This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

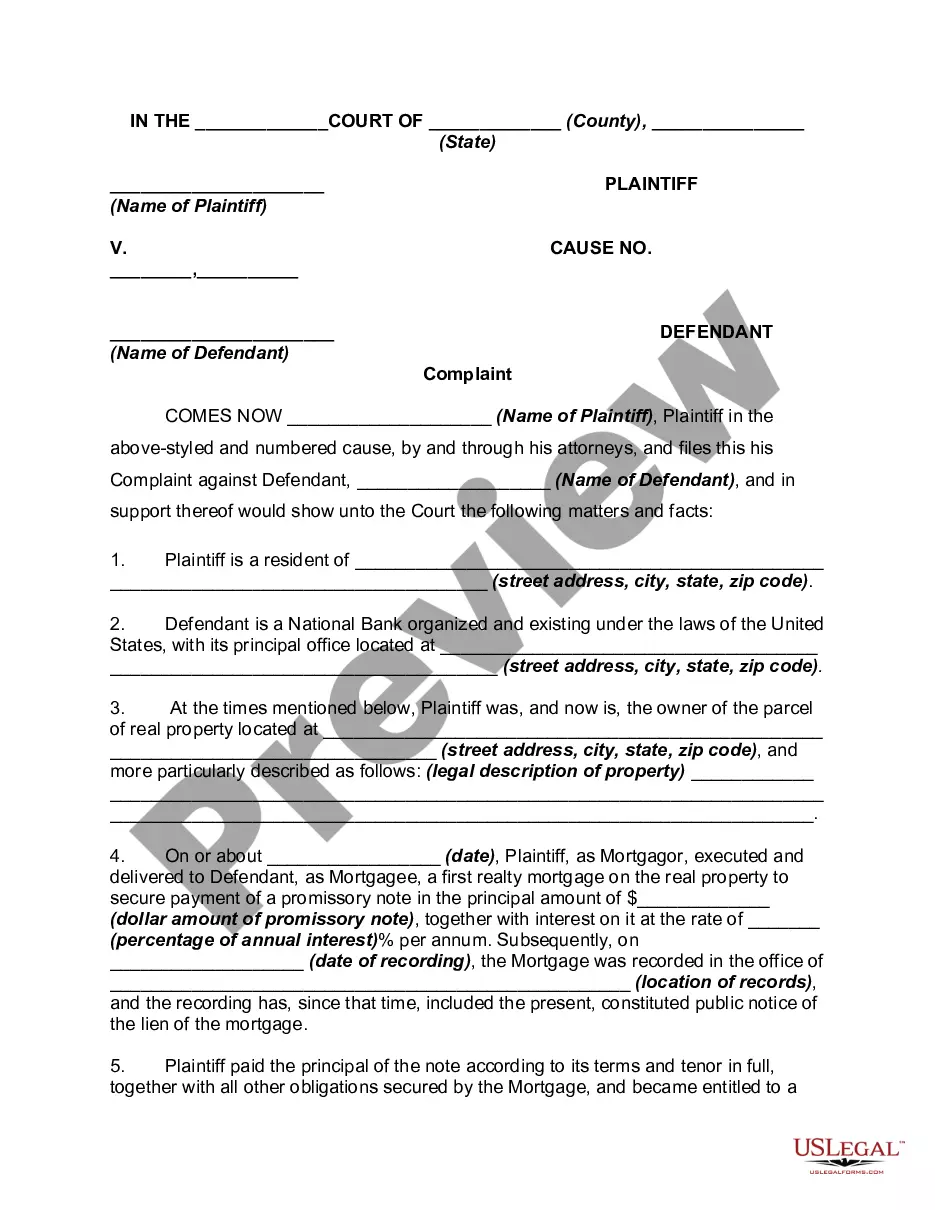

Alabama Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

If you wish to comprehensive, down load, or print legitimate record web templates, use US Legal Forms, the largest collection of legitimate types, which can be found on-line. Take advantage of the site`s simple and hassle-free research to obtain the documents you require. A variety of web templates for enterprise and individual functions are categorized by categories and claims, or search phrases. Use US Legal Forms to obtain the Alabama Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage within a number of clicks.

If you are presently a US Legal Forms client, log in for your bank account and then click the Acquire key to have the Alabama Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. You can even entry types you formerly delivered electronically within the My Forms tab of the bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for that appropriate metropolis/region.

- Step 2. Make use of the Preview option to check out the form`s information. Don`t neglect to see the description.

- Step 3. If you are not happy using the form, use the Search discipline near the top of the monitor to find other versions of the legitimate form template.

- Step 4. After you have identified the shape you require, select the Acquire now key. Opt for the costs prepare you favor and add your qualifications to sign up to have an bank account.

- Step 5. Method the financial transaction. You should use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the structure of the legitimate form and down load it on your product.

- Step 7. Comprehensive, revise and print or indicator the Alabama Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage.

