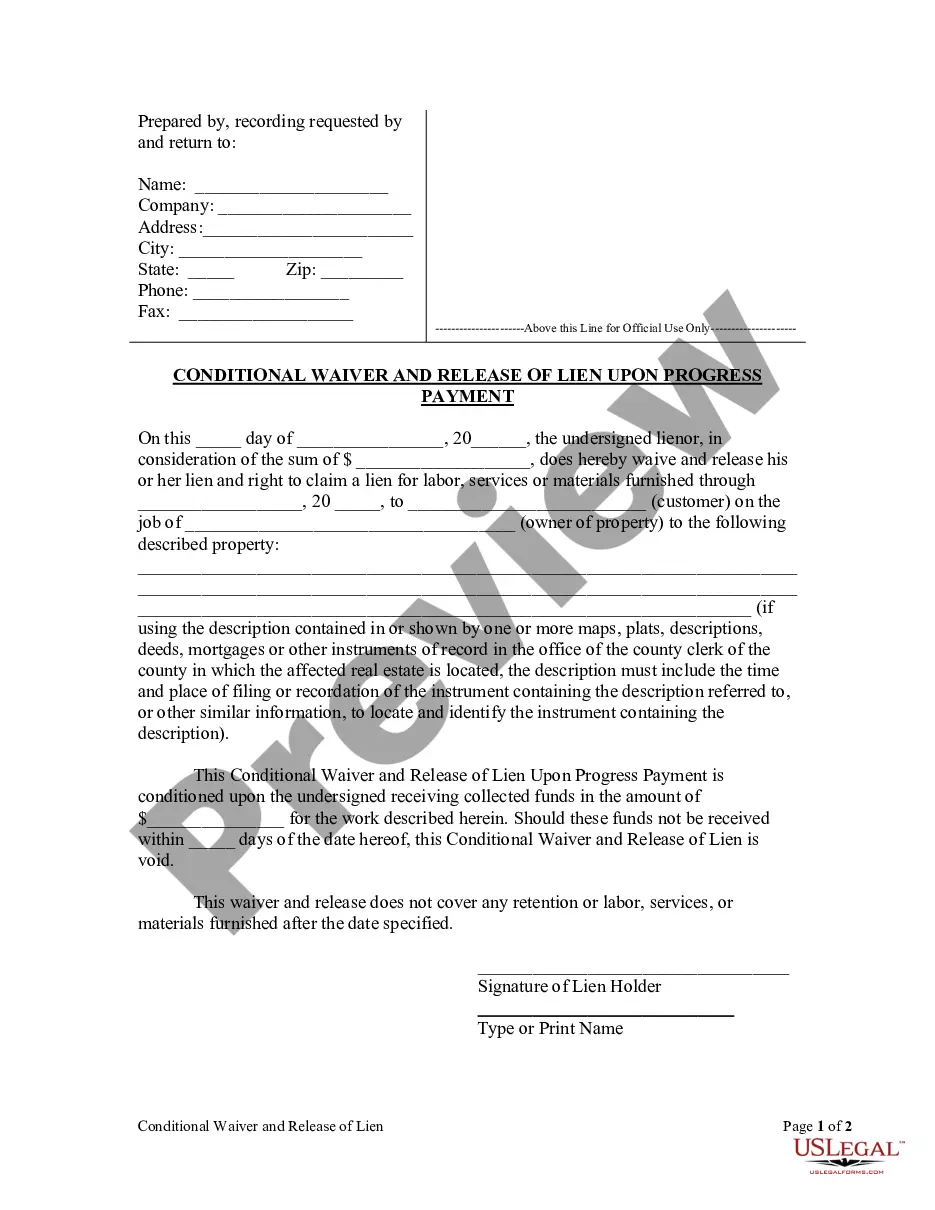

Alabama Escrow Instructions in Short Form serves as a concise document outlining the crucial details and procedures involved in an escrow arrangement in the state of Alabama. The instructions are primarily aimed at ensuring a smooth and secure transfer of funds and documents between the parties involved in a real estate transaction. These instructions typically include key information such as the names and contact details of the buyer, seller, and escrow agent, a description of the property, and the purchase price. In addition, they outline the specific terms and conditions regarding the release of funds, contingencies, and the timeframe for the completion of the transaction. There are various types of Alabama Escrow Instructions in Short Form, each tailored to specific situations or preferences. Some common types include: 1. Alabama Residential Real Estate Escrow Instructions: This form is used when the escrow arrangement involves the purchase or sale of a residential property. 2. Alabama Commercial Real Estate Escrow Instructions: Designed for escrow transactions involving commercial real estate properties, this form includes additional considerations unique to commercial transactions. 3. Alabama Construction Escrow Instructions: When the escrow arrangement is related to a construction project, this form outlines specific provisions regarding progress payments, change orders, and other construction-related matters. 4. Alabama Refinance Escrow Instructions: This type of form focuses on escrow arrangements associated with refinancing an existing mortgage loan. It includes provisions for paying off the original loan, releasing any excess funds, and updating the title and mortgage documents. By following the Alabama Escrow Instructions in Short Form, all parties involved in the transaction can ensure compliance with legal requirements, protect their interests, and facilitate a successful and efficient closing process.

Alabama Escrow Instructions in Short Form serves as a concise document outlining the crucial details and procedures involved in an escrow arrangement in the state of Alabama. The instructions are primarily aimed at ensuring a smooth and secure transfer of funds and documents between the parties involved in a real estate transaction. These instructions typically include key information such as the names and contact details of the buyer, seller, and escrow agent, a description of the property, and the purchase price. In addition, they outline the specific terms and conditions regarding the release of funds, contingencies, and the timeframe for the completion of the transaction. There are various types of Alabama Escrow Instructions in Short Form, each tailored to specific situations or preferences. Some common types include: 1. Alabama Residential Real Estate Escrow Instructions: This form is used when the escrow arrangement involves the purchase or sale of a residential property. 2. Alabama Commercial Real Estate Escrow Instructions: Designed for escrow transactions involving commercial real estate properties, this form includes additional considerations unique to commercial transactions. 3. Alabama Construction Escrow Instructions: When the escrow arrangement is related to a construction project, this form outlines specific provisions regarding progress payments, change orders, and other construction-related matters. 4. Alabama Refinance Escrow Instructions: This type of form focuses on escrow arrangements associated with refinancing an existing mortgage loan. It includes provisions for paying off the original loan, releasing any excess funds, and updating the title and mortgage documents. By following the Alabama Escrow Instructions in Short Form, all parties involved in the transaction can ensure compliance with legal requirements, protect their interests, and facilitate a successful and efficient closing process.