Alabama Consultant Agreement with Sharing of Software Revenues

Description

In this agreement, the consultant is not only paid an hourly rate, but is also paid a percentage of the net profits (as defined in the agreement) resulting from the software the consultant develops.

How to fill out Consultant Agreement With Sharing Of Software Revenues?

If you need to compile, download, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal uses are categorized by types and states, or keywords. Use US Legal Forms to obtain the Alabama Consultant Agreement with Revenue Sharing for Software with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to all forms you downloaded in your account.

Navigate to the My documents section and select a form to print or download again. Compete, download, and print the Alabama Consultant Agreement with Software Revenue Sharing using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Alabama Consultant Agreement with Software Revenue Sharing.

- You can also access documents you previously downloaded from the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct city/state.

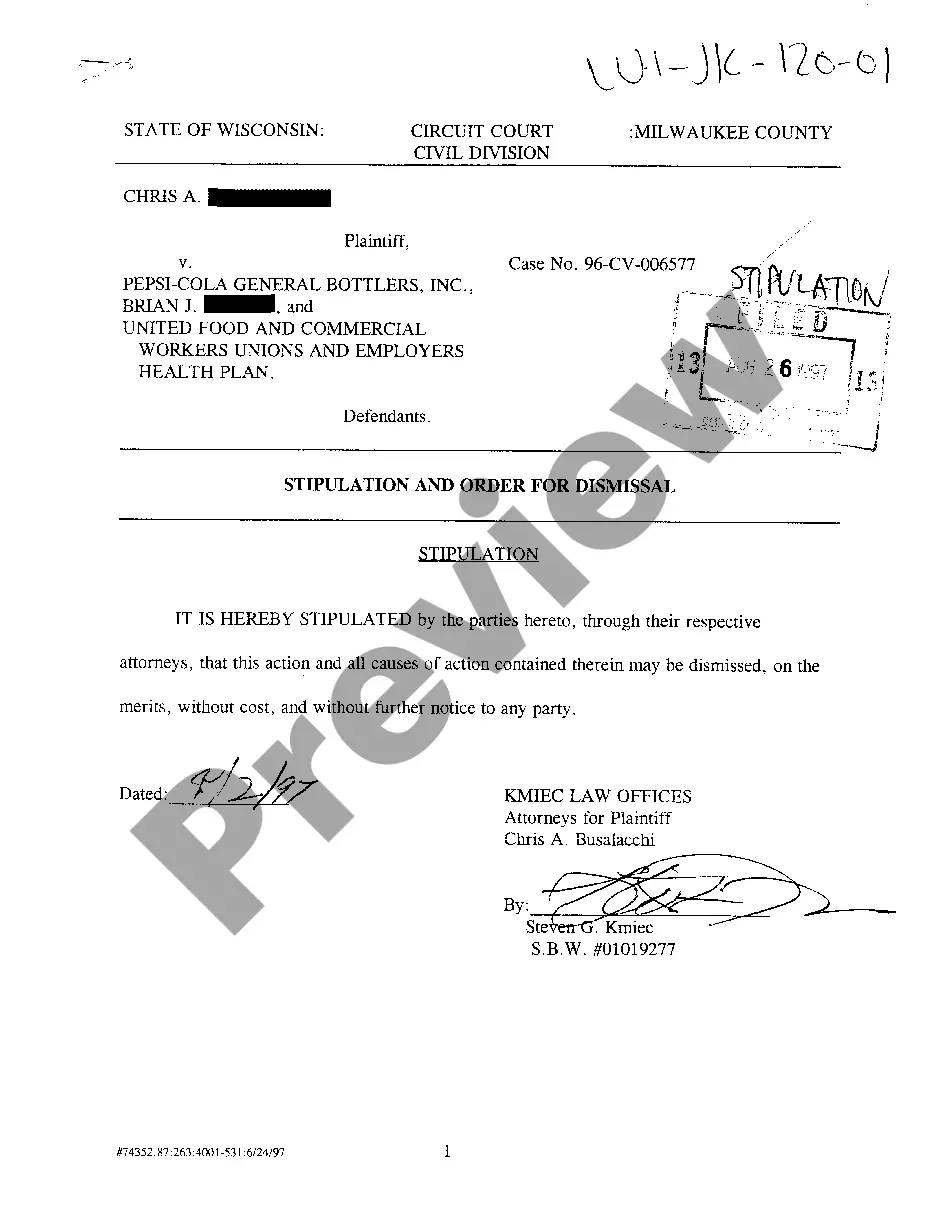

- Step 2. Use the Preview option to review the contents of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill in, modify, and print or sign the Alabama Consultant Agreement with Software Revenue Sharing.

Form popularity

FAQ

An example of a revenue sharing contract might involve a software developer and a marketing consultant. In this case, the developer allows the consultant to market the software for a share of the profits. The contract clearly defines roles, revenue percentages, and payment terms. Using an Alabama Consultant Agreement with Sharing of Software Revenues as a template can make drafting such a contract more manageable.

The revenue sharing model works by defining how earnings from a product or service will be distributed among partners. Typically, both parties agree on a specific percentage before launching their collaboration. As revenue is generated, it is shared according to this agreed-upon percentage. The Alabama Consultant Agreement with Sharing of Software Revenues can help streamline this process and ensure compliance with the terms.

In simple terms, revenue sharing refers to the distribution of income generated from a venture among the parties involved. It incentivizes collaboration, as each partner stands to gain from the overall success of the project. Businesses often use this model in various sectors, particularly in technology and software. Crafting an Alabama Consultant Agreement with Sharing of Software Revenues can help formalize these arrangements.

A typical revenue sharing percentage can vary widely based on the industry and specific agreement, but most often, it ranges between 10% to 50%. The percentage can depend on factors like the investment made or the risk involved by each party. It is crucial to negotiate terms that benefit all parties involved. An Alabama Consultant Agreement with Sharing of Software Revenues can clarify these percentages to ensure transparency.

