Keywords: Alabama Simple Promissory Note, Personal Loan, types Title: Understanding the Alabama Simple Promissory Note for Personal Loan Introduction: A Simple Promissory Note is a legally binding document that outlines the terms and conditions of a personal loan between two parties. In the state of Alabama, there are specific requirements and guidelines for creating a Simple Promissory Note for Personal Loan. This article aims to provide a detailed description of what an Alabama Simple Promissory Note is, its key elements, and potential variations based on different loan types. Key Elements of an Alabama Simple Promissory Note: 1. Parties involved: The Simple Promissory Note identifies the lender, also known as the creditor, and the borrower, also known as the debtor. Their legal names, addresses, and contact information are stated clearly. 2. Loan amount and interest: The Simple Promissory Note specifies the principal amount of the loan and whether interest will be charged. If interest is applicable, the note must state the interest rate and how it will be calculated. 3. Repayment terms: The note outlines a repayment schedule, including the frequency and due dates of payments. It may specify if the loan will be repaid in one lump sum or in installments, along with any late fees or penalties for missed payments. 4. Collateral (if applicable): In cases where the loan is secured by collateral (such as a vehicle or property), the Simple Promissory Note should include a detailed description of the collateral and information regarding its transfer in case of default. Types of Alabama Simple Promissory Note for Personal Loan: 1. Unsecured Promissory Note: This is the most common type where a borrower is not required to provide collateral. The lender relies solely on the borrower's creditworthiness and repayment ability. 2. Secured Promissory Note: In this type, the borrower pledges an asset as collateral to secure the loan. If the borrower defaults, the lender has the right to seize the collateral to recover the outstanding debt. 3. Demand Promissory Note: This type allows the lender to demand repayment of the loan in full at any time. While the borrower may repay the loan over a longer period, the lender has the flexibility to request full payment whenever necessary. Conclusion: Obtaining a personal loan in Alabama involves creating a Simple Promissory Note that clearly outlines the terms and conditions of the loan. Whether it's an unsecured, secured, or demand note, understanding the key elements is essential for both lenders and borrowers. By adhering to the legal requirements and specifying all relevant details, an Alabama Simple Promissory Note for Personal Loan ensures a transparent and fair lending process.

Alabama Simple Promissory Note for Personal Loan

Description

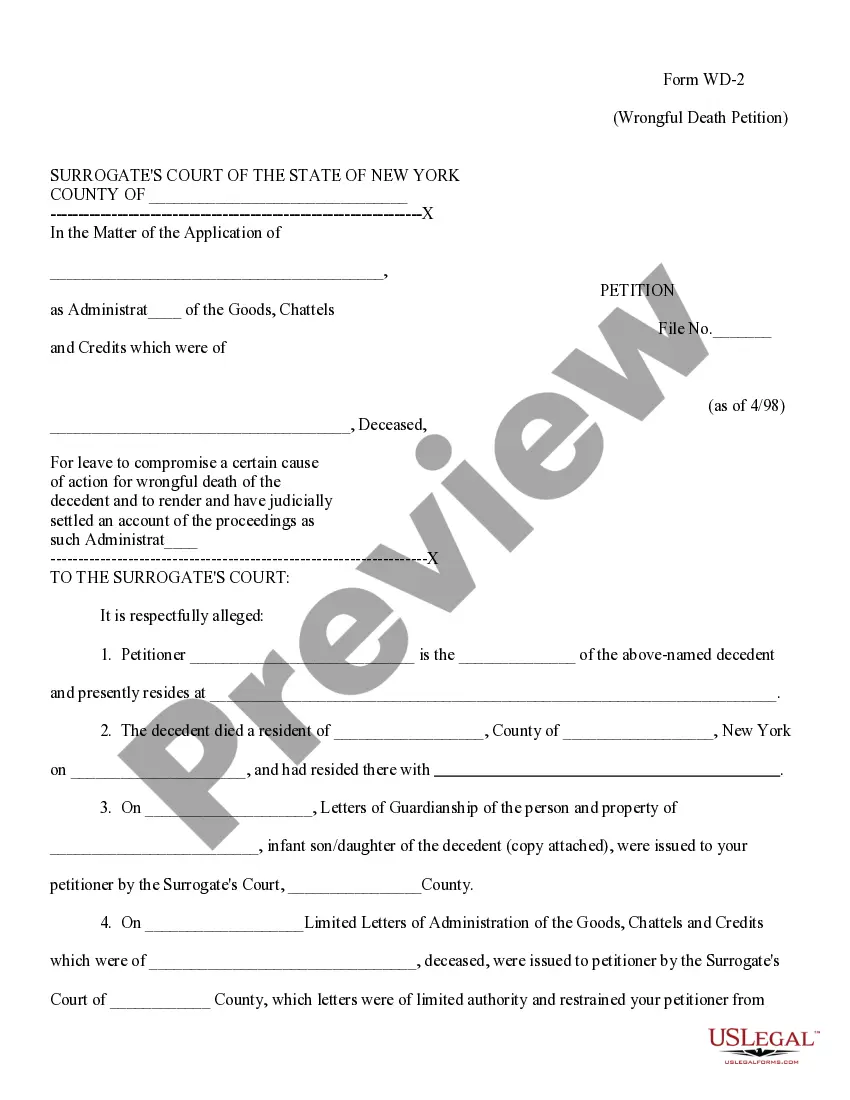

How to fill out Alabama Simple Promissory Note For Personal Loan?

US Legal Forms - among the biggest libraries of lawful types in the USA - provides a variety of lawful document themes you may download or print. Using the website, you can find 1000s of types for organization and specific reasons, sorted by groups, states, or keywords and phrases.You can find the newest versions of types much like the Alabama Simple Promissory Note for Personal Loan within minutes.

If you already possess a subscription, log in and download Alabama Simple Promissory Note for Personal Loan from your US Legal Forms catalogue. The Obtain button will appear on each and every form you see. You get access to all earlier downloaded types within the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, allow me to share basic directions to obtain started:

- Make sure you have chosen the best form for your area/area. Click on the Review button to analyze the form`s articles. See the form outline to actually have selected the appropriate form.

- In case the form doesn`t fit your demands, make use of the Look for field near the top of the display screen to get the one who does.

- Should you be satisfied with the shape, verify your option by simply clicking the Purchase now button. Then, select the costs strategy you favor and offer your accreditations to register to have an accounts.

- Approach the deal. Utilize your credit card or PayPal accounts to perform the deal.

- Select the file format and download the shape on the product.

- Make adjustments. Fill out, modify and print and indication the downloaded Alabama Simple Promissory Note for Personal Loan.

Each web template you included with your money lacks an expiration time and is the one you have permanently. So, in order to download or print yet another version, just proceed to the My Forms portion and then click in the form you will need.

Obtain access to the Alabama Simple Promissory Note for Personal Loan with US Legal Forms, one of the most substantial catalogue of lawful document themes. Use 1000s of expert and status-specific themes that meet up with your company or specific needs and demands.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

More info

All with one web portal, a secure online application, detailed budget calculator, and an easy-to-apply “no credit check” option. A personalized online loan calculator offers personalized loan recommendations from lenders that meet your interests. The tools you need to maximize your loan are right at your fingertips.