Alabama Acknowledged Receipt of Goods

Description

Goods are defined under the Uniform Commercial Code as those things that are movable at the time of identification to a contract for sale. (UCC ??? 2-103(1)(k)). The term includes future goods, specially manufactured goods, and unborn young of animals, growing crops, and other identified things attached to realty.

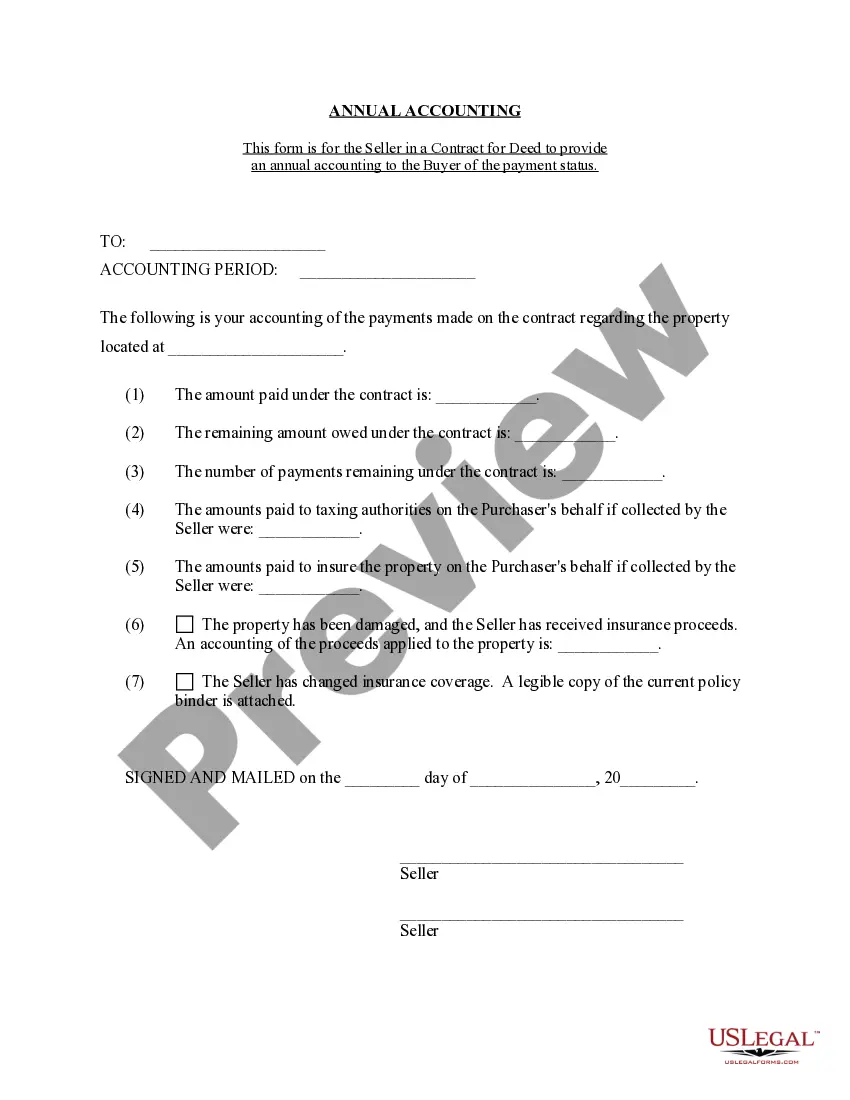

How to fill out Acknowledged Receipt Of Goods?

Finding the appropriate legal document template can be a challenge. Clearly, there are numerous designs available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Alabama Acknowledged Receipt of Goods, suitable for business and personal purposes. All forms are reviewed by professionals to ensure they comply with federal and state regulations.

If you are already a member, Log In to your account and click the Download button to obtain the Alabama Acknowledged Receipt of Goods. Use your account to browse the legal forms you have previously acquired. Navigate to the My documents section of your account to retrieve another copy of the document you require.

Select the file format and download the legal document template to your device. Complete, customize, and print and sign the acquired Alabama Acknowledged Receipt of Goods. US Legal Forms is the largest collection of legal forms, offering countless document templates. Utilize the service to obtain professionally crafted paperwork that meets state regulations.

- First, ensure you have selected the correct form for your jurisdiction.

- You can preview the form using the Review button and read the form description to confirm it is appropriate for your needs.

- If the form does not suit your requirements, use the Search field to find the proper form.

- Once you are confident that the form is correct, click the Get now button to acquire it.

- Choose the pricing plan you prefer and fill in the necessary details.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Acknowledge receipt of an item by drafting a brief statement that includes the item description, date, and your signature. Referencing 'Alabama Acknowledged Receipt of Goods' adds weight to the acknowledgment. This is particularly important for record-keeping and legal purposes.

Writing an acknowledgment receipt requires key information like the date, item description, and receiving party's details. Craft it in a straightforward manner, and reinforce it by including 'Alabama Acknowledged Receipt of Goods' to provide a legal backing. This ensures that the document serves its purpose.

To confirm a receipt, you can simply state, 'I confirm that I have received...' followed by details such as the item's name and condition. Including 'Alabama Acknowledged Receipt of Goods' strengthens the confirmation. This practice creates transparency and accountability in transactions.

Acknowledge receipt of something by clearly stating your acceptance in writing. Include details such as the item, the date it was received, and any related conditions. Mentioning 'Alabama Acknowledged Receipt of Goods' in your acknowledgment can provide extra assurance to the sender.

To fill out an acknowledgement receipt, enter the date, the description of goods or services, and the signature of the person receiving them. Ensure that you reference 'Alabama Acknowledged Receipt of Goods' to enhance clarity and legality. This form serves as a useful document for both parties involved.

Acknowledge a received product by writing a clear note that includes the product description, quantity, and the date received. It's beneficial to reference the 'Alabama Acknowledged Receipt of Goods' to maintain a proper record. This helps both parties keep track of the transactions.

To draft an acknowledgement receipt of payment, clearly state the date, the amount received, and the purpose of the payment. Include the payer's information and your contact details. Make sure to mention the 'Alabama Acknowledged Receipt of Goods' to confirm the transaction's validity.

Yes, if you meet certain income thresholds or have Alabama-source income, you are required to file a state tax return in Alabama. This applies to both residents and nonresidents engaging in business activities within the state. Compliance with Alabama tax laws ensures you maintain good standing and avoid potential fines. To simplify your filing experience, check out resources on USLegalForms tailored for Alabama tax returns.

If you earn income from Alabama sources while residing in another state, you typically need to file a nonresident tax return using Form 40NR. This requirement ensures that Alabama collects taxes owed on the revenue generated within its boundaries. Understanding and fulfilling this obligation can help you stay compliant and avoid penalties. For additional support, USLegalForms offers tools to assist with nonresident tax filing.

The 40NR form in Alabama is a tax return specifically designed for nonresidents who earn income from sources within the state. This form allows nonresidents to report their Alabama income and calculate their tax liability. By using the 40NR form correctly, you can ensure compliance with Alabama tax laws while potentially minimizing your tax burden. For further clarification on this form, check out USLegalForms for helpful resources.