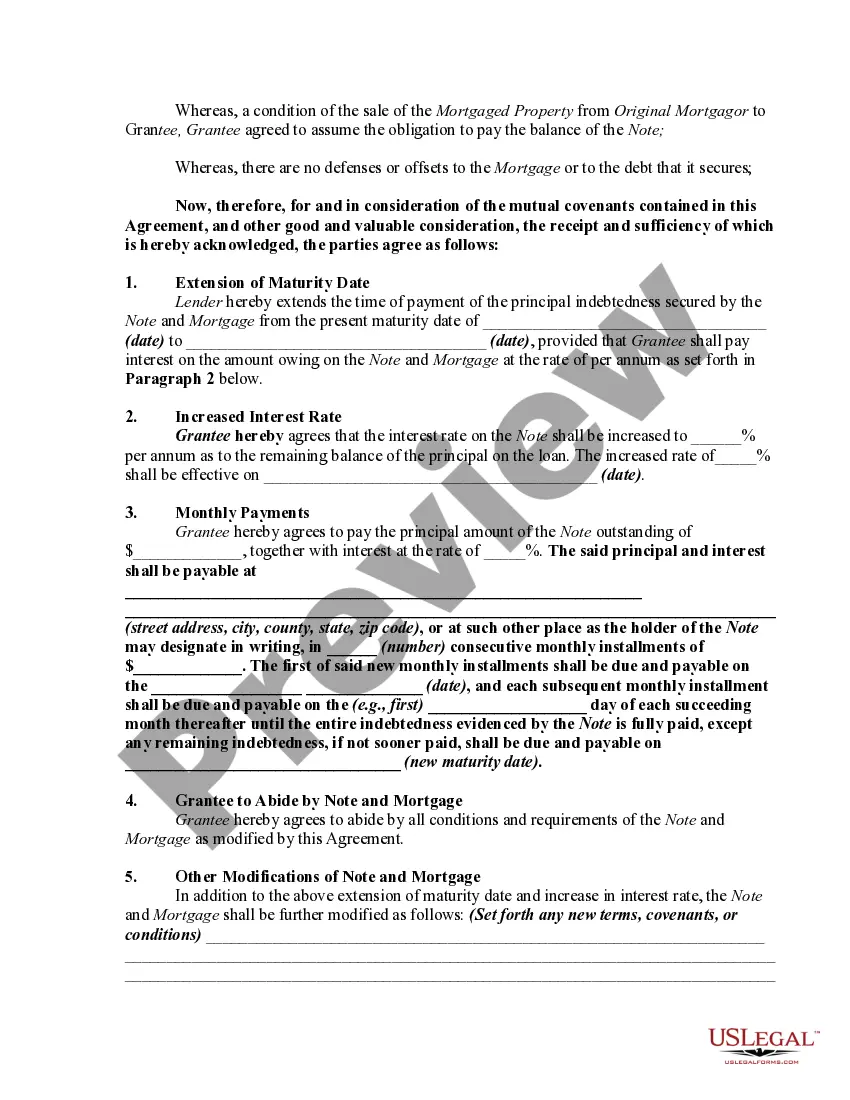

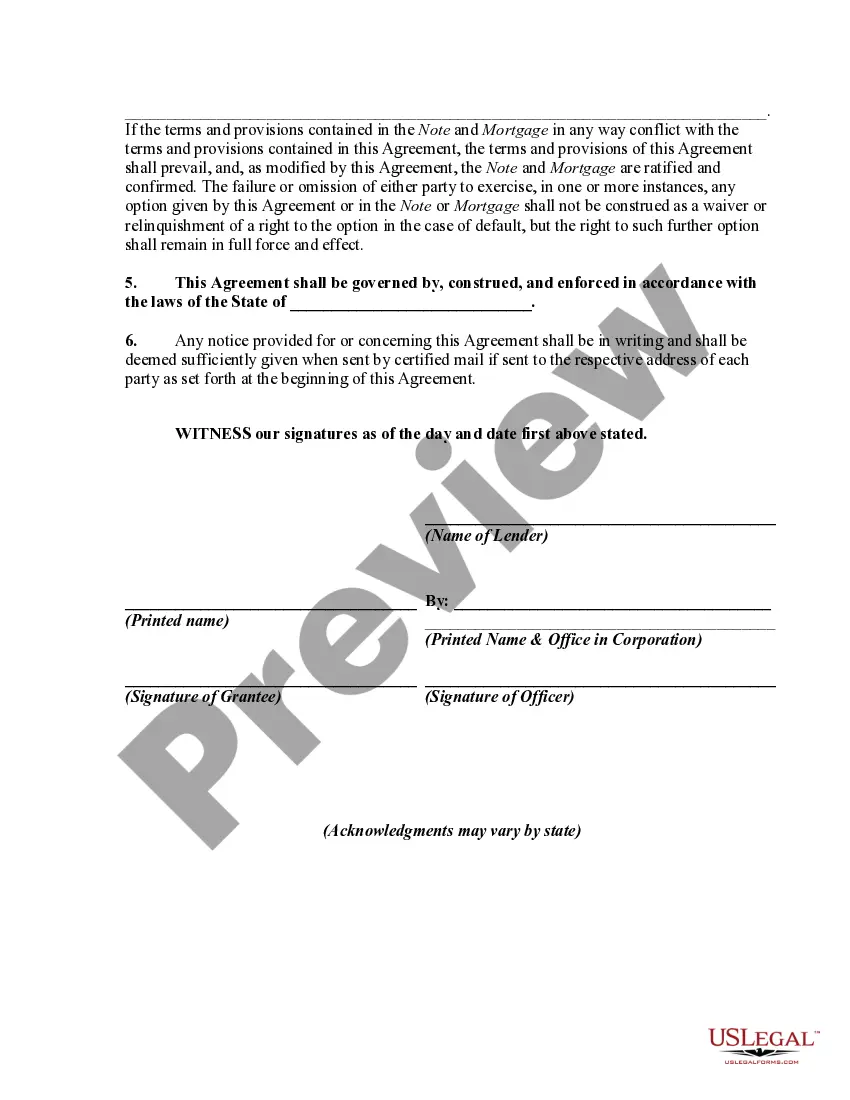

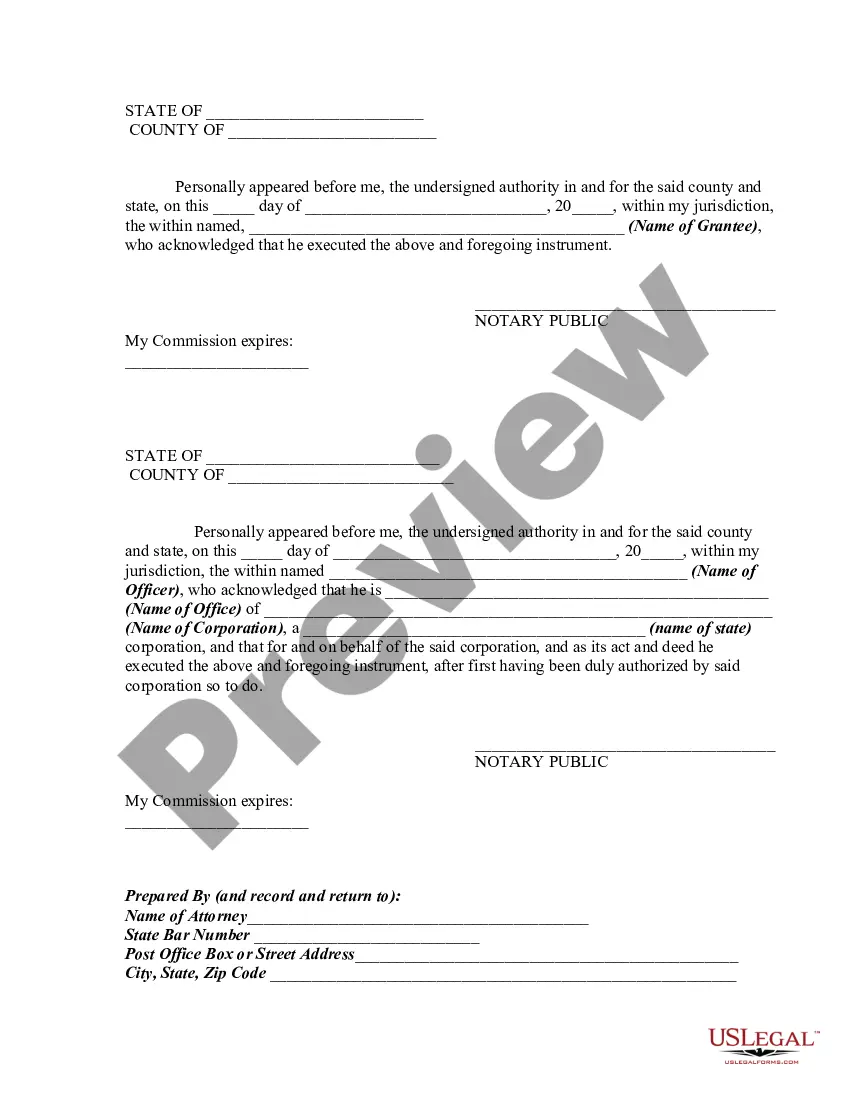

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

Finding the right legitimate record format can be quite a struggle. Of course, there are tons of templates available on the net, but how do you get the legitimate type you require? Use the US Legal Forms website. The assistance gives thousands of templates, for example the Alabama Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest, which can be used for organization and private needs. All of the types are inspected by specialists and meet federal and state specifications.

When you are already registered, log in for your profile and click the Obtain button to obtain the Alabama Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest. Make use of your profile to check throughout the legitimate types you possess ordered formerly. Proceed to the My Forms tab of your own profile and have one more backup of your record you require.

When you are a new consumer of US Legal Forms, listed here are simple instructions for you to stick to:

- First, ensure you have chosen the appropriate type for the town/county. You are able to look through the shape utilizing the Preview button and look at the shape outline to guarantee this is basically the right one for you.

- In the event the type does not meet your expectations, use the Seach field to obtain the correct type.

