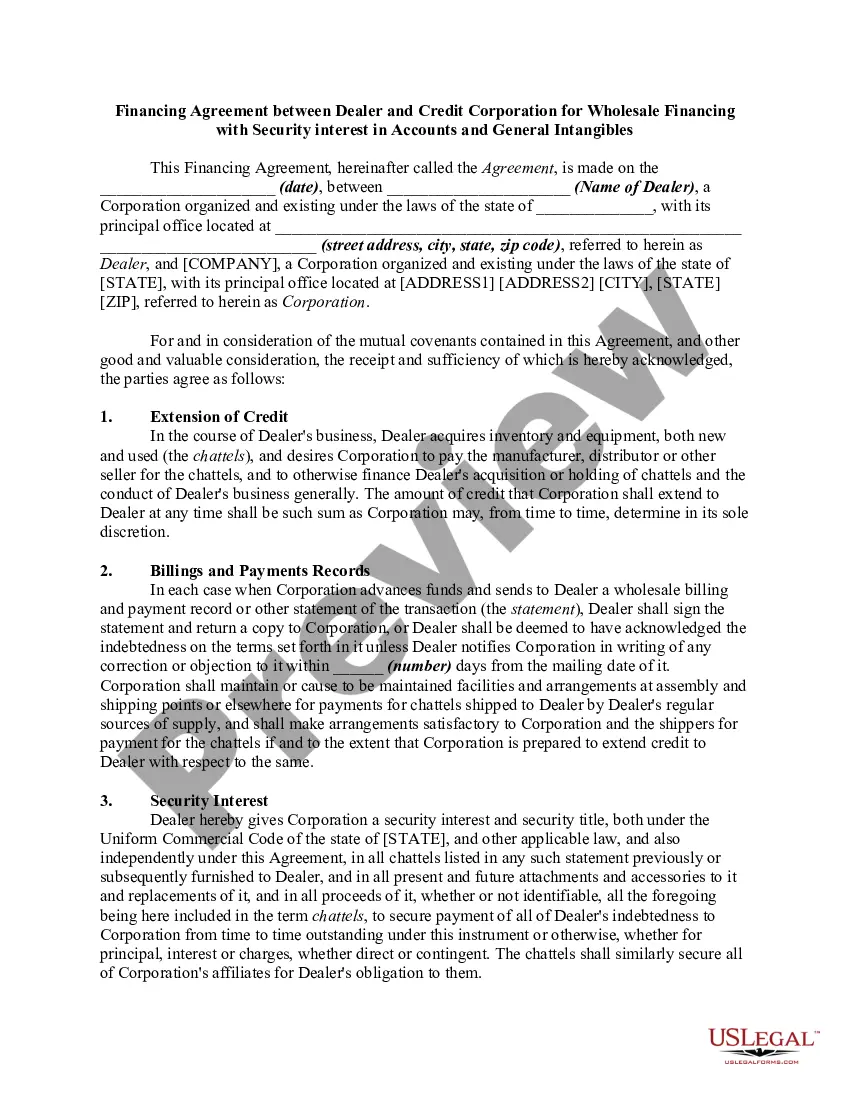

If you have to comprehensive, down load, or print legal papers themes, use US Legal Forms, the largest assortment of legal forms, that can be found on the Internet. Take advantage of the site`s simple and easy handy search to find the paperwork you will need. Various themes for business and individual functions are categorized by categories and says, or keywords and phrases. Use US Legal Forms to find the Alabama Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles in a number of mouse clicks.

When you are already a US Legal Forms consumer, log in to the accounts and then click the Download key to have the Alabama Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles. You can also entry forms you formerly downloaded from the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape to the right city/region.

- Step 2. Make use of the Review solution to look over the form`s information. Never overlook to see the description.

- Step 3. When you are unsatisfied using the form, make use of the Look for discipline at the top of the display to discover other variations of the legal form web template.

- Step 4. Once you have discovered the shape you will need, click the Buy now key. Pick the costs prepare you favor and add your qualifications to register for the accounts.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Select the formatting of the legal form and down load it in your gadget.

- Step 7. Comprehensive, revise and print or indicator the Alabama Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles.

Each legal papers web template you buy is your own permanently. You may have acces to every single form you downloaded with your acccount. Select the My Forms segment and choose a form to print or down load once more.

Contend and down load, and print the Alabama Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles with US Legal Forms. There are many specialist and condition-certain forms you can utilize for your personal business or individual requirements.