Alabama Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

You have the capability to invest time on the Internet searching for the legal document template that meets the state and federal requirements you seek.

US Legal Forms provides a vast array of legal forms that are reviewed by professionals.

You can easily download or print the Alabama Revocable Trust for Real Estate from my service.

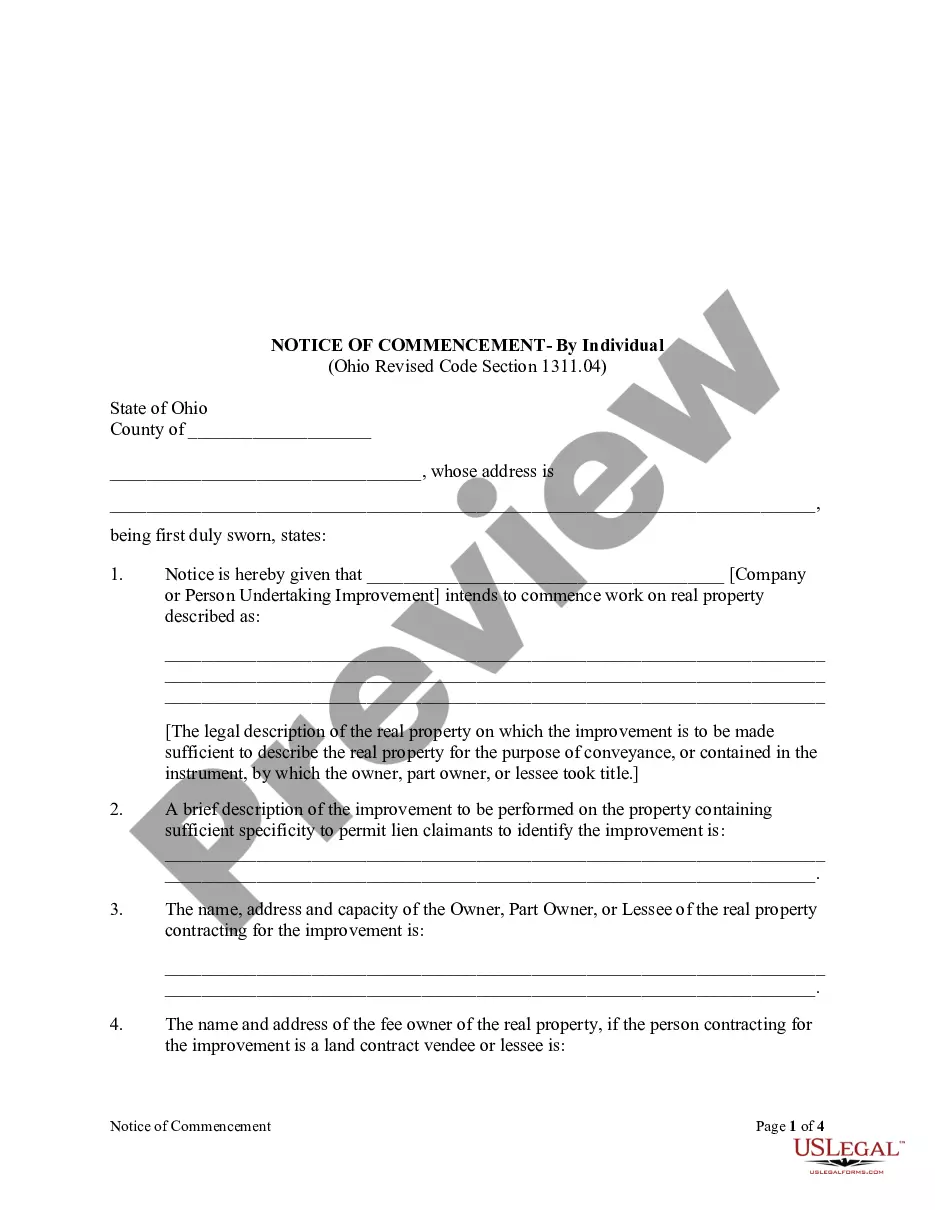

If available, utilize the Preview button to review the document template as well. If you wish to acquire another copy of the form, use the Lookup section to find the template that suits your needs and requirements.

- If you possess a US Legal Forms account already, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Alabama Revocable Trust for Real Estate.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the state/city of your preference.

- Check the form description to verify you have selected the right form.

Form popularity

FAQ

To register an Alabama Revocable Trust for Real Estate, begin by drafting a trust document that outlines the terms and conditions of your trust. You must then sign this document in front of a notary public. After that, you need to fund the trust by transferring ownership of your real estate and any other assets into the trust's name. Finally, consider filing the trust with your local probate court to formalize it and make it easier to manage in the future.

Putting your house in an Alabama Revocable Trust for Real Estate can be a wise decision for many individuals. This arrangement provides ease of transfer upon your passing and helps your loved ones avoid the lengthy probate process. However, it's essential to weigh the pros and cons based on your specific circumstances, as every situation is unique.

One primary disadvantage of an Alabama Revocable Trust for Real Estate is that it does not provide asset protection from creditors. Because you still have control over the assets in a revocable trust, they can potentially be reached by creditors in the event of financial issues. Therefore, it is crucial to assess your financial situation and estate planning goals before deciding on this type of trust.

To place your house in an Alabama Revocable Trust for Real Estate, begin by creating the trust document. You will need to transfer the property title into the trust by preparing a new deed and filing it with the local county office. Adding legal support, like uslegalforms, can simplify this process and ensure all necessary documentation is accurate and complete.

While there are benefits to an Alabama Revocable Trust for Real Estate, there are some disadvantages to consider. First, transferring your house into the trust may involve legal fees and paperwork, which could be time-consuming. Additionally, if you need to secure a mortgage or home equity line of credit, it may complicate the process, as lenders often prefer individual ownership.

Yes, an Alabama Revocable Trust for Real Estate can help avoid probate. Since the assets held within this trust are not considered part of your probate estate, they can pass directly to your beneficiaries upon your death. This streamlines the process, saves time, and reduces the overall stress for your family during an already difficult time.

Certain assets are typically not suited for an Alabama Revocable Trust for Real Estate. For instance, retirement accounts like 401(k)s and IRAs often have designated beneficiaries, making them unnecessary to include in the trust. Additionally, assets that require special management, such as certain business interests, may be better handled outside of a trust.

Suze Orman emphasizes the importance of a revocable trust in estate planning. She highlights that an Alabama Revocable Trust for Real Estate allows you to maintain control over your assets while ensuring they pass smoothly to your beneficiaries without unnecessary delays. By establishing this type of trust, you can achieve greater flexibility and protect your estate from the complexities of probate.

One common mistake parents make when establishing a trust fund is failing to update the trust as family situations change. This oversight can lead to misunderstandings or disputes over asset distribution. It's essential to review and revise your Alabama Revocable Trust for Real Estate regularly to reflect any changes in your family's needs or financial goals. Using platforms like uslegalforms can help simplify this process and ensure you stay on track.

For many homeowners, an Alabama Revocable Trust for Real Estate is one of the best options. This type of trust allows for flexibility, as you can modify or revoke it at any time during your lifetime. Additionally, it can help your heirs avoid probate, making the inheritance process smoother and more efficient.