- Once you are certain the shape is suitable, click the Acquire now button to obtain the type.

- Pick the prices plan you want and enter in the needed details. Build your profile and pay money for the transaction making use of your PayPal profile or bank card.

- Pick the document format and download the legitimate record format for your device.

- Full, revise and print out and sign the obtained Alabama Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest.

US Legal Forms is the biggest collection of legitimate types that you can see a variety of record templates. Use the service to download appropriately-manufactured paperwork that stick to state specifications.

Form popularity

FAQ

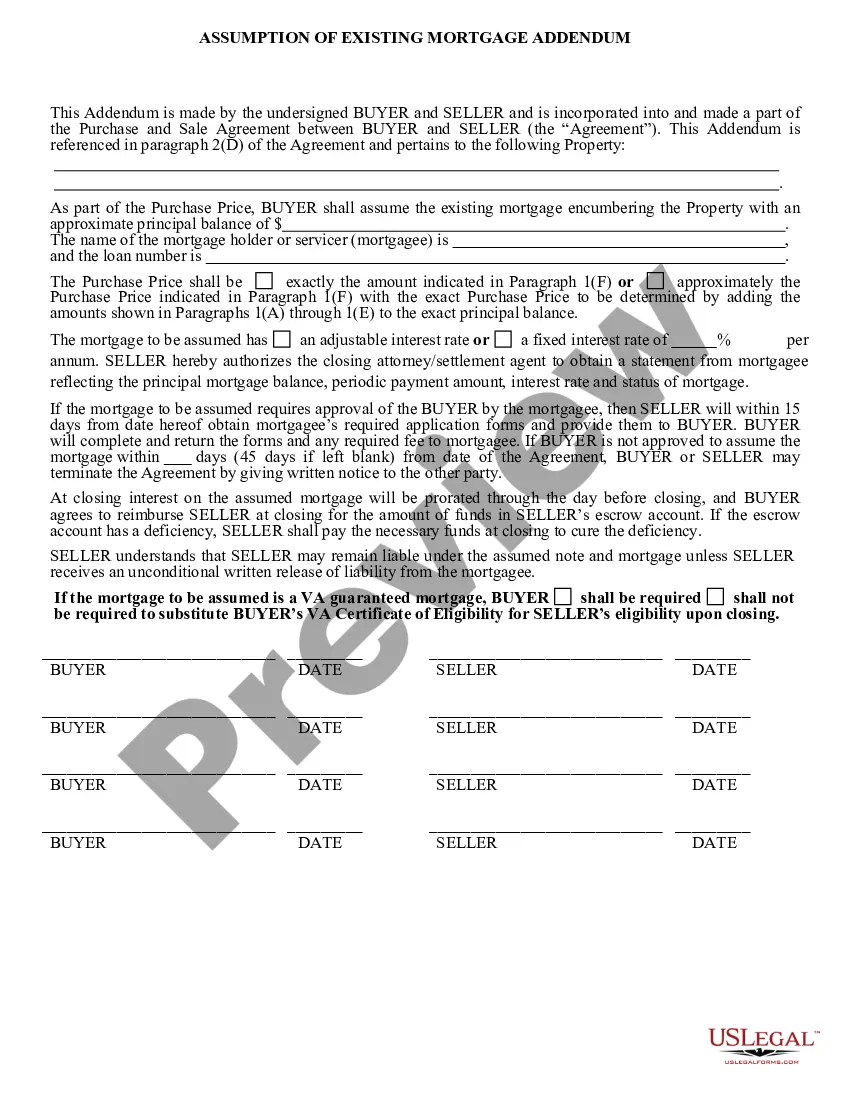

The due-on-sale clause protects your lender by preventing prospective buyers from assuming your mortgage.

There are assumption fees charged by lenders that may be limited by mortgage investor policy and state rules. You'll still pay other closing costs as in any mortgage closing, but these are usually less because there is less paperwork and typically no appraisal fee.

Loan assumption, however, allows a buyer to take over the current owner's mortgage while the loan's terms ? including the repayment period and interest rate ? remain the same. Ultimately, it can help people get into a home at a lower interest rate even as the housing market around them becomes more expensive.

Assumable refers to when one party takes over the obligation of another. In terms of an assumable mortgage, the buyer assumes the existing mortgage of the seller. When the mortgage is assumed, the seller is often no longer responsible for the debt.

In some situations, a buyer may be able to assume the seller's existing mortgage. The buyer takes over the seller's mortgage payments, and the seller receives the value of their equity in the home.

If you assume the mortgage, you'll need to compensate the seller for the equity they've built up in the home ? the amount of the mortgage they've paid off. While this is part of the overall purchase price, you have to pay it right away ? as part of your down payment, basically.

How do assumable mortgages work? When you assume a mortgage, the current borrower signs the balance of their loan over to you, and you become responsible for the remaining payments. That means the mortgage will have the same terms the previous homeowner had, including the same interest rate and monthly payments.

A seller is still responsible for any debt payments if the mortgage is assumed by a third party unless the lender approves a release request releasing the seller of all liabilities from the loan. If approved, the title of the property is transferred to the buyer who makes the required monthly repayments to the bank.