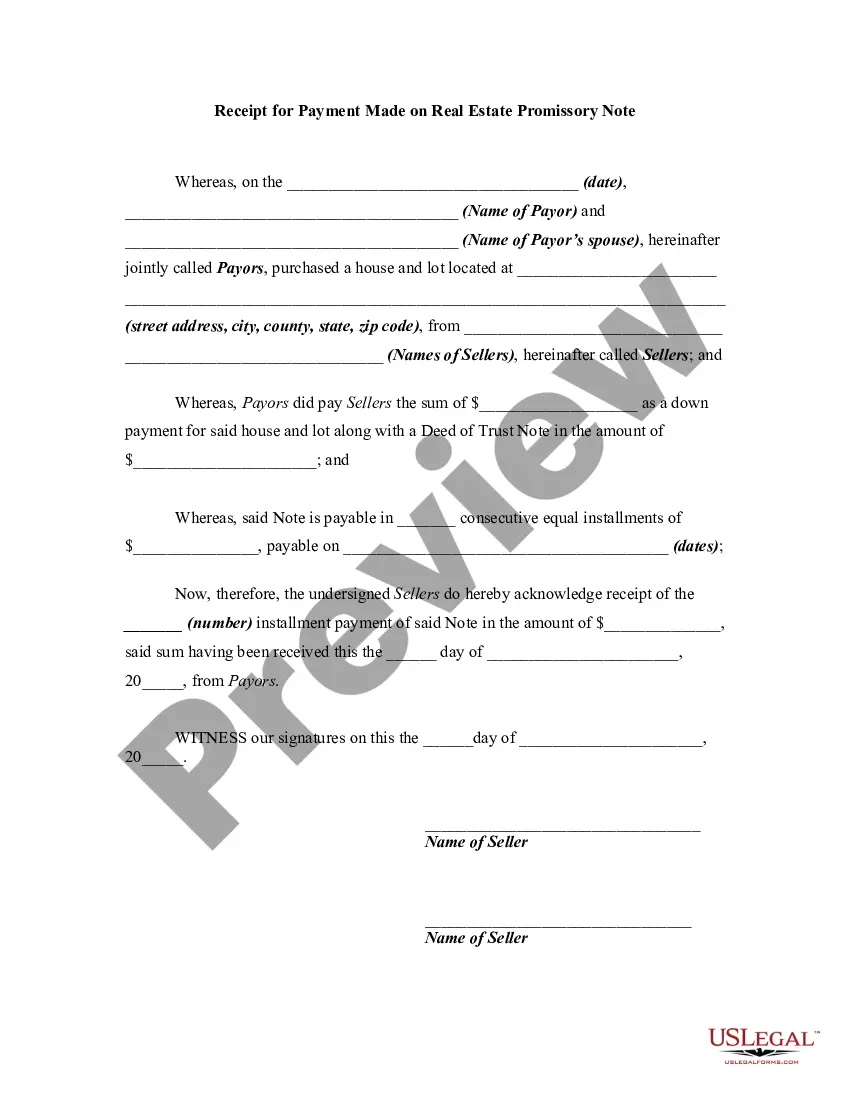

This form is a generic sample of a receipt for an installment payment for an owner financed real estate sale/purchase.

A receipt for payment made on a real estate promissory note in Alabama is a legally binding document that serves as evidence of a completed payment between a borrower and a lender in a real estate transaction. This receipt is crucial as it protects both parties by documenting the payment and ensuring transparency in the transaction. The Alabama Receipt for Payment Made on Real Estate Promissory Note typically includes the following key information: 1. Parties Involved: The names and contact details of the borrower (also known as the mortgagor) and the lender (also known as the mortgagee or note holder). 2. Property Information: The address and legal description of the real estate property being financed through the promissory note. 3. Payment Details: The specific details of the payment made, including the amount paid, payment method (e.g., cash, check, electronic transfer), and the payment date. 4. Note Information: The relevant details about the promissory note, such as the principal amount, interest rate, payment schedule, and maturity date. 5. Receipt Number: A unique identification number or code assigned to the receipt to facilitate record-keeping and referencing. 6. Signatures: The signature of both the borrower and lender, acknowledging the receipt of payment and confirming their agreement on the payment transaction. Different types of Alabama Receipt for Payment Made on Real Estate Promissory Note may include variations depending on specific requirements or the type of transaction. Some possible variations include: 1. Partial Payment Receipt: A receipt issued for a partial payment made by the borrower, documenting the specific amount paid and any remaining outstanding balance. 2. Final Payment Receipt: This receipt is issued when the borrower has fully repaid the promissory note, indicating that no further payments are required. 3. Lump Sum Payment Receipt: Occasionally, a borrower may opt to make a lump sum payment towards the promissory note. In such cases, a specific receipt may be issued to document the lump sum payment made. 4. Late Payment Receipt: If a borrower makes a payment after the due date or as a late installment, a specialized receipt may be issued to acknowledge the late payment and any applicable penalties or interest. 5. Specific Equated Monthly Installment (EMI) Receipts: In cases where the borrower repays the promissory note through a series of fixed monthly payments, separate receipts may be issued for each installment to document the individual payments made. It is important to consult legal professionals or real estate experts to ensure compliance with Alabama state regulations and proper execution of a Receipt for Payment Made on Real Estate Promissory Note.A receipt for payment made on a real estate promissory note in Alabama is a legally binding document that serves as evidence of a completed payment between a borrower and a lender in a real estate transaction. This receipt is crucial as it protects both parties by documenting the payment and ensuring transparency in the transaction. The Alabama Receipt for Payment Made on Real Estate Promissory Note typically includes the following key information: 1. Parties Involved: The names and contact details of the borrower (also known as the mortgagor) and the lender (also known as the mortgagee or note holder). 2. Property Information: The address and legal description of the real estate property being financed through the promissory note. 3. Payment Details: The specific details of the payment made, including the amount paid, payment method (e.g., cash, check, electronic transfer), and the payment date. 4. Note Information: The relevant details about the promissory note, such as the principal amount, interest rate, payment schedule, and maturity date. 5. Receipt Number: A unique identification number or code assigned to the receipt to facilitate record-keeping and referencing. 6. Signatures: The signature of both the borrower and lender, acknowledging the receipt of payment and confirming their agreement on the payment transaction. Different types of Alabama Receipt for Payment Made on Real Estate Promissory Note may include variations depending on specific requirements or the type of transaction. Some possible variations include: 1. Partial Payment Receipt: A receipt issued for a partial payment made by the borrower, documenting the specific amount paid and any remaining outstanding balance. 2. Final Payment Receipt: This receipt is issued when the borrower has fully repaid the promissory note, indicating that no further payments are required. 3. Lump Sum Payment Receipt: Occasionally, a borrower may opt to make a lump sum payment towards the promissory note. In such cases, a specific receipt may be issued to document the lump sum payment made. 4. Late Payment Receipt: If a borrower makes a payment after the due date or as a late installment, a specialized receipt may be issued to acknowledge the late payment and any applicable penalties or interest. 5. Specific Equated Monthly Installment (EMI) Receipts: In cases where the borrower repays the promissory note through a series of fixed monthly payments, separate receipts may be issued for each installment to document the individual payments made. It is important to consult legal professionals or real estate experts to ensure compliance with Alabama state regulations and proper execution of a Receipt for Payment Made on Real Estate Promissory Note.