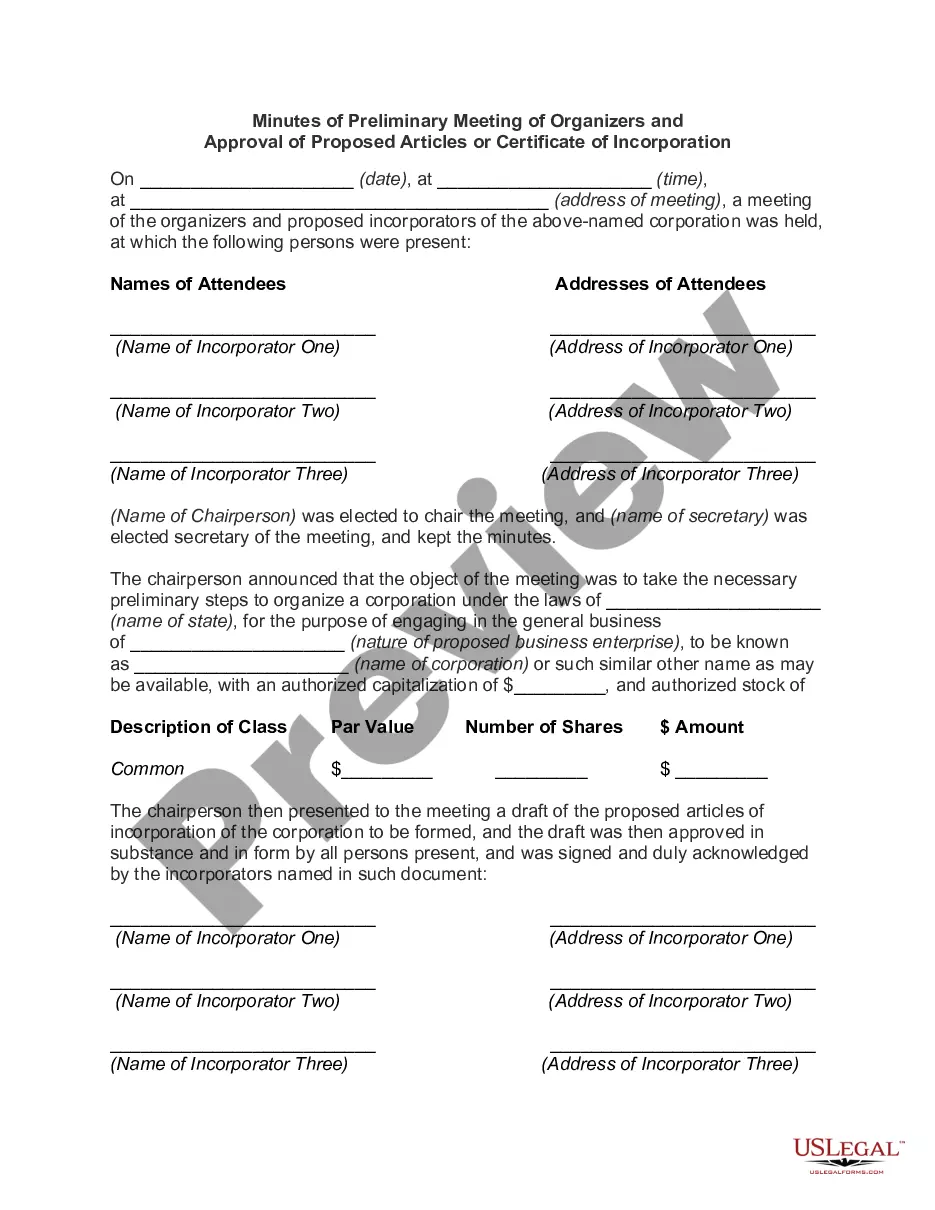

Alabama UCC-1 for Personal Credit: A Comprehensive Overview The Alabama UCC-1 for Personal Credit refers to a legal document filed by a creditor to establish a claim or security interest in personal property as collateral for a loan. This document is an essential part of the Uniform Commercial Code (UCC) filings in the state of Alabama and serves to protect the rights and interests of both creditors and debtors. The UCC-1 for Personal Credit allows creditors to publicly declare their priority in an individual's personal property, which includes assets like vehicles, equipment, inventory, receivables, and other miscellaneous personal belongings. By filing this document with the Alabama Secretary of State's office, creditors establish their priority in case of bankruptcy, default, or competing claims against the debtor's assets. The Alabama UCC-1 for Personal Credit contains various key components necessary for validity and enforcement. These include: 1. Debtor Information: The UCC-1 form requires accurate and specific details about the debtor, such as their full legal name, address, and social security number. It is crucial to input this information correctly to avoid potential disputes or inaccuracies. 2. Creditor Information: Similarly, the creditor's information, including their full legal name, address, and contact details, must be accurately provided. This ensures proper identification and communication between the parties involved. 3. Collateral Description: A detailed description of the collateral securing the loan must be included in the UCC-1 form. This section requires a precise explanation of the collateral, including its make, model, serial number, and any relevant identifying information. 4. Financing Statement: The UCC-1 for Personal Credit serves as a financing statement that publicly notifies other potential creditors of the creditor's security interest in the designated collateral. It essentially reveals the nature and extent of the creditor's claim. The Alabama UCC-1 for Personal Credit allows for different types of filings, catering to specific situations and needs. Some of these variations include: 1. Individual Debtor Filing: This type of filing applies when an individual debtor obtains a loan and pledges their personal property as collateral. 2. Joint Debtor Filing: In situations where multiple individuals jointly obtain a loan and pledge their personal property as collateral, a joint debtor filing is required. 