Alabama Assignment of Assets

Description

How to fill out Assignment Of Assets?

Are you presently facing a circumstance where you require documents for either organizational or personal reasons almost daily.

There is an abundance of approved document templates found online, but finding those you can rely on is challenging.

US Legal Forms provides a wide array of form templates, such as the Alabama Assignment of Assets, which can be utilized to fulfill state and federal regulations.

Utilize US Legal Forms, the most extensive collection of authorized documents, to save time and prevent errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Alabama Assignment of Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the correct area/region.

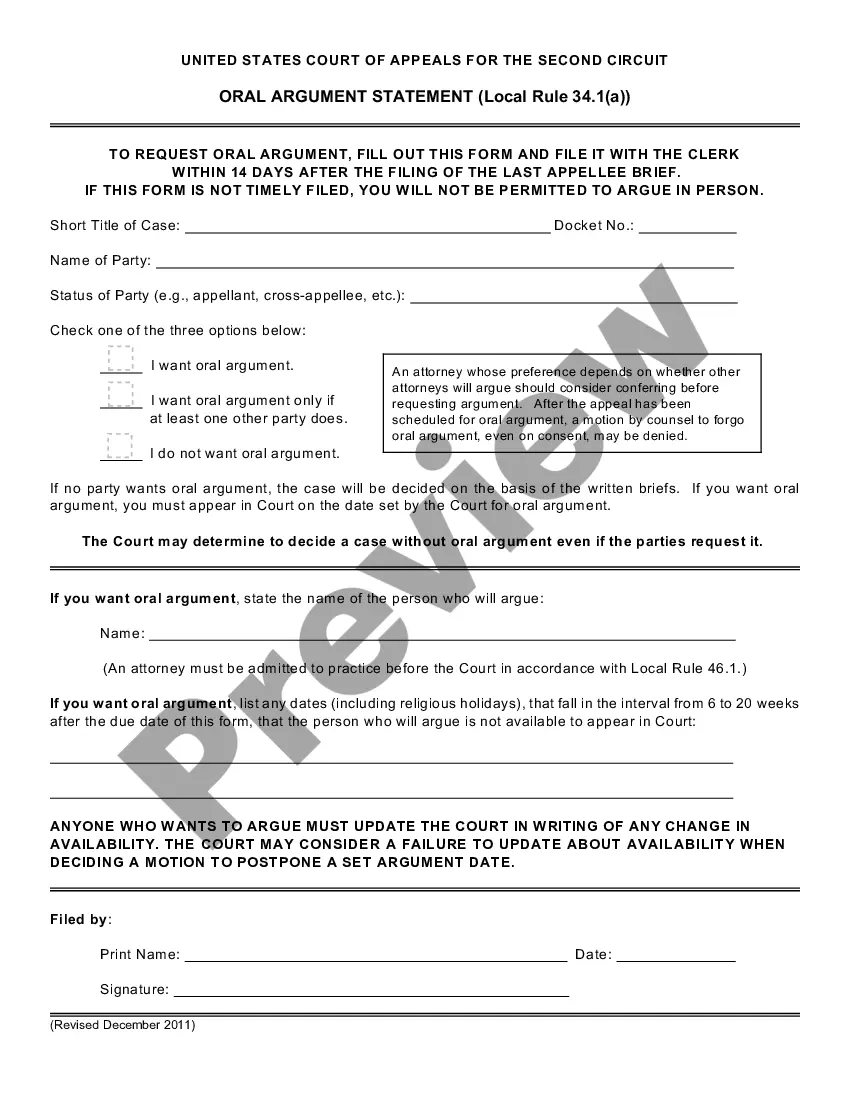

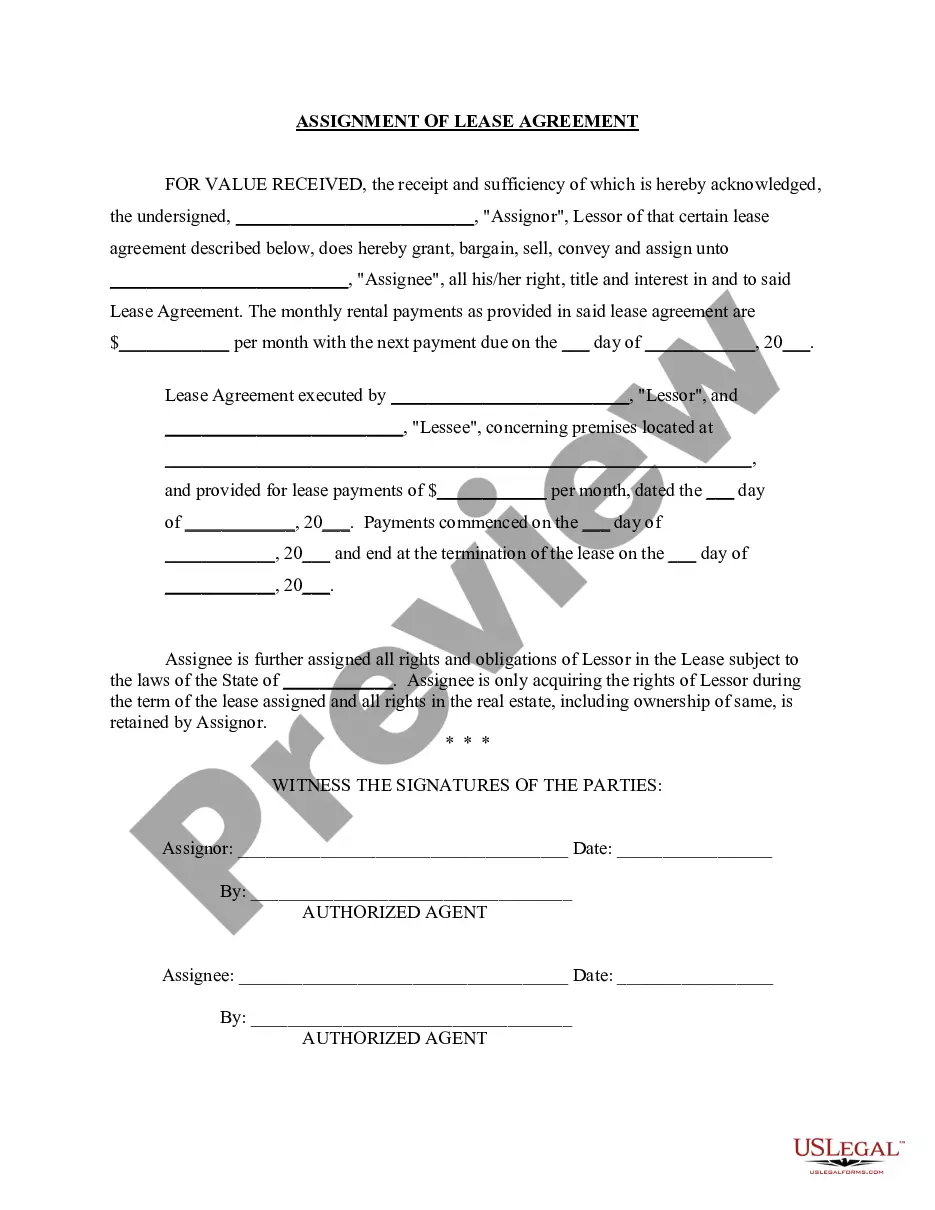

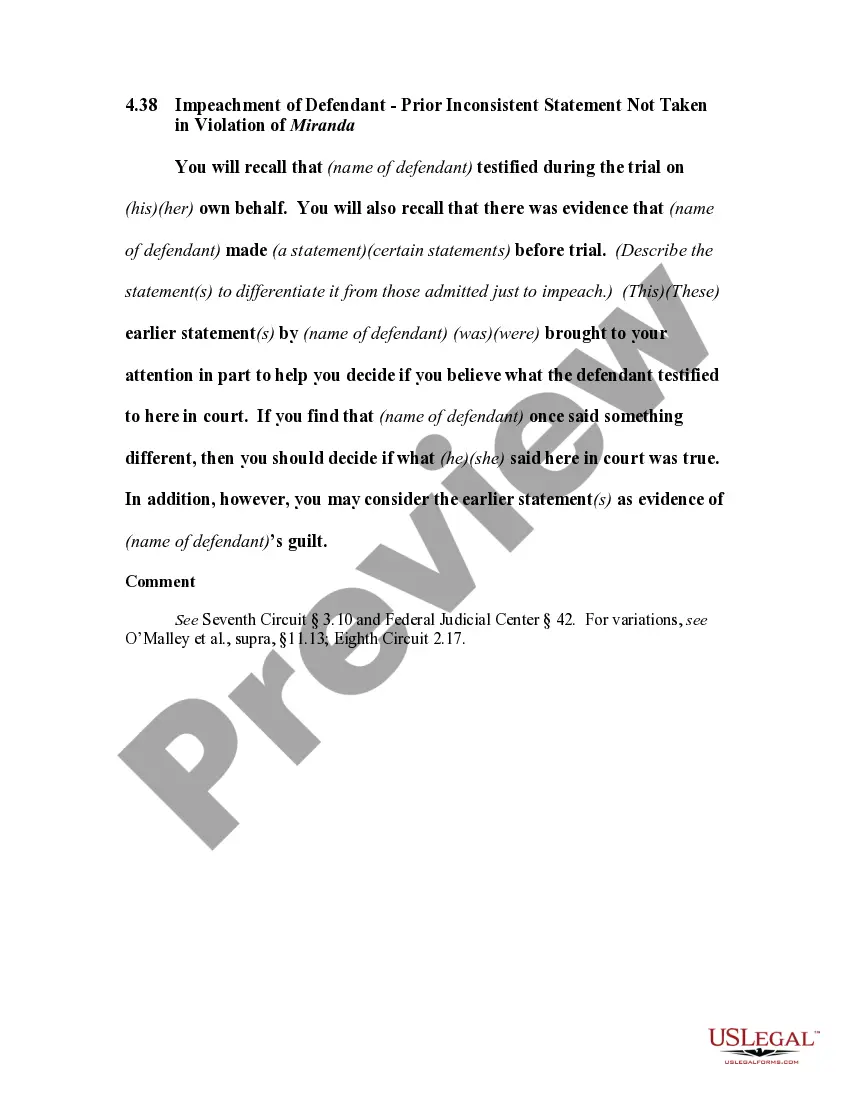

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search box to find the form that fits your needs and criteria.

- Once you have found the correct form, click Purchase now.

- Select the pricing plan you prefer, fill in the required details to create your account, and pay for your purchase using PayPal or Visa or MasterCard.

- Choose a convenient file format and download your copy.

- Access all the form templates you have purchased in the My documents section. You may obtain another copy of Alabama Assignment of Assets at any time if necessary. Click on the needed form to download or print the document template.

Form popularity

FAQ

Any individual or business earning income in Alabama must likely file a tax return. This includes residents and non-residents who earn income or have business operations within the state. When dealing with Alabama Assignment of Assets, being clear about your filing requirements can save you time and potential issues. Leveraging resources like uslegalforms ensures you have the right tools to navigate this process smoothly.

