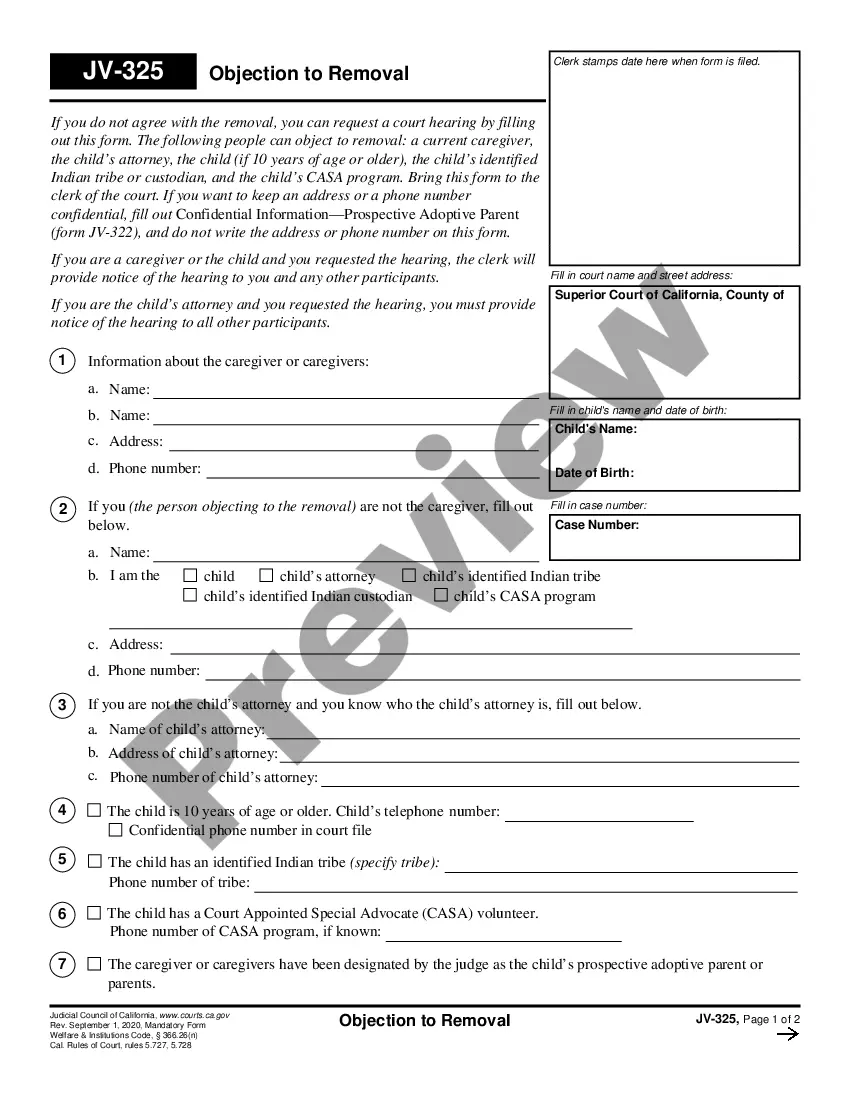

This form is a generic complaint and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A detailed description of the Alabama Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts would include the essential information regarding this legal document filed by individuals or businesses who have not received payment for services or goods rendered. Below is a comprehensive explanation of the purpose, content, and different types of this complaint, incorporating relevant keywords. Title: Alabama Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts Description: In Alabama, when an individual or a business fails to fulfill their debt obligations resulting from oral or implied contracts, creditors have the right to file a Complaint for Refusal to Pay Debt in the appropriate court. The purpose of this legal document is to seek legal action and recover the unpaid debt. Keywords: Alabama, complaint, refusal to pay debt, breach, oral contracts, implied contracts, legal action, unpaid debt. Content: 1. Introduction: The Alabama Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts is a legal document utilized by creditors to initiate a lawsuit against individuals or businesses who have neglected or refused to pay their outstanding debts. This complaint serves as the first step in bringing the case to court and seeking a legal remedy for the unpaid amount. 2. Identification of the Parties: The complaint should clearly identify both the plaintiff (the party seeking payment) and the defendant (the party in breach of the oral or implied contract). It is important to include accurate names, contact information, and any relevant identification numbers. 3. Statement of Jurisdiction: To establish the court's authority to hear the case, the complaint should mention the specific jurisdiction (e.g., county and court) where the lawsuit is filed. 4. Facts of the Case: The complaint must outline the details of the oral or implied contract, including the nature of the debt, the date and place of the agreement, and any supporting evidence of the agreement's existence (e.g., emails, invoices, or witness statements). 5. Breach of Contract: The complaint should clearly state how the defendant has breached the oral or implied contract by refusing to pay the debt owed. It should elaborate on the terms of the agreement, the agreed-upon payment amount, and any outstanding balance. 6. Damages: This section outlines the monetary compensation sought by the plaintiff, including the original debt amount, any overdue interest, collection costs, attorney fees, and any other applicable damages. 7. Legal Cause of Action: The complaint should specify the legal basis on which the lawsuit is filed, such as Alabama Code Title 8, Section X (pertaining to breach of oral or implied contracts). This demonstrates that the plaintiff is entitled to seek remedies under Alabama law. Types of Alabama Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts: 1. Individual vs. Individual: This type of complaint is filed when an individual creditor seeks legal action against another individual who has breached an oral or implied contract and has refused to pay the outstanding debt. 2. Business vs. Individual: In this case, the complaint is filed by a business entity against an individual who has failed to pay for goods or services provided, violating the oral or implied contract established between the parties. 3. Business vs. Business: This type of complaint involves businesses taking legal action against other businesses for non-payment, breach of oral or implied contracts, and refusal to settle outstanding debts. Remember, this description provides a general overview of an Alabama Complaint for Refusal to Pay Debt — Breach of Oral or Implied Contracts. It is recommended to consult an attorney to understand the specific requirements and procedures associated with filing such a complaint in Alabama.