Alabama Revocable Trust for Grandchildren

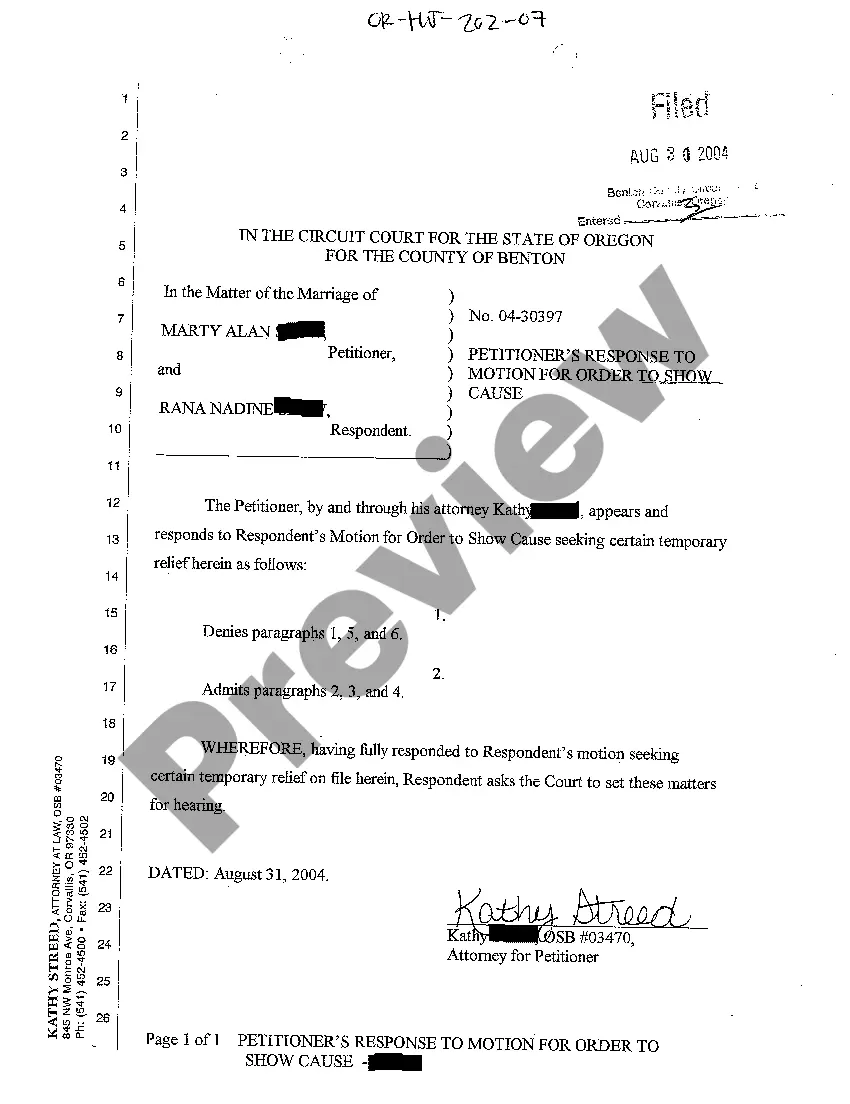

Description

How to fill out Revocable Trust For Grandchildren?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal document templates that you can download or print. By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of forms such as the Alabama Revocable Trust for Grandchildren in just seconds.

If you possess a membership, Log In and download the Alabama Revocable Trust for Grandchildren from the US Legal Forms catalog. The Download button will appear for each form you view. You can access all previously saved forms within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Alabama Revocable Trust for Grandchildren. Each template you save in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Alabama Revocable Trust for Grandchildren with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to check the form's details.

- Review the form description to ensure you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you’re satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

To leave an inheritance to your grandchildren, consider setting up an Alabama Revocable Trust for Grandchildren. This trust allows you to specify how and when your grandchildren receive their inheritance, offering you peace of mind. You can outline conditions that ensure they benefit at the appropriate stages of life, such as education or purchasing a home. Using a platform like US Legal Forms simplifies the process, helping you create the trust according to your wishes.

An Alabama Revocable Trust for Grandchildren is often considered a suitable option for leaving assets to your grandchildren. This type of trust allows you to maintain control over your assets while providing for your grandchildren's financial future. Unlike irrevocable trusts, you can modify or dissolve a revocable trust during your lifetime, giving you flexibility. By naming your grandchildren as beneficiaries, you ensure they receive support when they need it.

There is no strict minimum amount required to set up an Alabama Revocable Trust for Grandchildren; however, it is wise to consider the value of the assets you intend to include. A trust should be worth enough to justify its creation and maintenance costs. Consulting with professionals or using platforms like uslegalforms can help you navigate this aspect effectively, ensuring your trust serves its purpose well.

In Alabama, an Alabama Revocable Trust for Grandchildren does not necessarily have to be notarized but having it notarized can add an additional layer of authenticity. While notarization is not a legal requirement, it is advisable to ensure that the trust document is valid and recognized in case of disputes. Utilizing legal documents from uslegalforms can guide you in creating a well-structured trust that meets all requirements.

To set up an Alabama Revocable Trust for Grandchildren, start by determining the assets you want to place in the trust. Next, choose a trustworthy trustee who will manage the trust according to your wishes. You will need to draft a trust document, outlining the terms and beneficiaries, which you can create using resources from services like uslegalforms. Finally, transfer your assets into the trust to finalize the setup.

The Alabama Revocable Trust for Grandchildren is an excellent choice for grandparents looking to secure their assets for future generations. This type of trust enables you to manage your wealth during your lifetime and distribute it according to your wishes after your passing. You retain flexibility, allowing changes along the way if your circumstances or goals evolve. By establishing this trust, you not only safeguard your grandchildren's financial future but also ensure that your legacy aligns with your family's values.

Interestingly, though focused on the UK, a common mistake mirrors issues seen in Alabama—parents often neglect to clearly define the terms of the trust. This lack of clarity can lead to misunderstandings and conflicts among beneficiaries. It's crucial to communicate the trust's objectives and structure, ensuring that all parties understand their roles.

To set up an Alabama Revocable Trust for Grandchildren, start by drafting a trust document that outlines how the trust will operate. It is advisable to seek legal assistance to ensure compliance with Alabama state laws. After that, you'll need to fund the trust by transferring assets into it, ensuring the trust serves its intended purpose.

Setting up an Alabama Revocable Trust for Grandchildren comes with potential pitfalls. One common issue is the misunderstanding of revocation options, which can lead to confusion about altering assets in the future. Additionally, families often overlook the potential tax implications, which can affect the trust’s overall effectiveness.

In Alabama, an Alabama Revocable Trust for Grandchildren must comply with state laws regarding trust creation and management. A trust must have a clear purpose, a designated trustee, and identifiable beneficiaries. Additionally, the trust document should follow specific formalities, such as being in writing and signed, to be valid.