Title: Protecting Your Finances: Alabama Sample Letter for Reporting Fraudulent Charges Against Your Account Keywords: Alabama, sample letter, fraudulent charges, client's account, reporting, financial protection Description: In the state of Alabama, it is crucial to take immediate action when you discover fraudulent charges on your account to ensure the protection of your finances. This article provides a detailed description of an Alabama sample letter that can be utilized to report such fraudulent charges against your client's account. Sample Letter for Fraudulent Charges against Client's Account: [Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Bank/Credit Card Company Name] [Address] [City, State, Zip Code] Subject: Report of Fraudulent Charges against [Client's Name]'s Account Dear Sir/Madam, I am writing this letter to report a series of fraudulent charges that have been made on [Client's Name]'s account with your financial institution. As the authorized representative of [Client's Name], I request immediate investigation and appropriate action to rectify this matter. Account Holder's Information: Name: [Client's Name] Account number: [Client's Account Number] Date of Birth: [Client's Date of Birth] Contact Number: [Client's Phone Number] Incident Details: Upon reviewing our account statements, we have identified unauthorized transactions that occurred from [Date Range] for the following charges: — [Detailed description of the fraudulent charge] — [Include any relevant details, such as the date, time, and location of the transaction] We have taken the necessary steps to secure the account by changing all passwords and personal identification numbers. However, we urge your institution to conduct a thorough investigation into these occurrences and take immediate actions to address these fraudulent charges. Attached to this letter, please find supporting documents including bank statements, receipts, and any other evidence needed to assist you in your investigation. We kindly request your prompt attention to this matter, as it is critical to resolve these issues in a timely manner. We understand that fraud prevention is a priority to your institution, and we appreciate your favorable cooperation throughout this process. Furthermore, we also request that you keep us updated on the progress of your investigation and any action taken. Please contact me at the provided number or email address if you require any additional information or have any questions regarding this matter. Thank you in advance for your prompt attention to this serious issue. We trust that your institution will take the necessary steps to rectify these fraudulent charges and restore the rightful balance to [Client's Name]'s account. Yours sincerely, [Your Name] [Your Designation] [Your Company Name] Types of Alabama Sample Letters for Fraudulent Charges against Client's Account: 1. Alabama Sample Letter for Fraudulent Credit Card Charges 2. Alabama Sample Letter for Fraudulent Bank Account Charges 3. Alabama Sample Letter for Fraudulent Debit Card Charges 4. Alabama Sample Letter for Reporting Online Banking Fraud 5. Alabama Sample Letter for Unauthorized Wire Transfer Charges.

Alabama Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

Finding the right legal file web template can be quite a battle. Of course, there are tons of templates available on the net, but how do you obtain the legal form you need? Utilize the US Legal Forms website. The support offers a huge number of templates, such as the Alabama Sample Letter for Fraudulent Charges against Client's Account, which can be used for company and private requirements. Each of the varieties are examined by specialists and satisfy federal and state requirements.

If you are previously signed up, log in for your accounts and click on the Download button to obtain the Alabama Sample Letter for Fraudulent Charges against Client's Account. Use your accounts to check through the legal varieties you possess ordered earlier. Visit the My Forms tab of your own accounts and obtain another duplicate of the file you need.

If you are a fresh user of US Legal Forms, here are straightforward instructions so that you can adhere to:

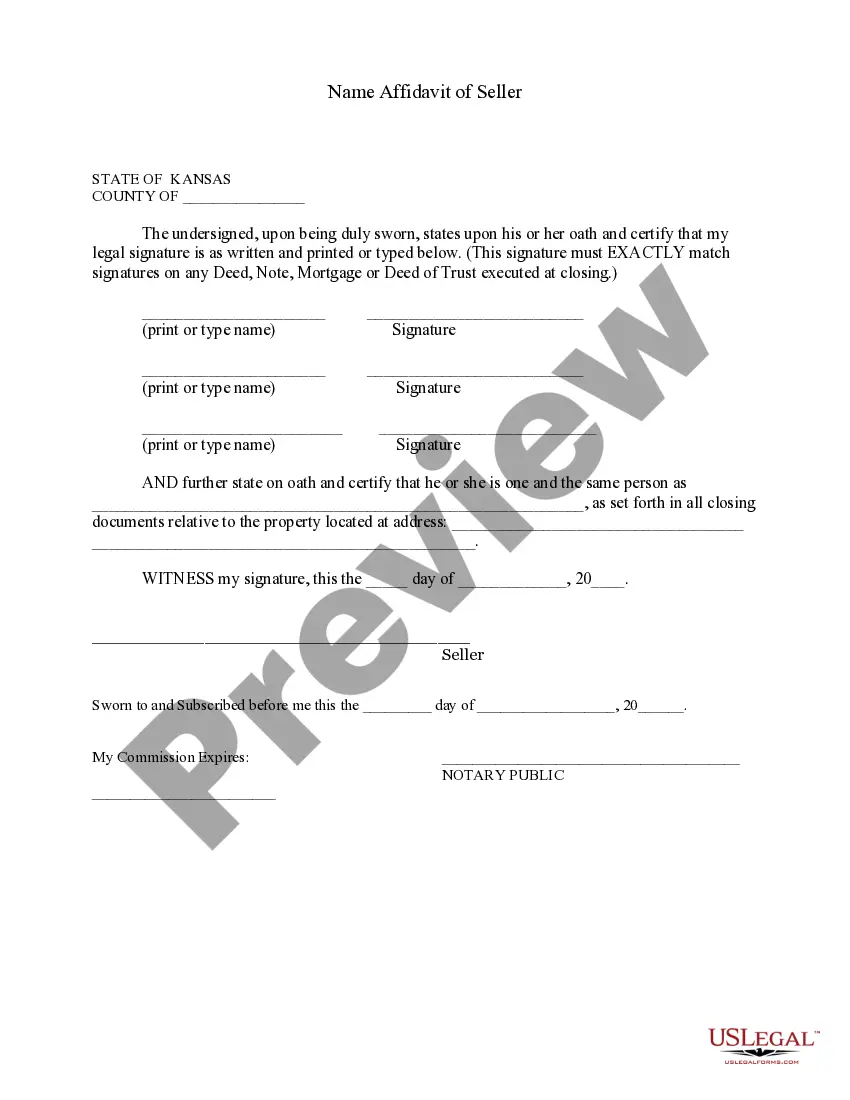

- First, ensure you have chosen the correct form for the town/area. You may check out the shape making use of the Preview button and look at the shape outline to make certain this is basically the right one for you.

- In the event the form does not satisfy your requirements, utilize the Seach field to obtain the right form.

- Once you are sure that the shape is acceptable, go through the Acquire now button to obtain the form.

- Choose the costs strategy you need and enter the necessary details. Create your accounts and purchase an order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the data file formatting and acquire the legal file web template for your system.

- Comprehensive, modify and printing and indication the received Alabama Sample Letter for Fraudulent Charges against Client's Account.

US Legal Forms will be the most significant local library of legal varieties that you can discover different file templates. Utilize the service to acquire professionally-made documents that adhere to express requirements.

Form popularity

FAQ

You may print out and complete a dispute form and enclose it with your letter. Or simply list out each item on your credit report that you believe is inaccurate along with the account number and the reason you believe the information is incorrect. Be as specific and factual as possible.

2) Do dispute letters work? Dispute letters are the most effective way to correct errors on your credit report. It also makes the credit bureau obligated by law to investigate your issue. Yet, a dispute letter doesn't ensure that your credit score will improve unless you have strong evidence backing your claim.

Notice of dispute Description of the dispute. [Describe the dispute as you see it.] Impact of the dispute. [Describe how the dispute has affected you.] Action already taken to resolve the dispute. ... Proposed solution. ... Who to contact about this notice.

To write a complaint letter, you can start with the sender's address followed by the date, the receiver's address, the subject, salutation, body of the letter, complimentary closing, signature and name in block letters. Body of the Letter explaining the reason for your letter and the complaint.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

How to write an effective complaint letter Be clear and concise. ... State exactly what you want done and how long you're willing to wait for a response. ... Don't write an angry, sarcastic, or threatening letter. ... Include copies of relevant documents, like receipts, work orders, and warranties.