The Alabama Sale of Deceased Partner's Interest refers to the legal process through which the ownership interest of a deceased partner in a business or partnership is transferred to another party. This procedure ensures the smooth continuation of the business and the transition of the deceased partner's rights and responsibilities to the appropriate individual. In Alabama, there are two primary types of sales of a deceased partner's interest: voluntary sales and involuntary sales. Let's delve into each type and explore their distinctive characteristics: 1. Voluntary Sale of Deceased Partner's Interest in Alabama: A voluntary sale occurs when the remaining partner(s) or the partnership itself agrees to purchase the deceased partner's interest. This type of sale is typically governed by the terms outlined in a partnership agreement, operating agreement, or buy-sell agreement. In many cases, the surviving partner(s) are given the first right of refusal to purchase the interest, allowing them to maintain control and continuity of the business. However, if they decline the opportunity or cannot reach a mutually agreeable price, the interest can be sold to a third party or auctioned off to interested buyers. 2. Involuntary Sale of Deceased Partner's Interest in Alabama: An involuntary sale takes place when the deceased partner's interest needs to be sold, but the remaining partner(s) do not voluntarily agree to purchase it. Several scenarios can trigger an involuntary sale, such as when the deceased partner's estate needs liquidity or when certain events outlined in the partnership agreement lead to the automatic sale of their interest. In such cases, the sale may be supervised by the court to ensure fairness and compliance with applicable laws. This process typically involves the appointment of a personal representative or administrator to oversee the sale and distribute the proceeds as per the deceased partner's will or state intestacy laws. Regardless of the type of sale, it is crucial to follow the appropriate legal procedures laid out by Alabama state statutes and the partnership agreement. These procedures often require proper valuation of the deceased partner's interest, notifying relevant parties, obtaining necessary approvals, and transferring ownership through the execution of legal documents. Navigating the Alabama Sale of Deceased Partner's Interest can be complex, as it involves legal, financial, and organizational considerations. Therefore, seeking guidance from experienced attorneys or business professionals well-versed in partnership law is highly recommended ensuring a smooth and legally compliant transaction.

Alabama Sale of Deceased Partner's Interest

Description

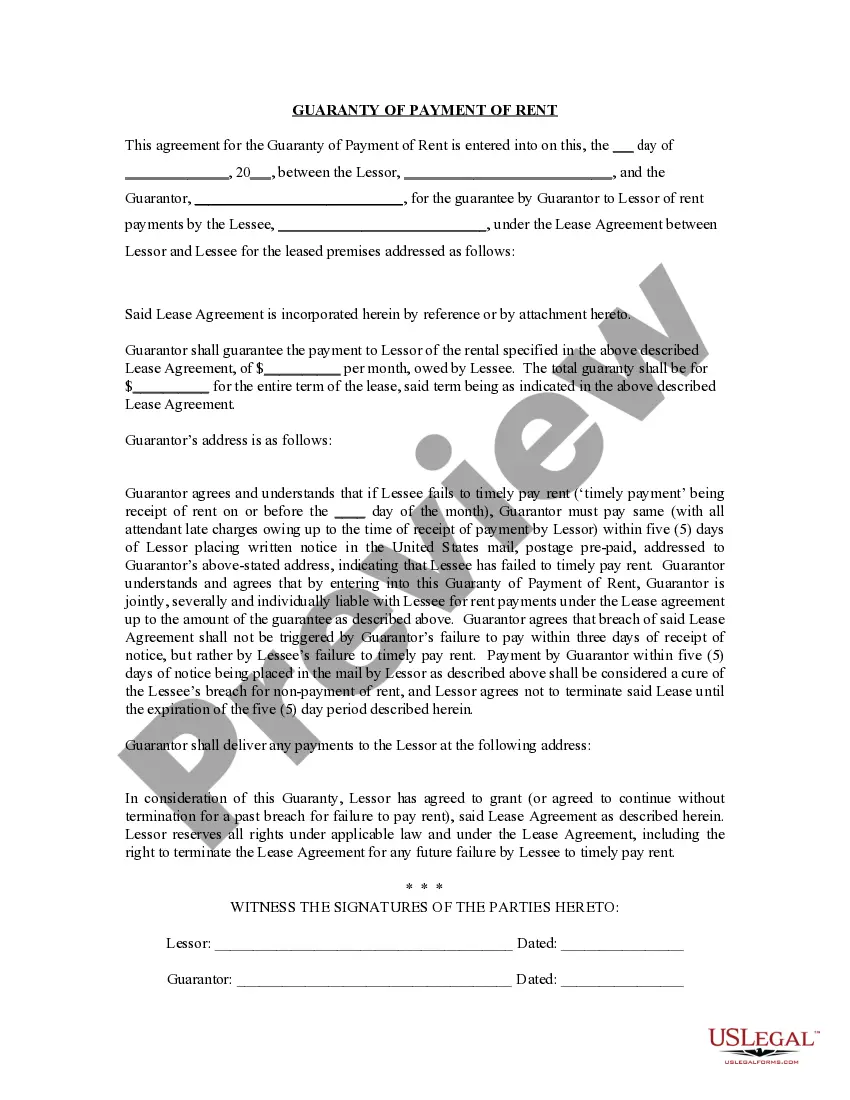

How to fill out Alabama Sale Of Deceased Partner's Interest?