3. Amendment Filing: If there is a need to modify or update the original UCC-1 filing, an amendment filing is performed. This could involve changes in debtors or collateral description. It is important to note that the UCC-1 for Personal Credit is a public record accessible to anyone interested in determining a debtor's financial standing or existing security interests. Creditors often conduct searches to evaluate the position and priority of their claims against other creditors. In conclusion, the Alabama UCC-1 for Personal Credit is a crucial legal document that protects the rights of both creditors and debtors. By accurately filing this form, creditors enhance their chances of receiving repayment or recovering their investment if a debtor defaults on their loan.

Alabama UCC-1 for Personal Credit

Description

How to fill out Alabama UCC-1 For Personal Credit?

Finding the right lawful document format might be a battle. Obviously, there are tons of themes available on the Internet, but how will you discover the lawful form you require? Utilize the US Legal Forms site. The support gives a large number of themes, such as the Alabama UCC-1 for Personal Credit, which you can use for enterprise and private requirements. Each of the varieties are checked by experts and satisfy state and federal requirements.

Should you be currently signed up, log in to your account and then click the Download switch to obtain the Alabama UCC-1 for Personal Credit. Make use of your account to appear from the lawful varieties you may have ordered earlier. Proceed to the My Forms tab of your account and get yet another duplicate from the document you require.

Should you be a whole new consumer of US Legal Forms, listed below are simple directions that you should adhere to:

- Initially, be sure you have chosen the appropriate form for your city/county. You may look through the shape utilizing the Review switch and look at the shape description to ensure it is the best for you.

- When the form fails to satisfy your requirements, use the Seach discipline to discover the proper form.

- Once you are certain the shape would work, click on the Get now switch to obtain the form.

- Select the prices plan you need and type in the necessary information and facts. Design your account and pay money for the transaction utilizing your PayPal account or charge card.

- Opt for the file file format and acquire the lawful document format to your gadget.

- Comprehensive, modify and print and indicator the received Alabama UCC-1 for Personal Credit.

US Legal Forms is definitely the biggest catalogue of lawful varieties for which you can see various document themes. Utilize the company to acquire professionally-produced papers that adhere to condition requirements.