Alabama Investment Letter regarding Intrastate Offering

Description

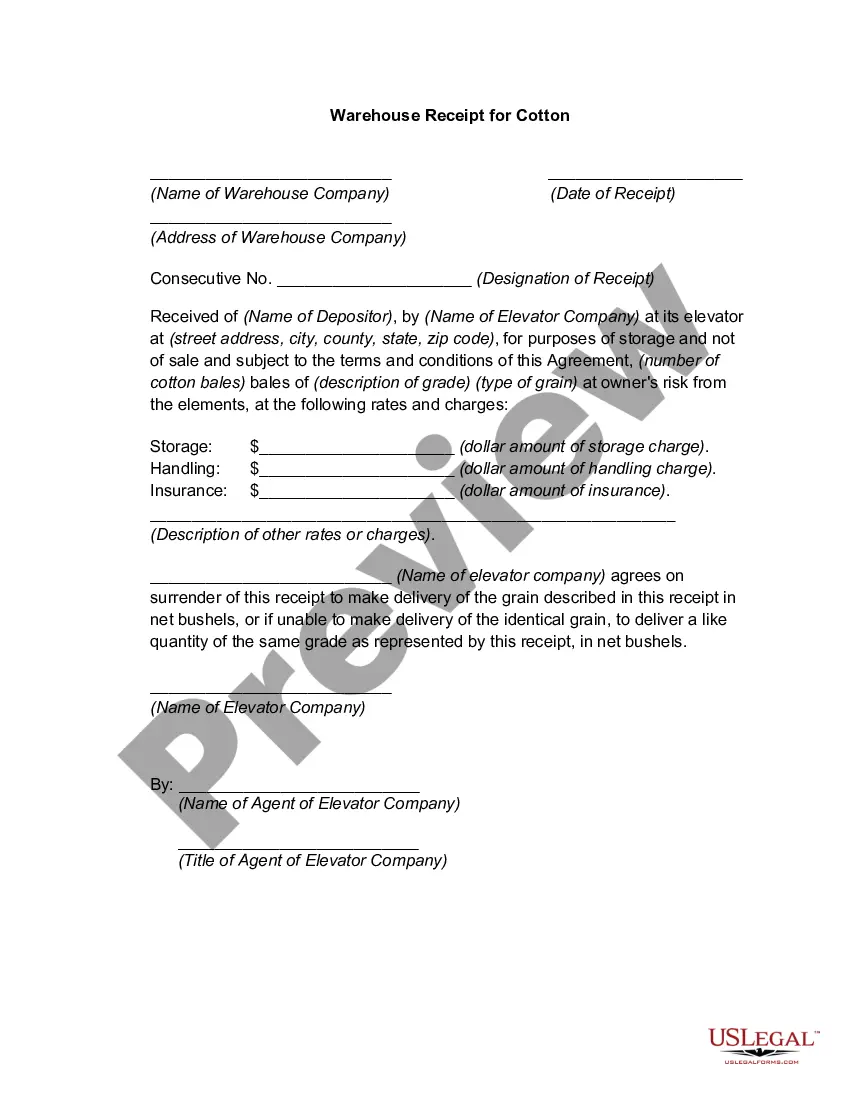

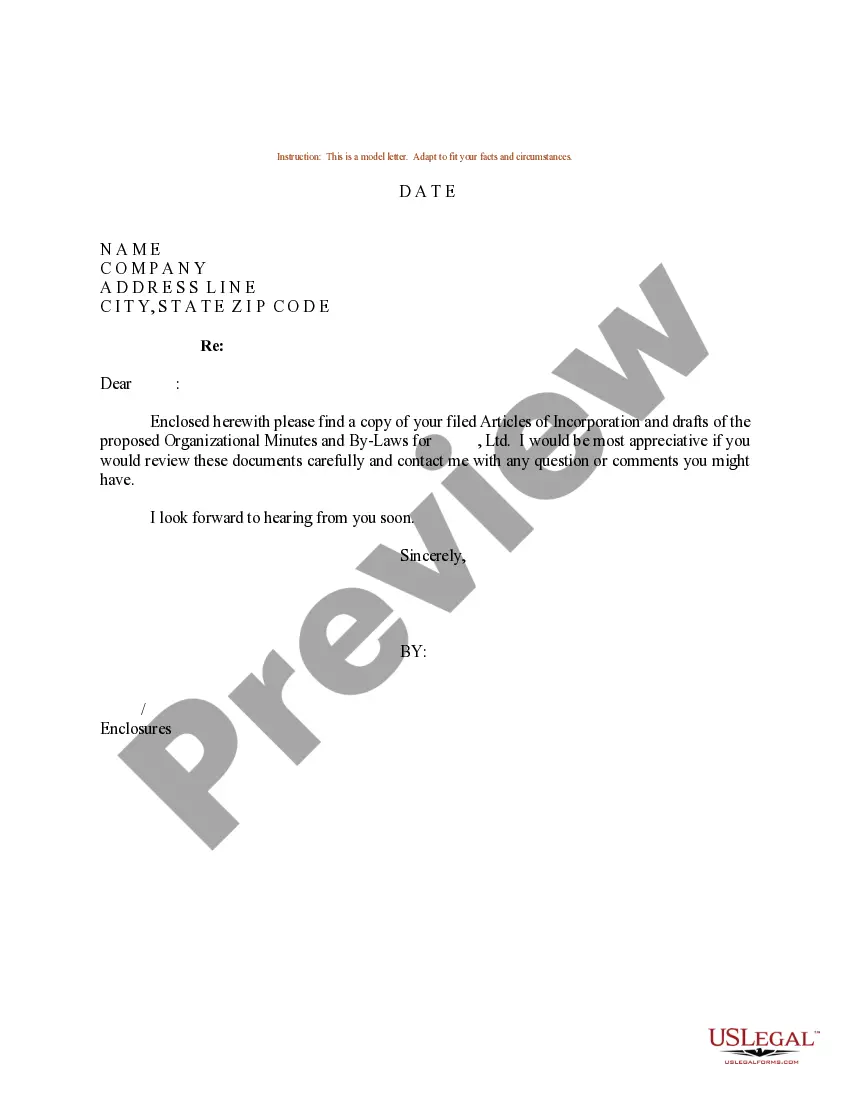

How to fill out Investment Letter Regarding Intrastate Offering?

Are you presently at the location where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, such as the Alabama Investment Letter for Intrastate Offering, which is designed to comply with federal and state regulations.

Choose a convenient format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Alabama Investment Letter for Intrastate Offering anytime, as needed. Just click on the desired form to obtain or print the template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Alabama Investment Letter for Intrastate Offering template.

- If you do not have an account and wish to start using US Legal Forms, take these steps.

- Find the form you require and confirm it is for the correct state/region.

- Use the Review option to examine the form.

- Check the overview to ensure you have selected the right document.

- If the form is not what you are looking for, utilize the Search field to locate the form that fits your needs and requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you prefer, fill in the necessary details to set up your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

Rule 147 enables issuers to raise capital locally by offering securities without federal registration, specifically targeting investors within the same state. This makes it easier for businesses in Alabama to attract local investment. The Alabama Investment Letter regarding Intrastate Offering is instrumental in navigating these provisions efficiently.

Criminal code 13A 8 11 in Alabama involves regulations concerning theft and fraud in business transactions. Violations can lead to serious legal repercussions. Thus, when engaging with the Alabama Investment Letter regarding Intrastate Offering, understanding this code is essential to avoid potential legal challenges.

Alabama Code 6 11 26 addresses the legal aspects of securities transactions and fraud. It plays a crucial role in protecting investors from deceptive practices in securities offerings. When preparing to issue an Alabama Investment Letter regarding Intrastate Offering, it is important to understand how this code influences compliance and investor protection.

The criteria for Rule 147 includes conditions such as the issuer being incorporated within the state and having a principal place of business there. Furthermore, the offer and sale must be limited to residents of that state. Meeting these criteria is essential when preparing the Alabama Investment Letter regarding Intrastate Offering.

