Alabama Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

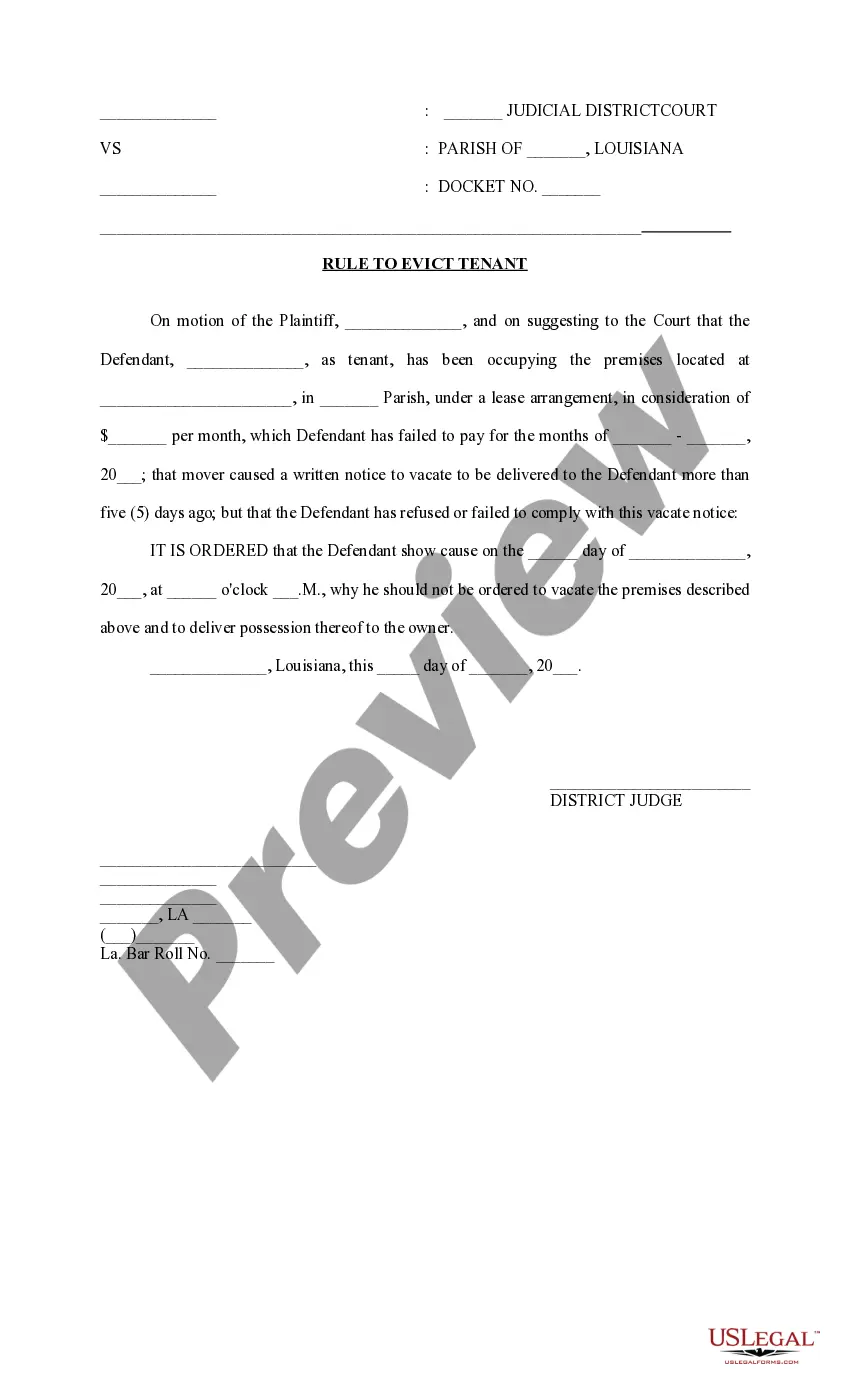

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

US Legal Forms - one of the largest collections of valid forms in the United States - provides a variety of authentic document templates you can download or create.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent iterations of documents like the Alabama Business Management Consulting or Consultant Services Agreement - Self-Employed in just a few minutes.

Read the form description to confirm you have chosen the correct one.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and retrieve the Alabama Business Management Consulting or Consultant Services Agreement - Self-Employed from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously acquired forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you've selected the correct form for your region/county.

- Click on the Preview button to review the form's details.

Form popularity

FAQ

An independent contractor can serve as an agent of a company if both parties agree on the terms. This relationship should be clearly articulated in a contract to avoid any potential legal issues. A well-structured Consultant Services Agreement - Self-Employed under Alabama Business Management Consulting can help define this relationship effectively.

Yes, you can be a manager as an independent contractor. This role should be clearly defined in your agreement to prevent misunderstandings. Consulting agreements under Alabama Business Management Consulting should clearly specify such managerial roles to ensure compliance with the Consultant Services Agreement - Self-Employed.

Yes, having a contract is essential for consultants. A well-defined contract protects both the consultant and the client, outlining the scope of work, payment terms, and responsibilities. Utilizing a comprehensive Consultant Services Agreement - Self-Employed is a key element of effective Alabama Business Management Consulting.

Independent contractors do not have the same rights as employees in Alabama. They typically lack access to benefits such as health insurance, retirement plans, and unemployment compensation. Understanding the differences is crucial when drafting your Consultant Services Agreement - Self-Employed under Alabama Business Management Consulting.

An independent contractor can manage employees if the agreement outlines such responsibilities. However, this arrangement can blur lines between contractor and employee roles. Hence, it's beneficial to clarify roles and responsibilities within your Alabama Business Management Consulting framework to promote clarity in a Consultant Services Agreement - Self-Employed.

Yes, an independent contractor can certainly act as a consultant. In fact, many professionals in Alabama choose this path for greater flexibility and autonomy. Utilizing Alabama Business Management Consulting can help streamline your Consultant Services Agreement - Self-Employed, ensuring that all terms are clearly defined.

When working with an independent contractor in Alabama, avoid treating them like an employee. This includes providing them with direct supervision, controlling their work hours, or taking over their equipment. Maintaining a clear boundary respects the spirit of Alabama Business Management Consulting and ensures compliance with the Consultant Services Agreement - Self-Employed.

The terms self-employed and consultant often overlap but have distinct meanings. A self-employed individual works for themselves, while a consultant offers expertise to businesses on a contractual basis. When engaging in Alabama Business Management Consulting, it is important to recognize these differences to establish the right agreements.

Yes, receiving a 1099 form indicates that you are self-employed. This form is typically issued to independent contractors and consultants, affirming that you have earned income without tax withholding. If you are in Alabama Business Management Consulting, ensure you keep track of your earnings for tax purposes.

Yes, consulting income is classified as self-employment income. As an independent consultant, you report this income on your tax return. Understanding the tax implications of your consulting work in Alabama Business Management Consulting can help you plan effectively.