It is feasible to invest hours online attempting to locate the legal documents template that meets the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that have been evaluated by experts.

You can conveniently download or print the Alabama Sale of Deceased Partner's Interest from the service.

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, edit, print, or sign the Alabama Sale of Deceased Partner's Interest.

- Each legal document template you obtain is yours for eternity.

- To obtain another version of a previously acquired form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Examine the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

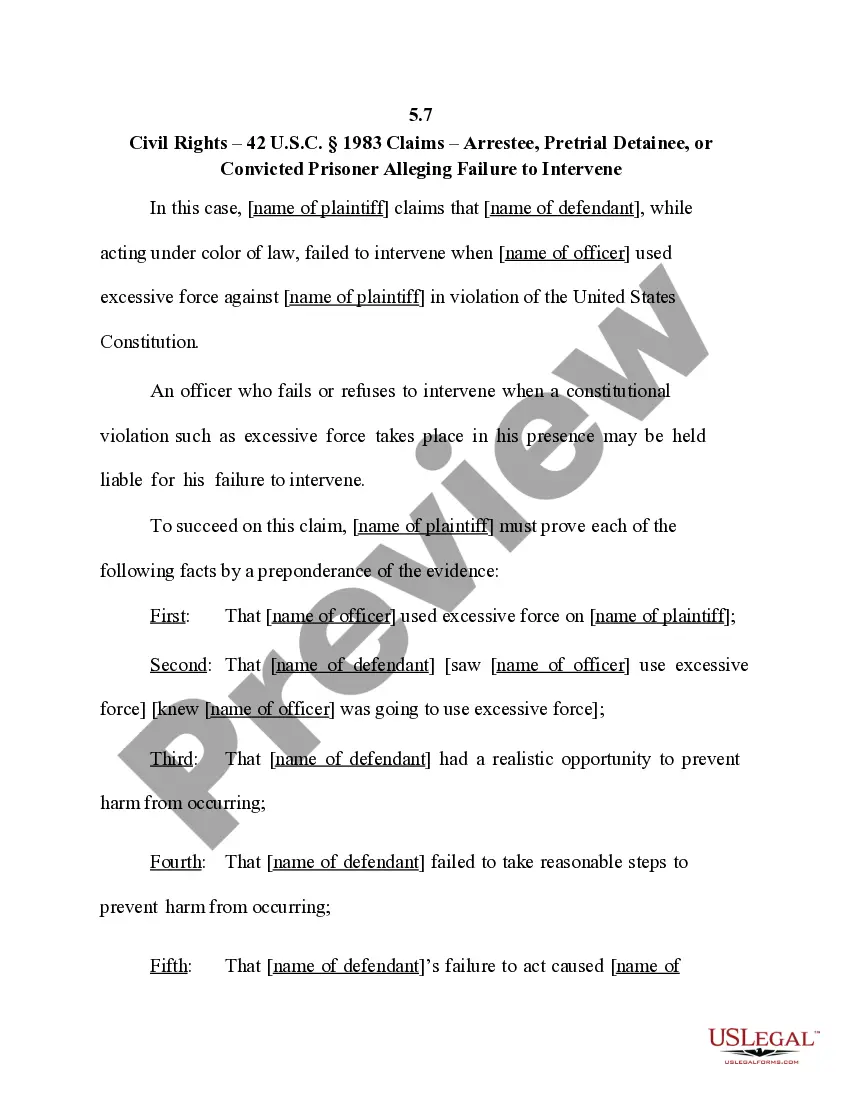

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

After the Death of a Business PartnerThe deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.

The tax rate for the Alabama Business Privilege Tax is based on how much revenue your business brings to the state of Alabama. So, your rate will rise and fall depending on how much money your business earns each year. Alabama tax rates range from $0.25 to $1.75 for each $1000 of your entity's Alabama net worth.

A partner may acquire an interest in a partnership in a variety of ways. For example, the partner may purchase his interest from an existing partner. Like any other asset, a partnership interest may be acquired through a gift or an inheritance.

The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form). In general, any full-year resident can choose to file Long Form 40 instead of Short Form 40A.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

person partnership does not terminate upon a partner's death if the deceased partner's successor in interest (usually the estate) continues to share in the partnership's profits or losses (Regs. Sec. 1. 7081(b)(1)(I)).

Interesting Questions

More info

If you are new to Wolters Kluwer, click on the link to learn more. We have many links here, especially to what we believe are the highest level of interconnections available today.