You can file Alabama Form 40 at your local Department of Revenue office or online through the state's tax website. It’s important to follow the instructions carefully to ensure your submission is correct. If you’re handling Alabama Assignment of Assets, filing Form 40 correctly helps you maintain good standing with tax authorities. For software guidance and tips, check out uslegalforms to simplify the filing process.

Alabama PPT filers typically include all professionals, such as doctors, lawyers, and accountants, who are practicing in Alabama. Additionally, businesses providing professional services may also need to file this tax. To navigate the ins and outs of Alabama Assignment of Assets, being aware of your filing requirements is essential. If you have questions regarding your specific situation, consulting a legal professional can be especially beneficial.

Individuals and entities that own or operate businesses in Alabama generally need to file the Alabama Professional Privilege Tax (PPT). This includes partnerships, corporations, and limited liability companies, among others. When dealing with Alabama Assignment of Assets, it's crucial to ensure you meet all filing requirements to avoid penalties. Always consider seeking help from a tax expert for accurate guidance.

In Alabama, certain entities are exempt from the Business Privilege Tax (BPT). These typically include nonprofit organizations, governmental entities, and individuals earning under a specific income threshold. Furthermore, understanding your obligations under Alabama Assignment of Assets can help clarify your tax situation. It's a good idea to consult a tax professional to explore your unique circumstances.

