This form involves the sale of a small business where the real estate on which the Business is located is leased from a third party. This form assumes that the Seller has received the right to assign the lease from the lessor/owner.

Alabama Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

If you want to total, obtain, or print out lawful file web templates, use US Legal Forms, the most important assortment of lawful varieties, which can be found on-line. Take advantage of the site`s simple and convenient research to discover the paperwork you require. A variety of web templates for business and individual functions are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Alabama Agreement for Sale of Business by Sole Proprietorship with Leased Premises with a handful of click throughs.

In case you are previously a US Legal Forms client, log in to your bank account and click on the Download key to have the Alabama Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Also you can gain access to varieties you earlier acquired within the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/nation.

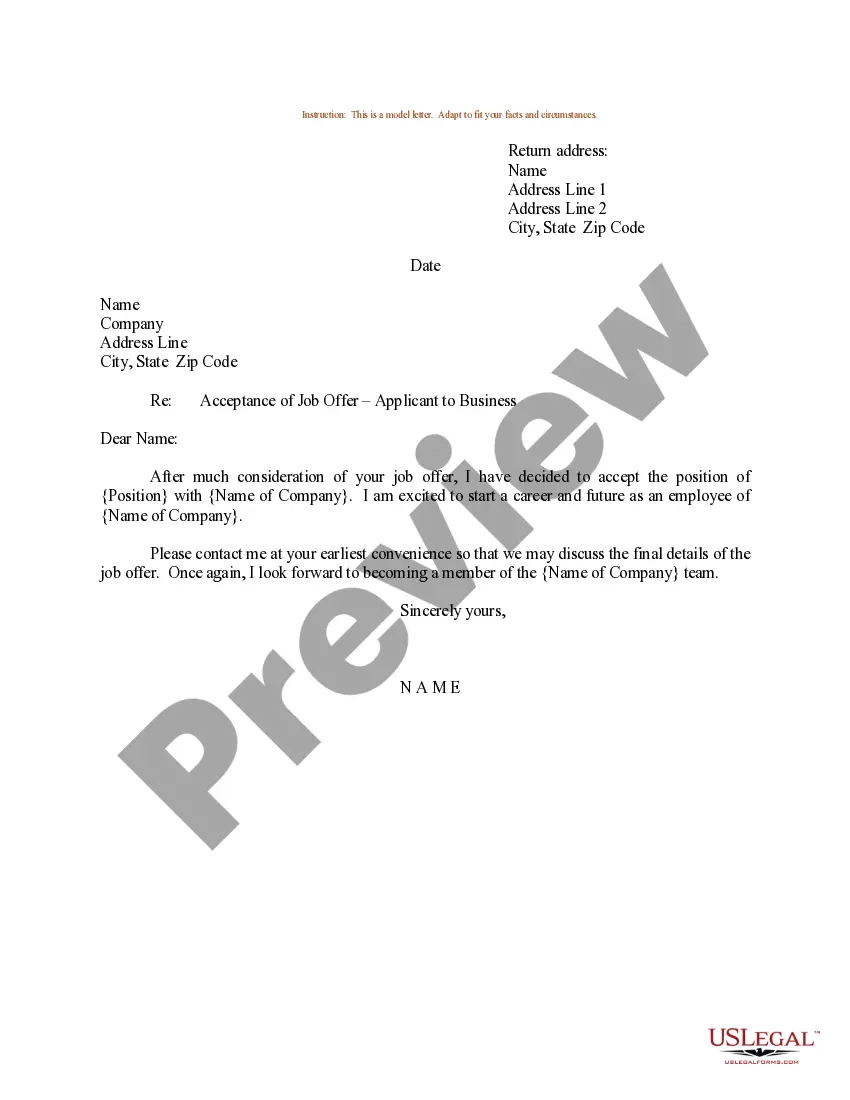

- Step 2. Use the Review method to check out the form`s content. Don`t neglect to read the outline.

- Step 3. In case you are not happy with all the kind, make use of the Look for field near the top of the display to locate other versions in the lawful kind web template.

- Step 4. After you have located the shape you require, go through the Acquire now key. Opt for the prices plan you prefer and put your qualifications to register for an bank account.

- Step 5. Approach the purchase. You may use your charge card or PayPal bank account to finish the purchase.

- Step 6. Select the format in the lawful kind and obtain it on the product.

- Step 7. Full, change and print out or indication the Alabama Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

Every single lawful file web template you purchase is your own permanently. You may have acces to each and every kind you acquired within your acccount. Select the My Forms area and choose a kind to print out or obtain yet again.

Compete and obtain, and print out the Alabama Agreement for Sale of Business by Sole Proprietorship with Leased Premises with US Legal Forms. There are many skilled and status-specific varieties you can utilize for your personal business or individual requires.

Form popularity

FAQ

As there is no separate entity under the law for a sole proprietorship business, contracts are normally signed by owner under his or her personal name. Even if the business uses a fictitious name, the owner will usually have his or her name written down in the checks issued by the clients.

A sole proprietor is someone who owns an unincorporated business by himself or herself.

Sole proprietors don't need operating agreements, but partnerships may choose to create one. Although they are not legally mandatory, Entrepreneur.com recommends partners create an agreement, because it will define the legal and personal operating rules. Without it many rules default to state mandates.

A sole proprietorship cannot be sold as a single entity like a corporation. Instead, when a sole proprietor sells the business, the sale is treated as the sale of the separate and identifiable assets of the business.

Sole proprietors and partners pay themselves simply by withdrawing cash from the business. Those personal withdrawals are counted as profit and are taxed at the end of the year.

Depending on your business activities, you might need to apply for business or professional licenses. At a minimum, Alabama does require you to obtain a business privilege license from the county where you do business. This license is usually issued by the county probate court.

Asset Sale ? Capital Gains Tax Capital gains tax is the proceeds of your asset sale minus the original cost. You'll pay tax on the capital gain or loss on the assets sold. Here's a quick equation: Sale price ? purchase price = net proceeds.

Overview. A sole proprietorship cannot be sold as a single entity like a corporation. Instead, when a sole proprietor sells the business, the sale is treated as the sale of the separate and identifiable assets of the business. The sale of a disregarded entity is also treated as the sale of the entity's assets.