Rule 147 focuses on intrastate offerings, while Rule 144 allows for the sale of restricted and controlled securities. Rule 147 is more specific to state-centric fundraising without federal oversight, whereas Rule 144 deals with resale of securities to ensure liquidity. Understanding these differences is crucial when considering the Alabama Investment Letter regarding Intrastate Offering.

Alabama Code 22 8A 11 outlines the regulations regarding intrastate offerings within the state. This law helps protect investors by establishing guidelines that issuers must follow. For those looking to raise capital, understanding this code is vital to complement the Alabama Investment Letter regarding Intrastate Offering.

Rule 147 allows companies to offer and sell securities exclusively within their home state. It enables issuers to raise funds locally while avoiding federal registration requirements. This is particularly relevant in Alabama, where the Alabama Investment Letter regarding Intrastate Offering serves as a key document to ensure compliance.

Alabama Code 11 12 8 regulates the issuance of securities within Alabama specifically concerning local offerings. This code provides guidelines for businesses intending to conduct intrastate offerings, ensuring they meet state requirements. With an Alabama Investment Letter regarding Intrastate Offering, businesses can demonstrate their compliance with this code, thereby instilling confidence in potential investors while facilitating a smoother funding process.

Yes, intrastate offerings can be exempt from federal registration under Rule 147 and Rule 147A of the Securities Act. This exemption allows companies to raise funds without the extensive process required for federal registration, focusing instead on state compliance. By using an Alabama Investment Letter regarding Intrastate Offering, you can navigate these exemptions effectively, helping you connect with investors while minimizing regulatory hurdles.

Intrastate offerings are sales of securities that occur within a single state, allowing businesses to raise capital from local investors. These offerings offer a streamlined process compared to interstate offerings, as they adhere to state regulations instead of federal mandates. By utilizing an Alabama Investment Letter regarding Intrastate Offering, you ensure compliance with Alabama's specific rules, making it easier and more efficient for local businesses to attract investment.