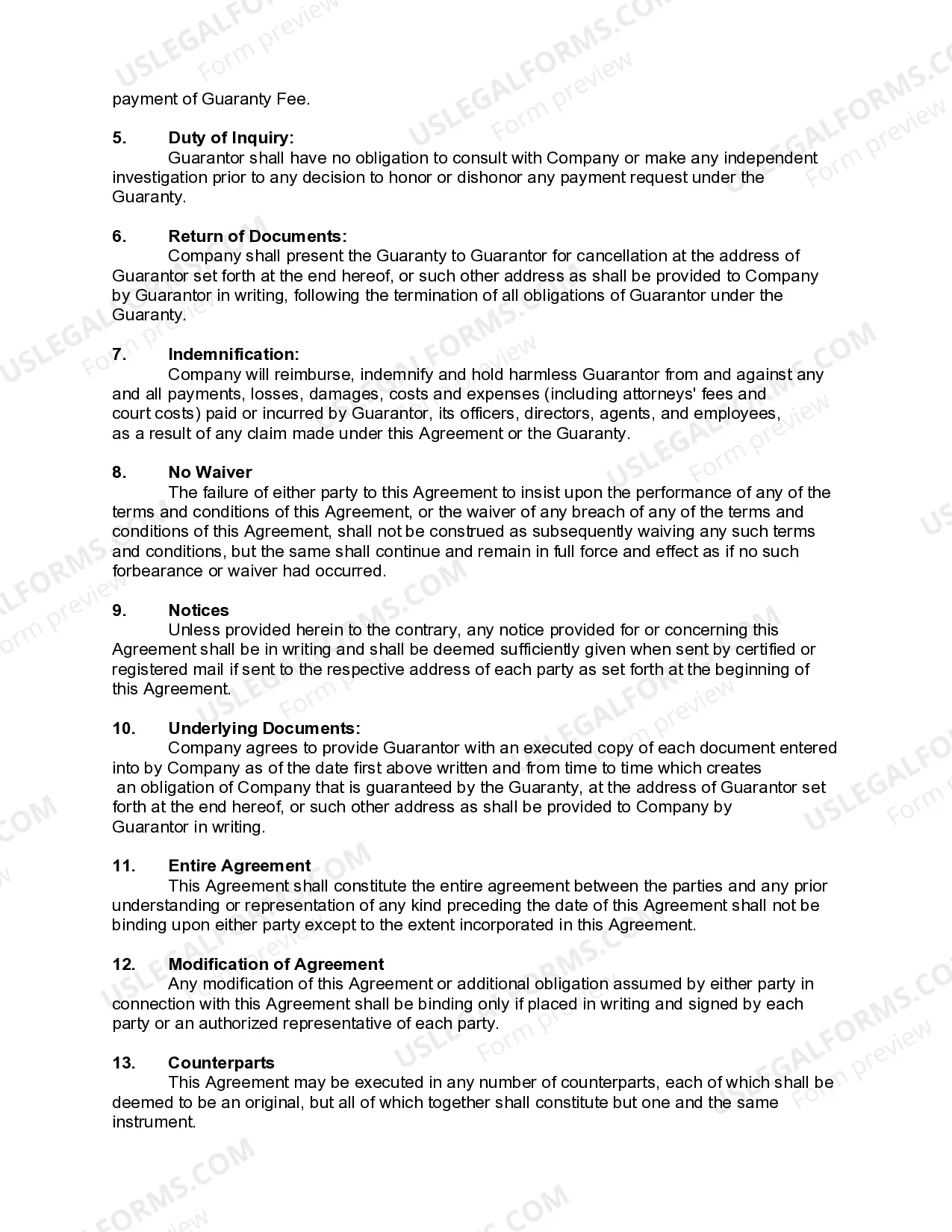

In this agreement, one corporation (the Guarantor) is providing financial assistance to another Corporation (the Corporation) by guaranteeing certain indebtedness for the Company in exchange for a guaranty fee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Alabama Financial Support Agreement — Guaranty of Obligation is a legally binding contract that provides financial backing and ensures the fulfillment of certain obligations or debts. This agreement is commonly used in various financial transactions and business dealings within the state of Alabama. It offers protection to lenders or creditors by adding an extra layer of security to the original financial arrangement. The Alabama Financial Support Agreement — Guaranty of Obligation serves as a guarantee for the repayment of loans, leases, or other financial obligations. It involves a party, known as the "guarantor," who agrees to assume responsibility for the financial debt or liability of another party, known as the "debtor." This agreement is especially relevant in situations where the primary debtor's creditworthiness or financial stability is questionable, requiring an additional party to ensure the lender's interests are protected. Key elements of the Alabama Financial Support Agreement — Guaranty of Obligation may include the identification of the parties involved, specifying the debt or obligation being guaranteed, the obligations of the guarantor, and any conditions or limitations on the guarantor's liability. It may also address the consequences of default, the procedures for notice and demand, and any applicable legal remedies available to the parties involved. There are different types of Alabama Financial Support Agreement — Guaranty of Obligation, including: 1. Unconditional Guaranty: This type of guaranty holds the guarantor fully responsible for the debtor's obligations and liabilities, regardless of any defenses the debtor may have. It provides the lender with maximum protection as the guarantor's liability is not contingent on any certain events. 2. Conditional Guaranty: In contrast to an unconditional guaranty, a conditional guaranty may limit the guarantor's liability to certain conditions or events. The guarantor's responsibility to fulfill the obligations arises only when these conditions, such as the debtor's default, are met. 3. Limited Guaranty: This type of guaranty restricts the guarantor's liability to a predetermined amount or specific obligations. The guarantor is responsible only up to the specified limit, beyond which their liability ceases. 4. Continuing Guaranty: A continuing guaranty remains in force until explicitly revoked or terminated by the guarantor. This type of guaranty covers multiple transactions or financial obligations over an extended period, providing ongoing assurance to the lender or creditor. It is crucial to understand the specific terms, conditions, and obligations delineated in the Alabama Financial Support Agreement — Guaranty of Obligation to ensure all parties involved are fully aware of their rights and responsibilities. Seeking