The 50/50 revenue sharing model is straightforward; it involves two parties sharing profits equally. Each participant receives half of the revenue generated from the project or service offered. This model often embodies fairness, fostering a collaborative spirit. Utilizing the Alabama Consultant Agreement with Sharing of Software Revenues can help formalize this equal partnership.

To write a profit sharing agreement, start by detailing the mutual goals of the parties involved. Include key elements such as the revenue-sharing percentage, the responsibilities of each party, and the duration of the agreement. Be thorough to avoid misunderstandings. The Alabama Consultant Agreement with Sharing of Software Revenues can provide a structured template to simplify this process.

A common example of a revenue sharing model is when two companies collaborate to develop a software product. In this scenario, they may agree that profits from sales will be divided based on predetermined percentages. This approach encourages both parties to work towards maximizing revenue. The Alabama Consultant Agreement with Sharing of Software Revenues can outline such arrangements clearly and fairly.

To write a profit sharing agreement, begin by specifying the profit-sharing formula and how profits will be calculated and distributed. It's crucial to incorporate the terms of the Alabama Consultant Agreement with Sharing of Software Revenues to ensure transparency and fairness. Additionally, outline the roles of all parties involved and include provisions for any changes in terms. Using US Legal Forms can simplify this process and help you create a legally sound agreement.

Setting up a consulting agreement involves several key steps, starting with drafting a clear document that outlines the services to be provided and the payment structure. Ensure that both parties agree on the terms and conditions related to the Alabama Consultant Agreement with Sharing of Software Revenues. It's also helpful to include termination clauses and dispute resolution mechanisms. Platforms like US Legal Forms offer templates that streamline the process, making it easier to create a customized agreement.

A consulting services agreement is a contract between a consultant and a client that outlines the services the consultant will provide. This agreement details the scope of work, payment terms, and timelines, ensuring both parties understand their obligations. When looking for an Alabama Consultant Agreement with Sharing of Software Revenues, it is crucial to include specific clauses related to revenue distribution. This clarity helps avoid misunderstandings and sets a professional tone for the consulting relationship.