A Simple Promissory Note for a Car Loan in Alabama is a legal document that outlines the terms and conditions of a loan taken by a borrower to purchase a vehicle. It serves as a formal agreement between the lender and the borrower, detailing the loan amount, interest rate, repayment schedule, and any other important clauses related to the loan. Keywords: Alabama, simple promissory note, car loan, legal document, terms and conditions, borrower, lender, loan amount, interest rate, repayment schedule, clauses. There are various types of Simple Promissory Notes for Car Loans in Alabama, including: 1. Fixed interest rate promissory note: This type of promissory note specifies a fixed interest rate that remains constant throughout the loan term. It provides certainty to both parties involved, as the borrower knows the precise amount they have to repay, while the lender has a clear understanding of the expected returns. 2. Variable interest rate promissory note: In contrast to a fixed interest rate note, this type of promissory note includes an interest rate that can change over time. Usually, variable rates are tied to an external economic index, such as the prime rate or the Consumer Price Index (CPI). The interest payments may fluctuate accordingly, leading to varying repayment amounts. 3. Balloon payment promissory note: This type of promissory note divides the repayment into regular installments for a specified period, but includes a larger lump sum payment known as a "balloon payment" at the end of the loan term. The balloon payment is typically higher than the regular installments and allows borrowers to have lower monthly payments throughout the loan period. 4. Secured promissory note: A secured promissory note requires the borrower to provide collateral, such as the purchased vehicle, as security for the loan. If the borrower defaults on the loan, the lender has the right to seize and sell the collateral to recover their investment. 5. Unsecured promissory note: In contrast to a secured promissory note, an unsecured promissory note does not require collateral. However, this type of note often includes higher interest rates and stricter repayment terms as the lender takes on more risk without any guarantee of recovering the loan amount through collateral. In conclusion, a Simple Promissory Note for Car Loan in Alabama is a key legal document that outlines the terms and conditions of a vehicle loan. It is crucial for both the borrower and lender to clearly understand the specific type of promissory note being used, such as fixed or variable interest rate, balloon payment, and secured or unsecured note, to ensure a mutually agreeable loan agreement.

Alabama Simple Promissory Note for Car Loan

Description

How to fill out Alabama Simple Promissory Note For Car Loan?

Discovering the right authorized record design could be a have difficulties. Obviously, there are a variety of themes available online, but how would you find the authorized type you will need? Use the US Legal Forms internet site. The service offers thousands of themes, including the Alabama Simple Promissory Note for Car Loan, which can be used for organization and personal requires. Every one of the forms are checked out by pros and meet federal and state specifications.

If you are already listed, log in to the account and click on the Obtain option to get the Alabama Simple Promissory Note for Car Loan. Make use of account to appear from the authorized forms you have ordered earlier. Proceed to the My Forms tab of the account and acquire an additional duplicate of the record you will need.

If you are a new consumer of US Legal Forms, here are basic recommendations that you should stick to:

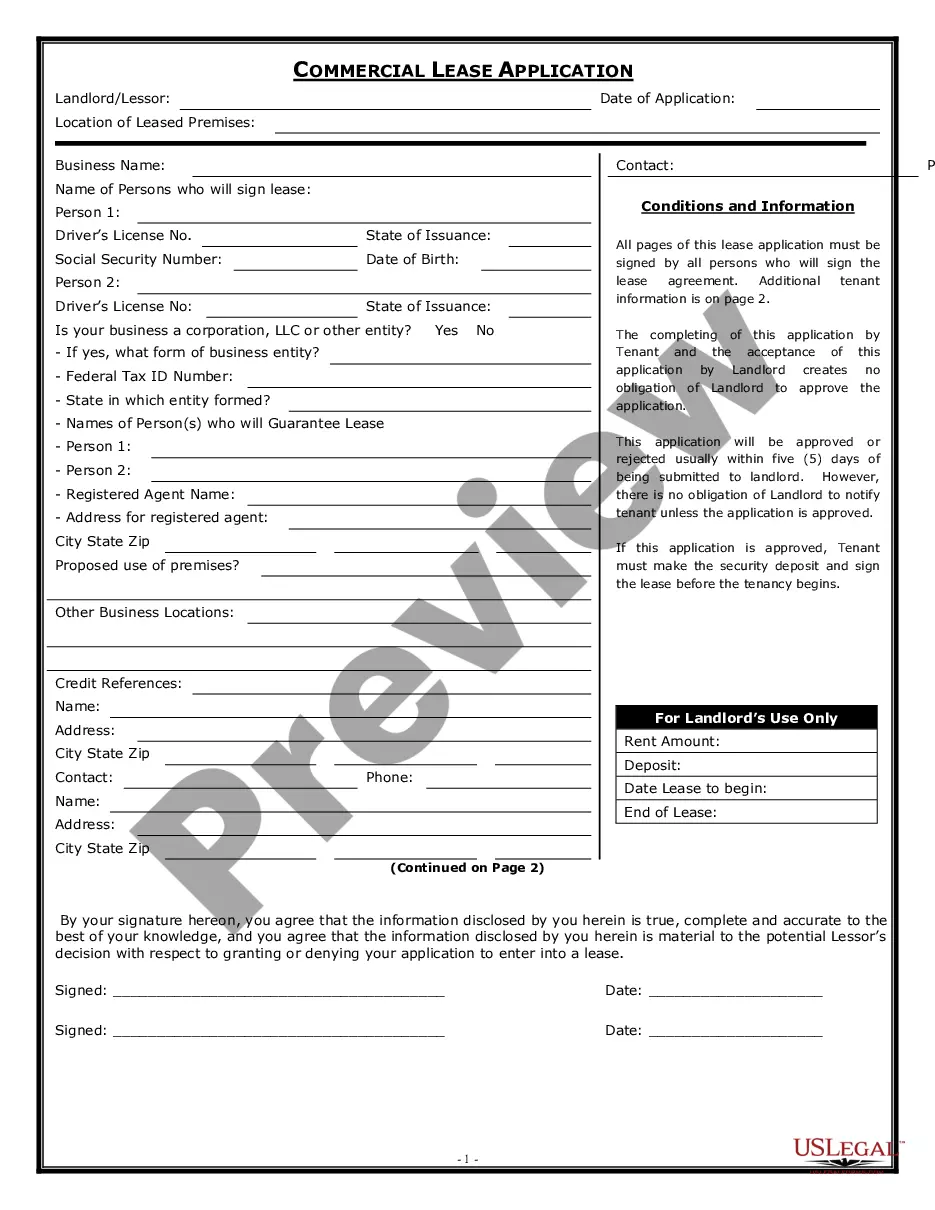

- Initially, be sure you have chosen the proper type for the town/area. You may examine the form using the Review option and look at the form outline to ensure this is the best for you.

- If the type does not meet your requirements, make use of the Seach area to get the appropriate type.

- Once you are sure that the form is proper, go through the Buy now option to get the type.

- Choose the pricing strategy you desire and enter the needed details. Design your account and buy the transaction with your PayPal account or bank card.

- Select the file format and download the authorized record design to the device.

- Total, modify and print and indicator the received Alabama Simple Promissory Note for Car Loan.

US Legal Forms is definitely the most significant library of authorized forms that you will find various record themes. Use the service to download appropriately-created papers that stick to express specifications.