Each legitimate record template you purchase is yours eternally. You may have acces to every single form you delivered electronically with your acccount. Click on the My Forms portion and select a form to print or down load once more.

Compete and down load, and print the Alabama Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage with US Legal Forms. There are thousands of specialist and state-particular types you may use for your enterprise or individual demands.

Form popularity

FAQ

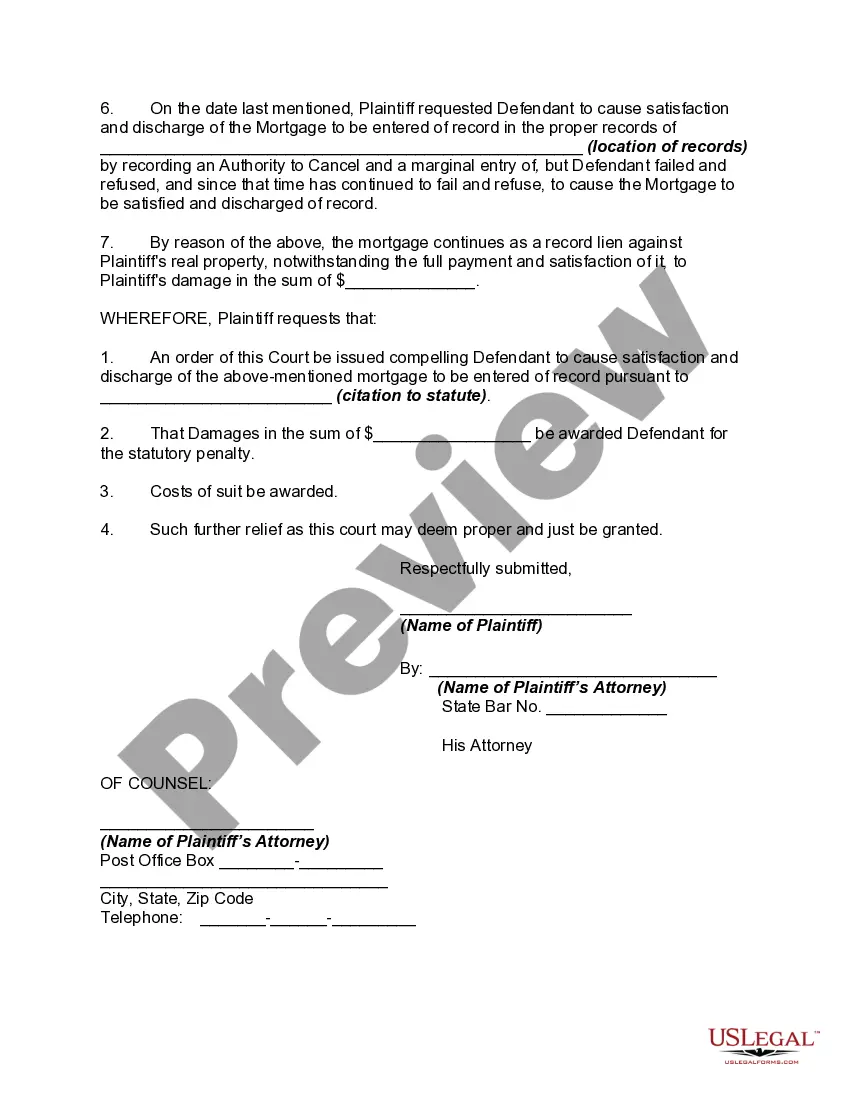

A satisfaction of mortgage, also known as release, cancellation or discharge of mortgage, is a type of legal document that proves you paid your mortgage in full. As a result, it also certifies that the property's title is clear of any liens.

Article 12 - Adverse Possession. Section 6-5-200 - When Title to Land Conferred or Defeated; When Claim May Be Defended or Prosecuted; Construction of Section.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

Secured Loans A secured loan typically involves both a lien and associated title rights to the collateral property. A creditor will create a lien to document their legal claim against secured collateral. The creditor is also usually the title owner on the collateral asset until the loan has been paid in full.

An attachment lien refers to an involuntary lien placed on a property that prevents its sale while a legal matter is pending. An attachment lien is a good example of the kind of lien that makes selling a home more challenging.

Instead of a Deed of Trust, a Mortgage is recorded in the public record and acts as a lien against the property until the debt is paid off. With a mortgage, a homeowner has both legal and equitable title.

Voluntary property liens are created through a mortgage agreement, in which the mortgage borrower allows the mortgage lender to use the property as collateral in exchange for loan repayment. Involuntary property liens are placed without the owner's consent, typically as a result of unpaid debts.

Liens generally follow the "first in time, first in right" rule, which says that whichever lien is recorded first in the land records has higher priority than later recorded liens. For example, a mortgage has priority over a judgment lien if the lender records it before the judgment creditor records its lien.