Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

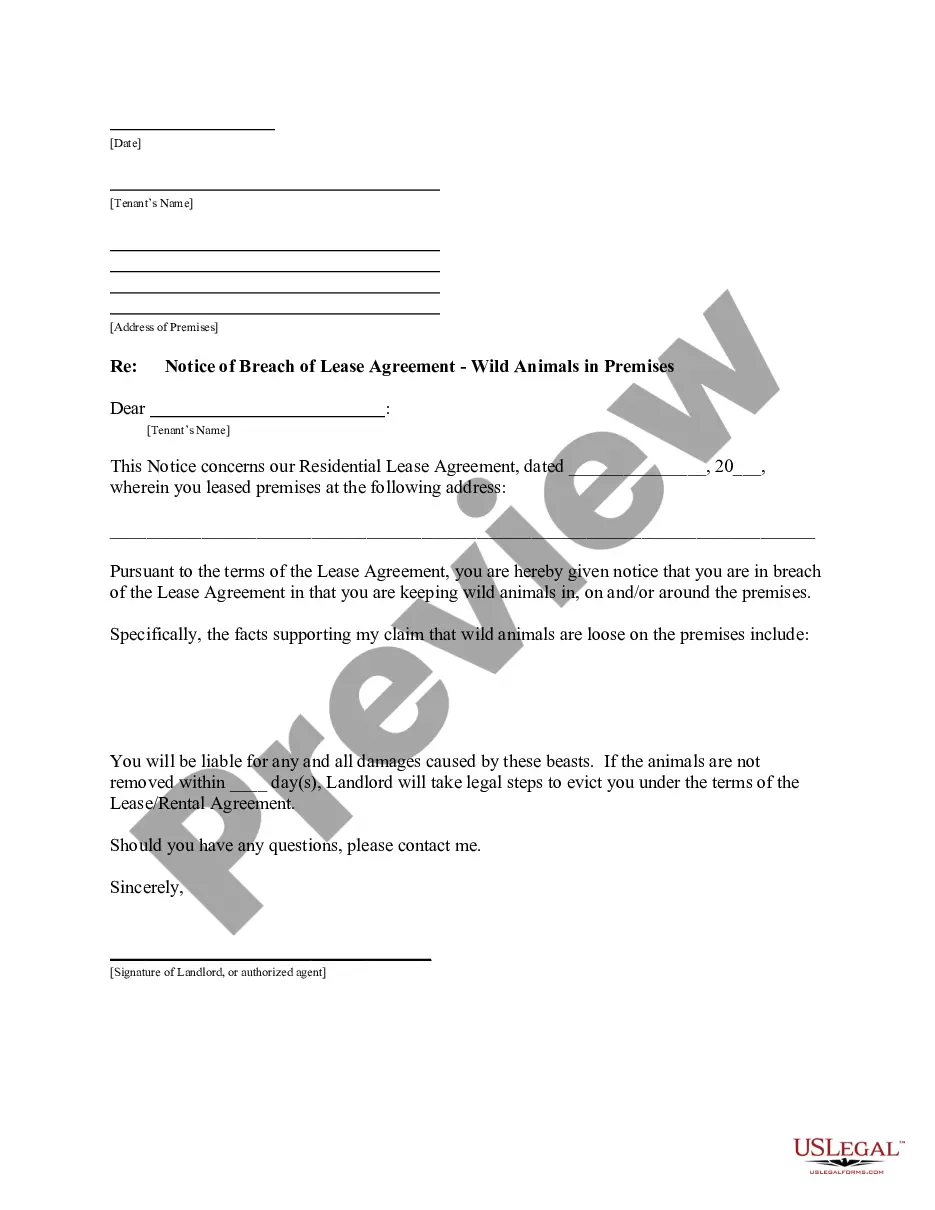

How to fill out Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

Have you found yourself in a situation where you need documents for both business or personal reasons almost every day.

There are numerous official document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, which are designed to meet federal and state requirements.

Choose a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement at any time if needed. Just choose the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to verify the form.

- Check the details to make sure you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

- If you find the right form, click on Buy now.

- Select the pricing plan you want, provide the required information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

To write a payment agreement for a car, outline the payment amount, schedule, and any interest rates if applicable. Make sure to detail the consequences of late payments or defaults, establishing clarity for both parties. A well-structured Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement can help ensure all important elements are included.

Writing a contract agreement for payment involves stating the payment amount, due date, and payment method clearly. Additionally, include any terms regarding late fees or penalties in case of missed payments. Utilizing an Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement can provide a solid framework for your agreement.

With owner financing, the seller becomes the lender, allowing buyers to make monthly payments directly to them. This option often benefits sellers by generating ongoing income and may allow them to sell the car faster if buyers have trouble securing traditional financing. Sellers must document the arrangement using an Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

When selling a car, you can handle payments by setting clear terms in your contract. Specify the payment frequency, the total amount due, and how payments will be made, such as via checks or electronic transfers. It is wise to refer to the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement to guide you on structuring these payments.

In a financed vehicle scenario, the buyer has use of the vehicle, but the seller retains legal ownership until the financing terms are fulfilled. This means that while you drive the car, the seller holds the title as security. Utilizing an Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement helps clarify ownership responsibilities. This can prevent misunderstandings about who holds the title during the financing period.

Owner financing can be beneficial for both buyers and sellers, as it allows for more flexible terms compared to traditional financing. Sellers can attract a wider range of buyers who might have trouble securing loans from banks. However, it's essential to establish clear terms and use an Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement to protect your interests and ensure a smooth transaction.

Yes, in Alabama, you need a bill of sale to complete the sale of a car. This document serves as proof of the transaction and includes essential information about the vehicle and the buyer. By using an Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, you can add extra security and clarity to your sale. It's crucial to ensure all details are correctly logged to avoid future disputes.

No, a bill of sale does not override a title in Alabama. While a bill of sale indicates a transaction has occurred, the title is the official document that establishes legal ownership. If you're dealing with an owner-financed vehicle, make sure to follow the steps in the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement to secure both documents.

In Alabama, you generally cannot register a car with just a bill of sale. You will need a title to complete the registration process. If you have purchased a vehicle through an owner finance agreement, you should ensure you secure the title from the seller as outlined in the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

A notarized bill of sale provides additional assurance of the authenticity of the transaction, but it still does not replace the need for a vehicle title in Alabama. While it can strengthen your claim of ownership, you must obtain a title for complete legal recognition. Utilizing the Alabama Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement will help clarify the terms.