Alabama Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you find the legal form you require.

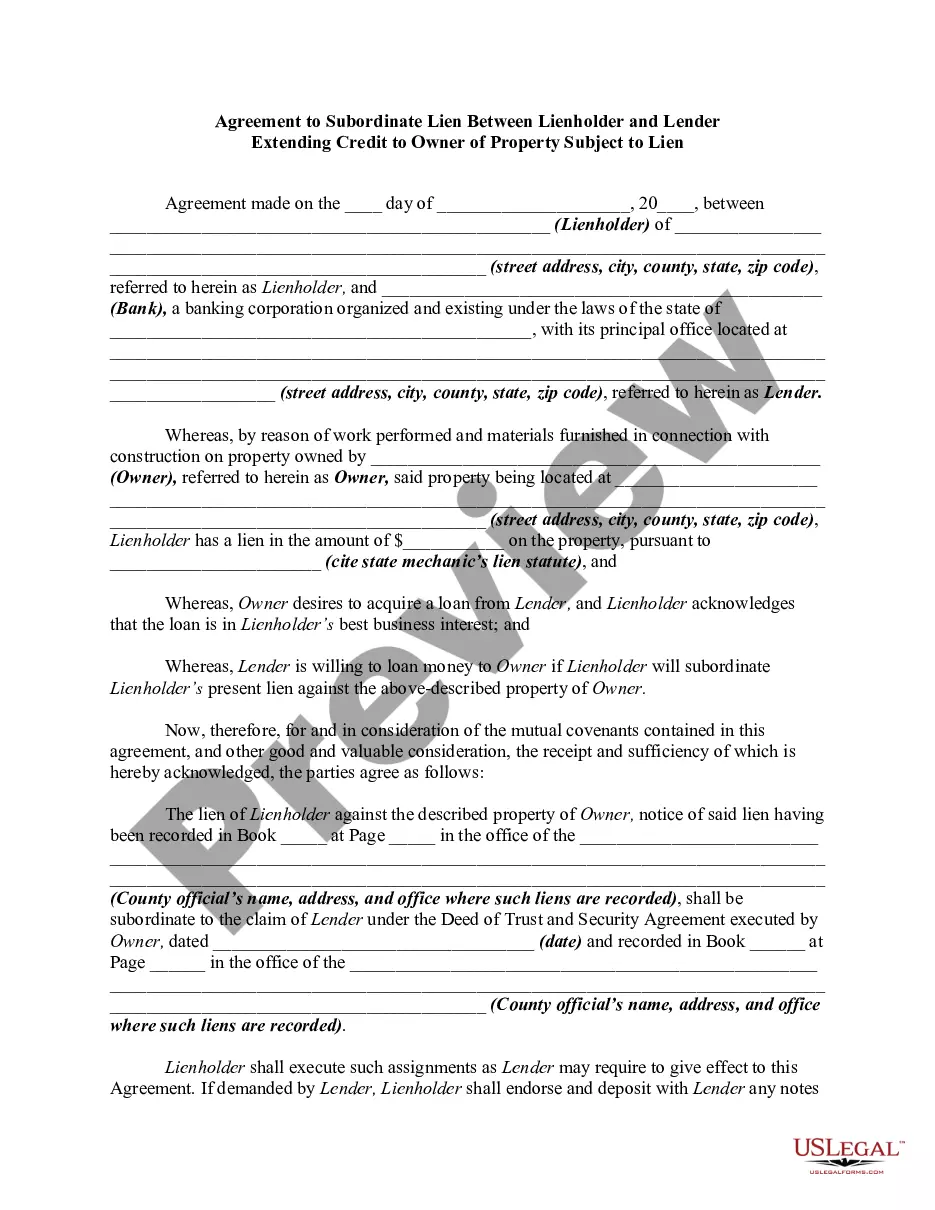

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the Alabama Retirement Cash Flow, suitable for both business and personal purposes.

You can review the form using the Preview option and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search area to find the appropriate form. Once you are certain the form is correct, select the Purchase now option to obtain the form. Choose the payment plan you desire and enter the required information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Alabama Retirement Cash Flow. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- All forms are reviewed by experts and meet federal and state standards.

- If you are already registered, Log In to your account and click on the Acquire button to access the Alabama Retirement Cash Flow.

- Utilize your account to search for the legal forms you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have chosen the correct form for your city/state.

Form popularity

FAQ

Your retirement benefit is calculated using a formula with three factors: Service credit (Years) multiplied by your benefit factor (percentage per year) multiplied by your final monthly compensation equals your unmodified allowance. Service Credit - Total years of employment with a CalPERS employer.

There is no provision for a loan from your RSA-1 account. You may not withdraw from your account unless you are no longer employed with a state agency or school, are age 70½ or older, have an unforeseeable emergency, or qualify for a small balance withdrawal.

Tier 1 members are eligible for retirement benefits at age 60 with at least 10 years of service. If you have 25 years of service, you can retire at any age and apply for full retirement benefits from RSA. Tier 2 members are eligible for retirement benefits at age 62 with at least 10 years of service.

Retirement BenefitsOfficers who have served for 10 years and are at least 57 years of age (55-56 years of age under certain conditions) are eligible to retire with a reduced annuity. Retirement at 65 years of age is mandatory.

Alabama is the sixth-best state for retirement in the United States. Alabama has mild winters, beaches, and golf topped off by a cost of living that is 13% below the national average.

Tier 1 members are eligible for retirement benefits at age 60 with at least 10 years of service. If you have 25 years of service, you can retire at any age and apply for full retirement benefits from RSA. Tier 2 members are eligible for retirement benefits at age 62 with at least 10 years of service.

You have the following withdrawal options:Partial lump sum or full lump sum.Periodic payment - monthly or annually.Outgoing rollover to an eligible plan.

GoBankingRates estimates you would need $599,453 to retire in Alabama. Mississippi required the least amount of savings to retire - $557,821. Hawaii comes in on the extreme other side of the spectrum. There you will need $1.8 million in savings to retire comfortably.

No. The only way to get money out of an ERS account is to terminate employment and withdraw the entire account.