The Alabama Security Agreement involving Sale of Collateral by Debtor is a legal document that establishes a debtor's pledge of collateral to a creditor as a form of security for a loan or debt. This agreement is crucial in outlining the rights and responsibilities of both parties involved. In Alabama, there are primarily two types of security agreements involving the sale of collateral by the debtor: the Uniform Commercial Code (UCC) Article 9 Security Agreement and the Conditional Sales Agreement. 1. UCC Article 9 Security Agreement: This type of agreement is governed by the Alabama Uniform Commercial Code, specifically Article 9, which deals with secured transactions. It allows debtors to offer specific assets as collateral to secure a loan or debt. The UCC Article 9 Security Agreement encompasses various types of collateral, including personal property, inventory, equipment, accounts receivable, and more. The Alabama UCC Article 9 Security Agreement typically includes the following key elements: — Identification of the debtor and creditor: This includes their legal names, addresses, and contact information. — Collateral description: The agreement specifies the collateral being pledged by the debtor, describing it in detail to provide clarity and avoid confusion. — Grant of security interest: This section outlines the debtor's pledge of the collateral to the creditor as security for the debt or loan. It also includes any specific conditions or limitations related to the security interest. — Obligations and liabilities: It clarifies the debtor's responsibilities and obligations to maintain or preserve the collateral, including insurance requirements and payment of taxes. — Default clause: The agreement stipulates the events that would constitute a default, such as non-payment of the debt or failure to comply with the terms of the security agreement. It also describes the rights and remedies available to the creditor in case of default. — Enforcement and sale of collateral: This section outlines the steps and procedures that the creditor can take to enforce its rights to the collateral, including the right to sell the collateral to recover the outstanding debt or loan amount. It usually includes provisions related to proper notice, public or private sale, and the creditor's ability to purchase the collateral at the sale. 2. Conditional Sales Agreement: This type of agreement is prevalent in various purchase transactions where the debtor finances the purchase of specific goods from a creditor. The Conditional Sales Agreement outlines the terms and conditions of the sale, including the payment schedule, interest rates, and the condition that the creditor retains ownership of the goods until the debtor has fully paid off the purchase price. In case of default, the creditor may repossess the goods. It's important to note that the content above has been generated for informational purposes only and should not be considered legal advice. It is advisable to consult with a qualified attorney who specializes in Alabama law to obtain accurate and up-to-date information specific to your situation.

