Alabama Assignment of Rents by Lessor

Description

How to fill out Assignment Of Rents By Lessor?

Are you presently in a situation where you regularly require documents for various organizational or personal reasons every single day.

There are numerous legal document templates available online, but finding reliable ones isn’t easy.

US Legal Forms offers thousands of document templates, such as the Alabama Assignment of Rents by Lessor, which are designed to comply with state and federal requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Alabama Assignment of Rents by Lessor at any time, if needed. Click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Alabama Assignment of Rents by Lessor template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city or county.

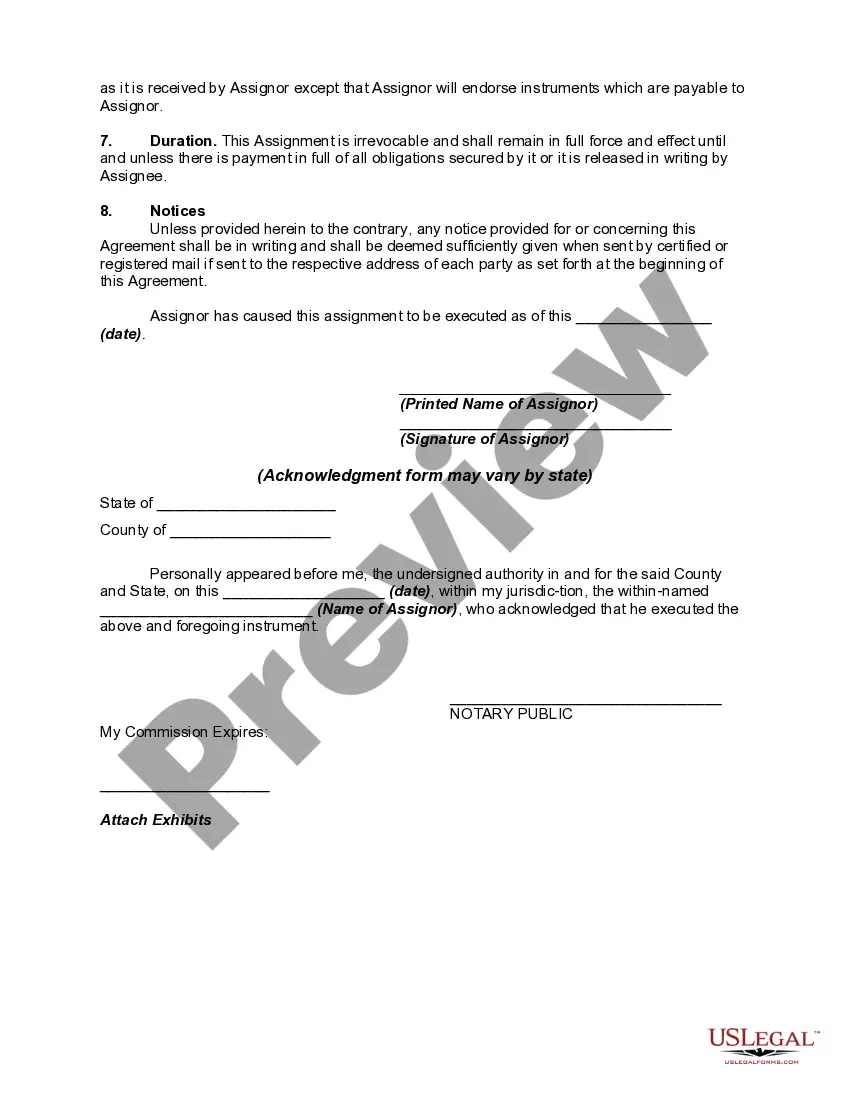

- Use the Preview feature to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you need, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

Landlord's consent to lease assignment refers to the approval that a landlord must provide before a tenant can assign their lease to someone else. This consent ensures that the landlord is aware of and agrees to the new tenant taking over the lease obligations. By utilizing the Alabama Assignment of Rents by Lessor, landlords can create a clear consent form that protects their interests and allows for orderly transitions.

Recording an assignment of lease is not mandatory in Alabama, but it is highly recommended. Recording provides legal notice to third parties about the change of parties, protecting the interests of both the original landlord and the new tenant. The Alabama Assignment of Rents by Lessor outlines best practices for ensuring that your assignment is properly documented.

The assignment of lease by the landlord is a process where the landlord transfers their rights and responsibilities under a lease to another party. This can happen for various reasons, such as relocating or liquidating property. When done correctly, by using tools like the Alabama Assignment of Rents by Lessor, both parties are protected under the law.

The form for the assignment of lease by landlord is a specific document that outlines the terms of the assignment. This form typically includes details about the original lease, the assignee, and any conditions. Accessing the Alabama Assignment of Rents by Lessor can provide you with a comprehensive template that simplifies this legal process.

The assignment of leases and rents document is a legal instrument that allows a landlord to transfer their rights to rental payments and any associated lease obligations. It ensures that tenants continue to honor the lease while payments go to the new assignee. Utilizing the Alabama Assignment of Rents by Lessor can help create a clear and binding agreement.

In Alabama, notarization is not always required for an assignment of lease, but it is advisable. A notarized document adds a level of authenticity and can protect all parties involved. Using the Alabama Assignment of Rents by Lessor can streamline this process and provide guidance on the necessary steps.

To assign a lease, start by reviewing your existing lease agreement. Ensure that it permits lease assignments. Next, you'll need to draft an Assignment of Lease document, which transfers your rights and obligations to the new tenant. For a smooth process, consider using the Alabama Assignment of Rents by Lessor to ensure all legal requirements are met.

The key difference between assignment and subleasing lies in the level of responsibility retained by the original tenant. When you assign a lease, you transfer all rights and responsibilities to the new tenant, meaning they will handle payments directly. Alternatively, in a sublease, the original tenant remains responsible for the lease, while the subtenant pays rent to the original tenant. If you're navigating these options under the Alabama Assignment of Rents by Lessor framework, uslegalforms can provide clarity and legal support to ensure compliance and protect your interests.

Lease assignments allow a lessee to transfer their rights and obligations under a lease to another party. Essentially, the new tenant assumes the lease and becomes responsible for the rent payment and other conditions of the original agreement. In the context of Alabama Assignment of Rents by Lessor, this means that the lessor can continue receiving rent payments even if the original lessee changes. For clarity and to ensure smooth transactions, consider using a reliable resource like uslegalforms to manage your lease assignments effectively.

An assignment of rents works by allowing a lessor to assign their right to collect rent to another individual or entity. Upon signing the assignment document, the assignee can collect rental payments directly from tenants while the lessor remains the property owner. Leveraging the Alabama Assignment of Rents by Lessor simplifies rental income management, making it a strategic move for property owners wishing to enhance financial operations.