Alabama Aging of Accounts Receivable refers to a financial process used by businesses or organizations to track and analyze the age of their outstanding customer invoices or receivables in the state of Alabama. This method allows them to gain insights into the payment patterns of their customers and assess the collection effectiveness of their accounts receivable. Keywords: Alabama, Aging of Accounts Receivable, financial process, businesses, organizations, outstanding customer invoices, receivables, payment patterns, collection effectiveness, accounts receivable. There are various types of Alabama Aging of Accounts Receivable that businesses can employ to manage their cash flow and monitor the timeliness of customer payments: 1. Standard Aging: The most common method, it categorizes outstanding invoices into predefined aging periods based on the number of days past the invoice due date, typically ranging from 0-30 days, 31-60 days, 61-90 days, and over 90 days. This classification helps identify potential issues or delays in receiving payment. 2. Weighted Aging: This approach considers the outstanding balance of each invoice and assigns weighted percentages to aging periods. For example, a 60-day overdue invoice with a higher balance may receive a higher weightage, signifying its impact on the overall accounts receivable. 3. Percentage-Based Aging: In this method, aging periods are determined using specific percentage ranges. For instance, invoices with 0-25% outstanding balance would fall under 0-30 days category, 26-50% under 31-60 days, and so on. This strategy helps examine the concentration of overdue amounts within different timeframes. 4. Scorecard Aging: Some organizations create customized scorecards or credit risk models to evaluate the creditworthiness of their customers. This model incorporates factors like payment history, credit score, or previous collection history and assigns scores or ratings to customers based on risk levels. The aging analysis is then applied to these scorecard categories to forecast payment behavior. 5. Customer-Specific Aging: This type of aging focuses on individual customers' payment history and tracks their receivables separately. It allows businesses to monitor specific customers who frequently have overdue payments, enabling targeted and personalized collection efforts. 6. Industry-Specific Aging: Businesses in Alabama can also use an industry-specific aging approach to analyze payment patterns within a particular sector. This method provides insights into the typical payment behavior for businesses operating within the same industry, helping companies set realistic expectations for payment timelines. By utilizing Alabama Aging of Accounts Receivable methods, businesses can effectively manage their cash position, identify potential collection issues, implement appropriate actions for past-due accounts, and make informed business decisions based on the analysis of customer payment behavior.

Alabama Aging of Accounts Receivable

Description

How to fill out Alabama Aging Of Accounts Receivable?

Are you presently within a position the place you will need papers for sometimes business or specific functions nearly every working day? There are a variety of lawful papers web templates available on the net, but finding versions you can rely on isn`t effortless. US Legal Forms delivers 1000s of kind web templates, just like the Alabama Aging of Accounts Receivable, which can be created to fulfill federal and state needs.

In case you are already familiar with US Legal Forms site and get an account, just log in. After that, you are able to obtain the Alabama Aging of Accounts Receivable design.

If you do not offer an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the kind you will need and make sure it is for the appropriate area/area.

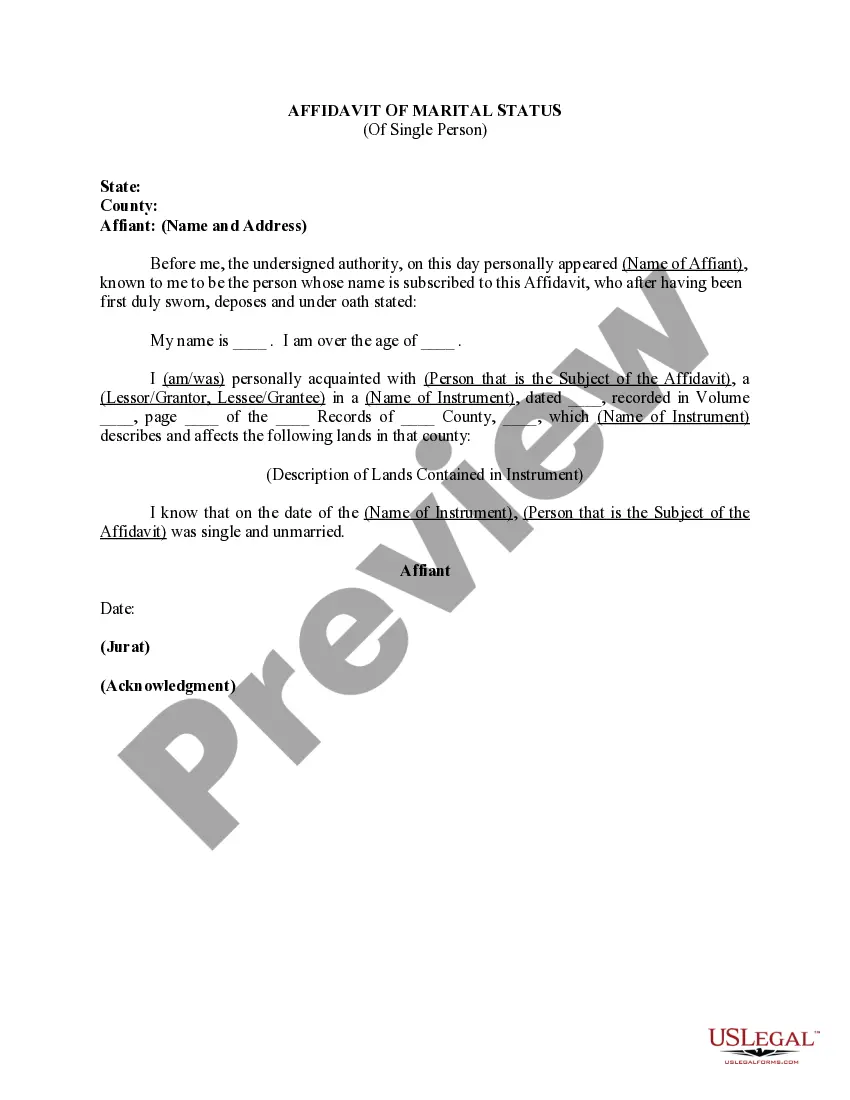

- Utilize the Review option to examine the form.

- See the explanation to ensure that you have selected the proper kind.

- When the kind isn`t what you`re seeking, make use of the Research discipline to get the kind that suits you and needs.

- When you discover the appropriate kind, click Acquire now.

- Choose the prices program you would like, submit the specified information to produce your money, and buy an order with your PayPal or credit card.

- Decide on a handy data file structure and obtain your backup.

Get all of the papers web templates you possess purchased in the My Forms menus. You may get a extra backup of Alabama Aging of Accounts Receivable at any time, if necessary. Just click on the essential kind to obtain or printing the papers design.

Use US Legal Forms, the most considerable selection of lawful forms, to save lots of time as well as prevent faults. The support delivers skillfully produced lawful papers web templates that you can use for a variety of functions. Produce an account on US Legal Forms and start producing your life easier.