legal advice before entering into such agreements is always advisable to safeguard one's interests and ensure compliance with Alabama state laws.The Alabama Financial Support Agreement — Guaranty of Obligation is a legally binding contract that provides financial backing and ensures the fulfillment of certain obligations or debts. This agreement is commonly used in various financial transactions and business dealings within the state of Alabama. It offers protection to lenders or creditors by adding an extra layer of security to the original financial arrangement. The Alabama Financial Support Agreement — Guaranty of Obligation serves as a guarantee for the repayment of loans, leases, or other financial obligations. It involves a party, known as the "guarantor," who agrees to assume responsibility for the financial debt or liability of another party, known as the "debtor." This agreement is especially relevant in situations where the primary debtor's creditworthiness or financial stability is questionable, requiring an additional party to ensure the lender's interests are protected. Key elements of the Alabama Financial Support Agreement — Guaranty of Obligation may include the identification of the parties involved, specifying the debt or obligation being guaranteed, the obligations of the guarantor, and any conditions or limitations on the guarantor's liability. It may also address the consequences of default, the procedures for notice and demand, and any applicable legal remedies available to the parties involved. There are different types of Alabama Financial Support Agreement — Guaranty of Obligation, including: 1. Unconditional Guaranty: This type of guaranty holds the guarantor fully responsible for the debtor's obligations and liabilities, regardless of any defenses the debtor may have. It provides the lender with maximum protection as the guarantor's liability is not contingent on any certain events. 2. Conditional Guaranty: In contrast to an unconditional guaranty, a conditional guaranty may limit the guarantor's liability to certain conditions or events. The guarantor's responsibility to fulfill the obligations arises only when these conditions, such as the debtor's default, are met. 3. Limited Guaranty: This type of guaranty restricts the guarantor's liability to a predetermined amount or specific obligations. The guarantor is responsible only up to the specified limit, beyond which their liability ceases. 4. Continuing Guaranty: A continuing guaranty remains in force until explicitly revoked or terminated by the guarantor. This type of guaranty covers multiple transactions or financial obligations over an extended period, providing ongoing assurance to the lender or creditor. It is crucial to understand the specific terms, conditions, and obligations delineated in the Alabama Financial Support Agreement — Guaranty of Obligation to ensure all parties involved are fully aware of their rights and responsibilities. Seeking legal advice before entering into such agreements is always advisable to safeguard one's interests and ensure compliance with Alabama state laws.