Alabama Sales Receipt is an official document that serves as proof of purchase in a commercial transaction conducted within the state of Alabama. It provides detailed information about the transaction, including the date, seller’s details, buyer’s details, a description of the purchased items or services, quantities, prices, total amount paid, and any applicable sales taxes. In Alabama, there are generally two types of sales receipts: cash sales receipts and sales receipts for credit or debit card transactions. A cash sales receipt is used when the buyer pays for the products or services with cash, check, or money order. It typically includes the method of payment, such as cash or check number, and may require the signature of both the seller and buyer to acknowledge the completion of the transaction. On the other hand, sales receipts for credit or debit card transactions are used when the buyer makes the payment through a card transaction, whether in-person or online. This type of receipt includes the cardholder's name, card number (usually obscured except for the last four digits), the card's expiration date, and the authorization code for the transaction. Additionally, these receipts might have additional details like the card issuer's name, merchant identification number, and the card's brand (e.g., Visa, Mastercard). In Alabama, sales receipts are not only essential for record-keeping purposes by the seller but also for consumer protection. Buyers may need the sales receipts to validate warranties, return or exchange items, obtain refunds, submit business expenses for reimbursement, or for tax purposes. As such, it is crucial for sellers to provide accurate and detailed sales receipts to maintain transparency and ensure a smooth customer experience. Keywords: Alabama, sales receipt, official document, proof of purchase, commercial transaction, seller details, buyer details, purchased items, services, quantities, prices, total amount paid, sales taxes, cash sales receipt, credit card transactions, debit card transactions, method of payment, signature, completion of the transaction, cash, check, money order, cardholder's name, card number, expiration date, authorization code, card issuer's name, merchant identification number, brand, Visa, Mastercard, record-keeping, consumer protection, warranties, return, exchange items, refunds, business expenses, reimbursement, tax purposes, transparency, customer experience.

Alabama Sales Receipt

Description

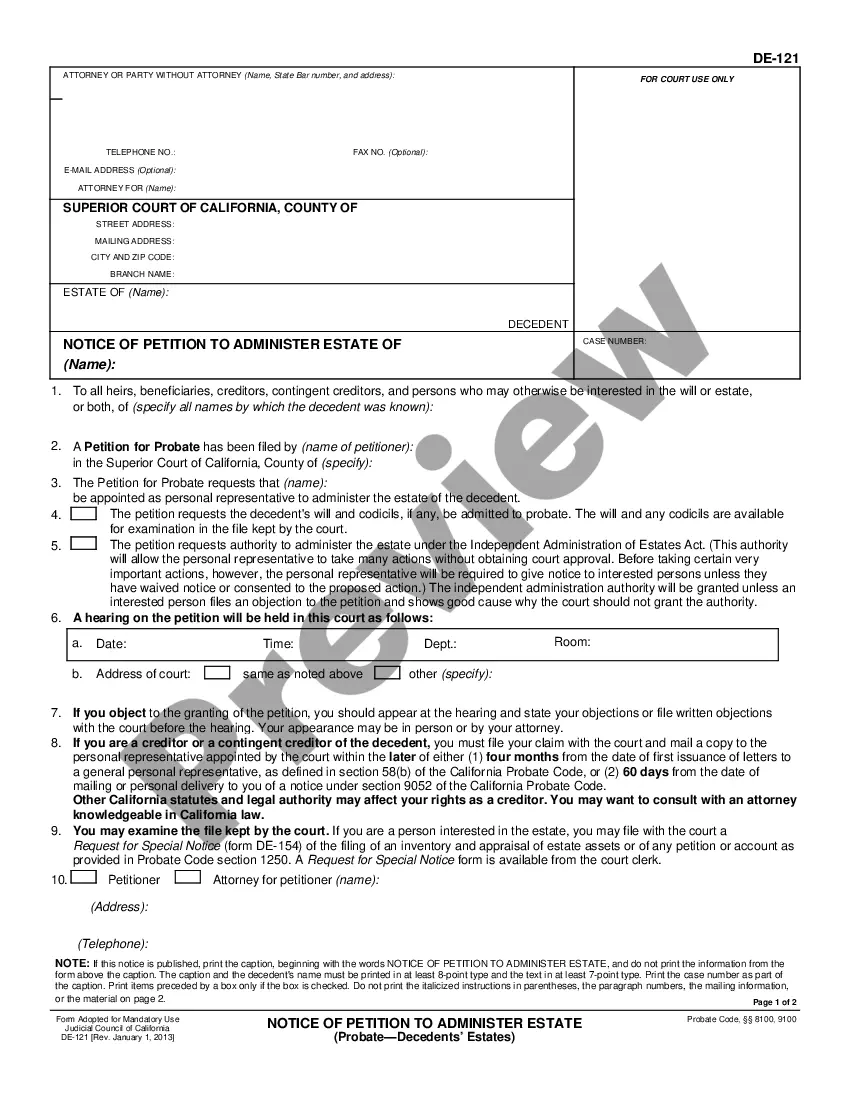

How to fill out Alabama Sales Receipt?

