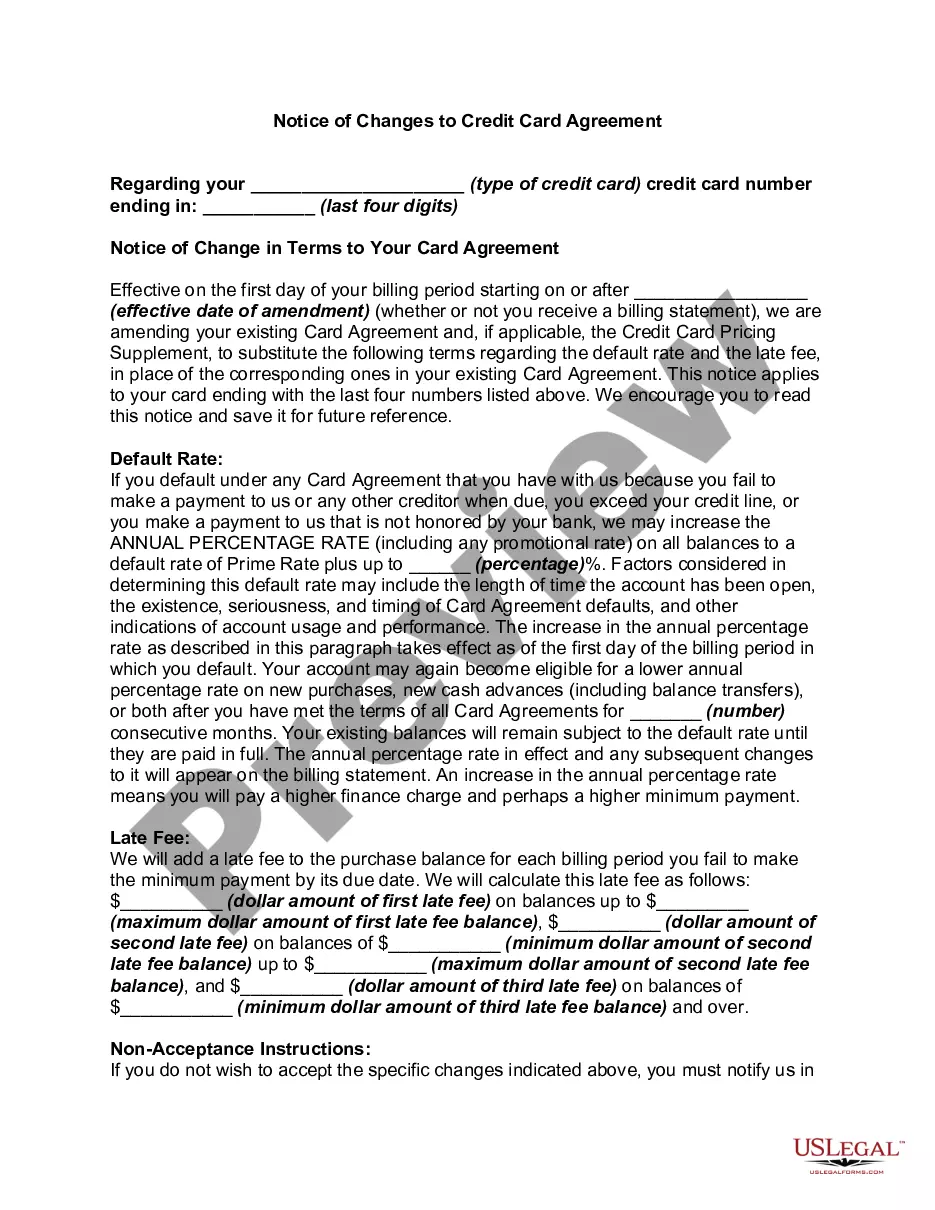

Alabama Notice of Changes to Credit Card Agreement is a formal document that notifies credit cardholders in the state of Alabama about modifications or updates made to their existing credit card agreements. The Notice of Changes serves as a means for credit card issuers to inform consumers about alterations to the terms and conditions of their credit card usage. By sending this notice, credit card issuers fulfill their legal obligation to provide timely information about any significant changes in the agreement, ensuring transparency and maintaining a fair relationship with cardholders. This notice is particularly important since credit card agreements contain various provisions, such as interest rates, fees, payment terms, and other key details, which can have a substantial impact on the cardholder's financial obligations and responsibilities. The Alabama Notice of Changes to Credit Card Agreement may include modifications regarding: 1. Annual Percentage Rate (APR) Changes: This type of notice informs the cardholder about any changes in the interest rates associated with their credit card. It may include information regarding increased or decreased APR's, adjusted balance calculation methods, or the introduction of new APR tiers. 2. Fee Changes: Credit card issuers may also notify cardholders of changes in applicable fees, such as annual fees, late payment fees, balance transfer fees, or cash advance fees. These changes may involve increases, decreases, or the introduction of new fees. 3. Payment Terms: This type of notice focuses on changes related to payment terms, including modifications in minimum payment requirements, due dates, grace periods, and penalty provisions. Cardholders will be provided with information on any alterations that affect their payment schedules and potential consequences for non-compliance. 4. Terms and Conditions: The notice may also address changes to terms and conditions that affect the overall cardholder agreement, such as alterations in liability limitations, dispute resolution procedures, card cancellation policies, or credit limit adjustments. It's vital for credit cardholders in Alabama to carefully review the Notice of Changes to Credit Card Agreement as it outlines the amendments made to their credit card terms. This notice ensures that cardholders remain aware of their rights and responsibilities and allows them the opportunity to assess whether the changes are favorable or require adjustments to their financial planning.

Alabama Notice of Changes to Credit Card Agreement

Description

How to fill out Alabama Notice Of Changes To Credit Card Agreement?

If you have to total, down load, or printing lawful file templates, use US Legal Forms, the most important collection of lawful varieties, that can be found online. Use the site`s basic and convenient research to discover the paperwork you require. Different templates for organization and personal functions are sorted by categories and states, or keywords and phrases. Use US Legal Forms to discover the Alabama Notice of Changes to Credit Card Agreement within a number of mouse clicks.

If you are already a US Legal Forms client, log in to the bank account and click on the Acquire option to obtain the Alabama Notice of Changes to Credit Card Agreement. You can also accessibility varieties you formerly acquired in the My Forms tab of your own bank account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for your right town/nation.

- Step 2. Make use of the Review method to check out the form`s information. Don`t forget about to read the information.

- Step 3. If you are unhappy using the kind, use the Lookup field on top of the screen to discover other variations of your lawful kind template.

- Step 4. After you have discovered the shape you require, click on the Acquire now option. Opt for the prices prepare you prefer and add your qualifications to sign up to have an bank account.

- Step 5. Approach the deal. You can utilize your credit card or PayPal bank account to complete the deal.

- Step 6. Choose the file format of your lawful kind and down load it on your device.

- Step 7. Complete, revise and printing or indication the Alabama Notice of Changes to Credit Card Agreement.

Each lawful file template you get is your own permanently. You have acces to every kind you acquired inside your acccount. Click on the My Forms area and select a kind to printing or down load once more.

Remain competitive and down load, and printing the Alabama Notice of Changes to Credit Card Agreement with US Legal Forms. There are thousands of professional and express-specific varieties you can utilize for your personal organization or personal requires.