Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

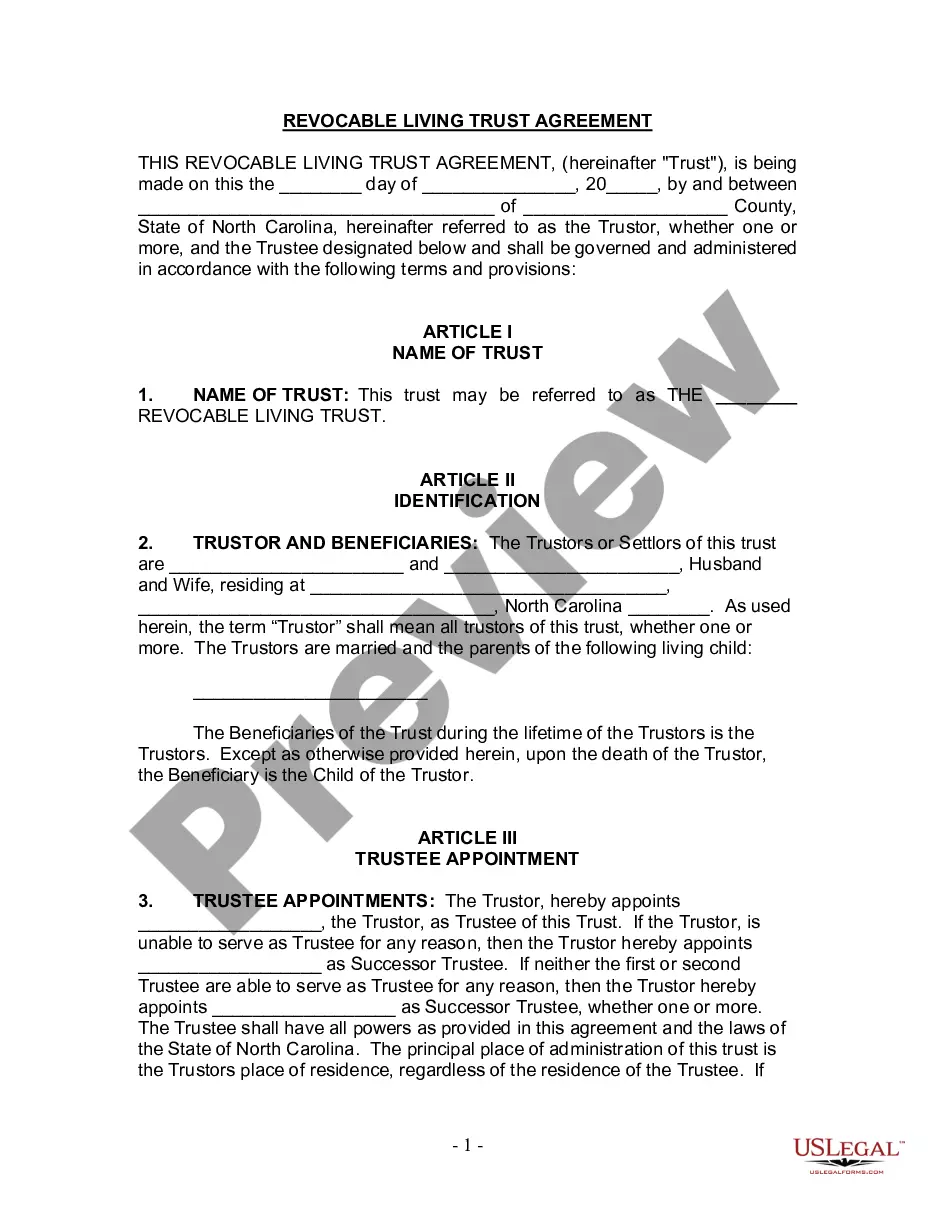

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

It is feasible to spend multiple hours online searching for the legal document template that fulfills the state and federal requirements you seek.

US Legal Forms offers thousands of legal forms that are evaluated by professionals.

You can conveniently obtain or print the Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income from your services.

To find another version of the form, use the Lookup field to search for the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and press the Download button.

- Following that, you can complete, alter, print, or sign the Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income.

- Every legal document template you receive is yours indefinitely.

- To have another copy of a purchased form, visit the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Read the form description to confirm you have chosen the right form.

- If available, use the Review button to examine the document template as well.

Form popularity

FAQ

A revocable trust is typically treated as a pass-through entity for tax purposes. This means that the income generated by the trust is reported on the personal income tax returns of the trustors. For an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both partners will report the trust's income as their own. Consulting with a tax advisor can help clarify the implications and optimize tax strategies for the trust.

A joint revocable trust, such as an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to, provides numerous advantages. It simplifies estate management, reduces probate costs, and allows for seamless transitions of assets between partners. Additionally, such a trust can create a unified strategy for tax planning and asset protection. These benefits help ensure peace of mind for couples as they plan for their future.

Yes, two people can indeed own a revocable trust. In an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both partners are considered co-trustees. This arrangement allows them to jointly manage the trust assets, ensuring that both partners have a say in how the trust is administered. Leveraging this setup can foster collaboration and mutual understanding in the couple's financial decisions.

Husband and wife can choose to have separate revocable trusts, depending on their financial situation and goals. However, an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to often simplifies asset management and estate planning. By opting for a joint trust, both partners can manage their assets together and provide for each other in the event of disability or death. It's crucial to discuss with a legal expert to determine the best option for your unique circumstances.

Suze Orman advocates for revocable trusts due to their flexibility and efficiency in estate planning. She emphasizes that these trusts not only help avoid probate but also allow for easy changes should circumstances shift. According to Orman, having an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to can ensure that your assets are distributed according to your wishes, providing peace of mind for you and your family.

Creating a revocable trust in Alabama involves a few essential steps. First, you need to choose the type of trust best suited for your needs, whether it's joint or individual. Next, you'll draft a trust document specifying the terms, beneficiaries, and assets to be included. Utilizing resources like uslegalforms can guide you through the process of establishing an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to, ensuring all legal requirements are met.

One significant disadvantage of a joint revocable trust is the potential loss of individual control over assets. With both spouses involved, any decisions regarding trusts must be mutual, which can slow down the process. Furthermore, upon the death of one spouse, the property's administration may become more complicated. Navigating these complexities can be simplified by using an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

Joint revocable trusts can create issues related to control and decision-making. When you and your spouse serve as trustors, both must agree on changes, which can be challenging if conflicts arise. Additionally, transferring property into a joint trust might lead to complications during changes in circumstances, such as divorce or death. Therefore, understanding the nuances of an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to is essential.

In an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to, the trustee holds the responsibility for managing and distributing trust assets, while the beneficiaries have rights to those assets. The power lies with the trustee in terms of decision-making and administration, but beneficiaries have the ultimate benefit of the trust's assets. It’s crucial for trustors to choose a reliable trustee and to clearly outline beneficiaries' rights, ensuring smooth operations and relationships.

While an Alabama Revocable Trust Agreement with Husband and Wife as Trustors and Income to offers many advantages, one downside is that it does not provide protection from creditors. Because the trustors maintain control over the assets, those assets may still be vulnerable to claims. Additionally, revocable trusts typically require careful management, including regular updates and administration. It's important to weigh these factors against the benefits before deciding to set up a trust.