If you have to comprehensive, acquire, or print lawful record layouts, use US Legal Forms, the biggest assortment of lawful forms, that can be found on the Internet. Take advantage of the site`s simple and easy hassle-free search to discover the files you will need. Different layouts for enterprise and person reasons are sorted by types and states, or key phrases. Use US Legal Forms to discover the Alabama Sales Receipt with a handful of click throughs.

When you are previously a US Legal Forms consumer, log in for your bank account and click the Download key to get the Alabama Sales Receipt. You may also entry forms you in the past downloaded from the My Forms tab of your bank account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that proper city/region.

- Step 2. Take advantage of the Review option to look over the form`s articles. Do not forget to read through the information.

- Step 3. When you are not happy with the develop, make use of the Research discipline on top of the display to find other versions of the lawful develop web template.

- Step 4. After you have identified the shape you will need, go through the Purchase now key. Pick the prices program you choose and put your credentials to sign up to have an bank account.

- Step 5. Process the deal. You can utilize your bank card or PayPal bank account to accomplish the deal.

- Step 6. Choose the file format of the lawful develop and acquire it on your own device.

- Step 7. Complete, revise and print or sign the Alabama Sales Receipt.

Every single lawful record web template you get is the one you have for a long time. You may have acces to each develop you downloaded in your acccount. Select the My Forms segment and select a develop to print or acquire once more.

Contend and acquire, and print the Alabama Sales Receipt with US Legal Forms. There are many professional and condition-particular forms you may use for the enterprise or person demands.

Form popularity

FAQ

Yes, Alabama collects sales tax on certain out of state purchases when the items are delivered to an Alabama address. This applies to online sales as well as purchases from other states. It’s important to include this on your Alabama Sales Receipt to accurately reflect the tax applied to these transactions. Make sure to stay updated on tax laws to ensure compliance.

If you sell goods or services in Alabama, you must register for sales tax. This registration ensures you collect the appropriate taxes from your customers, which is essential for compliance. You will also need to provide an Alabama Sales Receipt for your transactions to document sales tax collected. Using platforms like US Legal Forms can help streamline your registration process and keep your sales records organized.

To obtain an Alabama sales tax number, you need to register your business with the Alabama Department of Revenue online. During this registration, you will provide details about your business activities and estimated sales. Once registered, you will receive your sales tax number, which is essential for issuing legitimate Alabama Sales Receipts.

A sales tax deduction usually applies to purchases made when the buyer is an eligible entity or individual, especially for business-related acquisitions. Items bought for resale or as part of business expenses may qualify for this deduction. Keep thorough records, including your Alabama Sales Receipts, to substantiate these deductions during tax season.

Alabama Form 40, which is necessary for filing individual income tax returns, is available on the Alabama Department of Revenue's website. You can download the form in PDF format, making it convenient for your tax preparation. Having accurate forms ensures your Alabama Sales Receipts are correctly reported and documented.

To apply for tax-exempt status in Alabama, submit your application to the Alabama Department of Revenue, detailing your organization’s purpose and activities. Once your application is reviewed and approved, you will receive the tax-exempt status. This status allows you to make purchases without paying sales tax, simplifying your documentation process with proper Alabama Sales Receipts.

You can obtain a copy of your Alabama sales tax certificate by contacting the Alabama Department of Revenue directly. Alternatively, if you applied online, you might find an option to download it from their portal. Having this certificate handy helps when processing transactions and ensures you receive accurate Alabama Sales Receipts.

Tax-exempt individuals typically include those who are purchasing items for specific purposes, such as resale or use in exempt organizations. Additionally, veterans or certain individuals with disabilities may also qualify under specific circumstances. It’s important to understand the criteria and obtain the necessary Alabama Sales Receipt to document these purchases clearly.

To obtain a sales tax exemption in Alabama, you must complete an application form, typically available through the Alabama Department of Revenue. After submitting the application, you will receive a sales tax exemption certificate upon approval. Keep this certificate handy, as it simplifies transactions and can be used when acquiring goods, ensuring you get the right Alabama Sales Receipt.

To apply for sales tax exemption in Alabama, complete the appropriate exemption form provided by the Alabama Department of Revenue. You will need to provide a valid reason for the exemption and any supporting documentation. Once you receive approval, make sure to reference it in your Alabama Sales Receipt when applicable.