Alabama Hippa Release Form for Insurance

Description

How to fill out Hippa Release Form For Insurance?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a diverse assortment of legal document templates that you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, organized by categories, claims, or keywords. You will find the latest updates of forms such as the Alabama Hippa Release Form for Insurance in just moments.

If you hold a subscription, Log In and download the Alabama Hippa Release Form for Insurance from your US Legal Forms account. The Download button will appear on each form you view.

Once you are satisfied with the form, validate your choice by clicking the Buy now button.

Then, choose the payment method you prefer and provide your details to register for the account. Complete the transaction. Use a credit card or PayPal account to finish the transaction. Select the format and download the form onto your device. Edit. Complete, modify, print, and sign the downloaded Alabama Hippa Release Form for Insurance. Every template added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply head to the My documents section and click on the form you need. Access the Alabama Hippa Release Form for Insurance with US Legal Forms, one of the most substantial libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to examine the form's contents.

- Check the form description to confirm that you've selected the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

Form popularity

FAQ

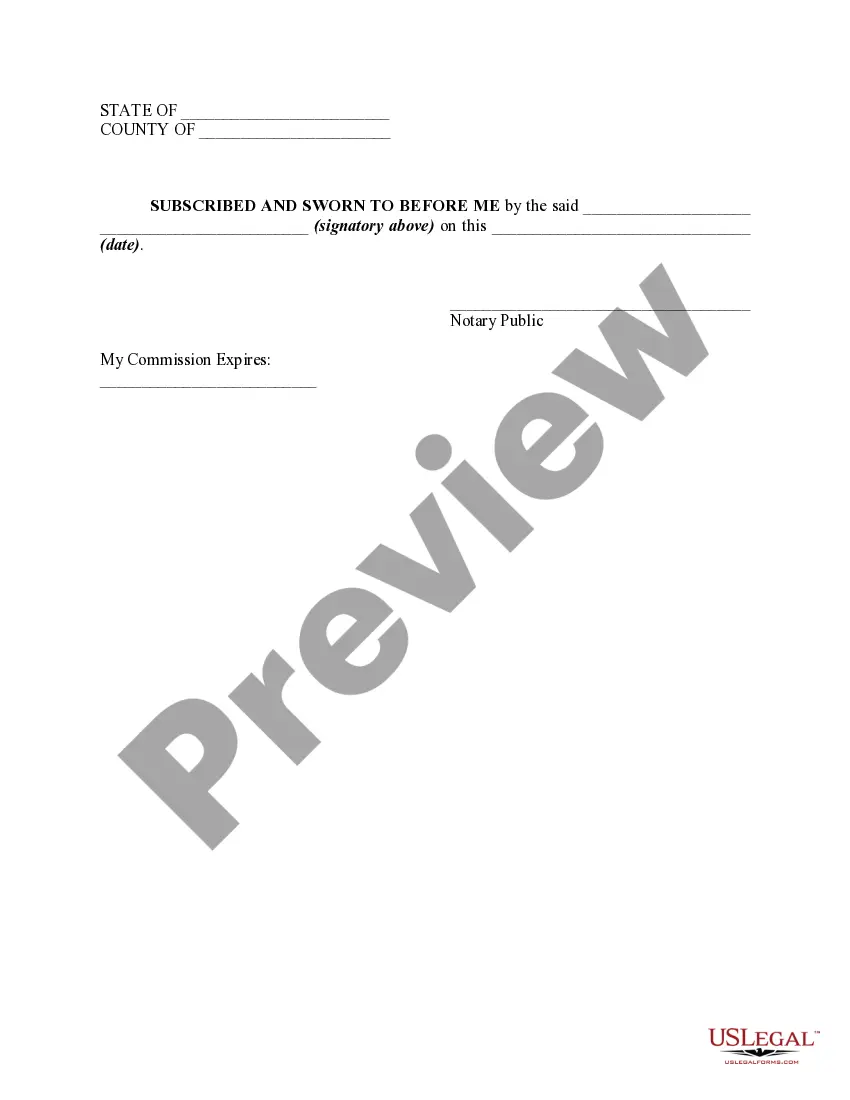

In most cases, a HIPAA release does not need to be notarized. However, some organizations may request a notarized signature for added security. It is always wise to check the requirements of your healthcare provider or the insurance company involved, especially when using the Alabama HIPAA Release Form for Insurance, to ensure that you meet their criteria.

A release of information generally requires a completed medical release form with accurate personal information, specific details about the records being released, and a signature from the patient. Additionally, when dealing with insurance, such as through the Alabama HIPAA Release Form for Insurance, ensure that you comply with any specific state requirements to safeguard your information.

Filling out a medical record release involves a few key steps. Start by entering your identification details, then clearly specify the records you want to be released. Make sure to sign the form, as your signature is necessary to validate the release. Using the Alabama HIPAA Release Form for Insurance can simplify this process and help you meet all legal requirements.

The patient holds the ultimate authority regarding the release of their medical records. This decision typically involves evaluating the purpose of the request and who will receive the information. It’s crucial that you consider using the Alabama HIPAA Release Form for Insurance to ensure that your rights are protected during this process.

To fill out a medical record release form, first, provide your personal information, including your name, address, and date of birth. Next, indicate the specific records you wish to release, whether for insurance purposes or to another party. Finally, sign and date the form to authorize the release of your information in compliance with the Alabama HIPAA Release Form for Insurance.

To gain HIPAA certification, organizations typically undergo an evaluation process to assess compliance with HIPAA standards. This may involve consulting with experts or using specialized software. Incorporating an Alabama HIPAA Release Form for Insurance can simplify compliance by ensuring you have the proper documentation in place. Always keep in mind that certification requires ongoing efforts to maintain and demonstrate compliance.

Getting HIPAA approval requires understanding the specific regulations your organization must follow. Start by training your staff on HIPAA guidelines, including patient privacy rights and security measures. Additionally, consider using tools such as the Alabama HIPAA Release Form for Insurance, which facilitates the process of obtaining consent from patients, helping you stay compliant with federal laws.

Authorizing HIPAA essentially involves completing the necessary documentation that grants permissions for health information sharing. You can do this by having patients sign a release form, like the Alabama HIPAA Release Form for Insurance. This step is crucial to ensure compliance and maintain trust with your clients. Make sure the form clearly outlines what information can be shared and with whom.

To obtain HIPAA approval, you must ensure that your organization complies with HIPAA regulations. Begin by conducting a risk assessment to identify potential vulnerabilities in your processes. Then, implement necessary safeguards and create relevant policies. Finally, utilizing an Alabama HIPAA Release Form for Insurance can help streamline the consent process, ensuring that all parties are protected.

In most cases, a HIPAA release form does not need notarization to be valid. However, some institutions may have their own policies regarding notarization. Utilizing the Alabama Hippa Release Form for Insurance via UsLegalForms helps clarify any specific requirements you may face. Always check with the receiving party if unclear about any procedural needs.