Alabama Security Agreement involving Sale of Collateral by Debtor

Description

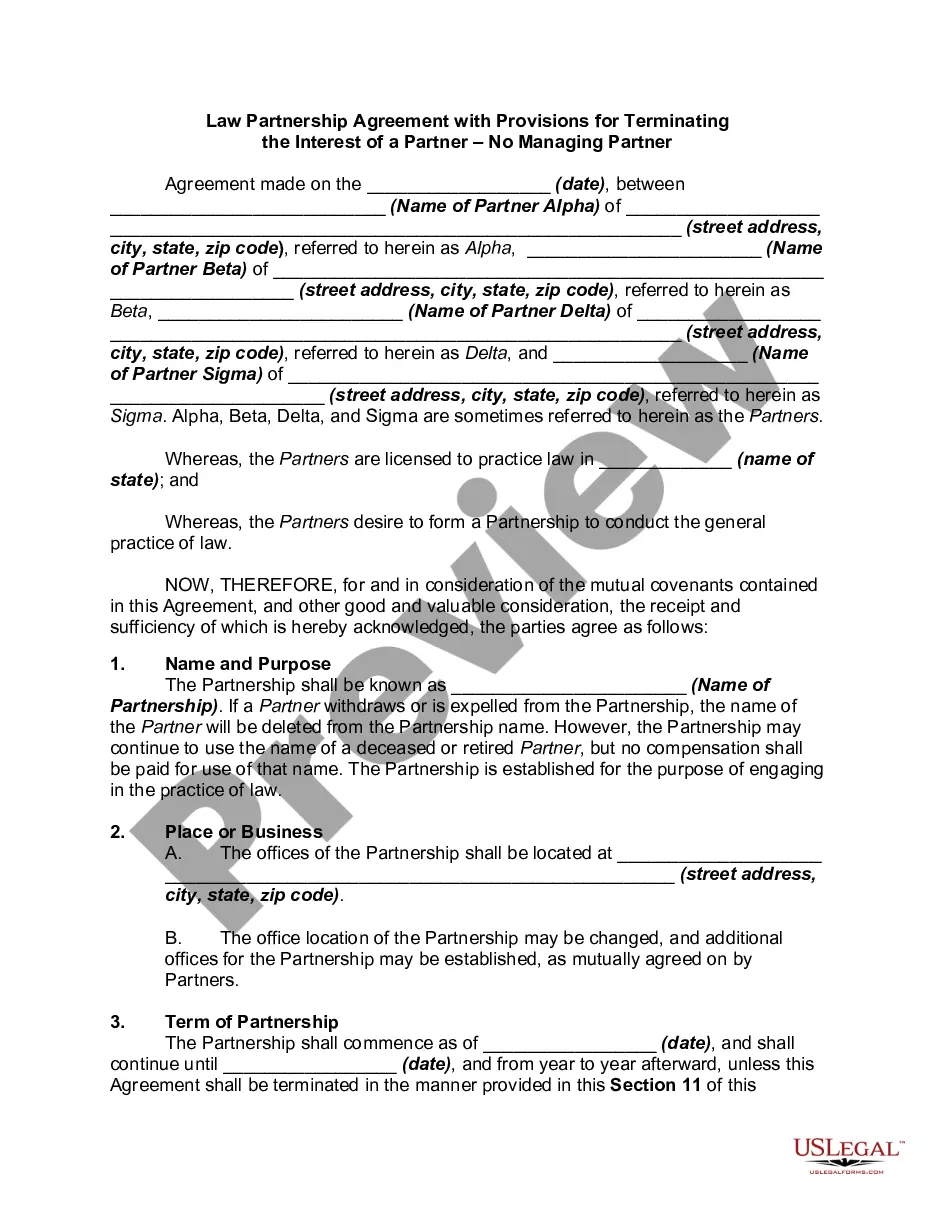

How to fill out Alabama Security Agreement Involving Sale Of Collateral By Debtor?

US Legal Forms - one of the most significant libraries of lawful varieties in the United States - delivers a variety of lawful file templates you are able to down load or print out. Using the web site, you can get thousands of varieties for enterprise and person purposes, categorized by classes, says, or keywords.You can find the newest versions of varieties like the Alabama Security Agreement involving Sale of Collateral by Debtor within minutes.

If you currently have a membership, log in and down load Alabama Security Agreement involving Sale of Collateral by Debtor through the US Legal Forms collection. The Acquire key will appear on each type you perspective. You have access to all earlier delivered electronically varieties in the My Forms tab of your profile.

If you wish to use US Legal Forms initially, listed below are straightforward guidelines to get you started out:

- Be sure to have chosen the right type for your personal town/county. Go through the Review key to analyze the form`s content material. See the type outline to ensure that you have chosen the proper type.

- In case the type does not fit your demands, utilize the Research field on top of the monitor to get the the one that does.

- If you are pleased with the shape, validate your selection by clicking on the Purchase now key. Then, select the rates program you want and offer your accreditations to register for an profile.

- Approach the deal. Use your bank card or PayPal profile to complete the deal.

- Pick the formatting and down load the shape on the gadget.

- Make alterations. Load, edit and print out and signal the delivered electronically Alabama Security Agreement involving Sale of Collateral by Debtor.

Each and every design you put into your bank account does not have an expiry date which is yours eternally. So, if you wish to down load or print out an additional duplicate, just visit the My Forms segment and then click about the type you need.

Gain access to the Alabama Security Agreement involving Sale of Collateral by Debtor with US Legal Forms, one of the most comprehensive collection of lawful file templates. Use thousands of professional and status-particular templates that satisfy your company or person needs and demands.