For a deed to be valid in Alabama, it must clearly identify the grantor and grantee, include a legal description of the property, and be signed by the grantor. Additionally, the deed should be notarized to meet state validation requirements. Ensuring that these elements are in place is crucial for effective property transfers, particularly under the framework of Alabama Assignment of Assets.

Typically, a deed is drafted by the property owner, a lawyer, or a title company. While property owners have the option to fill out a deed themselves, many prefer the expertise of a lawyer to ensure accuracy and legal compliance. Engaging with professionals through platforms like US Legal Forms can streamline this process, especially when managing Alabama Assignment of Assets.

While you can prepare a deed yourself, hiring a lawyer can provide you with expert guidance and reduce the risk of errors. A lawyer familiar with Alabama laws can ensure that your deed complies with state requirements, especially when handling complex transactions. For those dealing with significant assets, utilizing services like US Legal Forms can simplify the preparation process associated with Alabama Assignment of Assets.

In Alabama, business personal property tax is calculated based on the assessed value of personal property owned by businesses as of October 1st each year. This value is typically determined by local officials and is based on the fair market value of the assets. Understanding these calculations can help businesses better manage their financial obligations, particularly when considering asset transfers, like in Alabama Assignment of Assets.

To fill out an Alabama quit claim deed, start by obtaining a blank deed form specific to Alabama. Clearly list the names and addresses of both the grantor and grantee, and include a description of the property being conveyed. Make sure to sign the deed in the presence of a notary to validate the document. This process is essential for correctly managing property transfers, which is an important aspect of Alabama Assignment of Assets.