Title: Alabama General Form of Factoring Agreement — Assignment of Accounts Receivable: A Comprehensive Overview Introduction: In Alabama, a General Form of Factoring Agreement or Assignment of Accounts Receivable is a legal contract that enables businesses to convert their accounts receivable into immediate cash. This type of financing solution can help companies optimize their cash flow, enhance liquidity, and support growth initiatives. In this article, we will explore the various aspects of Alabama General Form of Factoring Agreement, its benefits, and any related variations. Keywords: Alabama General Form of Factoring Agreement, Assignment of Accounts Receivable, financing solution, cash flow, liquidity, growth initiatives. 1. The Purpose of a General Form of Factoring Agreement: A General Form of Factoring Agreement in Alabama serves as a contractual arrangement between a business (known as the "Assignor") and a financial institution or factor (known as the "Assignee"). The agreement allows the Assignor to sell its accounts receivable to the Assignee at a discounted rate, resulting in immediate cash inflow. Keywords: Assignor, Assignee, accounts receivable, discounted rate, immediate cash inflow. 2. Key Terms and Provisions: The Alabama General Form of Factoring Agreement typically includes the following provisions: 2.1 Assignment of Accounts Receivable: This provision enables the Assignor to transfer their rights, title, and interest in the accounts receivable to the Assignee. The Assignor assigns all its present and future accounts receivable to the Assignee in exchange for immediate cash. Keywords: Assignment, rights, title, interest, present, future, immediate cash. 2.2 Factoring Fee and Discount Rate: The agreement outlines the factoring fee or discount rate, which represents the percentage deducted from the face value of the accounts receivable. This serves as the cost of borrowing or the fee charged by the Assignee for purchasing the receivables. Keywords: Factoring fee, discount rate, face value, borrowing cost. 2.3 Verification and Collection: The Assignee undertakes the responsibility of verifying the assigned accounts receivable and collecting payments from the debtors. These reliefs the Assignor from the burden of managing collections. Keywords: Verification, collection, payments, debtors, burden. 3. Benefits of Alabama General Form of Factoring Agreement: The utilization of an Alabama General Form of Factoring Agreement offers several advantages for businesses, including: 3.1 Improved Cash Flow: By converting accounts receivable into immediate cash, businesses can meet their immediate financial obligations, pay suppliers promptly, and manage day-to-day operations more efficiently. Keywords: Improved cash flow, immediate cash, financial obligations, suppliers, day-to-day operations. 3.2 Enhanced Liquidity: Factoring agreements enhance a company's liquidity position by providing a steady stream of working capital, allowing businesses to invest in growth opportunities, purchase inventory, or expand their operations. Keywords: Enhanced liquidity, working capital, growth opportunities, inventory, expansion. 3.3 Reduced Credit Risk: Transfer of the receivables' ownership and collection responsibility to the Assignee mitigates the risk of non-payment or default by debtors, reducing credit risk for the Assignor. Keywords: Credit risk, non-payment, default, debtors, risk mitigation. 4. Alabama General Form of Factoring Agreement Variations: While the Alabama General Form of Factoring Agreement covers the fundamental elements of a factoring arrangement, specific variations may exist depending on the unique requirements of businesses or factors. Some common variations may include: 4.1 Recourse Factoring Agreement: This type of agreement allows the Assignor to retain the ultimate responsibility of repurchasing any uncollectible receivables from the Assignee. Keywords: Recourse factoring, uncollectible receivables, repurchasing. 4.2 Non-Recourse Factoring Agreement: In this variant, the Assignee assumes the risk of non-payment or default by the debtors, thereby eliminating the Assignor's obligation to repurchase uncollectible receivables. Keywords: Non-recourse factoring, non-payment risk, default risk, uncollectible receivables. Conclusion: The Alabama General Form of Factoring Agreement — Assignment of Accounts Receivable serves as a valuable financial tool for businesses seeking to optimize cash flow, enhance liquidity, and support growth. The agreement's provisions and variations allow companies to tailor the arrangement to their specific needs and requirements, providing them with a flexible financing solution. Keywords: Flexible financing solution, tailored arrangement, specific needs, requirements.

Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

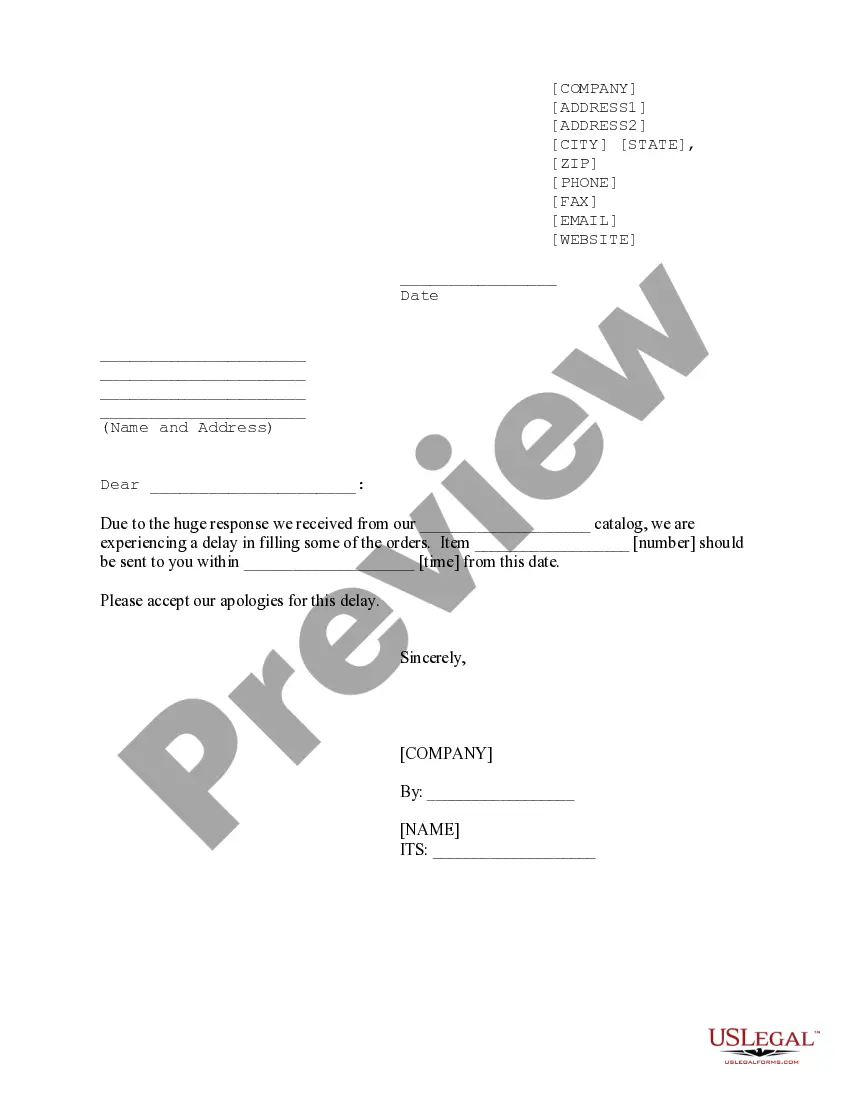

How to fill out Alabama General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Are you presently in a placement that you will need papers for both company or person purposes nearly every day? There are tons of authorized record templates available on the net, but discovering kinds you can rely on is not simple. US Legal Forms offers a large number of kind templates, just like the Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable, that happen to be published to fulfill state and federal needs.

Should you be presently knowledgeable about US Legal Forms web site and have a free account, merely log in. Afterward, you may download the Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable format.

If you do not offer an profile and want to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you will need and ensure it is to the right town/county.

- Utilize the Preview option to check the shape.

- See the explanation to ensure that you have selected the appropriate kind.

- If the kind is not what you`re searching for, use the Search area to discover the kind that fits your needs and needs.

- When you discover the right kind, just click Acquire now.

- Pick the rates prepare you would like, submit the desired information to make your account, and purchase the transaction using your PayPal or charge card.

- Choose a convenient paper formatting and download your duplicate.

Find all of the record templates you might have purchased in the My Forms menu. You may get a more duplicate of Alabama General Form of Factoring Agreement - Assignment of Accounts Receivable whenever, if necessary. Just click on the essential kind to download or print the record format.

Use US Legal Forms, by far the most comprehensive variety of authorized varieties, to save time and prevent errors. The support offers appropriately produced authorized record templates which can be used for a selection of purposes. Produce a free account on US Legal Forms and begin creating your lifestyle a little easier.