Alabama Triple Net Lease for Industrial Property

Description

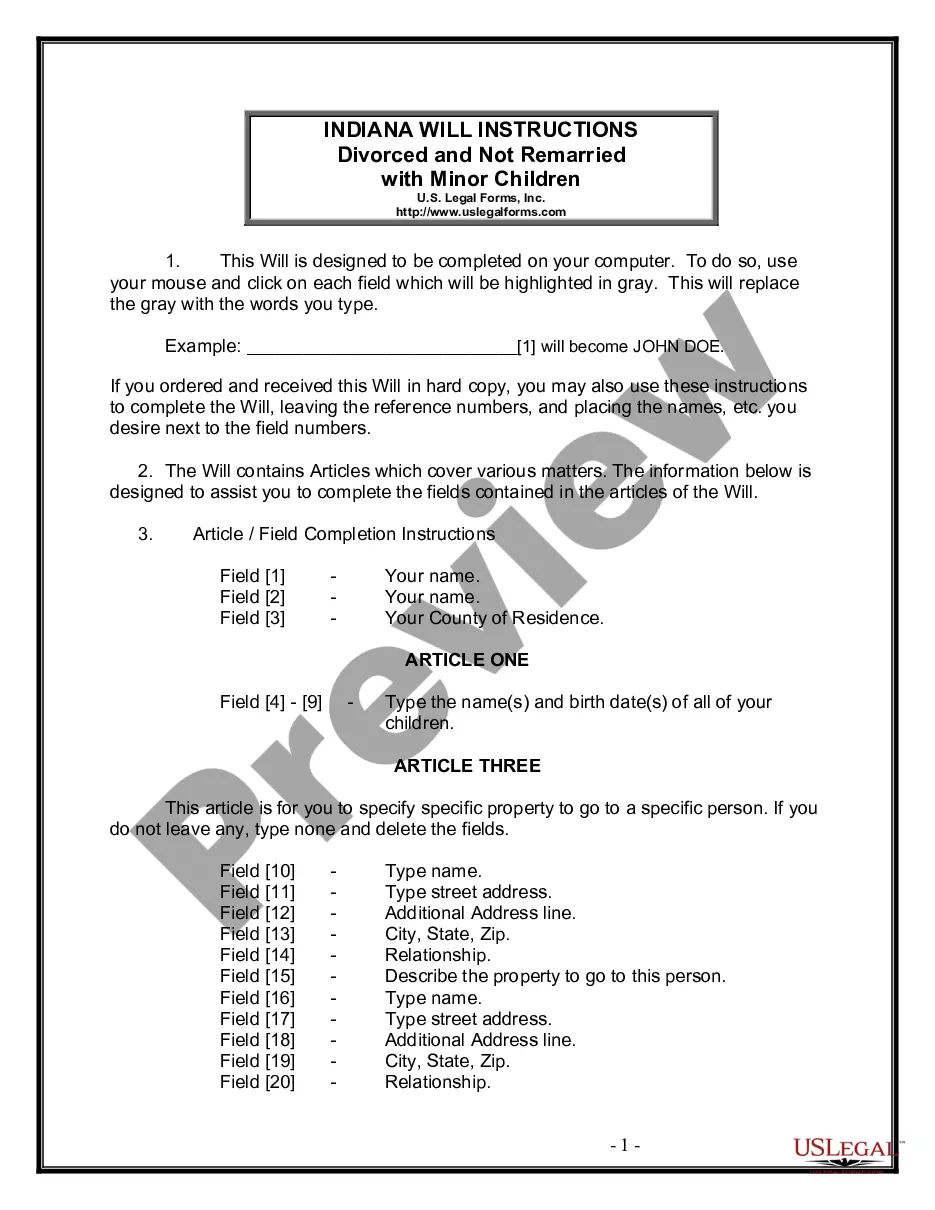

How to fill out Triple Net Lease For Industrial Property?

Have you ever found yourself in a scenario where you need documents for various business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but it can be challenging to find ones that you can trust.

US Legal Forms offers a multitude of form templates, including the Alabama Triple Net Lease for Commercial Property, which can be tailored to comply with state and federal requirements.

When you find the right form, click Purchase now.

Select the payment plan you desire, provide the necessary details for processing your payment, and complete the transaction using your PayPal, Visa, or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Triple Net Lease for Commercial Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/county.

- Use the Review option to assess the form.

- Read the description to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that fits your needs and requirements.

Form popularity

FAQ

Tenants often choose a triple net lease because it provides greater control over the property expenses, leading to potentially lower rent. Since the tenant assumes several property maintenance responsibilities, they can ensure the property meets their operational needs. This arrangement can also attract investors looking for a secure and predictable income stream, making the Alabama Triple Net Lease for Industrial Property an appealing choice for many businesses.

Entering into a triple net lease typically involves research and negotiation. You should start by identifying properties that offer Alabama Triple Net Lease for Industrial Property. Once you find a suitable property, work with a real estate agent experienced in commercial leases, review the lease terms, and get a clear understanding of your responsibilities before signing the agreement.

A triple net lease, often referred to as an NNN lease, places most property-related expenses on the tenant. This means that in addition to the base rent, the tenant pays property taxes, insurance, and maintenance costs. When dealing with an Alabama Triple Net Lease for Industrial Property, tenants can better predict their overall expenditures since they have clear financial responsibilities outlined in the lease agreement.

Industrial properties are most likely to have triple net leases due to their predictable operating costs and investment appeal. Investors often prefer this lease structure as it limits their responsibilities. The Alabama Triple Net Lease for Industrial Property specifically caters to this trend, attracting both tenants and landlords looking for robust investment opportunities.

NNN stands for 'triple net' in a commercial lease, indicating the tenant's responsibility for three primary expenses: property taxes, insurance, and maintenance. This type of lease provides clarity on financial obligations and allows for a simpler rental agreement. Understanding the implications of an Alabama Triple Net Lease for Industrial Property can enhance your lease negotiation and management strategy.

Yes, commercial leases often tend toward being triple net leases, particularly for industrial properties. This arrangement allows landlords to reduce their financial risk while giving tenants control over property expenses. By opting for the Alabama Triple Net Lease for Industrial Property, you align with a prevalent leasing trend that benefits both parties involved.

Many commercial leases are indeed triple net leases, especially in the industrial sector. This lease type offers landlords predictable income as tenants cover the majority of operating costs. This trend continues to grow in Alabama, making it an attractive option for property owners and investors alike. Familiarizing yourself with the Alabama Triple Net Lease for Industrial Property can empower you to choose the right lease structure.

To calculate commercial rent for a triple net lease, start with the base rent and then add the tenant's share of property expenses. For industrial properties, these expenses may include property taxes, insurance, and maintenance costs. This calculation ensures transparency for both landlords and tenants regarding financial responsibilities. Using the Alabama Triple Net Lease for Industrial Property can simplify this process further.

The most common type of commercial lease is the triple net lease. This lease structure, especially popular for industrial properties in Alabama, places most operational costs on the tenant. These costs typically include property taxes, insurance, and maintenance. Understanding the Alabama Triple Net Lease for Industrial Property can help you make informed decisions about your lease agreements.

To structure an Alabama Triple Net Lease for Industrial Property, start by drafting a clear legal agreement that specifies all terms. You should detail the base rent amount, the duration of the lease, and the specific expenses the tenant will cover, such as taxes and maintenance. Also, it is smart to include terms regarding rent escalation to adapt to potential economic changes. Consulting with legal professionals or platforms like US Legal Forms can help create a solid lease agreement tailored to your needs.