Alabama Disputed Accounted Settlement

Description

How to fill out Disputed Accounted Settlement?

Are you in a placement in which you need to have paperwork for sometimes organization or personal purposes almost every time? There are a lot of authorized file templates available on the Internet, but finding kinds you can trust isn`t effortless. US Legal Forms gives a huge number of develop templates, such as the Alabama Disputed Accounted Settlement, that happen to be created to meet federal and state specifications.

If you are already knowledgeable about US Legal Forms web site and also have an account, merely log in. Afterward, you may down load the Alabama Disputed Accounted Settlement design.

Should you not offer an account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the develop you want and ensure it is for that correct area/area.

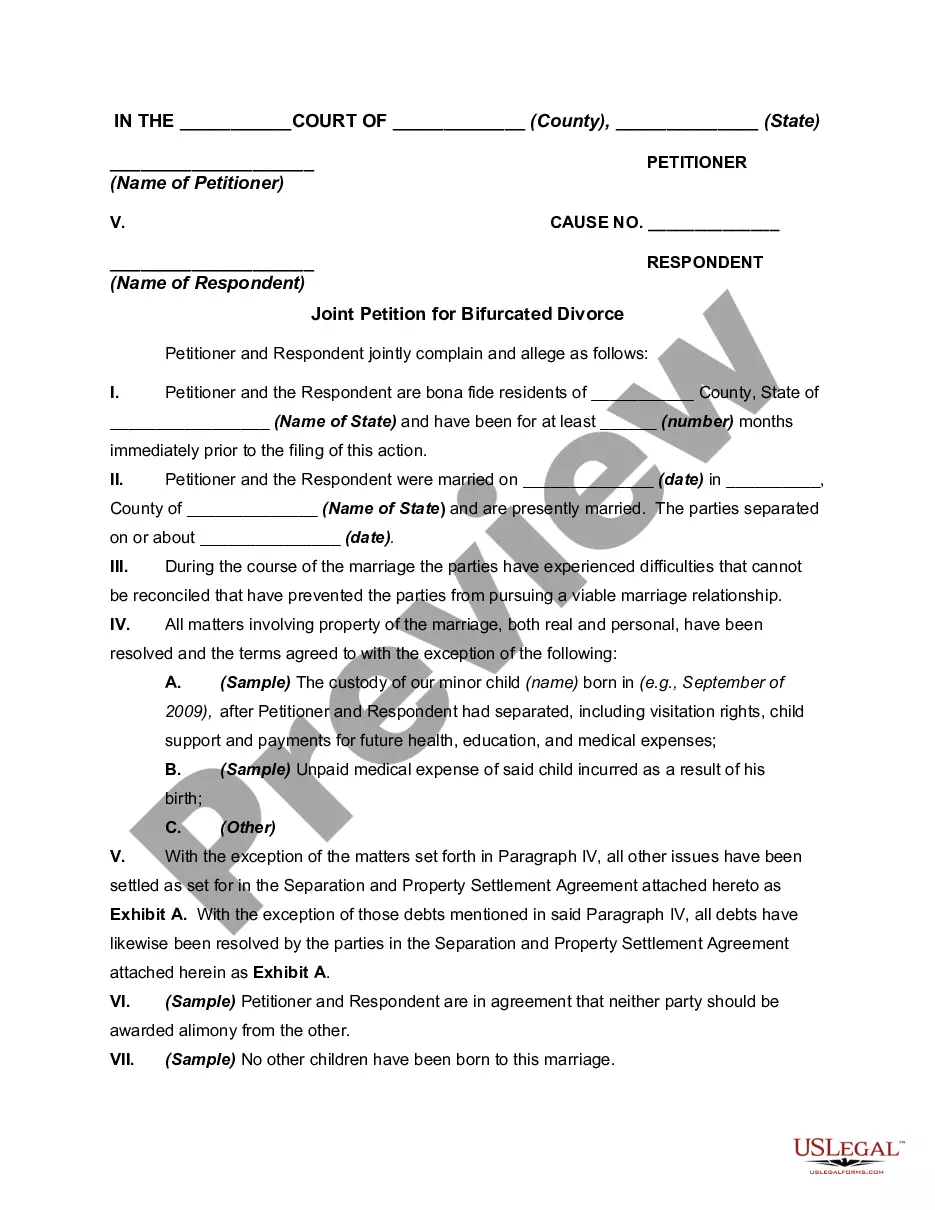

- Make use of the Review button to examine the form.

- Browse the explanation to ensure that you have chosen the correct develop.

- When the develop isn`t what you are trying to find, make use of the Lookup field to discover the develop that suits you and specifications.

- Whenever you obtain the correct develop, simply click Get now.

- Opt for the costs prepare you need, fill in the desired information to make your account, and buy the transaction making use of your PayPal or bank card.

- Choose a handy document structure and down load your backup.

Discover all the file templates you may have purchased in the My Forms food selection. You can aquire a further backup of Alabama Disputed Accounted Settlement whenever, if required. Just click on the needed develop to down load or print out the file design.

Use US Legal Forms, one of the most comprehensive selection of authorized types, to conserve time as well as avoid blunders. The support gives skillfully created authorized file templates that you can use for a range of purposes. Create an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

Collection suits are generally based on breach of contract or stated account, both of which fall under the six (6) year statute of limitations provided in Alabama Code Section 6-2-34. Actions for open or unliquidated account must be brought within three years.

If the defendant owns real property, you can enforce your judgment by levying and executing on the property. That is, the property will be sold at the courthouse to settle your claim. You may also execute on personal property.

In Alabama, a creditor can place a judgment lien on your real property (or your personal property or vehicle) in order to collect the judgment, and it will remain attached to your real property for 10 years, even if you sell the property.

In Alabama, money judgements last up to 20 years (Ala. Code § 6-9-190). But judgments are generally only enforceable for 10 years (Ala. Code § 6-9-191), and then they're renewed for another 10 years if the judgment debtor still hasn't paid the debt.

It will stay attached for 10 years, even if the property is transferred to someone else. At the end of that period, the judgment can be revived and a new lien created for another 10 years (or a total of 20 years from the date of the judgment).

A judgment cannot be revived after 20 years. Ala. Code § 6-9-190. Judgments are valid until satisfied or discharged; however, when a period of five years lapses, the judgment holder must file a motion with the court and prove sufficient cause for failure to obtain a writ of execution.

In Alabama, a creditor can place a judgment lien on your real property (or your personal property or vehicle) in order to collect the judgment, and it will remain attached to your real property for 10 years, even if you sell the property.